Agree Realty: The Preferred Shares Offer Great Risk/Reward

Justin Sullivan

Introduction

Agree Realty (NYSE:ADC) is one of the largest commercial net lease REITs. I like net leases as it means the tenant is actually responsible for all relevant operating expenses, including insurance, maintenance and property taxes. This generally means there are fewer headaches for the landlord, and it also makes the FFO and AFFO calculation ‘cleaner’ as the tenant and not the landlord is responsible for maintenance.

There recently have been some good articles on Agree Realty here on Seeking Alpha (here and here) for instance, but in this article, I wanted to have a closer look at the REIT’s preferred shares.

The FFO and AFFO remain strong

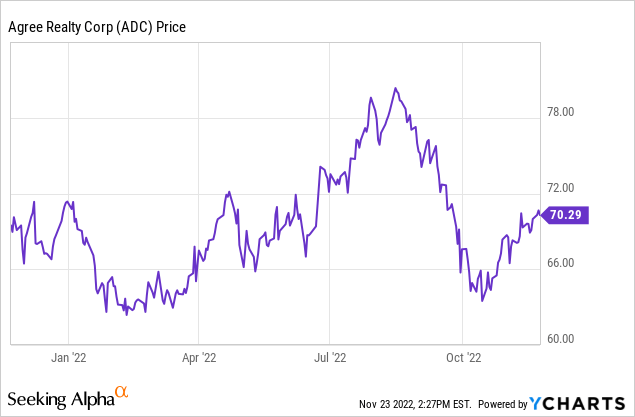

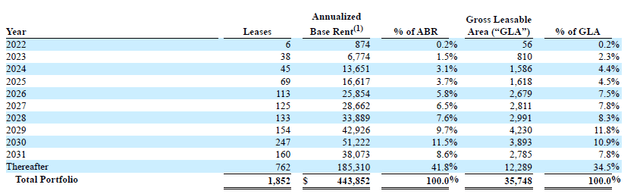

The third quarter was once again a good quarter for Agree Realty. As the vast majority of the leases are very long-term and are only expiring after 2030, the REIT enjoys an excellent visibility on its earnings. As you can see below, just over 50% of the Annualized Base Rent only expires from 2031 on. Additionally, between now and the end of 2024, less than 5% of the existing leases (again expressed in annualized base rent) are up for renewal.

Agree Realty Investor Relations

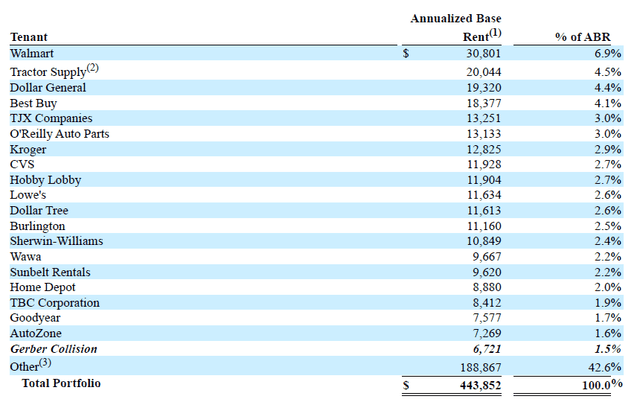

Additionally, it’s also important to know that Agree is mainly dealing with well-known tenants. The largest tenant is Walmart (WMT) followed by Tractor Supply (TSCO) and Dollar General (DG). Having respectable tenants should reduce the risk of defaulting on making the rent payments.

Agree Realty Investor Relations

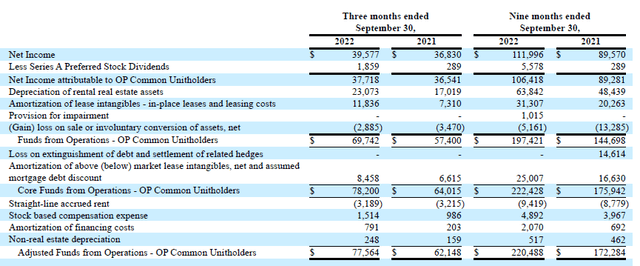

I won’t discuss the income statement, as that’s not very important for a REIT. Instead, the FFO and AFFO calculation deserve more attention. As you can see below, the starting point of the FFO calculation is the $39.6M net income anyway, to end up with a $69.7M Funds From Operations and a $78.2M Core Funds From Operations after adding back the amortization of lease intangibles.

Agree Realty Investor Relations

The total AFFO was $77.6M, which means the Core FFO came in at $0.98 per share, while the AFFO was $0.97 per share.

A closer look at the preferred shares

The preferred shares of Agree Realty are trading with (NYSE:ADC.PA) as their ticker symbol. They were issued in September 2021, and the preferred shares have a fixed preferred dividend of $1.0625 per year. While most preferred dividends are payable on a quarterly basis, Agree’s preferred shares are paying a monthly dividend of $0.08854 per share. At the current share price of just over $17.40 per preferred share, this represents a dividend yield of 6.1%. The preferred shares are callable from September 2026 on.

I focus on two elements when looking at a preferred share. First of all, I want to make sure the preferred dividend payments are well-covered. That’s clearly not an issue for Agree Realty, as the $77.6M in AFFO already includes the full impact from the preferred dividend, which is $1.86M per quarter. This means the AFFO result before taking the preferred dividend into account is approximately $79.5M, which also means Agree needs less than 2.5% of its AFFO on a quarterly basis to cover the preferred dividends. A coverage ratio of in excess of 4,200% is spectacular, there’s no other way to describe that.

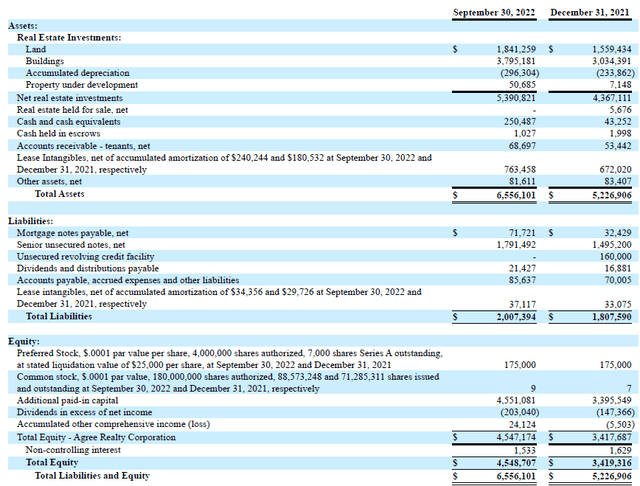

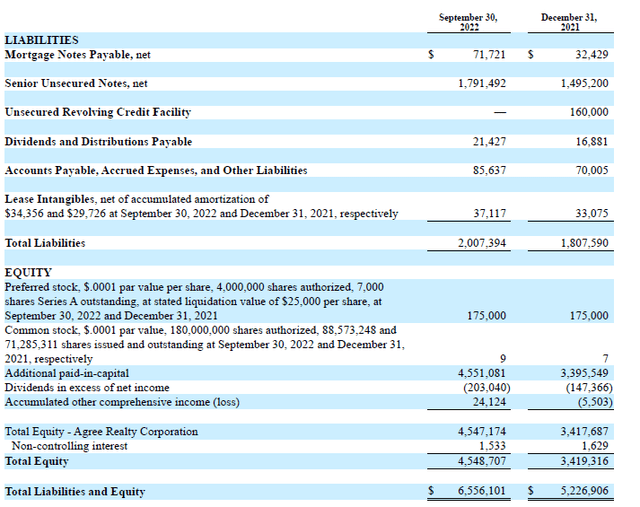

Looking at the balance sheet (see below), the REIT is definitely run based on conservative principles. The total book value of the real estate assets (including almost $300M in accumulated depreciation) is almost $5.4B. Agree also has just over $250M in cash on the balance sheet, which means the net debt (including the $21M in dividends and distributions payable) is just $1.63B.

Agree Realty Investor Relations

This also means the LTV ratio is just 30.3% when comparing the net debt with the book value of the assets. That’s a pretty low LTV ratio, and it further emphasizes the conservative balance sheet.

And looking at the liabilities side of the balance sheet, we see the 7 million preferred shares with a value of $175M represent just a minor fraction of the equity component. With a total equity value of $4.55B, in excess of $4.35B in equity actually ranks junior to the preferred shares, which means the asset coverage ratio based on the current book value of the real estate assets exceeds 2,500%. This basically means that even if the value of the assets would decrease by 60% overnight, all creditors and preferred shareholders would still see their money back if the REIT would be dissolved.

Agree Realty Investor Relations

Investment thesis

While owning the common units of Agree Realty makes a lot of sense, I can also understand there’s a specific sub-set of investors that just wants a safe dividend income and does not necessarily require to record capital gains. While I’m agnostic, I do have a specific portfolio with only fixed income securities (bonds and preferred shares) and Agree Realty’s preferred shares would be an excellent fit for that portion of my personal portfolio.

That being said, I also wrote put options on the common units in September and October when the share price was weak. Unfortunately, the share price has bounced back pretty nicely and all of my written put options will now very likely expire out of the money. I may very well continue to write put options, as I like how this REIT is being run.

I don’t have a position in the preferred shares yet. The current dividend yield of 6.1% is getting attractive, especially given how strong the preferred dividend coverage ratio is and how much equity is ranking junior to the preferred shares. So while the preferred dividend yield definitely isn’t the highest on the street, the risk/reward ratio is still attractive.