Airbnb: Is The Valuation Justified? (NASDAQ:ABNB)

courtneyk

Airbnb, Inc. (NASDAQ:ABNB), together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company’s marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences.

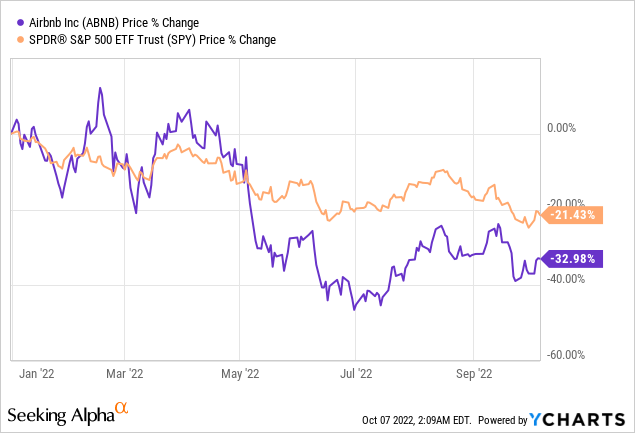

Year-to-date, ABNB has lost as much as 33% of its market value, underperforming the broader market, which has declined by about 21%.

Today, we are going to take a look Airbnb’s financial performance, and provide our view, whether the current valuation could be justified or not.

Let us start by studying several items from the firm’s latest quarterly earnings to understand what factors are causing (or will likely to cause in the near future) tailwinds and headwinds for the business and for the shareholders.

Quarterly results

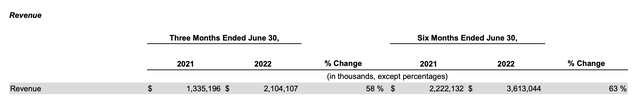

Revenue

Airbnb’s quarterly revenue has grown by 58% year-over-year, which is an impressive figure.

Revenue

The primary drivers of growth have been:

- Increase in nights and experiences booked.

In the second quarter of 2022, we had 103.7 million Nights and Experiences Booked, a 25% increase from 83.1 million in the same prior year period, and a 24% increase compared to the second quarter of 2019 (pre-COVID-19 pandemic). […] Our Nights and Experiences Booked increased from prior year levels largely driven by stronger results in North America, EMEA and Latin America, where we continued to see resilience in domestic and short-distance travel, as well as improvement in both longer- distance and cross border travel during the first half of 2022.

2. Increase in Gross Booking Value (GBV)

In the second quarter of 2022, our GBV was $17.0 billion, a 27% increase from $13.4 billion in the same prior year period. For the six months ended June 30, 2022, our GBV was $34.1 billion, a 44% increase from $23.7 billion in the same prior year period. The increase in our GBV was primarily due to an increase in Nights and Experiences Booked. The travel recovery we are experiencing has been dominated by our higher average daily rate (“ADR”) regions-North America and Europe, in particular, whereas Asia Pacific, one of our lowest ADR regions, remains depressed.

While we believe that these growth figures are indeed remarkable, we have to ask ourselves how sustainable these are, and what might hurt revenue in the near term?

FX headwinds

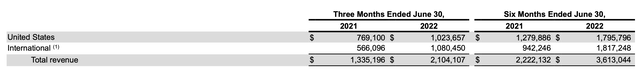

The first macroeconomic factor that comes to our mind, which has already caused and may further cause headwinds, is the unfavourable FX environment.

More than 50% of the company’s revenue has been generated outside of the United States. Because of this, the rapid appreciation of the USD relative to other currencies has been negatively impacting the firm’s financial performance in the second quarter.

Revenue by geography

On a constant currency basis, revenue growth in Q2 would have been as much as 64%.

In our opinion, the FX environment is likely to remain unfavourable and uncertain in the near term, due to the geopolitical tension between Russia and Ukraine, the uncertainty of the European energy supply, the elevated inflation (partially driven by the previously mentioned factors) and the rising interest rates in the U.S.

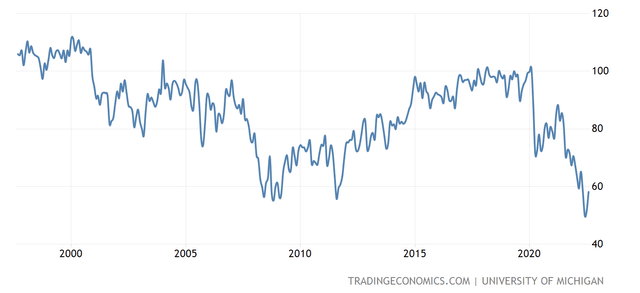

Consumer confidence

Consumer confidence – a leading economic indicator – is often used to estimate potential changes in the spending behaviour of the consumer in the near future.

Since the beginning of 2020, consumer confidence in the United States has been on a steep decline, despite the short uptick in the second half of 2020.

U.S. Consumer confidence (Tradingeconomics.com)

In 2022, confidence has even fallen below the levels observed during the 2008-2009 financial crisis.

We believe that the low consumer confidence can have both positive and negative impacts on the firm. Let us see why.

Negative:

Low consumer confidence means that people are more uncertain about their financial outlook and the health of the economy and therefore are less likely to spend larger sums on non-essential, discretionary items and services. Because of this, people may choose not to travel, which in turn can lead to a declining demand for ABNB’s services.

Positive:

On the other hand, if people anyway choose to travel, they are likely to look for cheaper, more affordable accommodation and experiences. This is, where ABNB may have an advantage over its peers and may gain some market share. Further, due to the strong USD, U.S. travellers may feel inclined to travel abroad now, which can also positively impact the business.

To sum up, we believe that there are several macroeconomic factors, including the FX environment and the consumer confidence, which could impact the demand for ABNB’s services and eventually firm’s financial performance going forward. Whether the impact will be positive or negative is uncertain. For these reasons, we do not advise to make an investment decision solely based on revenue growth.

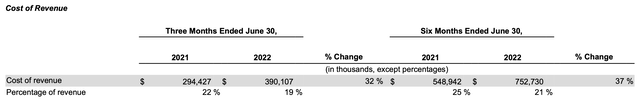

Cost of revenue

While the cost of revenue has increased in the second quarter, the revenue growth has outpaced it, resulting in a gross margin expansion.

Cost of revenue

Cost of revenue increased $95.7 million, or 32%, for the three months ended June 30, 2022, compared to the same period in the prior year, primarily due to an increase in merchant fees of $87.2 million largely due to an increase in pay-in volumes, an increase in data hosting service costs of $7.2 million, and $5.8 million in chargebacks, partially offset by a decrease of $7.3 million in amortization expense for internally developed software and acquired technology. Cost of revenue as a percent of revenue decreased to 19% for the three months ended June 30, 2022, compared to 22% in the same period in the prior year, primarily due to growth in revenue outpacing growth in cost of revenue as a result of the significant increase in Nights and Experiences Booked combined with higher ADRs and cost saving initiatives.

While many firms have been struggling with contracting margins in 2022, we like that despite the challenging environment ABNB has even manage to expand their gross margin.

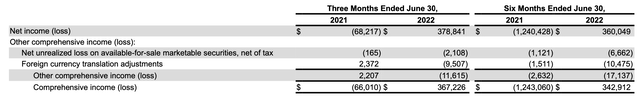

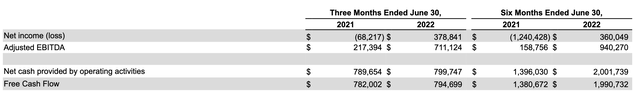

Net income and Free cash flow

Along with the revenue, net income and free cash flow have also increased significantly, not only in the second quarter, but also in the first half year of 2022.

Net income

While in the year ago quarter the firm has still been losing money, in 2022, they have managed to generate substantial profits.

Free cash flow

For the three months ended June 30, 2022, Free Cash Flow was $794.7 million, representing 38% of revenue, compared to $782.0 million, representing 59% of revenue, for the three months ended June 30, 2021. The increase was primarily driven by revenue growth, margin expansion and significant growth in unearned fees. Due to seasonality, the first half of the year typically benefits from working capital as unearned fees are generated by bookings, but not recognized as revenue until future periods when guests check-in.

All in all, we believe that ABNB has been performing well both top- and bottom-line. We believe that for this reason, ABNB’s stock could be attractive for growth investors, with a long investment horizon.

But is the current price justified for this growth?

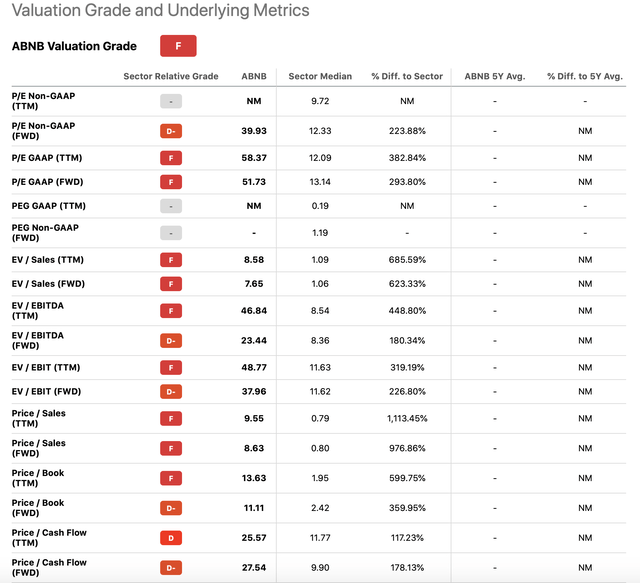

Valuation

While the growth is in fact impressive, the traditional price multiples all indicate that ABNB is substantially overvalued compared to the consumer discretionary sector median.

Valuation metrics (Seekingalpha.com)

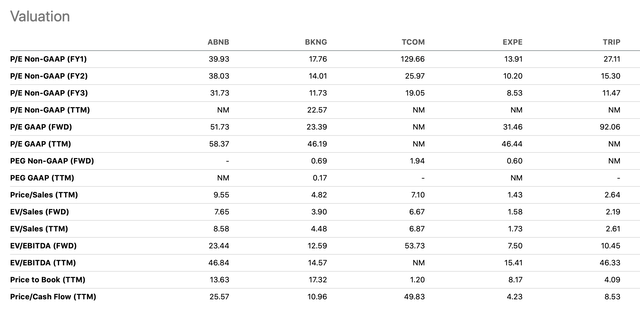

One might argue that the consumer discretionary sector is not valid for comparison, but even if we compare ABNB with its direct peers or competitors, the firm still appears to be trading at a premium.

Valuation of peers (Seekingalpha.com)

In our opinion, ABNB is not attractive from a valuation point of view at the current price levels, in the current, uncertain macroeconomic environment.

To sum up

Despite all the pros, including revenue growth and expanding margins, we believe that such a premium is not justified in the current environment. In general, we like ABNB’s business model and appreciate its growth potential and key role in the travel industry going forward, but we would like either the price multiples to contract or the macroeconomic environment to improve, before considering starting a position.

For these reasons, we currently rate the firm’s stock as “hold”.