Verano: Goodness Growth Termination Reveals Underlying Uncertainty (OTCMKTS:VRNOF)

VioletaStoimenova

Introduction

On October 14 Verano Holdings (OTCQX:VRNOF) announced it is terminating the January 31, 2022 agreement to acquire Goodness Growth Holdings (OTCQX:GDNSF). The reasons given were “GGH’s breaches of covenants and representations in the Arrangement Agreement and the occurrence of other termination events.” Like most industry followers, I was shocked, having written an article saying Goodness Growth was a good entry into Verano at a discount. I will personally take a big loss in percentage terms on GDNSF shares, although fortunately my initial cannabis positions are always small.

The details of the termination are not yet known, so this analysis is limited. We do know the details about each company, and terminations often feature certain characteristics, so I will put forth some ideas about what the future portends. This analysis focuses exclusively on Verano, which has a much larger investor base than Goodness Growth.

Facts and forecasts about the termination

-

The termination looks a lot like buyer’s remorse combined with deteriorated industry conditions. With the value of Verano shares down by 50% the acquisition dollar value is reduced by the same amount, but the dilution of Verano shares would be the same (.22652 VRNOF shares for each GDNSF share, and Verano no longer wants to give up that much of the company. As investors know, cannabis is going through a rough patch. Most companies are cutting back on capex and expansion. There is margin compression and oversupply. Under these diminished business conditions, the last thing Verano needs is the considerable expense of integrating another company, especially one that is not doing particularly well. On the other side of the ledger, Verano’s acquisition calculations were based on a certain level of Goodness sales and profitability, which under current conditions likely no longer applies. The most prominent example are New York licenses, which Verano was paying top dollar for but now look less remunerative. Was there also some ogre in Goodness’s closet Verano discovered that made Goodness defective? As yet there is no indication of that. Two months ago the acquisition was on schedule, and by recently offering a reduced price Verano signaled that they still found Goodness acceptable.

-

The acquisition is dead. Sometimes, when a market deteriorates, the acquiree agrees to a lower price. Verano attempted that here, but it was rejected by GG.

-

The court battle will take a long time to play out. Legal proceedings like these take years.

-

The legal proceedings will be expensive, but may not impact Verano’s results significantly, considering TTM revenues of $843 million. The $3 million in sunk merger costs is gone, but this is counterbalanced by saving the considerable cost of integrating GG’s operations into their own. Observers may remember that the Harvest acquisition by Trulieve (OTCQX:TCNNF) cost many millions and took most of a year. In the worst case, Verano will be liable for damage to GG’s business two or three years from now. With sales of $54.4 million last year and a recent market cap of $200 million, there are limits to how much Goodness Growth might recover. The signals from the investor community so far are that the legal proceedings are not much of a threat. Verano stock fell only 1.5% the day of the termination.

Review of Verano’s performance

The latest eight quarters of financial results are summarized in the table below. All numbers in thousands USD.

| 2020 Q3 | 2020 Q4 | 2021 Q1 | 2021 Q2 | 2021 Q3 | 2021 Q4 | 2022 Q1 | 2022 Q2 | |

| Revenue | 100549 | 113043 | 143297 | 198297 | 206828 | 211000 | 202240 | 223700 |

| Gross profit | 68956 | 61288 | 88693 | 100129 | 133369 | 115000 | 100000 | 98100 |

| Gross profit margin (adj) | 68.60% | 54.20% | 61.90% | 50.40% | 61.90% | 54.00% | 61.00% | 59.00% |

| Net income | 81612 | 65651 | 125573 | 6830 | 103715 | 27000 | -7000 | -9800 |

| EBITDA (adj) | 55648 | 48384 | 75047 | 81474 | 110697 | 84000 | 81000 | 76000 |

In the latest quarter, ending June 30, Verano had record revenue of $223.7 million, the result of both organic growth and expansion. Gross profit, net income and adjusted EBITDA were down, as expansion costs and tighter industry conditions took their toll. These results were similar to other big cannabis firms, and it will be interesting to see how the companies fared in third quarter results to come.

Verano indicated in the Q2 report that it is reducing capital expenditures for the remainder of 2022. In January they expected 2022 capex of $185 to $250 million, in July revised that to $130 to $160 million, and the Goodness Growth termination will lower the final tally. Analysts believe that in the longer term Verano’s business is sound. For 2023 they expect earnings of .29 a share and a PE ratio of 15.71. They expect sales to increase from $890 million to $1.13 billion.

Big issues

Management quality is the most important factor in business success, particularly for emerging growth companies. A major misstep, while cause for concern, is not necessarily enough to turn away from a company. Verano stumbled in early 2022 when they had to delay their annual report for 2021 because of accounting issues including conversion from IFRS accounting to GAAP. I did not see this as a red flag at the time, but delaying an annual report is never a good sign. There were no irregularities, and it appeared that Verano had simply underestimated the resources needed for conversion.

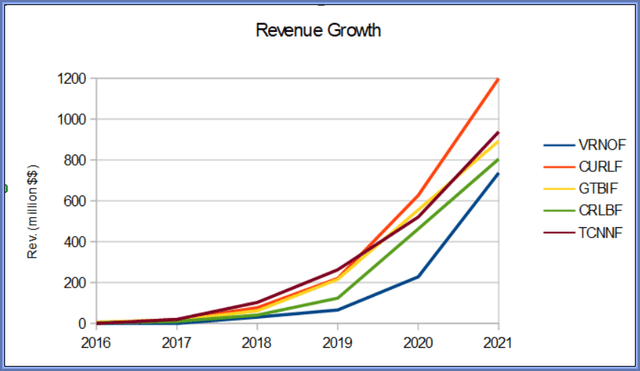

Concern goes to another level if there is more than one stumble. Now we have another misstep, brought on by Verano’s overzealous campaign of expansion. Prior to Goodness Growth, Verano had completed 14 acquisitions in less than two years. In 2019 Verano revenues were $66 million. In 2021 they were $738 million, up 1,118%. As the chart below shows, Verano had the sharpest growth rate increase among the five largest companies in 2021, ahead of Curaleaf (OTCPK:CURLF), Green Thumb (OTCQX:GTBIF), and Cresco (OTCQX:CRLBF). The slope of each line indicates the rate of increase.

When expansion is the primary objective it can overwhelm other things like due diligence, margin of safety, or long term planning. For whatever reason, the decision to acquire Goodness turned out to be defective. It will be an costly and time consuming distraction from the business of selling cannabis.

I am not a management expert, and therefore hesitant to pass judgment on the skilled and experienced executives at Verano or any other company. It’s possible that the accounting issues in early 2022 are nothing more than underestimating the resources required there. It’s also quite possible terminating the Goodness acquisition was a smart and necessary decision in light of changes in cannabis this year. It is time, though, to temper enthusiasm for Verano, to wait and see if more mistakes are revealed in the months to come.

Investment recommendations

I give Verano a HOLD rating. The Goodness growth situation is not good, but financial liabilities for billion dollar revenue Verano should be manageable. Any eventual liabilities are offset by avoiding the considerable integration costs.

Concerning the stock price, Verano has been reflecting the slower business environment experienced by all cannabis companies. The GG termination may actually improve Verano’s position in the short term by freeing up capital that is no longer needed for the acquisition. The improving chances for SAFE banking in Congress gives shareholders another reason to hang on for now.

The GG situation brings other, non-quantifiable issues to mind. Legal proceedings will be a distraction for management for some time to come. Every hour executives spend thinking about the lawsuit is time lost to things like marketing and operations.

The GG situation also calls into question the growth at any cost model Verano has been pursuing. If the high-growth strategy must be dialed back there will be more reliance on operations, marketing, branding, and corporate culture, and other aspects of the business.

The GG situation also raises questions about management in general. Two missteps in one year is not a trend, but it comes close, and alerts investors to the possibility of another unpleasant development. It also alerts us to the reliability of their corporate messaging, which in both cases turned on a dime. Concerning the messaging in earnings reports, it may be time for greater scrutiny of Verano’s “adjustments” to financial numbers. All cannabis companies do this, but my impression is that Verano does it to a greater extent than others.

The appropriate attitude towards Verano is watchful waiting, not just to developments related to Goodness Growth but in all aspects of its business. There’s no reason to sell shares for the time being, but no reason to buy shares either. There are other large cannabis companies whose potential is just as high but don’t come with the baggage that Verano currently presents.