Weyerhaeuser: Declining Special Dividends; A Value Trap? (NYSE:WY)

400tmax/iStock Unreleased via Getty Images

Shares of Weyerhaeuser (NYSE:WY) have lost about 20% of their value over the past year, roughly in-line with the market. WY’s business is tied to the housing market via its sale of lumber products. While not as directly tied to home prices as builders, residential construction is the primary use of its product. Even as I am not as bearish on housing as some, the sector clearly has headwinds, which are not fully reflected in WY’s stock relative to peers and I would be a seller.

Weyerhaeuser

Weyerhaeuser owns about 11 million acres in the United States and licenses another 14 million in Canada, making it the largest timberland company in North America. It generates about 56% of its Timberland EBITDA in the West and 43% in from the Southern United States. Alongside its timberland operation, WY strategically sells its real estate for other uses and uses its lumber to manufacture wood products for sale. WY is the 2nd largest lumber producer in the US and the largest engineered wood products manufacturer.

Of its timberland product, about one-quarter is used by the manufactured products segment. Of the remaining 75%, 50% is sold on the domestic market and 25% is exported. WY’s primary export market is Japan, at 69%. This is my first concern as currency will be a major headwind for Japan’s purchasing power. The yen has lost about 25% of its value, reaching a multi-decade low this year. This is likely to reduce Japan’s demand for imported product, and the strength of the dollar makes WY’s operations less competitive than those in countries who have had their currency underperform the US dollar.

Now similar to the model we have seen many oil companies adopt, WY is committed to paying out 75-80% of its cash flow to shareholders via a base dividend and then supplemental dividends, so that as lumber prices rise, it pays out more, and as they fall, it pays out less. The company is committed to 5% base dividend growth through 2025. The base dividend has just been a fraction of total payouts. Last year for instance, it paid out $1.95 in supplemental dividends while its base dividend is currently just $0.72 for a 2.51% yield. Unfortunately, I expect shareholder returns to decline over the next eighteen months.

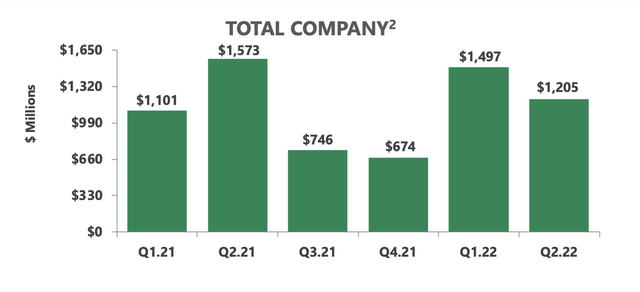

We began to see signs of “peak earnings” being passed in the company’s second quarter as sales were down 1% to $3.11 billion with adjusted EBITDA down about 5% to $1.5 billion. Adjusted earnings also fell about 5% to $1.31 a share. Then, the company cut guidance at the end of September with timberlands EBITDA expects to be similar to Q3 2021 rather than “moderately higher” previously. As you can see below, this will cause a meaningful deceleration from Q2 earnings.

Weyerhaeuser

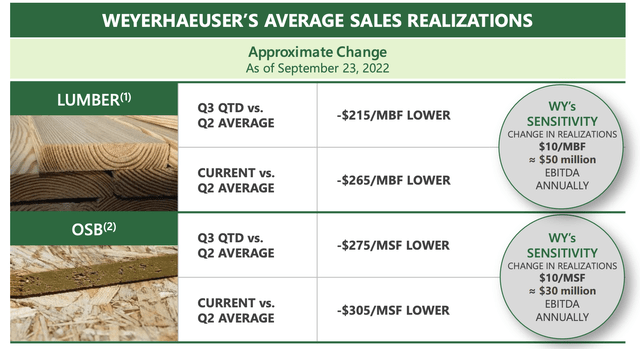

One partial offset to the decline in timberland EBITDA is that management expects about $325 million EBITDA from real estate sales, a bit higher than expected as it sells land with a lower cost basis. The primary headwind for results is declining lumber prices, which can swing so wildly that they more than outweigh the 5% production growth the company is targeting over the next three years. As you can see below, each $10 drop in MBF (thousand feet of board) reduces EBITDA by $50 million, so this normalization in prices over the past three months is an over a $1 billion headwind annualized relative to the Q2 pace.

Weyerhaeuser

As you may notice the current price is even lower than its Q3 average meaning the headwind will worsen in the fourth quarter. The below chart shows how volatile lumber prices have been post-COVID with spikes in 2020, 2021 and early 2022, amid supply chain issues and the rise in housing activity. As a reminder, 65% of WY’s lumber is used in new residential construction, 20% in remodels, and 15% in nonresidential construction. While prices have fallen remarkably, they actually are still higher than five-years, so lumber does not appear exceptionally cheap.

Seeking Alpha

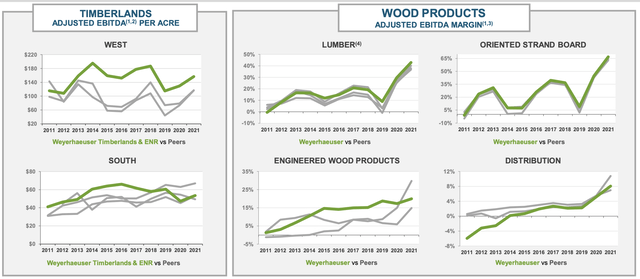

The surge in lumber prices greatly boosted WY’s margins over the past two years with wood products margins more than doubling from their pre-COVID levels. With lumber prices coming down and housing construction likely to slow somewhat, I expect these margins to normalize over coming quarters, reducing cash flow by up to $1.5 billion.

Weyerhaeuser

In other words, the $3.48 in earnings the company generated in 2021 likely represents something of a “one-off” as the company definitely benefited from the jump in lumber prices and used those prices in a shareholder friendly way, paying out large supplemental dividends and launching a stock buyback of $100-150 million per quarter. But investors should view these payouts as a one-time windfall rather than a permanent change in the company’s earning potential.

Seeking Alpha

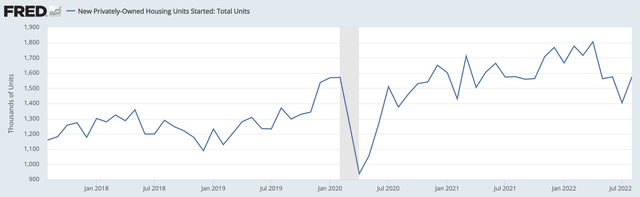

Additionally with the Federal Reserve raising interest rates, pushing the 30-year mortgage toward 7%, we are beginning to see new housing starts slow, down over 10% from their Q1 pace. The current level of starts in the 1.5-1.6 million range is by no means disastrous, but there is likely some downside risk. The point still stands that the tailwind of rising construction levels has passed, and until the Fed reverses course, construction activity is likely to be muted keeping a lid on lumber prices.

St. Louis Federal Reserve

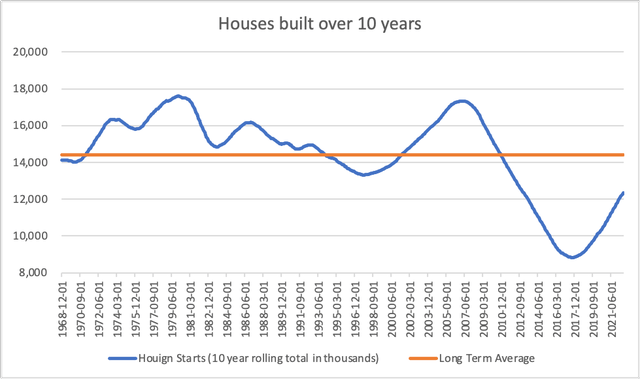

That said, I do believe that the US housing market is under-supplied. As you can see below, while we built more homes than normal in the 2000s, we far over-compensated the other direction in the 2010s, leaving us short 2-3 million houses. I believe this shortage will help us avoid a “worst case” scenario in the housing market of a prolonged construction recession and double-digit price increases. Nonetheless, I expect builders will be reluctant to increase construction activity until there is stabilization in interest rates.

My own calculation

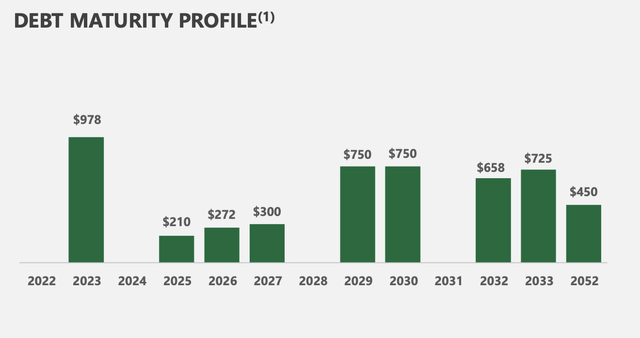

While higher interest rates are an indirect headwind for WY’s business by reducing construction activity, I would note the company has positioned its balance sheet well for this. All of its debt is fixed rate with an average maturity of 9 years. This limits refinancing needs and makes its cash flows fairly protected from rising interest expense.

Weyerhaeuser

So far this year, WY has generated about $1.4 billion in returnable capital; based on guidance and current lumber prices it should end the year around $2.1 billion. That is a 10% distribution yield. However, it is aided by the very strong H1 cash flow results when lumber prices were higher. Based on current market conditions, over the next twelve months the company can return about $1.7 billion in cash to shareholders for an 8% yield. Given its slow growth and high cyclicality in an end-market facing challenge, this is a fair multiple, particularly as I view risks to lumber prices as skewed to the downside, which means special dividends could fall more meaningfully.

I would rather own a homebuilder like Toll (TOL) or KB Home (KBH), which trade at mid-single digit earnings multiple and will have margins benefit from lower lumber prices than WY. Until there are signs housing activity has bottomed, I expected WY shares to be stuck in the $25-28 range, or an 8-10% yield as investors demand a premium yield given the volatility of its potential distribution and the headwinds facing lumber prices. Despite its year-to-date decline, WY still screens as more of a value trap than opportunity.