AerCap Holdings Stock: Why I See Scope For Growth (NYSE:AER)

dongfang zhao

Investment Thesis: AerCap Holdings could see upside from here on the basis of a recovery in quarterly earnings as well as a strong balance sheet.

AerCap Holdings (NYSE:AER) has faced a challenging macroeconomic environment over the past three years.

While the stock had seen a recovery throughout 2021 following the initial fall from the COVID-19 pandemic – the geopolitical and macroeconomic concerns of 2022 have led the stock lower:

The purpose of this article is to assess whether AerCap Holdings could be expected to see a renewal in upside from here.

Performance

For the six months ended June 2019, diluted earnings per share came in at $4.09. In the most recent six-month period, AerCap Holdings saw a diluted loss of -$6.92, albeit with earnings per share of $1.40 for the three months ended June of this year.

According to the company’s Q1 2022 earnings release – AerCap Holdings’ 135 aircraft and 14 engines leased to Russian airlines represented 5% of the company’s fleet by net book value as of the end of December 2021.

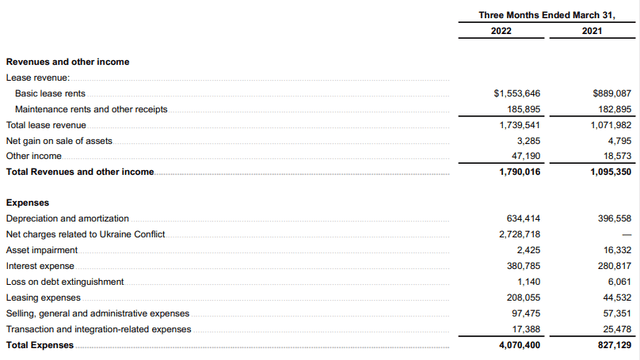

We can see that while earnings for the three months ended March 2022 saw a steep loss at -$8.35, this was primarily driven by net charges as related to the Ukraine conflict which came in at just over $2.7 billion – this figure remaining the same for the six months ended June 2022.

AerCap Holdings: Financial Results for the First Quarter 2022

These charges related primarily to the write-off of assets remaining in Russia and Ukraine, as well as impairment losses on recovered assets:

AerCap Holdings: Financial Results for the First Quarter 2022

From this standpoint – while the ongoing geopolitical situation between Russia and Ukraine weighed on the company for the first quarter – Q2 2022 earnings per share has recovered to $1.40 on a three-month basis.

Moreover, when comparing the company’s debt to total assets ratio for June 2019 and June 2022 – we see a very modest increase in the company’s debt to total assets ratio.

| June 2019 | June 2022 | |

| Debt | 29,019,666 | 47,927,887 |

| Total assets | 43,067,924 | 69,747,591 |

| Debt to total assets ratio | 0.67 | 0.69 |

Source: Figures sourced from AerCap Holdings Q2 2019 and Q2 2022 Financial Results. Figures (except debt to total assets ratio) provided in U.S. Dollars in thousands. Debt to total assets ratio calculated by author.

This is encouraging, as it indicates that in spite of the difficult macroeconomic environment that the company has faced over the past three years – AerCap Holdings has not needed to significantly grow its debt levels relative to its total assets.

Moreover, the company has seen its ratings outlook revised to positive by Fitch – along with having executed 184 transactions in the second quarter of 2022 as well as seeing 100% of its new aircraft order book placed for the coming year.

Looking Forward

Going forward, I expect that given the broad recovery across the aviation sector – we could reasonably expect to see further upside for AerCap Holdings going forward.

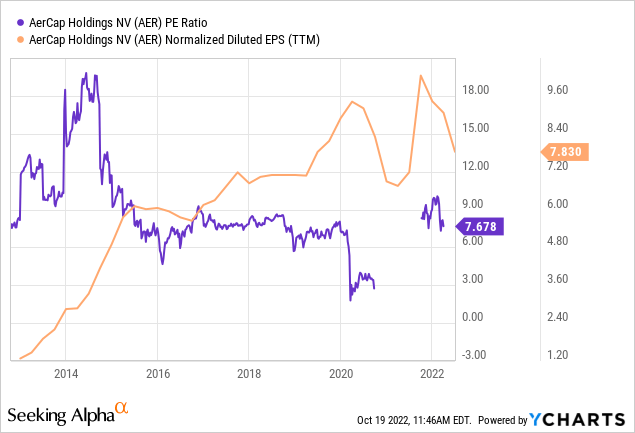

On a 10-year basis, we can see that in spite of recent pressures on earnings – normalized diluted earnings per share remains near a 10-year high. Moreover, while the P/E ratio is higher than at levels seen since 2020 – the ratio is still at reasonable levels as compared to levels seen nearly a decade prior:

ycharts.com

Looking to the third quarter – I take the view that investors will be looking for evidence of further earnings growth, along with a continually strong balance sheet. Specifically, should we see growth in total assets outpace that of debt, then this would be an encouraging sign as it would indicate that the company is not overly dependent on debt to expand its asset base.

Moreover, with AerCap Holdings having recently agreed with Airbus conversion house EFW on an order for 15 Airbus A321 Passenger-to-Freighter (P2F) conversions – this puts the company in a better position to continue servicing its cargo customers and allow such customers to upgrade from the older Boeing 757-200 freighter model.

Conclusion

To conclude, AerCap Holdings came under pressure at the start of this year as a result of the ongoing geopolitical situation between Russia and Ukraine. However, I take the view that should earnings continue to recover on the back of a strong order book – then AerCap Holdings could have significant scope to recover the decline in price seen earlier this year.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.