SSE plc: A UK-Based Utility With A Decent Upside (OTCMKTS:SSEZF)

Peter Fleming/iStock Editorial via Getty Images

Dear readers/followers,

In this article, I’m going to take a look at SSE plc (OTCPK:SSEZY), a UK-based energy company with operations in production, distribution, and metering. The company has solid operations in key, conservative geographies across UK and Ireland. The components making up SSE were Scottish Hydro-Electric and Southern Electric, and they merged back in 1998.

I’m going to really look at what we have here, to see what we can consider an attractive valuation for a utility out of the UK.

SSE PLC – Presenting a great utility

I like investing in utilities. After all the articles I’ve done on US ones like Pinnacle West (PNW), and European ones like Fortum (OTCPK:FOJCF), E.ON (OTCPK:EONGY), and Enel (OTCPK:ENLAY), this shouldn’t be a surprise to anyone. I own stock in a lot of them because I like owning fundamentally important businesses that don’t show a lot of seasonal, or economic volatility.

While utilities can be volatile, their underlying asset-based cash flows are typically very safe.

You also know (or will know after this article), that utilities are typically regulated, and the way that utilities work with growth is either through non-regulated service-based add-on businesses.

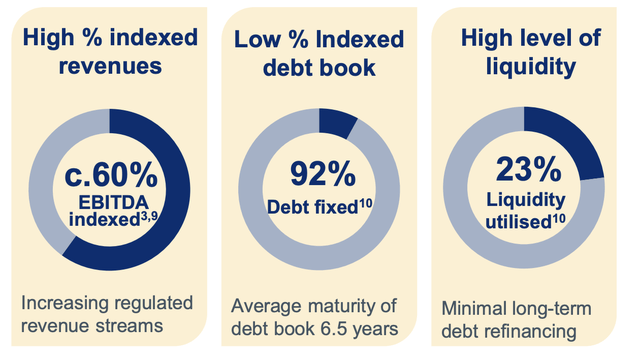

Now, SSE is a bit more atypical here, in that 60% of its business is indexed and regulated – and that is increasing – but 40% isn’t, which is higher than some other typical utilities I cover. However, the company has a very low rate of debt, and high liquidity, and what debt it does have is fixed with maturities of over 6 years.

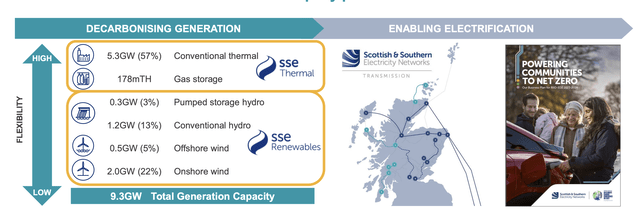

The company carries an impressive renewables portfolio of around 4 GW, which is mostly hydro and wind. The company has a flexible Thermal portfolio of around 5.3GW, and owns around 40% of the UK’s onshore underground gas storage capacity.

SSE has high conservative safeties, coming in at BBB+ from S&P Global. It has a market cap of $22B, and the current native yield based on the GBX ticker SSE is 5.27%, which is on the higher side on a global comparative basis. The company’s leverage is less than 4.6x net/EBITDA. The company also has a Baa1 from Moody’s

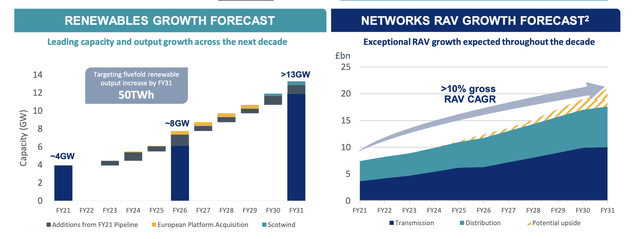

Like seemingly all utilities here, SSE is working on a net-zero carbon program. It has a fully funded investment plan that encompasses CapEx of £12.5B, which is slit 40% into networks, 40% into renewables, 20% thermal, and some minor sums in others. Current plans are to increase the renewables pipeline with onshore and offshore wind assets, as well as more hydro assets, while also pushing more investments into electricity networks.

The company currently expects a longer-term trend of around 7-10% EPS CAGR.

The company’s renewable pipeline is expecting to see significant growth or the next 9-10 years, more than doubling the current available capacity through both organic and inorganic growth/acquisitions.

So, the way the business operates is that SSE thermal operates a series of UK power stations, while the SSE renewables arm builds, operates, and maintains both onshore and offshore wind farms across the United Kingdom and Ireland. Its hydro operations are found in Scotland, and it has some JVs with NA companies that operate multi-fuel power stations in West Yorkshire

The company’s current results are excellent – and we have results from late November, which make them very recent overall. The current EU and international energy markets are complex, and all moving in the same direction, meaning net zero. The company’s mix is very resilient – take a look at these renewables specifics and where they’re located.

The advantages of the company are well-known – and there are more we can look at. The company has a very low overall comparative cost of debt – below 4%, and the near-term maturities are absolutely minimal with nothing above 10% until 2027 and beyond.

The company’s renewable hedges provide stable profits to the company – and stable protection for the consumers, while ownership in storage infrastructure hedges supply during critical times – such as the current one we’re in right now.

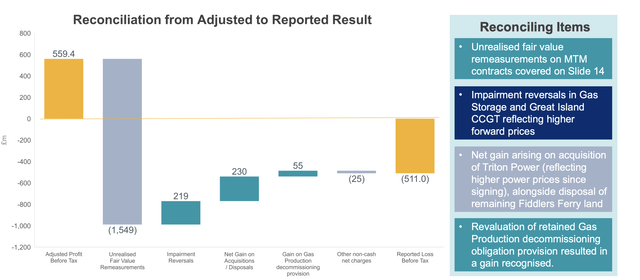

The current trends for 1H22, which go to September of 2023, show a significant increase in adjusted operating profit, and profit numbers. However, we’re entering SSE at a time when the company is adjusting with massive unrealistic fair value measurement due to the M&A of Triton Power, reflecting the higher power prices, as well as disposal of some of the land that was still in company ownership. These adjustments are currently massive, and that’s why we should look more at normalized levels and over time, than at specific current results.

The company has hedged wind and hydro prices all the way until 2025 – the unhedged prices for these don’t come into play until 2026 and beyond, at which point we’ll likely be in a very different situation.

The company is further working to divest its minorities and non-core assets in a series of disposals.

Straight segment-specific results for 1H23 were solid. Thermal saw a significant income increase due to prices, which resulted in almost a 3x higher YoY. adjusted EBIT, but there were also some outage losses. The company’s renewable results would have been very solid, but due to a hedge buyback, actually came in slightly below YoY. The hedge was a costly buy-back due to weather effects and construction delays.

Distribution results were, as you might expect, far more stable with slight growth, but still below par according to the company’s own expectations due to some timing issues. There also hasn’t been a recovery on the level that the company would have expected – as of yet. Transmission is as stable as distribution, with higher revenues, but the same under-recovery and cost increases. For now, the P&Ls are weighted up by top-line sales results and results are solid – but we’ll want to keep a close eye on those margins.

Company guidance is solid. The company expects its HY23 results to come in line with previous expectations, with an EPS guidance of at least 120p, or £1.2, with a growth expectation after that of about 7-10% CAGR until 2026, based on increased assets and expansion and better earnings.

The dividend, meanwhile, is also expected to stay stable. We have an interim dividend of 29p, with the FY23 dividend continuing to target that RPI increases – and we already know the FY24 dividend, because the company has communicated and rebased it to 60p, or £0.6/share.

SSE, therefore, joins other companies like E.ON and Enel in “guaranteeing” a payout and dividend for the next few years, increasing clarity and what you may at the very least get for your money. That 60p dividend means that the yield for the company is around 3.5% at the current share price – which is on the lower side, but it’s growing after that.

So the dividend is the reason you don’t see me pushing SSE ahead of Enel or E.ON. All of these companies have good dividends that the companies have essentially signed on for – except in the case of SSE, for business-related reasons, the company has capped the scrip dividend at 25%. The right choice? Well, time will tell – it’s by far the most conservative, maybe needlessly so.

But it gives us good visibility of the current trends.

The current dividend is closer to 5-6%.

But in a year, it’ll be cut to 3.5% based on today’s share price. Know that.

Let’s look at the company valuation.

SSE’s valuation

So, SSE plays the field with other utilities in Europe. Its closest peers, as things stand, are companies you know that I cover. I mean businesses like Iberdrola (OTCPK:IBDRY), E.ON, Enel, Forum, Orsted (DNNGY), and others. The issue is that this is a list full of quality companies – and I actually own stock in most of them more than I do in SSE. SSE isn’t by any measure massively more expensive, or cheaper than the average here. Its NTM native P/E is around 12.5x – Fortum and Enel are cheaper, but Iberdrola is more expensive here. The company’s revenue multiples, sales multiples, and EBITDA multiples are nothing really amazing in terms of undervaluation from a peer average either.

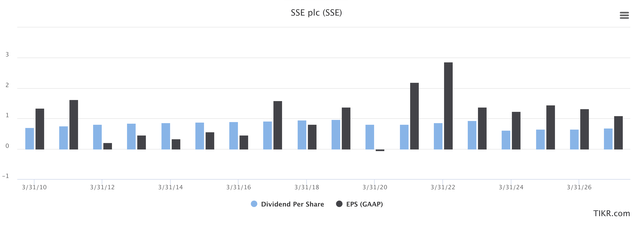

For historicals, the company has an interesting history based on multiple structural changes that have influenced how the company’s EPS and the dividend has looked over time. Unlike some of the other utilities, This company has been on a somewhat worrying dividend trajectory for the past 10+ years.

We’ve had dividends that are slowly growing, only to then abruptly get cut – and grow back, but never again to the level we’ve seen before. Again, there are explanations for this. The company’s P&L’s are rocky and volatile, with GAAP EPS trends that go up and down and are expected to continue to do so.

Investor trends are nothing to write home about either – probably a good reason why they don’t showcase the 10-year total RoRs here, because they’re not very good.

SSE Valuation (TIKR.com/S&P Global)

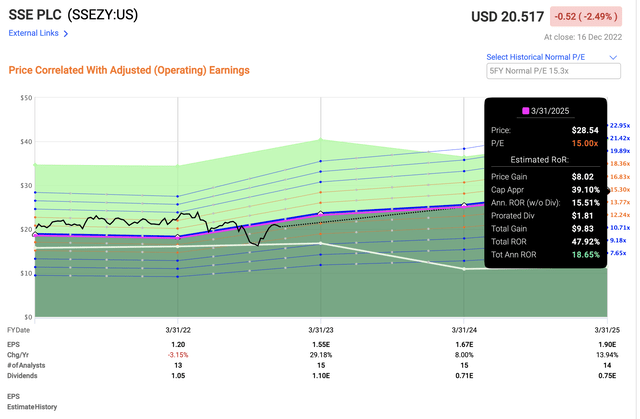

Less than 2% per year – ouch.

But there are upsides. I would say that analysts and forecasts here are 100% correct – the future for SSE is not as volatile and poor as we’ve seen in some years. I believe in future stability for the company, and with that stability comes some allowances for valuation. For the time being, a 2-4% growth in earnings is the least we can justify, I think (almost half the company’s own forecast), and considering the company’s low cost of capital and its excellent capital planning, credit rating and safeties, there is something to “get here”, at the right price.

When I say that the upside on this utility is “decent”, I mean the following.

SSE typically trades at an average of 12.9x P/E for the 10-15-year period. It’s currently at 12.7x for the native. The ADR is closer to 14.5x on the 10-year, and the SSEZY ADR is currently at 14.2x – so you see, there might be a slight upside here, which together with expected EPS growth, becomes decent.

At current trends, the company is expected to deliver a decent EPS growth after dividend normalization.

So what you would need to do is accept the rebalanced dividend, as well as look at the potential upside to a 14-15x P/E, which for SSEZY here could be as high as 15-18% per year if those circumstances materialize.

SSE Upside ADR (F.A.S.T Graphs)

When I started my position in SSE, the company was cheaper – not by much, but cheaper. I would say that the companies Iberdrola, Enel, and E.ON are “better” in terms of stability and dividend reliability, and forecastability. That’s also why I’m fully invested in Enel, almost in Iberdrola, and have positions in E.ON.

However, SSE is one buy I would make above Fortum today – which is why my SSE is bigger than Fortum today.

SSE isn’t the best utility on the block today. But for me, it serves the purpose of FX Diversification due to GBP exposure, and a solid return, despite it being lower than 5% yield next year.

That’s “good enough” as I see it, and for that reason, I give this company my stamp of “BUY”.

Current analyst street targets are as follows. 18 analysts follow the company at a £16.5 to £24 range, with an average PT of £19.71. Note that even the lowest is close to the current share price. Out of 18 analysts, 15 are at a “BUY” or equivalent rating, with an average upside of 16.7%.

I would go somewhat lower than this, and cap the discounted PT at around £18/share for the native.

Here is my thesis for SSE.

Thesis

- SSE is a good utility out of the UK and Ireland. It’s not class-leading, and there are better players out there – but it’s nonetheless a solid asset portfolio with a 3.5-5% yield. There are far worse places to put your money than the companies that heat people’s homes and provide for their basic needs, and that’s why my utility investments are currently one of the biggest ones I make.

- I would say that SSE is a “BUY” at anything below a 15x P/E on a normalized basis for the ADR, and 13.5x for the native London ticker.

- My current native PT for SSE comes to £18/share.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company therefore fulfills all but ONE of my investment criteria, which to me is good enough.