Albertsons Stock Looks Cheap With A Favorable Technical Setup (NYSE:ACI)

lechatnoir/E+ via Getty Images

Food inflation continues to run unabated. Seeing those price tags at the grocery store is unnerving for cost-conscious consumers. Rising costs in all parts of the supermarket from produce to meats (my favorite) to the bakery and the center aisles strain folks’ budgets. Egg prices, in particular, are surging. A popular way to play higher food prices is to buy up shares in grocery stocks.

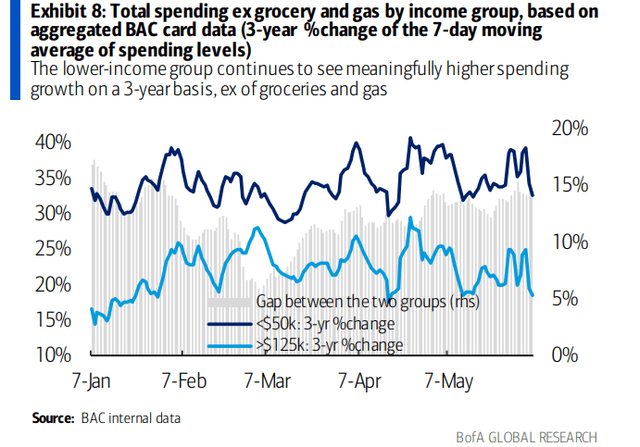

Bank of America reported that spending growth, outside of gas and grocery, shows signs of slowing across all income groups, according to the May CPI report issued earlier this month. This trend will be one to watch as the year progresses. Will the consumer hold up amid this higher cost-of-living environment?

Retail Spending Dips as Gas & Grocery Costs Mount

BofA Global Research

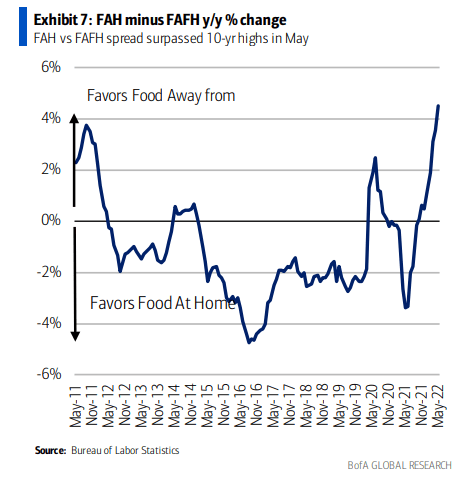

Also in the May CPI economic data release, there was a positive FAH-FAFH inflation gap which extended above the 10yr highs, according to Bank of America Global Research. That illustrates just how expensive grocery store prices are vs eating out. And going to a trendy restaurant is no cheap excursion these days, either!

Groceries Are Relatively Pricey vs Eating Out

BofA Global Research

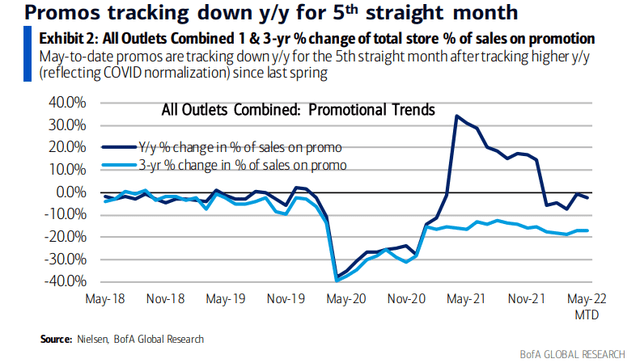

Within the industry, stores have been stingy on sales and promotion, according to BofA. In an effort to protect profit margins, May-to-date promos are tracking down over the past year for the fifth straight month after tracking higher year-on-year since early last year.

Grocers Have Cut Promotions & Sales to Beef Up Margins

BofA Global Research

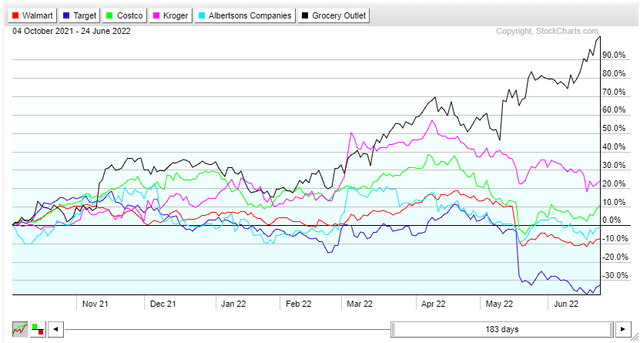

Meanwhile, grocers are hanging in there. Though the big-box retailers have seen recent stock price volatility, traditional grocery store chains have performed well since food inflation really took off in 2021.

Traditional Grocery Store Chain Stocks Have Performed Well Amid A Volatile Market

Stockcharts.com

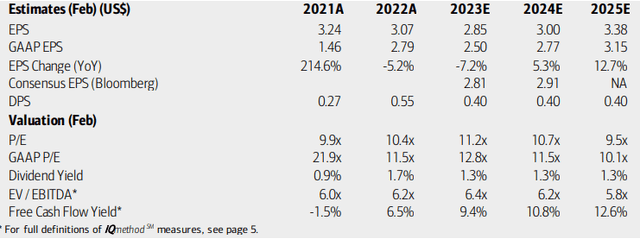

One particular grocery store, Albertsons (NYSE:ACI), looks attractive here from both a fundamental and technical point of view. While ACI’s earnings per share might not rise dramatically in the coming quarter and years, its free cash flow yield is expected to jump from 6.5% this year to above 12% by 2025. Moreover, its price-to-earnings ratio is exceptionally low compared to the broad market. Analysts mention that ACI’s adjusted earnings multiple is significantly below that of the industry, too.

ACI Earnings, Valuation, Dividend, Free Cash Flow Forecasts

BofA Global Research

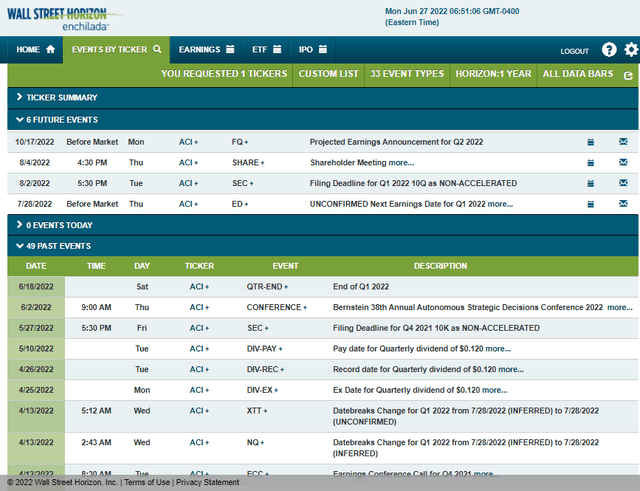

The corporate event calendar is light for the next month. Albertsons reports profit numbers early in the reporting season. The grocer’s Q1 earnings report is unconfirmed to take place on Thursday, July 28 BMO. A shareholder meeting is scheduled for August 4.

Albertsons Corporate Event Calendar: Earnings Date & Shareholder Meeting

Wall Street Horizon

The Technical Take

With a solid valuation and improving free cash flow, what do the charts say? I see a tradeable range with defined risk. That’s a solid technical setup. As ACI shares trade toward the lower end of the range dating back to August last year, a long position makes sense. If the stock breaks out above the bearish double-top pattern, that would support a longer-term bullish thesis. A breakdown below $25, however, could lead to a retest of the $21 breakout point from last summer.

ACI Chart: Trading Range With Downside Levels To Watch On A Breakdown

Stockcharts.com

The Bottom Line

ACI shares look good here. Valuation is compelling and free cash flow improvement supports the fundamental narrative. The charts, meanwhile, have a defined risk/reward setup.