Altria: High-Yielding Dividend Stock For Income Investors (NYSE:MO)

A Christmas stocking stuffed with U.S. currency notes. badmanproduction/iStock via Getty Images

With Thanksgiving Day more than a week behind us at this point, the Christmas season is in the air. As a child, I had many favorite Christmas-time traditions. One of the most memorable things each year was checking my stocking for small toys, candy, or money. In my later years of childhood and early years of adulthood, I learned a couple of things: Christmas is really more a time of giving than it is receiving, and Santa Claus isn’t real.

But even though Santa isn’t real, we still have the next best thing: Top-notch dividend stocks that could stuff our proverbial stocking by sending us reliable cash payments to our brokerage accounts every quarter.

That brings us to Altria Group (NYSE:MO), which is the second biggest dividend payer in my portfolio behind Energy Transfer (ET). For context, the tobacco company accounts for 2.7% of my annual dividend income. For the first time since August, I will discuss what makes Altria Group such a great pick for investors looking to pad their passive income.

A 53-Year History Of Dividend Growth With No End In Sight

Just as I predicted back in August, Altria Group went on to announce a 4.4% increase in its quarterly dividend per share to $0.94. This marked the 53rd consecutive year that the company hiked its dividend, which makes it a Dividend King.

And from a dividend payout ratio perspective, this illustrious dividend growth streak doesn’t look like it will cease anytime soon.

Altria Group produced $4.61 in adjusted diluted EPS in 2021. Stacked against the $3.48 in dividends per share that it paid out during the year, this is equivalent to an adjusted diluted EPS payout ratio of 75.5%. This is below the company’s targeted adjusted diluted EPS payout ratio of 80%.

And the adjusted diluted EPS payout ratio looks like it could slightly improve in 2022. This is because analysts are forecasting $4.84 in adjusted diluted EPS for the year. Compared to the $3.64 in dividends per share that will be paid this year, this would be a 75.2% adjusted diluted EPS payout ratio.

Analysts are anticipating 4.2% annual adjusted diluted EPS growth over the next five years from Altria Group. Paired with a payout ratio that should slightly expand, I believe my expectation of a 4% annual dividend growth rate is more than reasonable.

Altria Group Continues To Deliver Decent Results

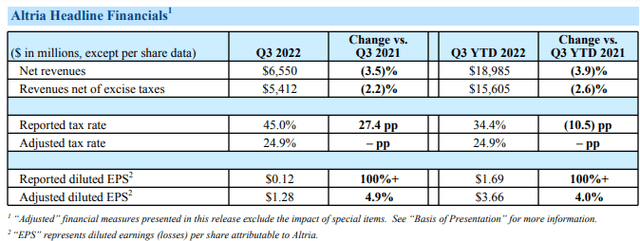

Altria Group Q3 2022 Earnings Press Release

Altria Group has put together solid results through the first three quarters of 2022. The company has generated $15.6 billion in revenue net of excise taxes year to date, which was down 2.6% year over year (figures sourced from page 1 of 29 of Altria Group Q3 2022 earnings press release).

Investors understandably don’t want to see a dip in the top line, I get it. But things aren’t quite as they seem in the case of Altria Group.

Last October, the company completed the sale of its Ste. Michelle Wine Estates business. The wine segment generated $480 million in revenue net of excise taxes for Altria Group in the year-ago period. Excluding this revenue, the company’s core businesses delivered a modest 0.4% growth rate in revenue net of excise taxes through the first nine months of the year (data points according to pages 2 and 13 of 29 of Altria Group Q3 2021 earnings press release and page 1 of 29 of Altria Group Q3 2022 earnings press release).

The smokeable segment’s year-to-date revenue net of excise taxes increased 0.6% year over year to $13.7 billion. Higher pricing again offset volume declines through the first nine months of the year (details per pages 8-9 of 29 of Altria Group Q3 2022 earnings press release).

Altria Group’s oral tobacco segment reported $1.9 billion in revenue net of excise taxes, which was up 0.5% over the year-ago period. A decline in shipment volumes was more than made up for by price hikes (figures sourced from page 11 of 29 of Altria Group Q3 2022 earnings press release).

The tobacco giant recorded $3.66 in adjusted diluted EPS through the first nine months of 2022, which was 4% higher year over year. Due to Altria Group’s operating efficiency, the company’s adjusted net margin increased by nearly 180 basis points over the year-ago period to 42.5% year to date (data points according to pages 25 and 1 of 29 of Altria Group Q3 2022 earnings press release and page 1 of 29 of Altria Group Q3 2021 earnings press release).

Coupled with a 2.2% decline in the company’s outstanding share count to 1.8 billion, this is how Altria Group has managed to deliver healthy earnings growth so far in 2022 (details per page 19 of 29 of Altria Group Q3 2022 earnings press release).

Risks To Consider:

Altria Group continues to churn out satisfactory earnings results just about every quarter. However, every investment has its share of risks that investors need to watch.

With the probability of a U.S. recession being a nearly certain outcome within the next 12 months, some consumers may have to tighten up their finances. This could include making at least a temporary switch from premium Marlboro cigarettes to discount cigarette brands, which would harm Altria Group’s financial results.

The company’s predominant smokeable products segment experienced a steep 9% drop in shipment volume in the first nine months of 2022. This decline was primarily due to the negative impact of inflation on consumers’ disposable incomes (figure sourced from page 9 of 29 of Altria Group Q3 2022 earnings press release). And the declines should revert more to the mid-single-digits as inflation eases over time. But it’s a reminder that Altria Group’s cigarette alternatives like the oral nicotine pouch brand called on! will have to keep growing to allow revenue net of excise taxes to move higher over the long run.

The Stock Is Still A Blue Chip Bargain

Altria Group may be a wonderful business. But even the best businesses have a point of no return valuation at which you can’t expect optimal investment results. This is why estimating the fair value of a stock and insisting upon not paying too far above that price is paramount to investing success. That explains why I will be using two valuation models to appraise Altria Group’s shares.

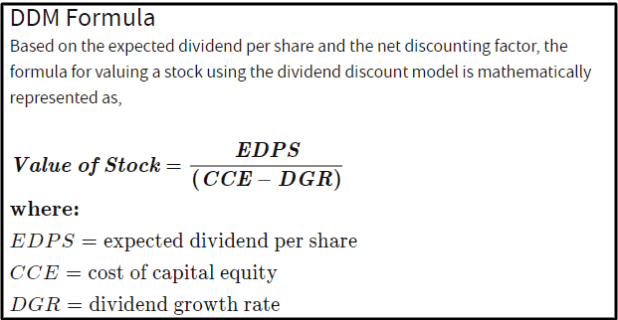

Investopedia

The first valuation model that I will utilize to assess the fair value of shares of Altria Group is the dividend discount model. This contains three inputs.

The first input into the DDM is the expected dividend per share, which is the annualized dividend per share. Altria Group’s annualized dividend per share is currently $3.76.

The next input for the DDM is the cost of capital equity, which is another term for the annual total return that an investor requires from their investments. My personal preference for this input is 10%.

The final input into the DDM is the annual DGR or dividend growth rate over the long haul. As I alluded to earlier in the article, I will assume a 4% annual dividend growth rate.

Using these inputs for the DDM, I come out to a fair value of $62.67 a share. This indicates that Altria Group’s shares are priced at a 24% discount to fair value and can provide a 31.6% upside from the current price of $47.63 a share (as of December 2, 2022).

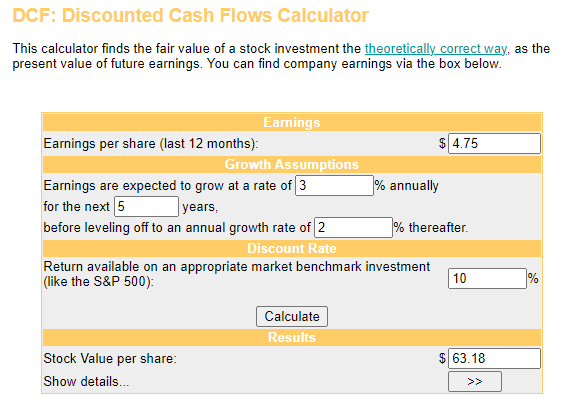

Money Chimp

The first valuation model that I’ll use to calculate the fair value of shares of Altria Group is the discounted cash flows model or DCF model. This also is comprised of three inputs.

The first input for the DCF model is a company’s trailing twelve-month adjusted diluted EPS. This is $4.75 for Altria Group.

The second input into the DCF model is growth assumptions. Erring on the side of caution, I’ll use a 3% annual adjusted diluted EPS growth rate for the next five years. And I’ll model a drop-off to 2% in subsequent years.

The third input for the DCF model is the discount rate. This is the required annual total return rate. I will again use 10% for this input.

Plugging these inputs into the DCF model, I arrive at a fair value of $63.18 a share. This suggests that Altria Group’s shares are priced at a 24.6% discount to fair value and offer 32.6% capital appreciation from the current share price.

Averaging these two fair values together, I compute a fair value of $62.93 a share. This means that shares of Altria Group are trading at a 24.3% discount to fair value and can provide a 32.1% upside from the current share price.

Summary: Altria Group Is An Undervalued And Dependable Income Stock

Altria Group is among the select few stocks that have raised their dividends for at least half a century. And based on the company’s sustainable dividend payout ratio and stable fundamentals, that track record appears positioned to continue.

Throw in Altria Group’s double-digit percentage undervaluation using my valuation model inputs and the stock is a great buy for income investors.