Bank The Dividend Yield And Look For Incremental Upside In Regional Banks In 2023

-slav-

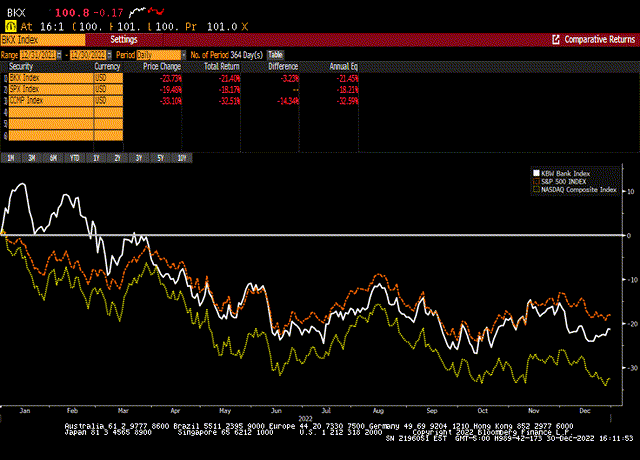

- 2022 represented a challenging year for the regional banks, where their price performance didn’t offer a respite vs. the bear market hitting the major indices (KBW Bank Index -24% vs. S&P 500 Index -19% and Nasdaq -33% in 2022).

- Primary reasons for underperformance in 2022 are ephemeral and likely won’t carry over into 2023. These reasons include AOCI headwinds due to higher rates environment, P/E multiple compression due to recession fears, elimination of M&A premium due to more stringent regulatory review of large bank mergers and evaporation of traditional drivers of fee income.

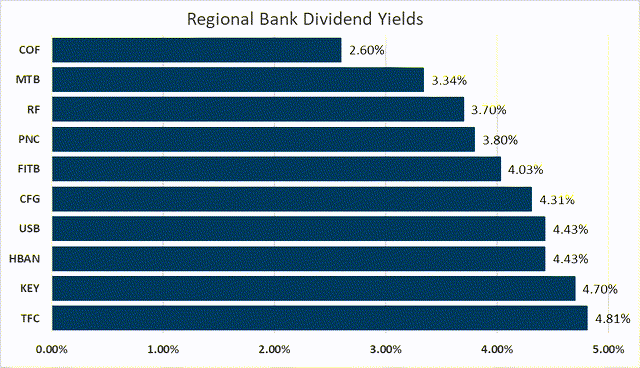

- Current dividend yield is attractive at 4% for the sector while also providing modest capital appreciation potential.

- Bank NII and NIM benefiting from the most aggressive Fed-rate hiking cycle in modern history.

- Current wall of worry hanging over the banks is the direction of credit costs and that NIM has peaked due to both funding pressures and potential for falling rates in mid-late 2023.

- Top regional bank picks for 2023 include CFG, PNC & MTB.

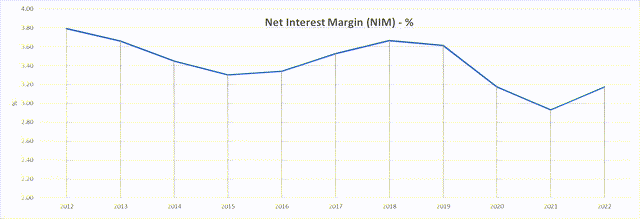

The broader markets in 2022 generated the worst returns since 2008, as the uptick in inflation forced the Fed to hike the federal funds rate by 425 bps since its March 16th meeting. This along with the Fed’s transition to quantitative tightening and Jackson Hole rhetoric about a willingness to cause “some pain” has caused the market to sell-off as it awaits future Fed guidance on when the rate hikes will cease or if/when the Fed will pivot. While a rapid ascent in rates is detrimental to risk assets due to investors’ pricing in a higher cost of capital, higher rates are a boon for banks as their net interest margin (NIM) and net interest income (NII) increase given the ability to earn more on interest rate sensitive assets (e.g., loans, securities and excess reserve balances). Despite the underperformance in 2022, we are convinced that the regional banks are poised to outperform in 2022 and should prove to be a desirable asset class in what will likely be a volatile year for the economy and broader markets.

For the purposes of this report, we define the regional banks as a depository institution with assets between $100 – $600 Billion). While we are also constructive on the Big 4 Banks (JPMorgan, Bank of America, Citigroup, Wells Fargo), the additional complexity associated with their more stringent and evolving regulatory capital requirements and the associated regulatory risk leaves us on the sidelines for now.

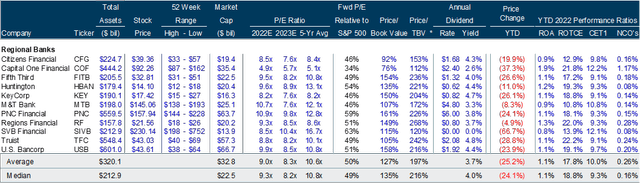

The universe of regional banks is as shown in the table below:

S&P Capital IQ; Author Calculations.

Current State of the Banking Sector

The past year has presented a quandary for bank investors. While current conditions have been mostly favorable, with higher levels of NII and solid credit quality, the fear of what may occur if the economy enters a recession in 2023 has caused bank investors to stay on the sidelines for the time being. Early in the year, bank stocks jumped out to a +11% return in mid-January but then pulled back sharply (see below chart) as the war in Ukraine escalated and the Fed’s transitory inflation call fell apart and it became clear that the Fed would have to turn hawkish.

The current fundamentals of the regional banks appear solid, as demonstrated by:

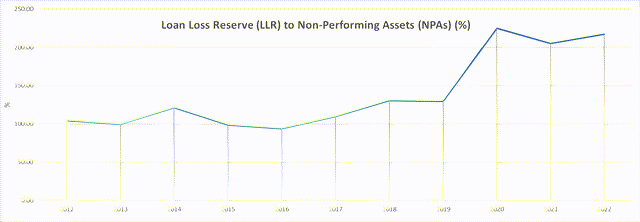

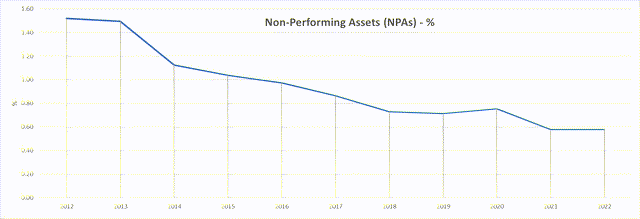

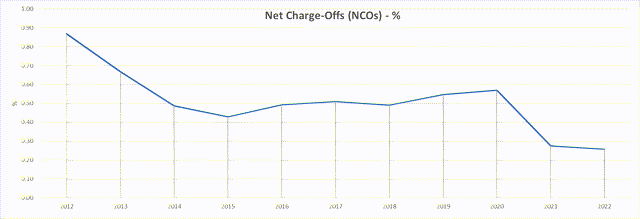

- Clean credit quality with low levels of non-performing assets (NPAs) and net charge-offs (NCOs) for the regional banks (see below);

Author calculations. Author calculations.

- Robust reserve coverage that is positioned to be able to accommodate much higher levels of unemployment and stress in the economy. Anecdotally, many of the bank CEO’s have stated at industry conferences that they are reserved for 5% unemployment and 0% GDP growth;

- Modest, but consistent, loan growth, as Fed H8 data shows loan balances up 1.9% QoQ and 12% YoY;

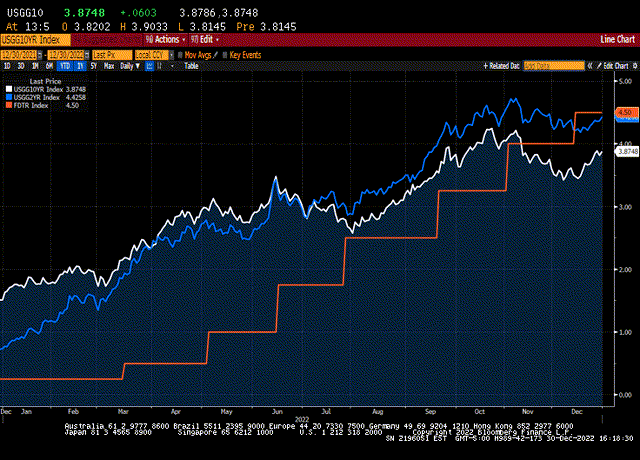

- Higher levels of NIM due to higher rates (see below chart depicting the Fed Funds rate alongside the 2- and 10-Year Treasury yields) and bank asset sensitivity;

Bloomberg Author calculations.

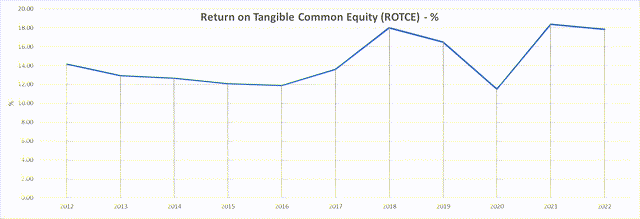

- Solid capital generation evidenced by high double-digit return on tangible common equity (ROTCE);

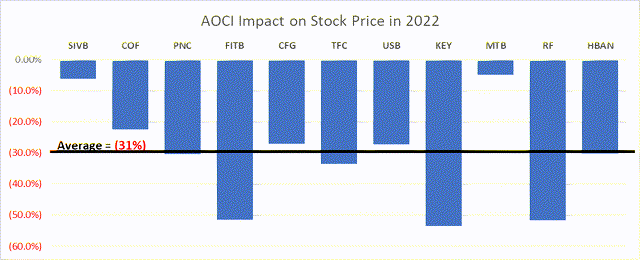

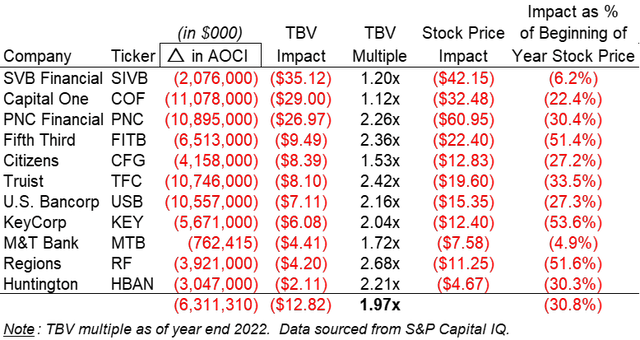

The primary issue dragging down bank stock prices has been the massive revaluation lower of fixed income securities holdings due to the spike in interest rates across the yield curve. Banks have most of their bond holdings designated as available-for-sale, which pursuant to FASB ASC 320 results in unrealized gains/losses flowing through AOCI, net of taxes. This has resulted in the following:

- Bank tangible book values (TBV) have taken a substantial hit, as AOCI is a component of shareholders’ equity. On average, regional banks saw AOCI decline by $6.3 billion (or $12.82 per share) thus far in 2022.

- Although regional banks have generated high returns on capital which is accretive to TBV, it has been more than overshadowed by the drastic decline in TBV precipitated by negative AOCI marks.

- As Price/TBV is a primary valuation metric used to value banks, the hit to TBV as a result of AOCI has been magnified as the average regional bank trades at 2.0x TBV. As shown in the below chart, the average regional bank saw its share price drop by 31% solely as a result of a lower TBV.

S&P CapitalIQ; Author calculations

S&P CapitalIQ; Author calculations

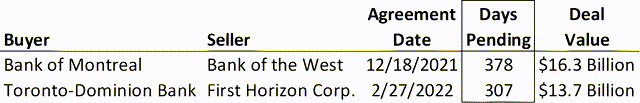

Another challenge faced by the sector has been the regulatory scrutiny that the Federal Reserve has placed on large bank M&A resulting in elongated approval times and regulatory review. This has caused any element of trading with an embedded M&A premium to evaporate, especially among the smaller regional banks. Whereas in the past, the potential for regional bank M&A existed with deals like the 2019 combination of BB&T and SunTrust Banks which formed Truist Financial, this no longer appears viable. In fact, two large bank transactions have been pending for more than 300 days awaiting approval, which is far greater than the average time period between announcement and close of approximately 5-6 months which used to be the norm.

Investment Thesis

While the investment community has thrown out the banks with the proverbial bath water in 2022, there remain numerous reasons to believe that the sector will outperform the broader markets in 2023 as indicated by the following:

- Stabilization of AOCI marks – the magnitude of unrealized losses in bank investment portfolios were unprecedented this past year due to the aggressiveness of the Fed rate hiking cycle (>400bps over a 9-month period). As the level of inflation has begun to decrease and the Fed is nearing its terminal rate (somewhere in the 5 – 5.25% range, as indicated by the latest FOMC Dot Plot), we expect there to be no further unrealized losses and the potential for securities portfolios to be revalued upwards towards the mid-end of 2023. This, along with solid retained earnings, will result in a rebuilding of TBV that will drive stock prices higher.

- Attractive Dividend Yield with Growth potential – with an average dividend yield of 4%, the regional banks offer the ability to collect a meaningful income plus the opportunity for price appreciation. In addition, these banks have grown their dividends over the past 10-years at a 16% CAGR and provide incremental upside to the current run rate of dividends. Look for the banks to increase their dividends at the end of June upon release of the stress test results.

- Relative Valuation – the regional banks are currently trading at a P/E discount, both on an absolute and relative basis. The current forward P/E multiple of 8.2x for the regional banks is more than two turns lower than the 5-year average of 10.6x. On a relative basis when compared to that of the S&P 500, the group is currently trading at only 50% of the forward S&P 500 P/E multiple while the 10-year average relative P/E multiple has been 71%. Closing of these gaps will result in multiple expansion for the group.

Below is a chart displaying the current P/E multiples for the regional banks and the S&P 500, both on an absolute and relative basis.

Thoughts on Individual Regional Bank Names

There are several ways to trade the group including several ETF’s whose holdings comprise many of the regional banks (i.e., KRE, KBWB, IAT, FTXO). Should you choose to purchase select names from the group, below are our thoughts on which names will outperform.

Sector Outperform |

|

Citizens Financial Group, Inc. (CFG): despite pristine credit quality, solid capital levels and an attractive franchise, CFG was down (20%) in 2022 and remains undervalued relative to its peers at a forward P/E multiple of 7.6x and a P/TBV multiple of only 150%. Fee income was challenged in 2022 given exposure to mortgage banking and IB/capital markets which dried up. Balance sheet is levered to higher interest rates while recent hedging actions protect from declining rates. Should the regulatory stance on big bank M&A loosen, CFG would be a viable candidate for a merger/MOE given quality of franchise and age of CEO. Attractive 4.3% dividend yield coupled with capital appreciation potential as stock should trade up to a minimum of 8.5x 2023E EPS ($45) by year-end. The PNC Financial Services Group, Inc. (PNC): solid franchise trading at a premium valuation with a coast-to-coast franchise with the addition of the BBVA USA acquisition in 2021. Stock was sold off in-line with the rest of the sector despite a highly diversified franchise, more earnings levers and greater efficiency opportunities given continued integration of BBVA USA acquisition. Price should hit $175 by year-end (11x 2023E EPS) while providing a healthy dividend yield of 3.8%. M&T Bank Corporation (MTB): historically high-performing franchise whose stock has been out of favor (down over 20%) since it reported weak 3Q results. Stock is trading unreasonably low, at only 7.6x forward 2023E EPS, as the market is doubting management’s ability to effectively integrate and generate the stated earnings accretion from its recently closed People’s United acquisition Note that M&T has been an effective consolidator historically as evidenced by the acquisitions of Hudson City, Wilmington Trust and Provident. Expect the stock to trade up to $170 by year end. |