XLF Vs. XLK ETFs: I Prefer Financials Over Tech

naphtalina/iStock via Getty Images

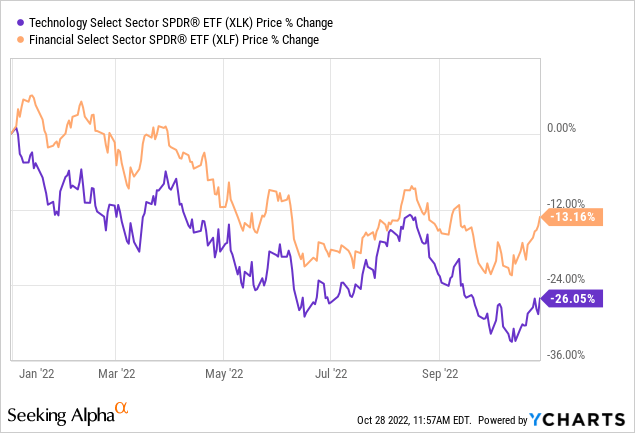

The financial sector has been less prone to volatility than Tech as evidenced by the Technology Select Sector SPDR ETF (NYSEARCA:XLK) underperforming the Financial Select Sector SPDR ETF (NYSEARCA:XLF) by nearly 13% since the beginning of this year as seen in the charts below.

However, Tech has managed to recoup some of its lost ground during the last month as seen by the blue chart’s uptrend to the right, with the financial results of Apple (AAPL) and Microsoft (MSFT) adding fuel to the upside on Friday 28. Still, this thesis is of the opinion that this upside should not be sustained with the looming Federal Reserve meeting on November 1-2. Instead, the other objective of this thesis is to show that the time has come for the financial sector to be prioritized by investors.

I start with Tech which after coming a long way since the dot-com bubble of 2000 now accounts for 26.1% of the S&P 500 index compared to only 11.2% for Financials.

Cracks Starting to Appear in Tech

The start of Big Tech earnings season has normally been a period of joy, especially from the days of the pandemic when companies like Alphabet (GOOG) (GOOGL) or Meta Platforms (NASDAQ:META) would beat earnings and trigger an upside in the Nasdaq. Nothing seemed to be able to stop the progression of Big Tech with their global infrastructures spanning throughout the globe as they quickly turned Covid lockdowns into new sales opportunities, be it from the cloud, search or advertisement.

However, the recent earnings season has shown that these two companies are not immune to economic cyclicality, but investors can rest assured that did not form part of XLK’s holdings, at least as of October 26.

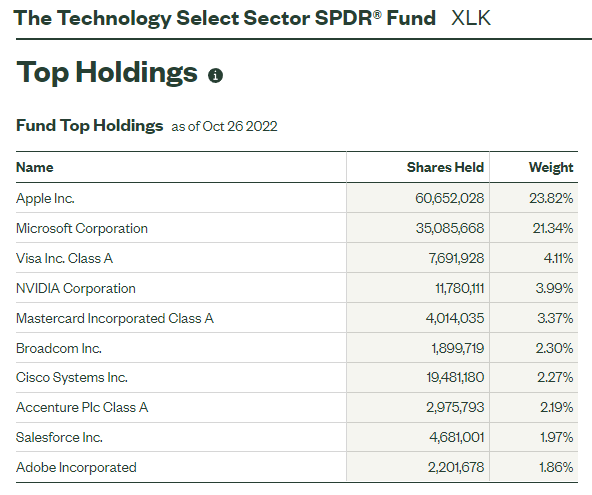

Looking at the industry, a lot has changed between 2020 and 2022, with Big Techs’ global footprint now becoming pain points as the strong dollar and supply chain spanning the far east create headwinds for Microsoft and Apple respectively, XLK’s two largest holdings as shown below.

XLK’s Top Holdings (SSGA)

Out of these two, Apple was the only one that reported positive earning beats, but, looking into the details of the financial results, it remains supply-constrained with sales also being impacted by a strong greenback. These two factors may in turn impact future results.

Changing Economic Outlook

Pursuing further, the U.S economy where they derive most of their revenues and profit margins is rapidly evolving with high inflation eating into corporations’ disposable income to such a point that they have to curtail spending. This has been exacerbated by the Federal Reserve, whose hawkish stance aimed at taming the hot inflation remains justifiable, but has the unintended consequences of raising borrowing costs, thereby discouraging people from buying homes or businesses from investing in order to grow revenues.

In this respect, when you analyze the earnings transcripts for companies in general, it is more about reducing Capex to increase free cash flow, either to increase dividend payments or perform stock buybacks, than to increase IT budgets. To further support this statement, Gartner predicted that there would be a rise in IT spending by 3% in 2022, but at the same time, admitted that “Inflation is top of mind for everyone”.

Therefore, while Apple can manage to generate more sales in the coming holiday season, the ingredients are not present for sustained iPad or PC demand as even if people work from home, they are not likely to purchase devices in such high numbers as before. Also, do not expect this to change overnight even if the Fed suddenly turns dovish.

Moreover, while digital transformation remains a secular trend, companies do not necessarily have to migrate their IT workloads to Microsoft’s Azure cloud. As for Cisco (NASDAQ:CSCO), its supply chains include China where the strict Covid-zero policy remains in place while NVIDIA (NASDAQ:NVDA) cannot export certain AI chips as before due to government restrictions. Along the same lines, with Apple just reporting another record for the number of active devices and supply chain constraints persisting in China, it may prove difficult to sustain sales and earnings growth in the first half of 2023.

For this purpose, I calculated the average year-on-year EPS growth for the last four reported quarters to be 7.5% for Apple and 10.6% for Microsoft. To put things into perspective, these figures are below the rate of 13.33% achieved by XLK’s holdings during the precedent 3-5 years as pictured below.

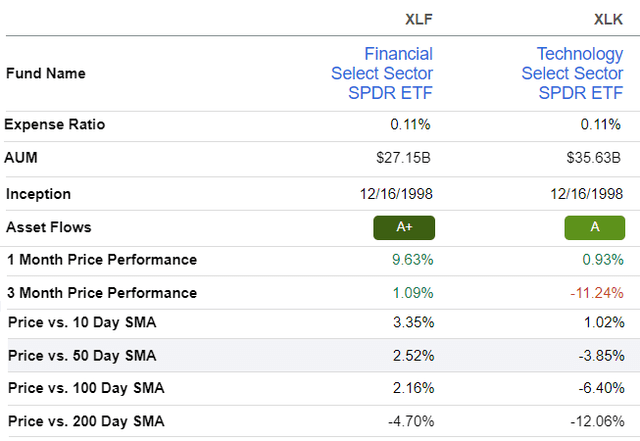

Comparing XLK and XLF metrics (SSGA)

Now, XLK consists of other holdings than just Apple and Microsoft, but in case there is a further deceleration of Tech revenue that reverberates on the bottom line as appears to be the most likely scenario in the short to medium term with high inflation and supply chain issues, their earnings growth will fall further at the point of becoming comparable to the Financial sector’s 8% as pictured above.

Financial Sector Deserves Better Valuations

Hence, with a fall in EPS growth, Tech no longer deserves its price-to-earnings multiple of 21.11x which is 1.6 (21.11/13.21) times those of the financial sector. This sector consists of banks and insurance companies that still underperforms the broader market during the last year, which is illogical in view of the Fed raising interest rates.

For investors, higher rates bode well for banks in particular as it enables them to glean more profits out of the money they hold for clients. For this matter. bankers profit from the differential between the interest they pay and earn by lending to borrowers.

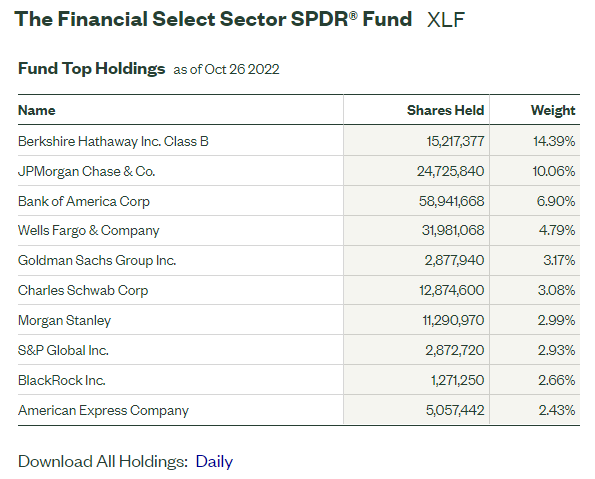

Still, adopting a cautionary posture, higher recession risks as the Fed tightens monetary supply have also weighed on investors’ sentiment who seem to be more focused on how a recession will harm bank earnings rather than how interest rates are favorable to them. As a matter of fact, banks form a large chunk of XLF’s assets or 34.6% as pictured below, with the ETF also consisting of nearly 20% of insurance companies.

XLF Top holdings (SSGA)

Now, it is extremely difficult to predict when there will be a prolonged recession and what it will actually look like, but, defying the outlook of many economists earlier on, the U.S. economy has rebounded in the third quarter of 2022.

Furthermore, analysts at Goldman Sachs (GS) have a neutral instance on the financial sector while cutting down on exposure to tech. This means that in relative terms, they favor Financials over Tech, and for this matter, fund flows also indicate that investors have a preference for the banking sector, with XLF scoring an A+ for asset flows as pictured below, indicating that more money is being poured into the ETF.

Asset Flows and Momentum Indicators

This positive momentum in favor of the financial sector ETF is also supported by its better short-term price performances of one and three months as shown below, while its share price outpacing its SMA (simple moving average) implies at least a medium-term upside, possibly to the $39.5 level last reached in March this year.

To further support my bullish stance, compared to the great financial crisis of 2008, U.S. banks have become much more selective about whom they lend money to, and there are more stringent capital requirement ratios that have been put in place by the Fed since then.

Comparing metrics, Asset Flows, and SMAs (Seeking Alpha)

As for Tech, the Price-SMA differential being skewed toward the moving averages does not support a rally, at least in the short-to-medium term. In fact, after the rebound of the U.S. economy in the third quarter, the Fed is not short of arguments to support further rate hikes.

Looking at the long-term picture, Big Tech has shown a remarkable ability to adapt and promote growth through acquisitions. First, Microsoft acquired Activision Blizzard (NASDAQ:ATVI) earlier this year for expanding its gaming footprint and together with its intelligent cloud should be a major player in the metaverse as, at the same time, the U.S. authorities have denied its Chinese competitor Tencent (OTCPK:TCEHY) of vital ingredients for its AI cloud.

Second, as I have elaborated in an earlier thesis, Apple, by partnering with Globalstar (GSAT) for its Direct-to-Satellite iPhone 14 has significantly expanded its total addressable market to over $11.5 trillion.

Conclusion

Therefore, this thesis is not bearish on technology and sees XLK more as an ETF to put on your watchlist as the hardware, software, networking, and semiconductor companies it holds execute in an economic environment that is less conducive to supporting high revenue and earnings growth.

On the other hand, with a price-to-earnings multiple of only 13.21x, XLF is better suited for the value strategy, which is likely to become prevalent as monetary policy is further tightened. Finally, the Fed’s hawkishness means more pain for XLK’s holdings, which export to the rest of the world while it augurs well for banks’ profitability.