JPMorgan’s Earnings Power, Rate Tailwinds Provide Protection From Headwinds (JPM)

subman

Few would question that JPMorgan Chase (NYSE:JPM) is an excellent and well managed business, but the stock has sold off aggressively as macroeconomic fears supersede the positives in this bear market. While I have no ability to forecast short-term changes in stock prices, I believe there is clearly tremendous value at current prices in the common stock of JPM. Long-term investors would be wise to accumulate on weakness, as this best of breed bank is poised to generate robust results even during a recession. Tailwinds from higher rates will help dramatically to offset weakness in other areas of the business.

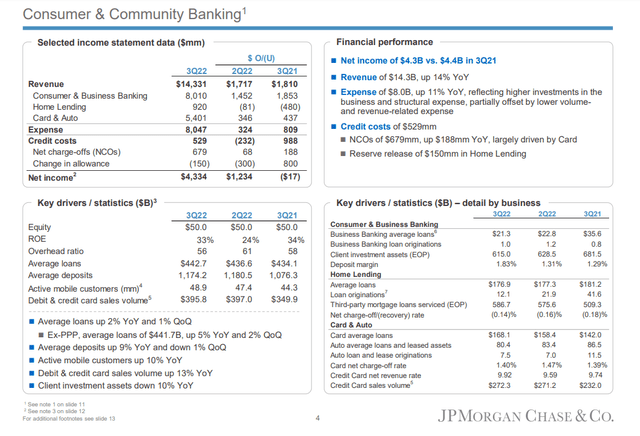

JPM Q3 Earnings Presentation

On October 14th, JPM reported an exceptional quarter resulting in net income of $9.7B and EPS of $3.12, on $33.5B of managed revenue, despite incurring $959MMof losses on investment securities. Revenue was up 10% YoY. This was good for a ROTCE and ROE of 18% and 15%, respectively, which puts the bank in the elite category. Net interest income of $17.6B was up $2.4B sequentially, and $4.4B YoY. This tailwind from higher rates goes a long way to offsetting weakness in other areas. The company continues to invest in its business with expenses of $19.2Bm which was up $2.1B YoY, or 12%, and a managed overhead ratio of 57%. Credit costs of $1.5B were up $.4B sequentially, and $3.1B YoY, due to a release in that period. The net reserve build of $808MM included a $937MM build in Wholesale, reflecting loan growth and updates to JPM macroeconomic scenarios, partially offset by a $150MM release in Home Lending. Management indicated that consumers still seem to be in quite good shape with combined debit and credit spend up 13% YoY, and cash buffers remaining elevated. Naturally, with spending growing faster than income, that cushion is declining, and consumers and businesses are getting more cautious about the economic outlook. In a major recession, a big chunk of credit losses would likely come from credit cards, but card delinquencies are still tending well below pre-pandemic levels but are expected to normalize over time. For full-year 2022, management indicated that the card net charge-off rate should come in around 1.5%, which is below previous expectations. Banks are over-earning on credit, so we’ll see how long that continues to last, as it has already lingered more than most anticipated.

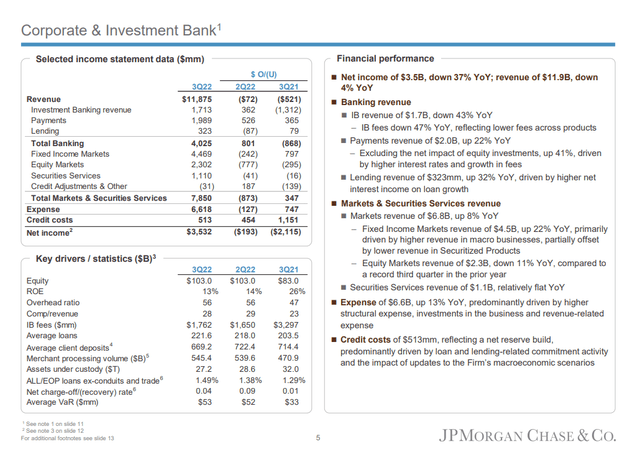

JPM Q3 Earnings Presentation

JPM had a record 3rd quarter in Markets of $6.8B, up 8% YoY, and the company ranked number one in retail deposit share. Fixed income in particular was quite strong, while investment banking was exceptionally weak, down 43% YoY given the macro environment. The company really has come such a long way over the last 15 years, as its hard work and successful acquisitions have accrued many benefits. Average loans of $1.1T were up 7% YoY and up 2% QoQ. Average deposits of $2.4T were up 3% YoY and down 3% QoQ. JPM ended the quarter with $210B of CET1 capital, which is good for a standardized ratio of 12.5%, and 13% advanced, up from 12.2% and 12.9%, respectively, in Q2. Tangible book value per share grew slightly to $69.90, and is roughly flat YoY, mostly due to the impact of higher rates hurting AOCI as bonds have dropped in price. Risk-weighted-assets were down by roughly $23B sequentially, with growth in lending being more than offset by balance sheet management, as the company meets the higher capital requirements of the new CCAR cycle. JPM paid its $3.0B quarterly dividend in the quarter, or $1.00 per share.

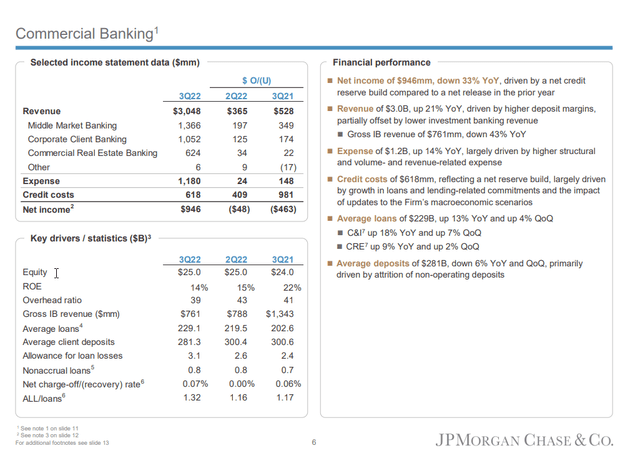

JPM Q3 Earnings Presentation

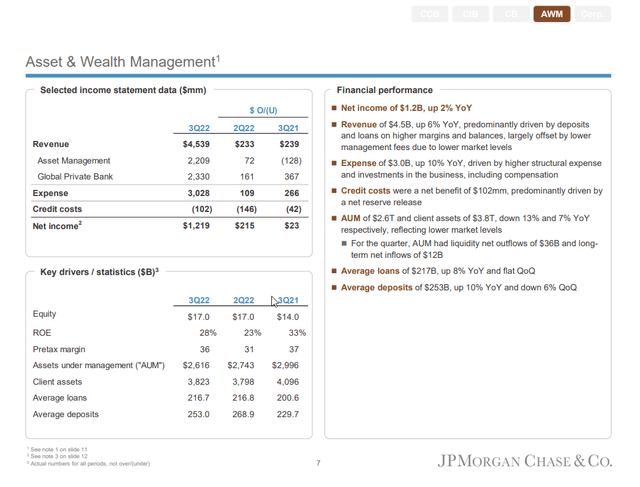

JPM Q3 Earnings Presentation

Moving into the 4th quarter, JPM expects NII to be approximately $19B, implying full-year NII of roughly $66B. The 4th quarter annual run rate of $76B is much higher than the $66B the company guided to on Investor Day, but management did indicate that it would expect a modest decline for the full-year 2023, but NII should be up substantially for the year relative to 2022 given the rate hikes that have already occurred. Banks will face pressure to rise deposit rates more aggressively at this point in the rate hiking cycle, which is why there will be less benefit per hike moving forward.

Much of the bear argument around banks is that credit is likely to worsen in a recession, which seems likely to be right around the corner, if it isn’t here already. CECL accounting was implemented in 2020, which already incorporate a percent of what management expects averages consequences to be. Now if the environment weakens, banks will still have to add to reserves, but I believe the risk is overstated. Jamie Dimon said that if unemployment goes to 5% to 6%, that will likely imply adding $5-6B to reserves over a couple of quarters. This is bank that just earned $9.7B in the quarter, despite adding to credit reserves, and with several of its key businesses facing material headwinds.

At a recent price of $111.19, JPM trades at just 9.2x forward earnings and pays a 3.6% dividend yield. The company has stopped buybacks temporarily to meet the higher capital requirements, but they should ramp up again next year. 1.6x tangible book value is obviously a lot more expensive than some of its competitors, but the business is far superior, as seen by the exemplary returns on capital that the company has achieved in a myriad of different economic environments. I’m a buyer of JPM at current levels and would continue to add on any weakness. JPM’s massive earnings power makes it far easier to deal with adversity, and ultimately benefit from it, as competitors tend to be far more constrained. Jamie Dimon won’t lead the company forever, but this is a bank that is poised to continue its leadership and attractive returns into the future.