RingCentral: Technicals Turn Less Bearish (NYSE:RNG)

JHVEPhoto

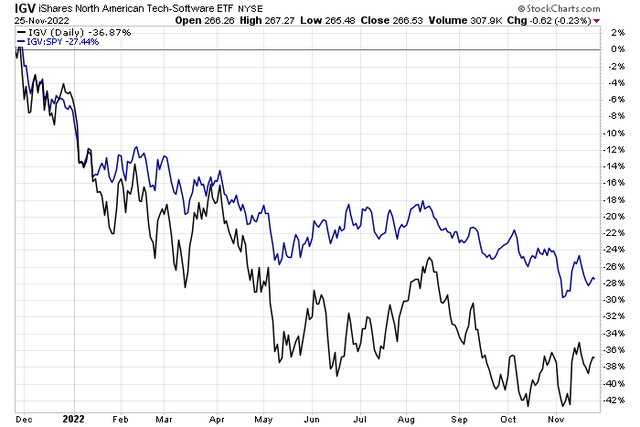

Are software stocks finding their footing? The iShares North American Tech-Software ETF (IGV) made new lows earlier this month, but relative to the S&P 500, a double bottom was notched, and a higher high was put in two weeks ago. There is still a lot of work for the bulls to do here, but one name rallied on big volume following its Q3 earnings beat and job layoff announcement.

Software Equities Trying To Put In A Relative Bottom

According to Bank of America Global Research, RingCentral (NYSE:RNG) offers a cloud-based solution for business communications that replaces legacy and expensive on-premises communications systems. It is delivered as an application that follows the user regardless of device (office phone, smartphone, desktop, tablet). Features include team collaboration, voice, text, fax, audio conferencing, and integration with document and customer relationship management systems.

The California-based $3.4 billion market cap Software industry company within the Information Technology sector has negative trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

The embattled firm recently announced it would slash 10% of its workforce amid ongoing challenges in the tech sector. Interestingly, the stock traded higher following that news along with reporting a Q3 earnings beat, according to Seeking Alpha. That kind of price action, when it occurs on high volume, makes for an interesting long-side case. We will dive into the technicals later.

RNG provides cloud-based software solutions for the corporate world as a replacement for more cumbersome communications systems. The company generally benefits from the flexible work environment world, but a return to the office in a loosening job market could be a risk. Still, operating earnings are positive, and margins remain solid.

Downside risks include strategic partnerships taking longer to create cost savings and profits versus expectations. The management team must also carefully execute growth plans in what could be a particularly challenging 2023. Finally, its small and mid-sized business target market will feel macro pressures next year along with competitor offerings from Microsoft and Zoom Phone causing possible profitability issues.

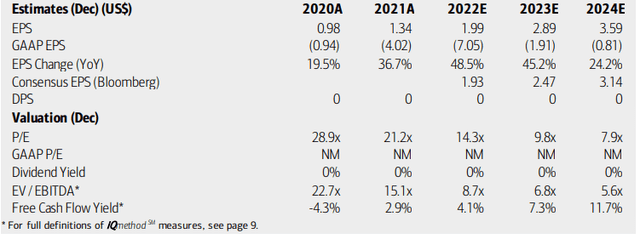

On valuation, analysts at BofA see earnings continuing to grow sharply in the years ahead. While the Bloomberg consensus EPS forecast is not quite as sanguine as BofA’s outlook, it still shows robust growth. GAAP per-share profits are seen as being sharply negative, though.

Using non-GAAP numbers, the P/E ratio turns very cheap given the growth forecast. Moreover, its EV/EBITDA on a look-ahead basis looks more attractive than it did a few quarters ago. What I also like is that RNG is free cash flow positive.

Overall, I like the GARP valuation now versus my bearish take during the summer. Seeking Alpha has an A rating on RingCentral’s forward PEG ratio – a good metric for this growth stock.

RingCentral: Earnings, Valuation, Free Cash Flow Forecasts

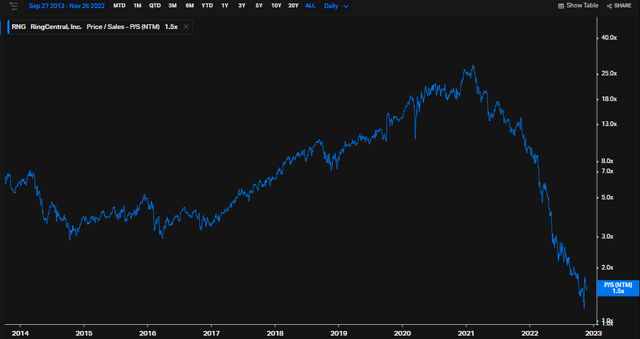

Another interesting look is RNG’s forward price-to-sales ratio, which is near 1.5, per Koyfin Charts. Seeking Alpha has it at 2.5. Either way, it is a far cry from the nosebleed-level 5-year average of 14.2.

RNG: Forward Price-to-Sales Ratio History

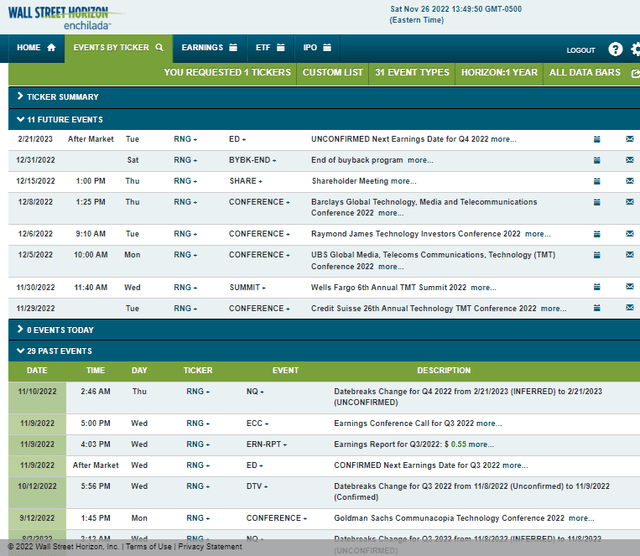

Looking ahead, there are several volatility catalysts in the coming weeks when looking at corporate event data from Wall Street Horizon. RNG’s management team presents at a pair of conferences this week and three more during the first full week of December. Then comes a shareholder meeting on December 14 before its share buyback program ends. Finally, RingCentral’s Q4 2022 earnings report is unconfirmed to take place on Tuesday, February 21 AMC. There are many volatility catalysts upcoming.

Corporate Event Calendar

The Technical Take

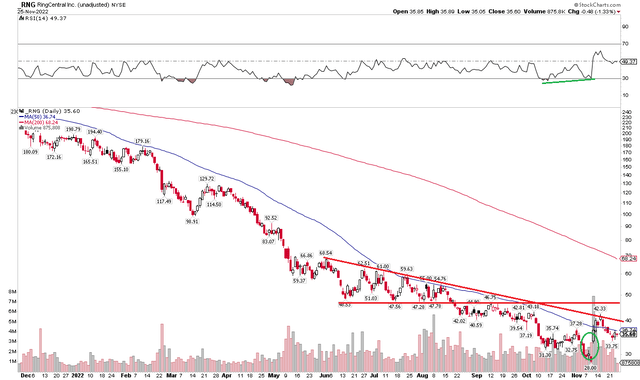

Back in August, I was bearish on RNG’s fundamentals and technicals. The situation has improved on both fronts. We have gone through how much better the valuation looks, but also notice some signs of life in the technical view below. Shares gapped higher post-earnings and after the job cut news in October. Now, the stock is going through what appears to be a bull flag pattern.

I see resistance in the $46 to $49 range, which would be an impressive gain from here. Also, take note of a broader downtrend resistance line that was first probed in October – that is still in play, but a bullish RSI divergence suggests it could be taken out before long as the sellers might be giving up their stranglehold on RingCentral. Overall, I think a tradeable low is in, but the bulls still have some work to do.

RNG: Shares Showing Signs of a Bottom. Not There Yet, Though.

The Bottom Line

RNG has a much better valuation look now versus many months ago now that shares are down and better earnings are expected, at least according to BofA. I think the stock is at least a hold today. I will revisit later on to see if the stars are aligning for a buy call.