Google Stock: At These Levels, It’s Hard To Be So Bearish (NASDAQ:GOOG)

Justin Sullivan

Thesis

Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) stock’s -33.4% YTD total return is a reminder to investors that even GOOG was lifted to unsustainable valuations at its highs in February 2022, as it underperformed the SPDR S&P 500 ETF’s (SPY) -23.8% YTD total return.

We highlighted in our August article emphasizing that the recovery would be highly challenging, and investors should not expect a fast recovery. While we had anticipated GOOGL’s May lows to hold, the market clearly had other ideas. As a result, GOOGL has underperformed since our previous update, as the market battered its valuations further.

We believe the market is at a critical juncture. Given GOOGL’s well-battered valuation, we are leaning increasingly bullish and see attractive entry zones at the current levels. However, we urge investors to plan for further downside, given the market’s positioning, as discussed in our recent S&P 500 (SP500) update.

We reiterate our Buy rating on GOOGL and encourage investors to continue accumulating. As a note, we are leaning more bullish than our previous position in August at these levels.

Google Faces An Increasingly Tough Ad Environment

The ad industry is expected to continue weakening in 2023 and likely move into a recession. William Blair highlighted in a September commentary indicating that global ad spend could “fall between 2% and 8% in 2023.”

However, it remains constructive on Google’s search ad leadership but sees higher risks to YouTube’s ad revenue. Notably, it estimates Google’s ad revenue to increase by 10% YoY (no recession) but fall by 8% in a recession.

Coupled with more intense competition from TikTok (BDNCE), we urge investors to continue planning for a more subdued recovery prospect for YouTube. Notwithstanding, YouTube has upped the ante recently against TikTok by leveraging its revenue share with creators on short format videos. Therefore, YouTube CEO Susan Wojcicki & team are competing aggressively to stake their leadership in the short format space against TikTok. Furthermore, the growth in TikTok’s viewing metrics (minutes per day) in August has slowed markedly from its highs.

Insider reported that “YouTube was still growing 3% compared with the same month last year — an impressive showing for a much older app than TikTok.” In contrast, TikTok’s viewing metrics increased by 9% YoY in August. However, it was way below the highs of 45% in previous years.

Furthermore, Microsoft (MSFT) is also pushing harder into the advertising space. The software behemoth is targeting to double its ad revenue from $10B to $20B. With the digital ad industry’s growth continuing to slow moving forward, Microsoft’s ambitions could see it taking share from the leading incumbent Google and Meta (META) if successful.

Hence, we aren’t surprised that Google is making sure that it remains relevant with Gen Z in Google Search. Google acknowledged in July that Gen Z users are increasingly relying on TikTok as their main search engine, bypassing Google Search or Maps. Hence, Google implemented “several visual changes to its map and search features” in its bid to compete aggressively with TikTok.

Insider Intelligence also highlighted the threat facing Google Search in a September feature. It articulated:

TikTok is very popular with young consumers. We estimate that 61.3% of the Gen Z cohort in the US uses TikTok at least once a month. Additionally, 58% of American teenagers ages 13 to 17 visit TikTok at least once a day, and 16% access TikTok “almost constantly,” according to research conducted by Pew Research Center this spring. – Insider Intelligence

Google Cloud To The Rescue?

Therefore, there shouldn’t be any surprise that Google CEO Sundar Pichai is placing an increasing emphasis on Google Cloud to help lift the company’s slowing ad revenue growth over the medium term.

Under Google Cloud CEO Thomas Kurian, Google Cloud’s revenue has continued to outperform the company’s corporate average, posting revenue growth of 35.6% in Q2.

However, investors are urged to watch for near-term weakness in enterprise cloud spending, which could further hamper GCP’s near-term momentum. Notwithstanding, Kurian & team remains confident in delivering Google’s expansion from a consumer-focused company with a significant enterprise edge as GCP takes on Azure and AWS (AMZN) in the cloud computing space.

Google Cloud is leveraging its momentum in the data cloud, industry verticals, and its customers’ preference for multi-cloud capability to diversify their reliance on a single hyperscaler.

But, its path to profitability needs to be closely watched, as it could hurt Google’s bottom line growth as its other profitable business segments slow.

Is GOOGL Stock A Buy, Sell, Or Hold?

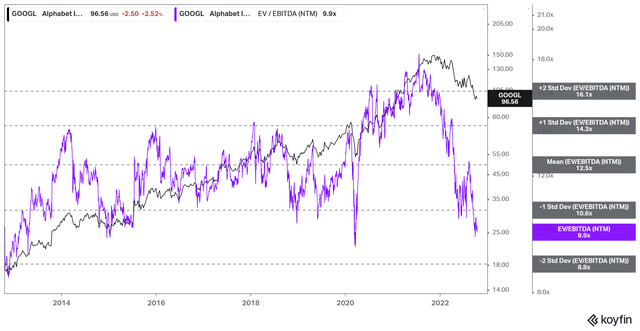

GOOGL NTM EBITDA multiples valuation trend (S&P Cap IQ)

With an NTM EBITDA multiple below the one standard deviation zone under its 10Y mean, it’s hard to argue that GOOGL’s valuation has not been battered.

Notwithstanding, we believe investors should be prepared (keep some spare ammo) for value compression if the market anticipates further estimates cuts are necessary for the ad industry due to a worse-than-expected recession.

As a result, it could send GOOGL down to the two standard deviation zone under its 10Y mean, thus improving its reward-to-risk profile further.

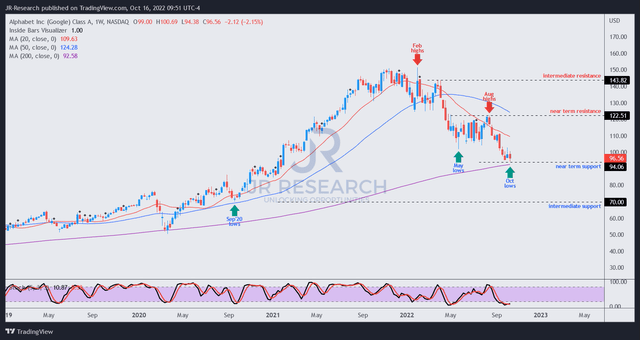

GOOGL price chart (weekly) (TradingView)

As seen above, the market took out GOOGL’s May lows decisively, even though we had anticipated it to hold.

However, with GOOGL supported above its 200-week moving average (purple line), we postulate that the market has already reflected significant damage in its valuation.

But, if the market anticipates a severe recession that could cause deeper earnings compression, we deduce that GOOGL could fall toward its intermediate support (up to a 28% decline). We postulate that GOOGL could then form its eventual bottom between these two support levels. Hence, we encourage investors to layer in their exposure to capitalize on potential downside volatility as GOOGL’s valuation seems attractive at the current levels.

As such, we reiterate our Buy rating on GOOGL.