Millicom: Compelling Risk/Reward Amid Depressed Stock Valuation (OTCMKTS:MICCF)

Faiz Dila/iStock via Getty Images

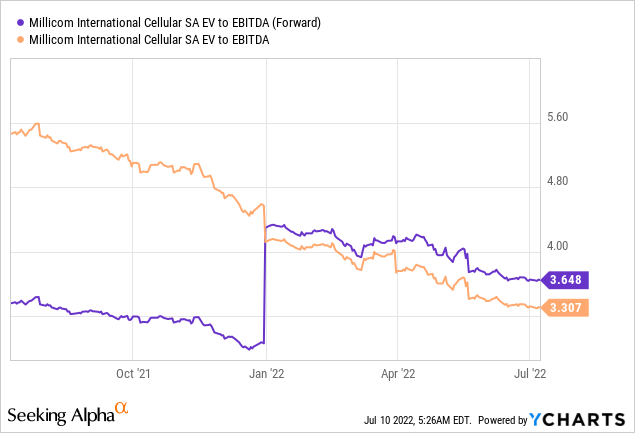

LatAm telco operator Millicom’s (NASDAQ:TIGO) recent exercise of a put option from its Panama minority partner has mixed implications for investors. On the one hand, the financial terms seem accretive – the acquisition of the 20% stake it did not own came at a reasonable ~8x EV/EBITDA valuation, while the incremental FCF contribution more than adequately covers its cost of debt. That said, the strategic rationale is puzzling, given that ~40% of gross proceeds from the rights offering (or ~$290m) will be used to buy the stake in Panama instead of de-levering the balance sheet as originally intended. Thus, the move could raise governance and funding concerns going forward, particularly given the scale of the dilution from the rights offering (~70%). At its core, though, the TIGO investment case as a proxy for an expanding middle-class LatAm population remains intact, in my view. With the stock also massively underperforming its key LatAm peer América Móvil (AMX) and de-rating to ~4x EV/EBITDA, I see a clear case for a re-rating depending on its mid to long-term operational performance.

An Unexpected Deal Announcement

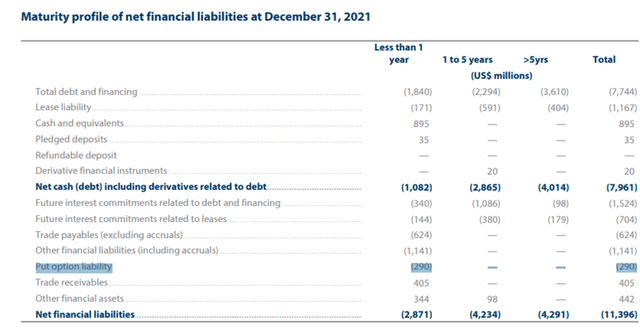

TIGO’s recently announced execution of its partner’s put option (part of a shareholders’ agreement entered in 2018) will result in the company acquiring the ~20% stake it did not previously own in the Panama operations. The accompanying press release confirming the stake acquisition does not provide details on the amount paid by Millicom to hit 100% ownership, but the company’s last annual report offers some clues. Per the filing, “As of December 31, 2021, the value of the ‘Transaction Price’ put option is lower than the ‘Unconditional’ put option’s value, and therefore the Group recognized the put option liability at the higher of both valuations at $290 million (December 31, 2020: $262 million).” So, using the put option valuation booked on TIGO’s balance sheet implies a ~$290m price and, relative to its share of the underlying EBITDA from the Panama business, entails an ~8x EV/EBITDA valuation multiple on 2022 numbers.

FCF Accretive But Unfavorable Leverage Implications

While the optics of the Panama deal is far from ideal, coming on the heels of a massive rights issue originally slated for debt paydown, the case for FCF accretion is sound. As the second-largest source of FCF for TIGO (after Guatemala), Panama reported unlevered FCF of ~$123m (2021 EBITDA of ~$277m net against lease expenses of $10.5m, capex of $125m, and ~$18m in taxes), which nets to ~$25m if we account for the 20% stake. To fund the incremental FCF, the company will spend ~$290m from the rights offering proceeds – at an in-line ~7% cost of debt, the incremental ~$20m debt servicing cost is more than accounted for by the incremental FCF contribution. Thus, the deal will likely prove net accretive to TIGO over time, even if the added ~$5m/year of cash flow only contributes a minor % of the group’s overall FCF.

The leverage implication is less ideal, though – at least, from an accounting standpoint. Per disclosures, the $290m amount was registered in liabilities but not in TIGO’s net debt calculation, and thus, it was historically excluded from the net leverage ratio. As ~40% of the proceeds from the rights offering will also no longer be used for debt paydown, TIGO’s deleveraging targets will likely be achieved later than expected. Assuming FCF growth is in-line with guidance, year-end leverage levels should only move slightly below the >3x as of last quarter (per company definition), so there could be implications for the credit rating and, by extension, cost of debt, as well. The other key variable is buybacks, which could be downsized to make the 2.5x leverage target by 2025.

Heavily Discounted Post Rights Issue

Prior to the Panama acquisition and in conjunction with the purchase of the remaining 45% equity stake in TIGO Guatemala, TIGO tapped into a $2.2bn bridge loan facility (of which ~$350m remains outstanding). To fund the gap, TIGO had announced a massive share issue of 70.4m new shares – equivalent to a ~70% dilution of the existing shareholder base. Per the terms of the rights issue, owners of a TIGO share or depository receipt are granted a subscription right (ten subscription rights entitle the holder to subscribe for seven shares) at a subscription price of $10.61/share – a heavy discount to the $23.50 share price pre-announcement. As the (significantly oversubscribed) rights offering has now been completed, the pro forma shares outstanding will rise to 172.1m (up from 101.7m pre-rights).

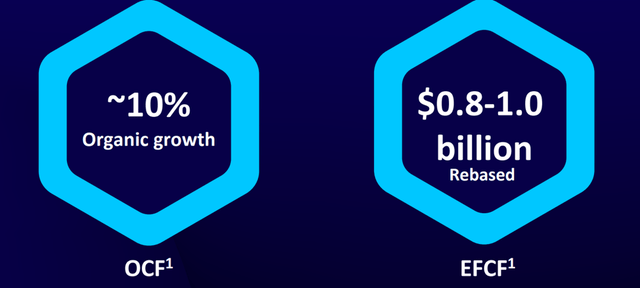

Net, investors that bought the shares pre-rights at $23.50/share and subsequently subscribed to the rights offering at $10.61/share are out of the money with the stock at $14.39/share. Given América Móvil stock has been resilient over the last month, by contrast, the diverging equity performance offers investors a compelling entry point, in my view. Currently, the pro forma market cap stands at ~$3bn, while the FCF generation potential remains intact at >$300m (recall TIGO’s guidance is for a cumulative free cash flow of $0.8-1.0bn over 2022-2024), implying a ~10% FCF yield at current levels.

Compelling Risk/Reward Amid Depressed Stock Valuation

While the deal economics will likely prove accretive over time, TIGO equity holders may be less than pleased that ~40% of gross proceeds from the recent rights offering will be used for M&A (vs. debt pay downs as previously anticipated). That said, TIGO stock has already come under severe pressure from the completed share issue, despite the secular investment thesis remaining intact. Thus, the risk/reward in TIGO looks attractive, in my view, at an EBITDA multiple of ~4x (massively underperforming its key LatAm peer América Móvil) relative to an operating cash flow growth target of ~10% per year. Meanwhile, potential carve-outs from its tower portfolio and fintech businesses (Tigo Money) offer additional upside catalysts over the coming year.