Quanex: A Strong Valuation Case Ahead Of Q4 Earnings (NYSE:NX)

Matveev_Aleksandr

Building Products is a tough space right now with a deteriorating housing market and the prospect of a global recession during the first half of 2023. One firm reports Q4 results this week and its stock price has been meandering. Is there value in Quanex (NYSE:NX) or should investors avoid this cyclical name with significant foreign exposure? Let’s check it out.

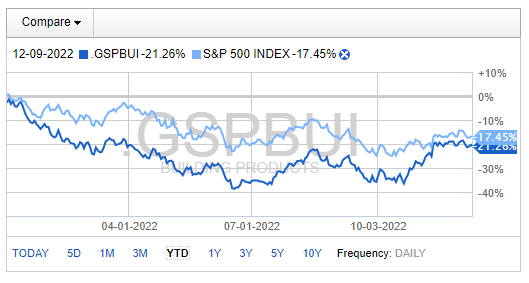

Building Products Industry Stocks Making A Relative Comeback

Fidelity Investments

According to CFRA Research, Quanex Building Products Corporation, together with its subsidiaries, provides components for the fenestration industry in the United States, Europe, Canada, Asia, and internationally. The company operates through three segments: North American Fenestration, European Fenestration, and North American Cabinet Components.

The Texas-based $772 million market cap Building Products industry company within the Industrials sector trades at a low 9.2 trailing 12-month GAAP price-to-earnings ratio and pays a 1.4% dividend yield, according to The Wall Street Journal. The company recently declared an $0.08 dividend after being active on the M&A front by purchasing custom polymer mixer LMI Custom Mixing for $92 million, announced back on November 1. NX beat on both its top and bottom line estimates in its Q3 report on September 1.

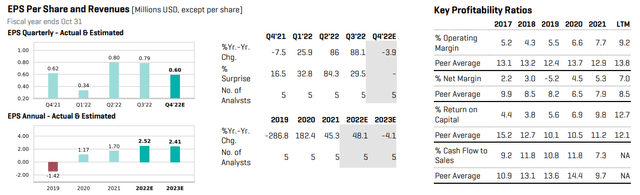

On valuation, Quanex earnings are seen as falling just slightly from $0.62 of per-share profits reported a year ago to $0.60 in its upcoming Q3 report. For the year, 2022 EPS is forecast to have increased sharply to $2.52 from $1.70 in 2021. A slight drop is then expected next year. With operating margins below its peers but with a higher-than-category average return on capital, the company appears to be performing decently despite a challenging macro environment. I like the stock’s single-digit trailing and forward P/Es as well as a forward PEG ratio of just 0.77 – significantly below the sector median and at a sharp discount to its 5-year average. Overall, I could see the stock trading with a 12 multiple which would put the stock price near $29.

NX: Earnings Outlook & Key Profitability Ratios

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2022 earnings date of Thursday, December 15 after market close with a dividend ex-date on Friday the 16th. The corporate event calendar is light after this week.

Corporate Event Calendar

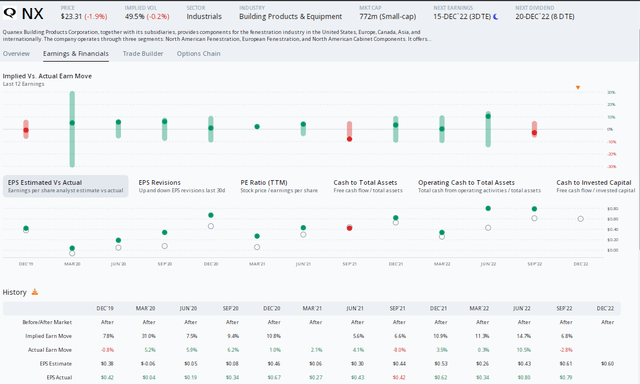

Catching my eye on NX’s earnings history is a solid string of bottom-line beats, sans the September 2021 quarterly report. Also notice that shares usually don’t move much post-earnings, according to data from Option Research & Technology Services (ORATS). Given the trend, it’s likely that Quanex will issue another beat later this week.

NX: A Positive EPS Beat Rate History

The Technical Take

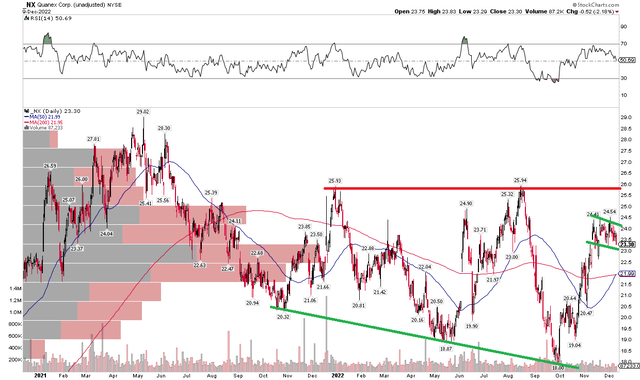

I like the valuation and see positive headline risk post-earnings, but how does the chart look? NX has resistance just shy of $26 but is currently trading in a bull flag pattern that would have a price objective near $31 should it break. The bears can point to a downtrend support line that could be tested if there is further weakness. With shares trading above and below the whippy 50-day and 200-day moving averages, it is certainly not a clean chart. I would wait for a move above $26 before getting long, but I’d also be a buyer of the stock should it dip into the teens.

NX: A Messy Chart, But Watch $26

The Bottom Line

Quanex has a solid valuation but a mixed chart. With a positive earnings beat rate history, I am a buyer of shares before earnings, but urge investors to carefully monitor price action around $26 on NX.