ARKK: Inflows Mean Nothing (NYSEARCA:ARKK)

Marco Bello

Cathie Wood’s investment fund received new investment funds in June, following a dramatic collapse in the market for growth firms that resulted in significant losses for the ARK Innovation ETF (NYSEARCA:ARKK).

The fund manager continues to increase its bets on high-potential growth firms such as Zoom Video Communications (ZM).

In terms of portfolio composition, the flagship fund has recently undergone significant adjustments. New capital inflows, on the other hand, are unlikely to alleviate the fund’s underperformance.

Significant Performance Gap Between ARKK And S&P 500

In terms of performance, the ARK Innovation ETF has underperformed and disappointed to the greatest extent in the last year.

While the ARK Innovation ETF first flew high on the enticing ‘disruptive innovation’ investment theme, seeing billions of dollars in inflows before and during the Covid-19 outbreak, the euphoria has all but gone down. It’s easy to see why:

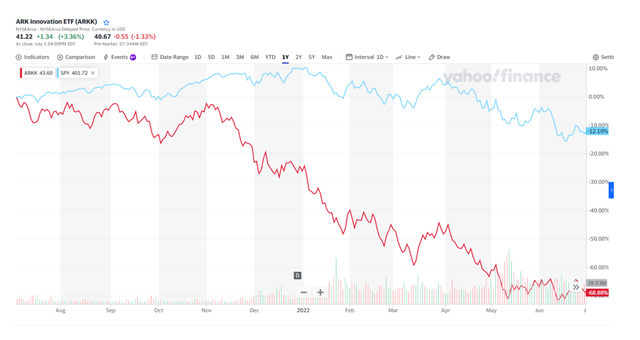

Over the last year, a do-nothing passive investment strategy returned -12.1%, while an investment in the ARK Innovation ETF, which manages a sizable $8.85 billion, returned -68.9%. Investors would have outperformed the exchange-traded fund if they had simply stuffed the money beneath their mattresses and accepted the inflation impact.

ARK Innovation ETF Performance (Yahoo Finance)

Major Changes To The Portfolio

Stock price reductions were brutal, particularly in growth areas that did well during the epidemic, such as video teleconferencing, electric vehicles, and streaming, forcing Cathie Wood to make significant modifications to the ARK Innovation ETF portfolio.

One of the most notable changes is that cryptocurrency exchange Coinbase Global (COIN) is no longer among the top ten.

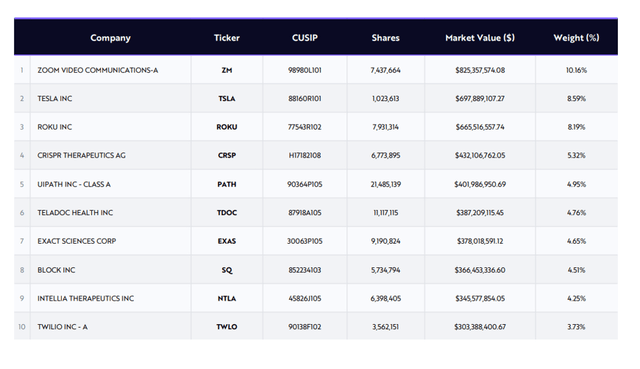

Furthermore, Zoom Video Communications has surpassed Tesla (TSLA) as the largest investment in the Ark Innovation ETF. The ARK Innovation ETF held 7.4 million shares of the video-conferencing company as of 07/05/2022, which is around 546.6K more shares than the fund held at the end of April. The Zoom Video Communications portfolio holding climbed from 7.78% in April to 10.16% in the first week of July.

The current portfolio breakdown of the ARK Innovation ETF is as follows:

ARKK’s Top 10 Investments (cathiesark.com)

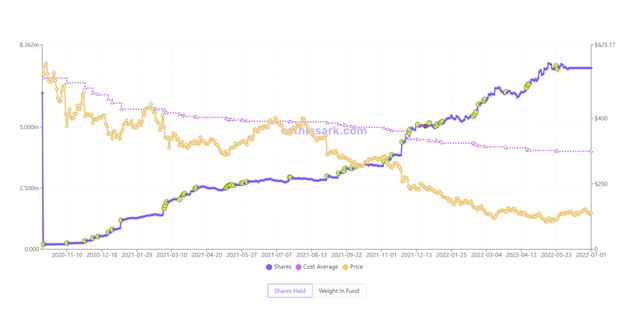

When the stock price of Zoom Video Communications fell, Cathie Wood doubled down. Zoom Video Conferencing’s stock is currently trading at $110.97, which is 73% less than its all-time high during the pandemic. According to Cathie’s Ark, the cost average as of 7/01/2022 was $299.37, representing a 63% unrealized loss on ARK Innovation ETF’s largest holding.

ARKK Holdings Of Zoom Video Communications (cathiesark.com)

Recent Capital Inflows

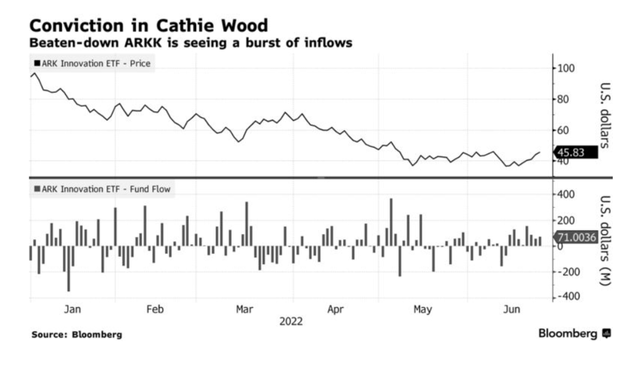

Despite a 69% drop in the fund’s share value, the ARK Innovation ETF saw a rise in capital inflows around the end of June, indicating that investors are giving Cathie Wood’s disruptive innovator fund another go.

Over an eight-day period in late June, investors poured around $640 million of new funds into the ARK Innovation ETF, implying that investors haven’t completely given up faith on a recovery in growth equities.

However, given ARKK’s massive underperformance over the last year and the very tiny magnitude of capital inflows relative to a total fund value of about $9 billion, investors should not expect additional capital contributions to make a significant difference for ARKK.

Recent Capital Inflows (Bloomberg)

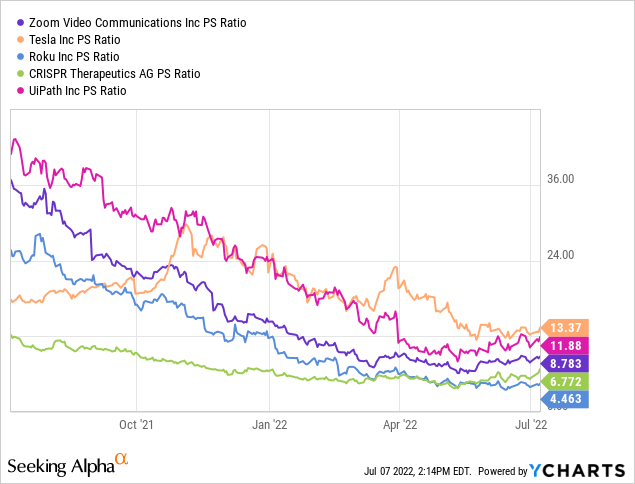

High Valuation Multiples Still Exist

The ARK Innovation ETF’s core positions are still vastly overvalued, signaling significant valuation multiple correction risks if the stock market reacts as violently to recession concerns as it did in the first six months. The valuation multiples of the ARK Innovation ETF’s core position remain extremely high, posing dangers to fund investors.

Why The ARK Innovation ETF’s Net Asset Value Could Increase

Stocks in video conferencing and other industries that benefited from the outbreak remain extremely valuable. However, if additional capital flows into Cathie Wood’s flagship fund, the fund manager may be able to double down on more of her high-conviction picks while also lowering her cost base, particularly in top positions like Zoom Video Communications.

A market rebound may then be sufficient to improve the fund’s portfolio performance in the future. However, I believe this is a long shot given that CNBC reports that 7 out of 10 CFOs anticipate a near-term recession.

My Conclusion

The ARK Innovation ETF has undergone significant changes in recent months, with Cathie Wood increasing her stake in Zoom Video Communications, which is currently the fund’s largest position. Zoom Video Communications’ growth in the ETF’s portfolio occurred at the expense of Tesla, which has also witnessed a significant drop in stock value this year.

Despite the fact that the flagship fund has benefited from additional capital inflows, giving Cathie Wood new firepower to double down on holdings the fund is underwater on, investors should not get too excited because the ARK Innovation ETF’s most major positions are still highly richly valued.

Given the possibility that recession headwinds may have a significant influence on the stock market in the second half of this year, the ARK Innovation ETF’s value will most likely continue to fall.