Alibaba: Let’s Address The Elephant In The Room (NYSE:BABA)

Andrew Burton

Flashback

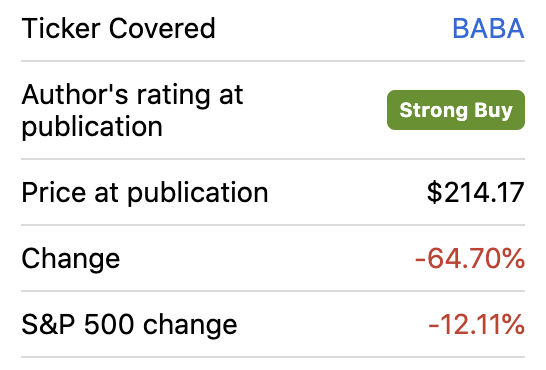

I remember vividly how bullish I was on Alibaba (NYSE:BABA) when the Chinese Internet giant was going through a series of political setbacks sparked by Jack Ma back in 2021. In my very first article on Alibaba published on 5/27/2021, I recommended buying the stock based on a DCF analysis suggesting that markets were pricing in irrationally low growth rates that significantly underestimated the company’s prospects and earnings power. Unfortunately, the article didn’t age too well.

Seeking Alpha

In April 2022, I came to the realization that Alibaba was a dramatically different company dealing with political and regulatory risks that no analysts could accurately quantify or predict. As a result, I wrote the following in my second article on Alibaba.

Looking back, it’s clear that I missed the elephant in the room: China is a vastly different investment environment characterized by highly unpredictable government intervention in the private sector. No matter what numbers analysts come up with in their models, the regulatory outlook for Alibaba and other Chinese tech names remain the same: Party first, business second.” – Alibaba: I Missed The Elephant In The Room (4/19/22)

Fast forward to today, I continue to search for any information that would suggest the worst is over for Alibaba as many investors would hope to see. Regrettably, I’m afraid that the elephant in the room remains alive and well.

Limited economic visibility

One can hardly be bullish on the prospects of Alibaba without believing in the future prosperity of the Chinese economy. For many investors in Chinese equities, the fastest way to get a sense of China’s economy is by looking at key statistics released on a regular basis. Unfortunately, China just announced on Monday 10/17 that it would indefinitely delay the release of economic data previously scheduled for Tuesday morning.

Last Friday, the General Administration of Customs also indefinitely delayed the release of China’s September import/export data.

Whether experts may be wondering this is a way to avoid looking bad (the actual numbers are probably awful) during the CCP’s twice-a-decade national congress from 10/16 to 10/22, investors should be concerned by this highly unusual move without any further explanation from the Chinese authorities.

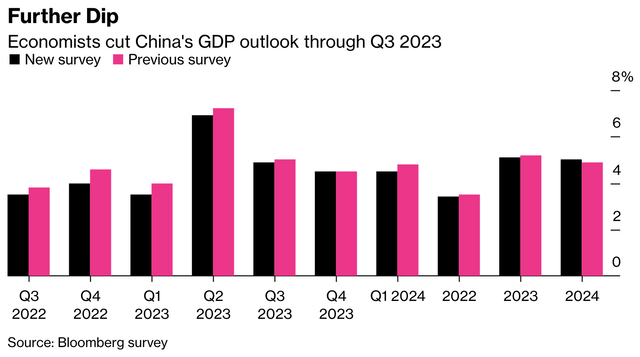

Per economists in the West, China is expected to grow its economy by 3.3% in 3Q22 after a difficult 2Q22 when growth was just 0.4% due to a 2-month Covid lockdown in Shanghai. For full year 2022, economists have predicted a 3.3% increase in GDP, which is materially below the 5.5% target for the year.

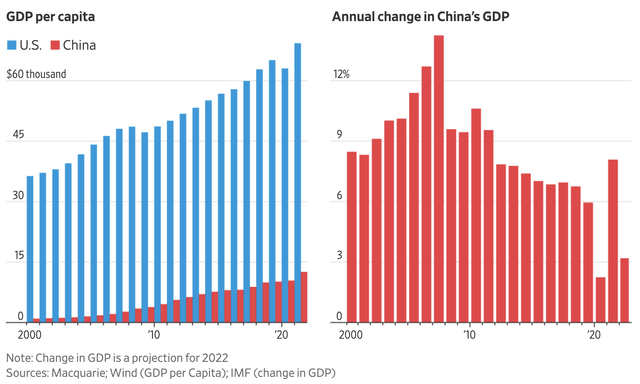

Ambitious economic targets

In a two-hour long speech on 10/16, president Xi Jinping reiterated his ambitious plan to grow China into a “medium-developed country” by 2035. Per analyst Robin Xing of Morgan Stanley, this means China’s GDP per capita will have to increase from just over $12,000 in 2021 to $20,000-$24,000, implying a 4.5% growth rate until 2035. In other words, China will have roughly doubled the size of its economy by year 2035.

According to Bloomberg survey, economists still widely expect China to grow its GDP by 5.1% and 5% in 2023 and 2024. But a number of financial institutions are beginning to question whether these estimates are too optimistic. Already, Nomura has cut China’s 2023 GDP growth estimate from 5.1% to 4.3%, while Goldman Sachs has revised its number from 5.3% to 4.5%.

A real estate bubble

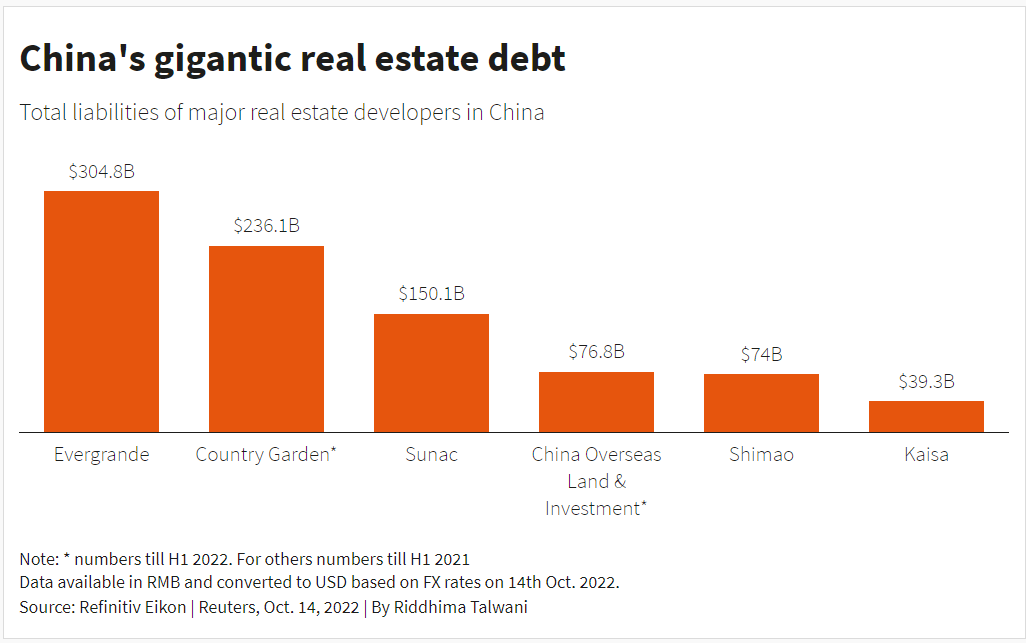

There is also a systematic problem with China’s overextended housing market where the total size of empty real estate (2.8 billion sq. meters) is about 47x that of Manhattan. The China Evergrande Group, the second largest property developer in China, has about $300 billion in total liabilities, while several other developers easily score above the $50 billion mark.

Reuters

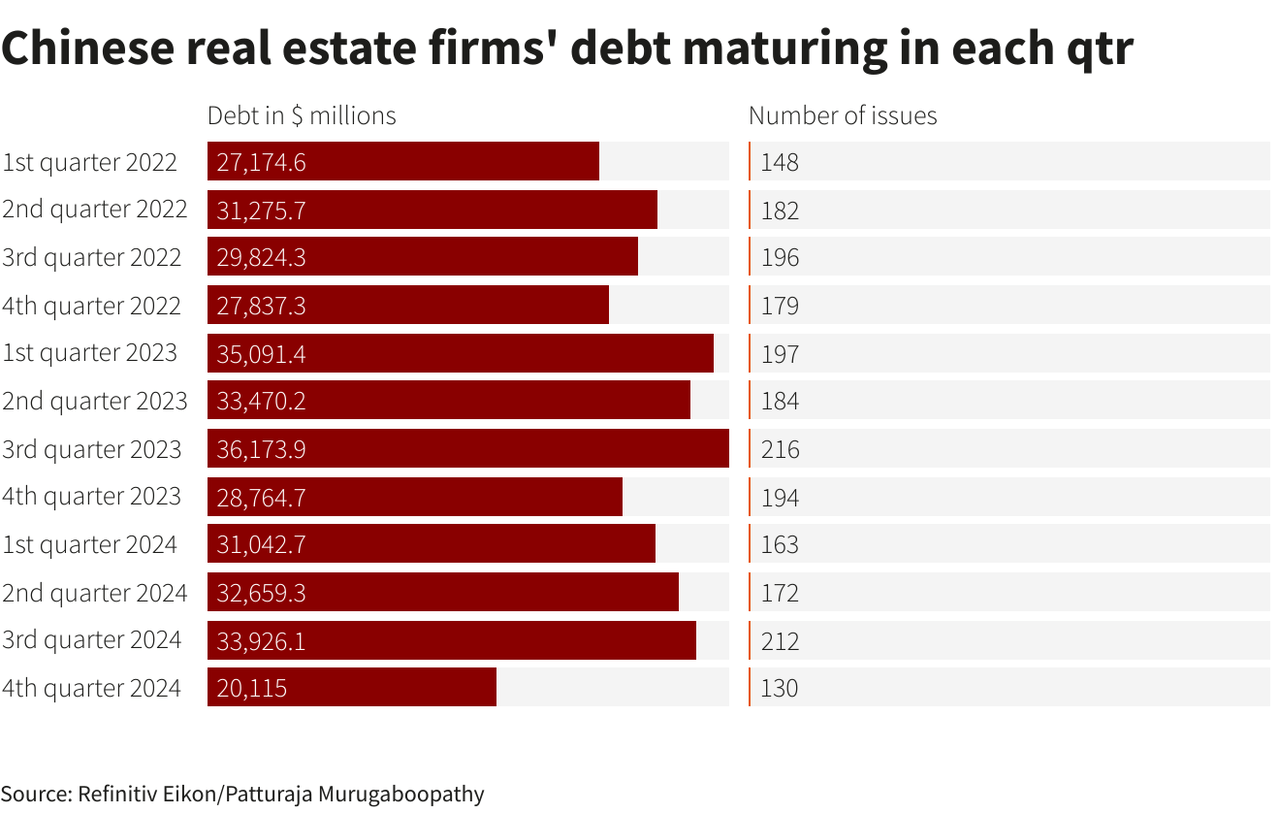

In 2H22, about $58 billion worth of property developers’ debt face maturities. About $133 billion and $116 billion worth of debt will come due by 2023 and 2024, respectively. Already, the average prices of China’s junk dollar bonds (mostly comprised of real estate companies) have fallen below 56 cents on the dollar on Tuesday. In China, the real estate market accounts for roughly 40% of household assets and 29% of GDP. Evidently, there’s a major housing crisis that will likely weigh on the country’s economic growth going forward.

Reuters

Weakening Western demand

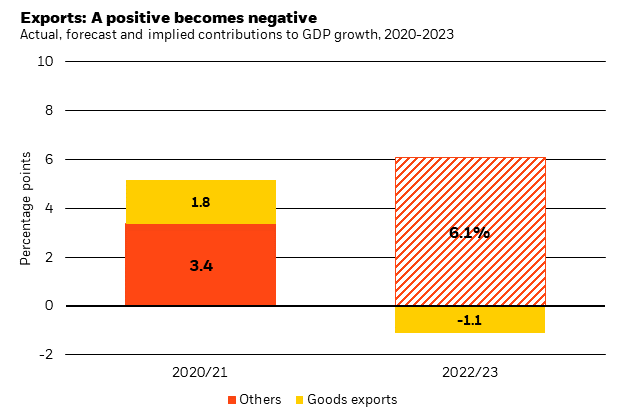

As demand for consumer goods in the West faces destruction due to high inflation and fading Covid tailwinds, China’s exports also face pressure. During the pandemic, China was able to keep most of its factories in operation due to strict restrictions, which allowed the country to capture rocketing foreign demand while production in other Asian countries was severely challenged. This is why China’s exports increased by an average of 10% in 2020 and 2021, significantly above the years before the pandemic.

However, the pandemic-driven tailwind is likely to turn into a headwind as consumer demand has shifted from goods to services in the West. Per BlackRock, China’s exports could contribute a negative 1.1% in GDP growth in 2022/23 vs. +1.8% in 2020/21. This means in order to achieve a 5% steady growth rate, domestic demand will have to almost double in the current year and the next.

BlackRock

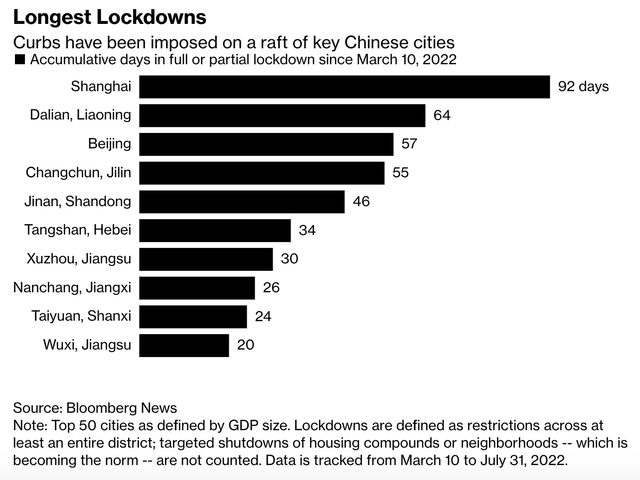

Zero-Covid Policy

China has taken a draconian approach to Covid by maintaining strict restrictions in major cities and suburbs. This has gotten to a point where the economic costs have far exceeded the benefits, as ongoing supply chain disruptions within the manufacturing and transportation sectors have made foreign buyers question whether they would want to continue making their goods in China. For example, Apple (AAPL) is looking to move a meaningful share of its hardware production to India and Vietnam by 2025.

It’s also possible that the CCP is sticking to these restrictions to prevent any social unrest before the 20th National Congress, but this shows that China’s political stability is far more important than economic activities.

While China’s zero-Covid policy will likely be reduced after the 20th National Congress, it’s unlikely that it will be a one-time move where all restrictions are lifted at once. The virus is still evolving and domestic developments of new vaccines are still ongoing. More relaxed Covid restrictions will certainly provide some upside to China’s economic activities, but it’ll likely be a choppy recovery with one step forward and two steps back.

Worsening Sino-American relations

In 2022, tensions between the US and China have been amplified by events such as Russia’s invasion of Ukraine and House Speaker Nancy Pelosi’s visit to Taiwan. While past events pointing to a worsening US-China relationship are well documented, investors should pay close attention to attempts made by the US to block China from developing advanced semiconductor technology. In September, the Biden administration already asked Nvidia (NVDA) and AMD (AMD) to stop selling advanced AI/supercomputer chips to China.

On 10/7, the Department of Commerce announced a set of export controls on the sale of advanced semiconductor chips and tools to China. These new rules go beyond those introduced during the Trump era and will likely take away all the possibilities for China to develop semiconductor technology at the leading edge.

Under these restrictions, China will not be able to develop and produce logic chips of 16nm/14nm or below, DRAM chips of 18nm or below, and NAND flash chips with 128 layers or more. From 10/12, it would be against the law for any US persons (including dual passport holders) to participate in the development and production of semiconductor chips at a Chinese-based facility.

Already, semiconductor tool makers are cutting ties with Chinese customers. Applied Materials (AMAT), KLA Corp (KLAC), and Lam Research (LRCX) have withdrawn employees from Yangtze Memory Technologies, China’s largest memory maker. Non-US companies are also abiding by US rules, where EUV-maker ASML (ASML) has asked employees to stop working with Chinese clients and Taiwan Semiconductor (TSM) just had to obtain a 1-year license from the US to continue purchasing equipment for its 16nm and 28nm facilities in Nanjing, China.

In summary, the Chinese economy is facing many headwinds that will likely put the CCP’s economic targets at risk. With limited economic data, potentially lower-than-expected GDP growth, a housing bubble, reduced export demand, ongoing Covid controls, and a deteriorating relationship with the US that stifles innovation, China is a difficult place to invest.

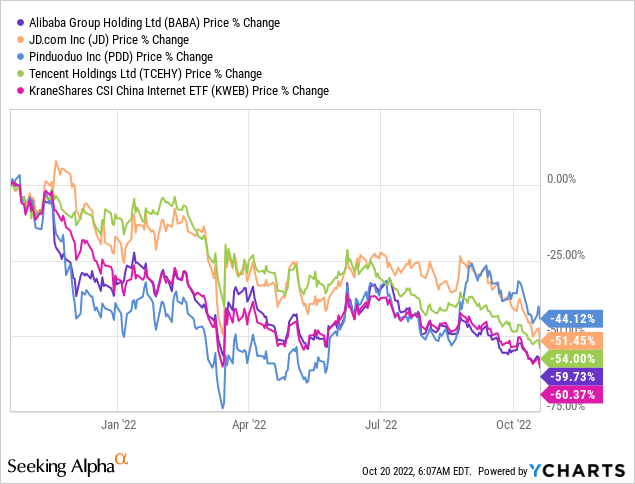

Alibaba’s recent performance

Now that we have a basic understanding of China’s macro outlook, let’s discuss Alibaba’s recent performance. Over the past 12 months, shares of Alibaba have suffered a ~60% decline alongside other Chinese Internet heavyweights like Tencent (OTCPK:TCEHY) and JD.com (JD). The KraneShares CSI China Internet ETF (KWEB) has also dropped 60%.

In C2Q22, Alibaba reported muted revenue growth as business was severely challenged by Covid restrictions across China. Revenue of RMB 206 billion was flat YoY from +8.9% in C1Q22. China commerce revenue of RMB 142 billion declined by 1% YoY, and cloud revenue grew just 10% to RMB 18 billion. Q2 EBIT was down 19% YoY to RMB 24.9 billion, which represented an EBIT margin of 12%.

In the trailing 12 months, Alibaba had an EBIT margin of 10.6%, which was materially below fiscal 22/21/20/19 at 11.3%/15.3%/18.7%/16.4%. Whether margins will stabilize and return to historical levels remains to be seen, but the trend is clearly negative. Nevertheless, management highlighted the need to improve operational efficiency and optimize cost structure.

In the C2Q22 earnings call, Alibaba noted a gradual recovery in consumption in July, but acknowledged risks of slowing macroeconomics. Thus far, the macro picture remains challenged given ongoing Covid cases. In September, Chengdu went into lockdown mode where 21 million people were ordered to stay indoors. In October, Beijing’s Covid cases reached a 4-month high, though no major lockdowns have been imposed. Nonetheless, the CCP is likely to continue its zero Covid policy at least for the foreseeable future. This means Alibaba’s 2H22 numbers are unlikely to be inspiring, while 2023 could still face pressure given a worsening global macro.

Do analysts have the crystal ball?

Over the past 6 months, analysts have cut Alibaba’s FY23 (March) revenue and EPS estimates by ~14% and ~12%. For the current fiscal year (ending in March 2023), Alibaba is expected to see a 0.7% decline in revenue to $125.7 billion, while EPS is expected to be $7.19, down 8% YoY. For fiscal 2024, analysts are expecting revenue of $141.7 billion (+12.7% YoY) and EPS to grow 17.6% to $8.46. This comes down to a FY23/24 P/E of 9.9x/8.4x, at the low end of the stock’s historical valuation range.

Though many would consider shares a bargain at such depressed multiples, Alibaba’s outlook is so unpredictable that even some of the best analysts can’t get it right.

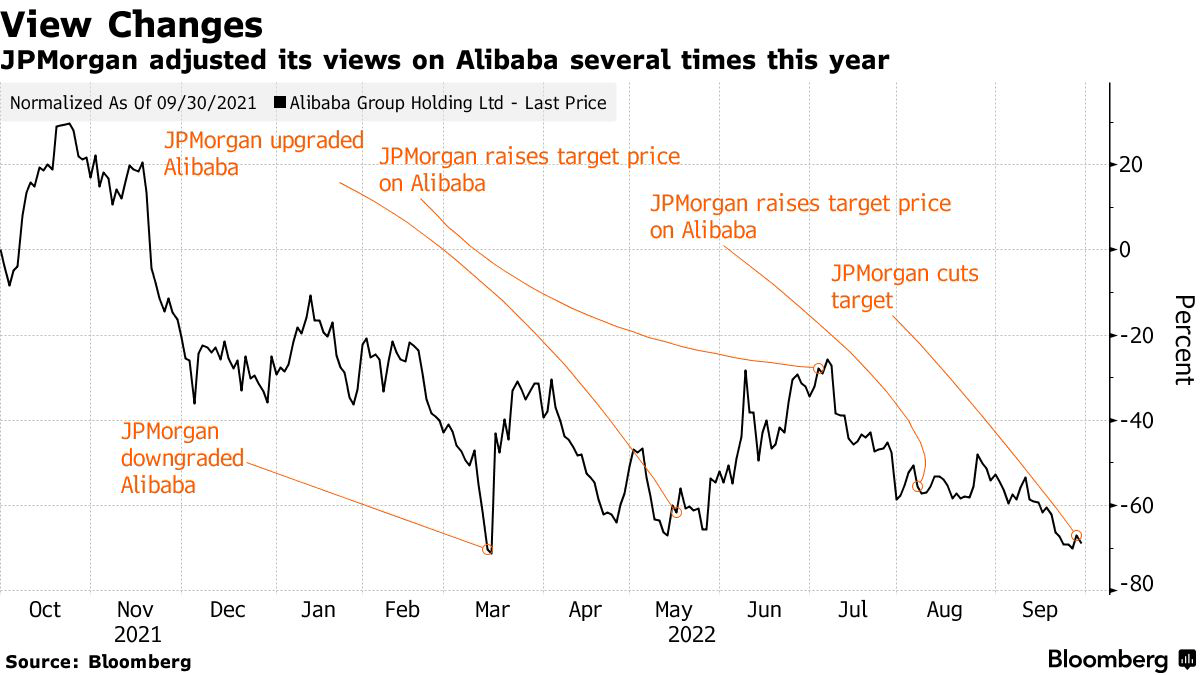

In March 2022, analyst Alex Yao of JP Morgan famously called Alibaba and the Chinese Internet sector “uninvestable” based on increasing macro and geopolitical risks that would cause foreign investors to continue cutting exposure to Chinese equities. Further, weak consumption due China’s Covid restrictions and the CCP’s “common prosperity” push would pose challenges to the e-commerce sector and investors’ confidence on future earnings.

Bloomberg

The report (subsequently edited) caused quite a scene, and even made JP Morgan lose its role as the senior underwriter for Chinese cloud company Kingsoft Cloud.

In May, however, JP Morgan took a 180-degree turn and upgraded Alibaba (and many other Internet companies) on improved regulatory risks following the State Council’s announcement of a series of measures to support the Chinese economy in mid-March (shortly after JPM’s “uninvestable” report). The team changed its rating from Underweight to Overweight and revised its price target from $65 to $130. In the following months, JP Morgan raised Alibaba’s price target to as high as $145, then reduced it to $135 at the end of September on limited improvement in top-line growth.

If everything works out perfectly (multiple expansion will be the key driver), the stock could return 90% from the current price of $71. But the key takeaway here is that trying to predict Alibaba’s revenue and earnings is a highly murky exercise, and no one has the crystal ball.

Conclusion

For Alibaba, the elephant in the room remains alive and well, and investors should treat management guidance and analyst estimates with skepticism given there’s virtually no way of predicting the regulatory outcome in China. As cheap as the stock may be at under 10x forward EPS, Alibaba’s top and bottom-line outlook is largely unclear as the Chinese economy faces a series of headwinds from weakening consumption to increasing geopolitical tensions that hurts innovation. When the elephant refuses to leave the room, investors should just leave the door closed.