Airbnb Earnings: Mixed Bag, But I’m Optimistic (NASDAQ:ABNB)

Andres Victorero/iStock via Getty Images

Investment Thesis

Airbnb (NASDAQ:ABNB) saw its revenue growth rates decelerate. Going into the earnings result, I made my bearish stance clear that Airbnb was going to struggle to positively impress investors.

And now, despite making that call right, I’m upwards revising my rating to a hold.

There are two considerations to keep in mind. On the one hand, Airbnb’s revenue growth rates are slowing down. On the other hand, despite Airbnb being extremely profitable, its investor base is not thinking about its bottom-line profitability. Airbnb is still perceived as a growth company.

And changing that conversation is going to be a challenge, how Airbnb shifts its narrative away from a ”hyper-growth” company, to a more middle-of-the-road growth company.

Because, if a growth company continues to guide for under 30% CAGR (currency-adjusted), it will soon be valued off on its bottom-line profitability.

And in this instance, the stock is still priced at approximately 41x forward EPS. Now, I should be clear that I believe that Airbnb’s earnings next year will be lower than analysts expect. This implies that Airbnb is probably priced at closer to 45x forward earnings, rather than 41x.

However, even at 45x forward earnings, this is not the end of the bull case and there are some positive considerations too. It’s a mixed-bag investment. But I’m less bearish on this name overall.

What’s Happening Right Now?

Bear market rallies are fascinating. They have a purpose: to destroy investors’ capital. It’s that constant up and down, that withers away at investors’ enthusiasm and capital.

The end result isn’t that investors don’t realize at the end of it that stocks are cheap at the bottom.

On the contrary, investors recognize that stocks are cheap. But investors generally believe that despite stocks being cheap, that stocks will still go lower. And also, crucially, investors have little excess capital to meaningfully buy stocks at the bottom, because they are already fully invested. And we are slowly grinding along that line.

Revenue Growth Rates Slow Down

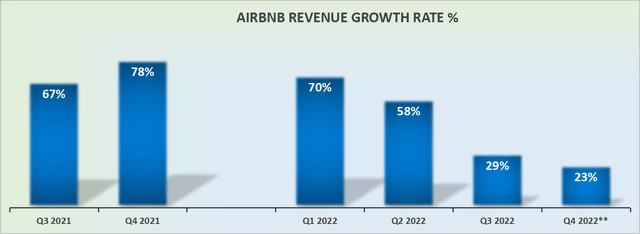

ABNB revenue growth rates

Airbnb’s revenue growth rates above are as-reported, as GAAP revenues. Meanwhile, Airbnb guides that on a constant currency, revenue growth rates for Q4 2022 would at the high end be up 29% y/y.

Consequently, despite everything that was being said about the great reopening, Airbnb’s revenue growth rates are slowing down. And that’s understandable, given all the macro headwinds, including a cost of living crisis in many parts of the world.

Furthermore, Airbnb has really tough comparables with last year’s Q4 2021. Also, it could be said that those challenging comparables are probably going to remain in place well into H2 2023.

For investors that feel like a really long time, to hold onto a stock that still has nearly 5 or 6 months before we start to at least consider the end of the headwinds around.

Next, let’s discuss its crown jewel, its profitability profile.

Profitability Profile Continues to Improve

Airbnb is guiding for approximately $440 million of adjusted EBITDA for Q4. Approximately 32% higher than in Q4 of last year. That puts this year’s adjusted EBITDA at approximately $2.8 billion.

However, the problem here is, what will 2023 look like for Airbnb? And therein lies the difficulty for me. Can we assume that Airbnb’s adjusted EBITDA margin can continue to expand, unhindered, by approximately 30% relative to 2022?

If that were so, Airbnb would next year see approximately $3.7 billion of EBITDA.

ABNB Stock Valuation – 17x Forward EBITDA

Assuming all goes well in 2023, this would leave Airbnb priced at 17x next year’s EBITDA.

On the other hand, inflation could persist for a while still. To illustrate, Italy’s inflation is presently around 9.4%, while the UK’s is around 8.6%.

Hence, if inflation continues to affect countries around the world by approximately 5% to 7% in 2023, that would be yet another aspect weighing down Airbnb’s profit margins, with the end result that Airbnb’s EBITDA would come down, and its multiple would increase.

The Bottom Line

It’s not all negative when it comes to investing in Airbnb. Airbnb is a large and very well-known company. It’s not a difficult concept to get around the idea of what Airbnb does. And it’s the ease of understanding its value proposition that will lead the stock to remain tightly held by investors.

Because even if Airbnb was to be a ”relative” underperformer over the coming year, this would most likely not lead investors en masse to throw in the towel on the stock.

After all, Airbnb is the leading host marketplace. Airbnb is a brand. Airbnb is a blue-chip company. And when times get tough in the stock market, investors generally flock to safety, and that is what Airbnb offers investors.