Palantir Stock: FoundryCon – A Milestone Moment (NYSE:PLTR)

Andreas Rentz

What is the goal of this article?

Palantir (NYSE:PLTR) shareholders, non-shareholders, and those who have never heard of the stock, I would like to provide you with my insights and key takeaways from the company’s first ever FoundryCon US customer event. I believe any investor or critic could not call Palantir a “black box” company anymore, after watching this. Viewers will walk away with understanding the value and ROI Palantir Foundry brings customers.

This event is going to strengthen the Palantir customer community but also lead to future commercial customer pipeline. Customer networking, business outcomes, and customer experiences and satisfaction delivered are what help companies build a brand. This event included all of that and then some and was broadcast on YouTube live for all to see. I believe we will all look back to the conference that Palantir hosted this week as a milestone moment for the business, let me tell you why.

What Does Palantir Do?

If you already know what Palantir does, then you can skip ahead in the article or you can read this section for a refresher on their business.

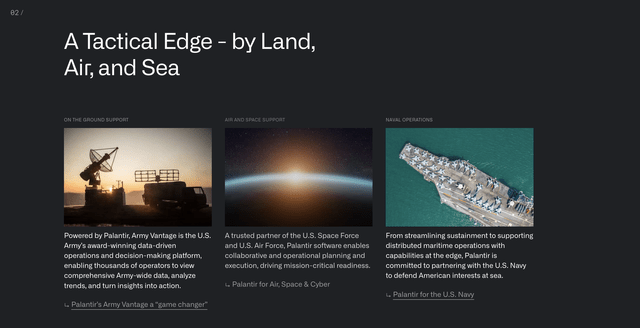

Palantir is a software company that delivers three software-as-a-service (SaaS) platforms for both government and commercial customers. These platforms help them integrate their data to make better decisions, operate their business more efficiently and generate alpha against their competition. The company for the first 17 years was a private company that predominantly helped the U.S. Government, and its western allies make better decisions to protect their civil liberties. Well known results that the public may know Palantir for, is helping the U.S. troops find Osama Bin Laden years ago. Palantir also played a key role in identifying and convicting Bernie Madoff of his fraud Ponzi scheme. In the past two years the company’s Gotham platforms helped the U.S. get troops out of Afghanistan and Western Allies be able to deliver COVID vaccines to their citizens.

Palantir Gotham (Palantir Website)

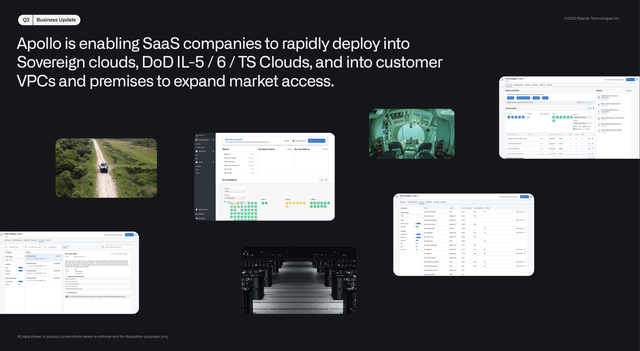

There are two other platforms Palantir offers which are Apollo and Foundry. Palantir describes Apollo as “a SaaS solution for application teams who build, continuously deploy, and continuously secure software on Kubernetes in one or many environments. Apollo unifies Developers, Security teams, and Operators to enable Autonomous Deployment – the complete automation and integration of DevSecOps. It increases the speed of release and supports full roll backs and roll overs combined with the automated assurance of product stability, product availability and product security.”

Palantir Apollo (Q2 Palantir Earnings Presentation)

So, Apollo not only helps developers deliver apps faster to production but also maintain the operational efficiency of the apps. Apollo also allows organizations to create production environments from one build to many, so applications can reside in Azure, GCP, AWS, private clouds, hybrid clouds, on-premises, air-gapped environments, and ruggedized environments. Wherever customer data and applications reside whether on the back of a Humvee, submarine, in outer-space, or on the factory floors, Apollo makes it possible for continuous deployment and maintenance updates in any environment.

The third product platform is Foundry which services Palantir’s commercial customers and was created just six years ago. Palantir Foundry serves as the central operating system for individual institutions but also entire industries. For example, Airbus (OTCPK:EADSY) built their Skywise application on the Palantir Foundry platform and has become the aviation industry operating system that connects data from more than one hundred airlines and 9,000 aircraft around the world.

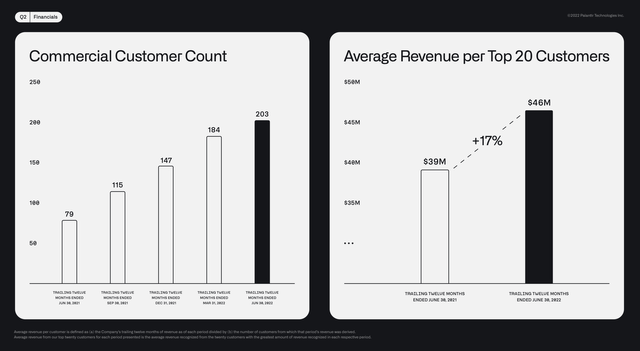

Average Top 20 Customer Revenue Growth (Q2 Palantir Presentation)

As you can see the customer base for Palantir is very diverse and global. The Top 20 customers of Palantir average a total annual spend of $45.8 million which is 17% higher than the year before. The customer count in the last 12 months has increased 80% year over year and the U.S. Commercial revenue grew 120% year over year.

Why Was FoundryCon Important for Palantir?

This week Palantir held its first ever customer user conference called FoundryCon for those using the Foundry platform. Of course, I would assume they also had potential customers or customers with deals in the pipeline there as well. Hopefully they invited financial analysts as well, because after attending these systems, no one could call Palantir a “black box” company anymore. The company took the opportunity to have six of their Foundry customers from all different verticals speak on their customer experience, ROI received, and the differentiation in the software platform itself. Palantir made this part of the conference also available for others to watch live on their YouTube channel.

It was impactful to hear from customers on what their onboarding experience was and the level of detail and customer service that Palantir delivered throughout the sales and deployment process. One of the customers that spoke was Morgan Stanley and they got to share their elongated deployment experience due to numerous internal challenges and headwinds that came their way. However, they highlighted how the Palantir team was there for them every step of the way and ensured the solution got successfully deployed.

Customers that Presented at FoundryCon (Palantir Official Twitter Page)

The Space Systems Command shared how their legacy systems were built on numerous point solutions that created significant technical debt, lack of integration, and challenges to maintain operationally. With Palantir Foundry they were able to decommission their legacy platforms, deliver better insights and value outcomes, on a significantly reduced budget.

Jacobs Solutions (J) is a waterfront structural engineering and services company that shared how Palantir Foundry was able to compile, integrate, and utilize the mass amounts of data the company was intaking. The speaker was able to highlight how Foundry helped them meet their employees where they were technically by delivering real-time and simplified instructional assistance and alerts via mobile phones.

I won’t go over every customer success story, as you can watch them all here, but let me conclude with Tyson Foods (TSN). Yes, you heard me right Tyson Foods uses Palantir Foundry to streamline business operations and improve efficiencies for the entire company. The CIO & CTO Scott Spradley gave the presentation and it was phenomenal! He outlined how they had no developers and outdated technology, and how hard it was to get technology purchases approved within the organization. Palantir was able to bring Tyson Foods to a new level of operations. Scott Spradley said “Our value is here is that we have had about 20 different projects, we’ve created over $200 million in value — savings. That’s a big deal. This has all been in 2 years. That’s hard to beat. That’s really hard to beat.”

Tyson Foods Presentation at FoundryCon (Palantir’s Official Twitter Page)

Understand the Paradigm Shift

The FoundryCon for me as a shareholder was a confirmation of my belief there is a paradigm shift going on in both the procurement process of software internally for organizations and how value is delivered to customers in the market. Customers are wanting to consolidate their software tools, simplify management, make data-based decisions, and see quantifiable ROI results from their purchases. The day of selling a big long-term contract and walking away from the customer after the sale, is going away. Software as a Service (SaaS) says everything in the name itself, it should be delivering a service that is creating the desired outcomes for the customer. To do this the software has to be able to perform like its sellers say it will, but also be able to prove quantifiably without a doubt it makes the business operate more effectively and efficiently.

The days of it being acceptable for software to just being able to provide data insights and information that is not in context, real-time, or actionable is coming to an end. The CIO and CTO no longer have the ability to just have IT be a CAPEX drain on the business, but instead are being asked to deliver solutions for the business that showcase IT as a revenue generator and a cost saver. This paradigm shift is happening faster and faster throughout certain industries, and will eventually cascade through all industries. Businesses face constraints whether it is skill-gaps for employees, operational inefficiencies, lack of data intelligence and strategic decision making, or lack of automation, so the term “work smarter not just harder” is at its definition in IT.

I believe software companies have to be able to prove the value they are able to deliver sooner in the post sales motion and ensure the business outcomes are reached by their customer. The best software companies in the world are able to justify their costs by being able to deliver quantifiable, proven, worthwhile ROIs, that scale over-time. There are not many in the world that do this today, and this is Palantir’s strength, once the customer recognizes doing business the same old way is the problem. It is very difficult to sell a customer a solution even if you know it will provide them extreme amounts of value, until the customer themselves admit they have a problem.

This is why events like this FoundryCon are so impactful because it is customers sharing their thought process and challenges and why they chose to go with Palantir to improve their business intelligence and operations. When you create a very useful product that then becomes a platform and the customer experience is so high that customers sell their experience to their friends and colleagues, then you have a brand that begins to scale. Palantir is in the early stages of this in my opinion, but they are picking up steam.

Challenges and Metrics to Pay Attention to

As my readers know I will always try to make sure I list out potential risks or challenges for investors to be aware of with any company. I believe there are several short-term headwinds or concerns that you would want to pay close attention to with Palantir.

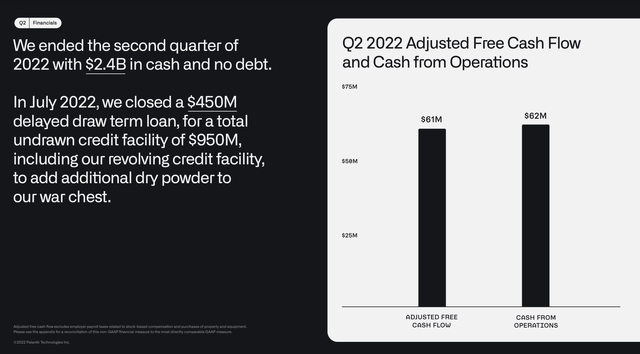

Q2 Palantir Earnings Presentation

Palantir has a clean balance sheet with $2.4 billion in cash and $3.2 billion when their credit is included, and they have zero debt. However, Palantir does not have the same deep pockets at scale that competitors like Microsoft and Google must pay top talent. Palantir has been using large sums of stock-based compensation to attract top engineering talent and to keep them there. This has been the sole reason for Palantir not being profitable and having negative operating expenses. It has been decreasing for the past few quarters, but it still needs to come down further moving forward.

Another risk to pay attention to is declining revenue growth in their government business, however I believe this is due to the lumpiness in government budget cycles. I believe Palantir will demonstrate over the next few quarters growth will be re-accelerating for their government business. I would watch these metrics closely during the rest of 2022 and 2023.

The top three customers for Palantir in June of 2021 consisted of 19% of total revenue and has declined to now 16% as of last quarter. These customers make up a concentrated amount of revenue, but have been with Palantir for over six years, and no one customer makes up 10% of revenue. I would make sure to continue to pay attention to this metric and see if it is continuing to decline.

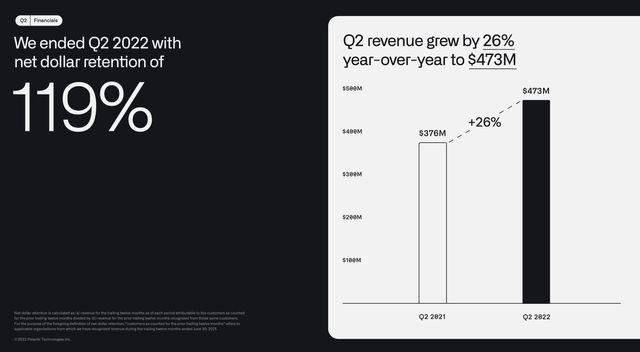

Palantir Q2 Net Revenue Retention (Q2 Palantir Earnings Presentation)

As mentioned earlier Palantir’s top 20 customers continues to grow revenue annually year over year, this contributes to the company’s net revenue retention rate. The net revenue retention rate of Palantir was 119% last quarter, and I would like to see this number back above 130%. The total customer count grew 80% year over year last quarter, and this is another metric I would watch in this Q3 earnings call coming up in two weeks. Lastly, I would watch to see what the Q3 revenue growth is and that it returns above 30% year over year. There is a chance they miss this number in Q3, but this is an area for the long-term Palantir needs to be above consistently to meet shareholder expectations.

In Summary

I was extremely pleased with the value and exposure FoundryCon provided for Palantir. I look forward to many more of these conferences and public exposures of the Palantir technology. It is not the engineering talent or product superiority that Palantir has struggled with, but it has been more of the Go-To-Market strategy and evangelizing the technology to the masses. I do believe Palantir will continue to improve in these areas and their customer growth, expansion, and profits will snowball bigger and bigger.

In my opinion, long-term investors who are patient with Palantir and keep up with the stock and dollar cost-average into cheap share prices, like they are now, will do very well. I continue to add to my position over time and it is my second largest holding behind Nvidia (NVDA). I encourage you to watch the video of FoundryCon and provide your feedback in the below comments. Reader feedback matters and the more investor dialogue we get below, the more we learn from each other.