A Complicated Dilemma | Seeking Alpha

Guido Mieth

By Erik Norland

At a Glance

- What happened with the banking sector in the past few weeks may be a harbinger of what’s to come, and we may soon see much tighter credit conditions.

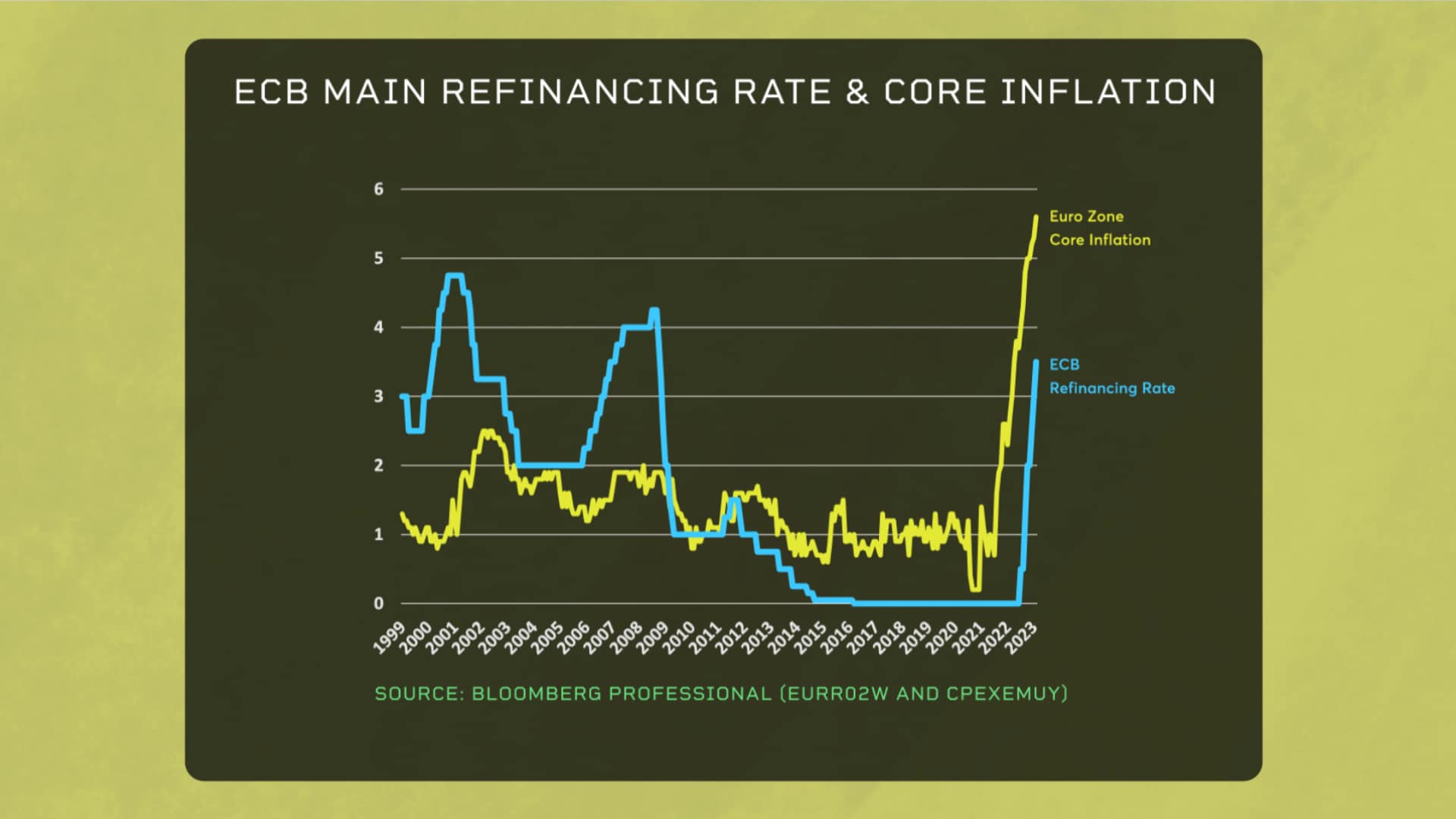

- While headline rates of inflation have subsided with lower energy prices, core inflation has not.

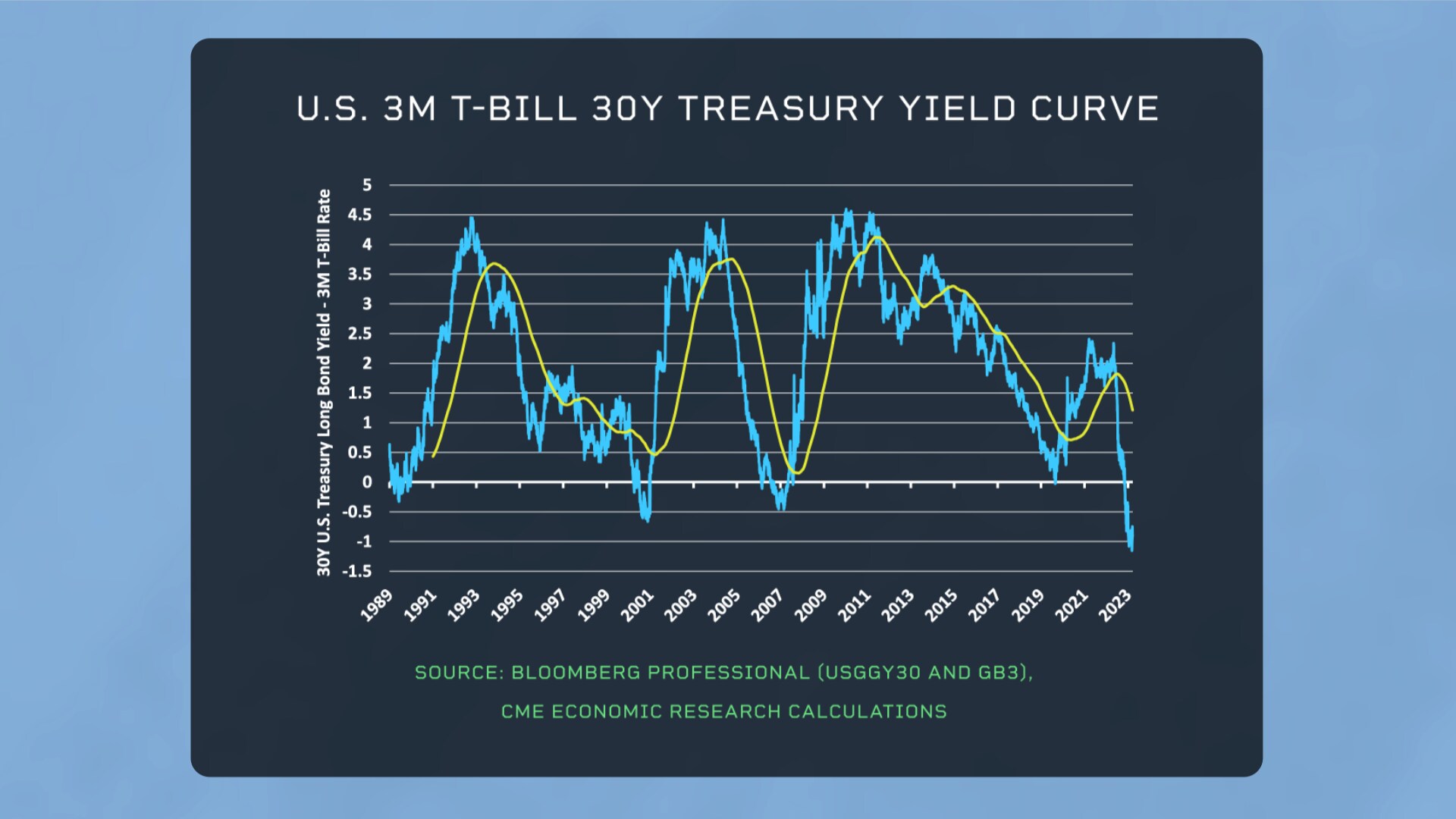

Over the past year, the Federal Reserve and the various European central banks have raised rates more than at any time since 1981. Short-term interest rates rose above long-term rates, creating the steepest yield curve inversion in decades.

At some point, the consequences were bound to be felt. As such, we’ve spent much of the last six months warning that central bankers were going to find themselves in a dilemma, having to choose between fighting inflation and financial stability.

What is particularly disconcerting is that policy rates remain far below the rate of core inflation. For example, the Fed has its rates 100bps below core inflation, while the ECB and BoE have their rates over 200bps below core inflation.

While headline rates of inflation have subsided with lower energy prices, core inflation has not. So, it’s not clear that they have done enough to win the inflation battle.

On the other hand, the failure of Silicon Valley Bank (SIVB), Signature Bank and Credit Suisse (CS) show that stresses in the system are building. In general, as yield curves invert, bank profit margins decline since banks make money by borrowing short term from depositors and lending long term to businesses and households.

As such, what happened with the banking sector in the past few weeks may be a harbinger of what’s to come, and we may soon see much tighter credit conditions.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.