Energy Transfer Likely To Generate Strong Double-Digit Returns (NYSE:ET)

hirun

Energy Transfer (NYSE:ET) is back below $10 per share, pushing the company’s market capitalization with its 3 billion shares right around the $30 billion level. The company’s dividend yield is now roughly 8% and in exchange you get a growing company with a strong portfolio of assets, generating a much higher overall shareholder yield. As we’ll see throughout this article, options can help you magnify that.

Energy Transfer Latest Performance

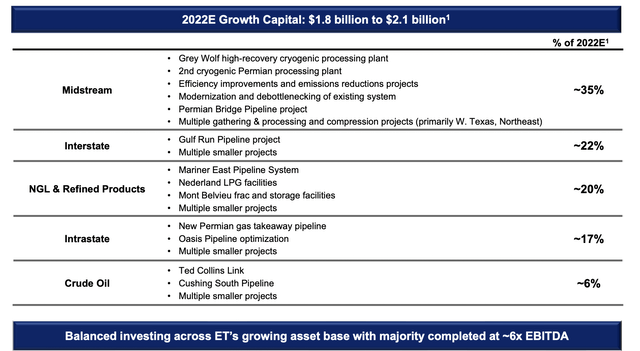

Energy Transfer has continued to execute in its portfolio over the past months with several new startups.

Energy Transfer Investor Presentation

Energy Transfer Latest Performance – Energy Transfer Investor Presentation

Energy Transfer recently started construction on a new 200 million cubic feet / day processing plant for natural gas in the Permian Basin. With companies looking to reduce flaring, it’s an opportune time to start it, and the plan is expected to be in service by year-end 2022. We expect continued bolt-on processing plants after this.

The company also started construction on the Gulf Run Pipeline while completing several additions (Ted Collins Link, Phase II of Cushing South Pipeline, and the Mariner East Pipeline). All these new pipelines will enable the company’s EBITDA to expand in coming years. The company’s 2022 guidance is for ~$2 billion in capital spending (~25% maintenance capital spending and ~75% growth capital spending) with $12 billion in overall revenue.

The company’s continued execution in its businesses, especially over the last month, is exciting to see.

Energy Transfer Investments

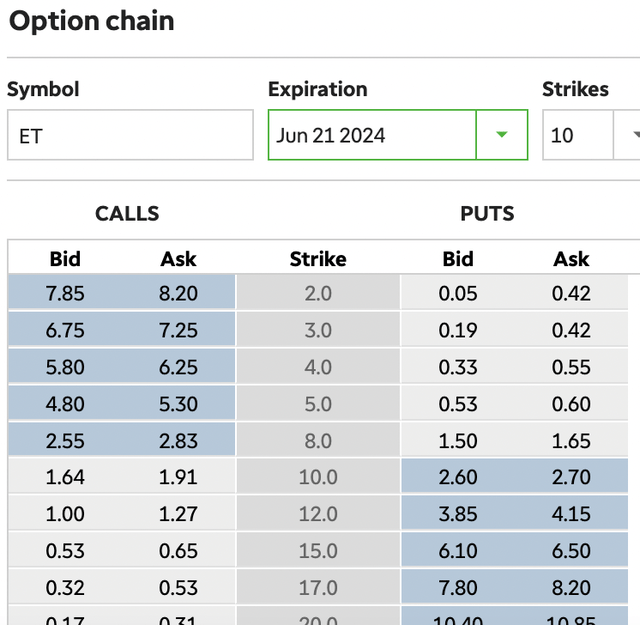

From a more detailed look, the company is looking to invest ~$2 billion in growth capital which will generate several hundred $ million in new EBITDA.

Energy Transfer Investments – Energy Transfer Investor Presentation

Energy Transfer has numerous businesses and in our view the lower crude oil proportion is actually a good thing. We expect natural gas to be essential to the markets for longer than crude oil, presenting additional long-term cash flow and growth opportunities. That means the company’s cash flow could remain reliable or grow for decades to come.

More so many of the company’s growth opportunities are small connection bolt-ons. These are assets where the company is taking advantage of mis-pricing in the markets, enabling high returns at minimal cost. The company is heavily investing in growth capital with numerous projects and we expect that to increase the company’s ability to generate shareholder returns.

Energy Transfer Management and Valuation

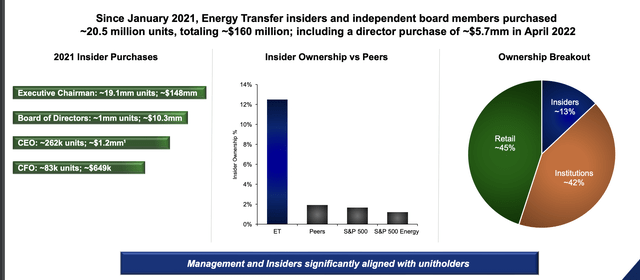

Energy Transfer also has some of the most committed management in the industry.

Energy Transfer Investor Presentation

Energy Transfer Insider Ownership – Energy Transfer Investor Presentation

Energy Transfer has double-digit insider ownership. The company’s insiders and independent board members have purchased >20 million units since January 2021 totaling more than $150 million. This insider ownership gives the company strong incentives to maintain continued dividends and other direct shareholder returns.

Our View

At the same time, the company continues to have a lower valuation. The company generates roughly $8 billion in annualized DCF or an almost 30% DCF yield. From this the company’s dividend costs $2.4 billion and growth and maintenance capital takes that to roughly $5 billion for the company. That growth capital is enough to increase DCF ~2-3% annually.

After all that, the company is left with $3 billion. The company has rapidly reduced its debt towards $40 billion. Reducing that further would increase DCF rapidly by reducing interest expenses.

If we had a wishlist we’d like to see the company spend its $8 billion in annual DCF as follows:

– $2.4 billion dividends (maintain the existing dividend)

– $0.5 billion maintenance capital (maintain the existing infrastructure)

– $0.5 billion growth capital (take only the highest return bolt-on projects)

– $4.0 billion share repurchase (buy all you can as long as the yield is >5%)

– $1.5 billion debt paybacks (repurchase the highest yield debt possible)

We expect with several years of this, the buybacks would rapidly drive up the overall share price, while debt paybacks and growth capital will increase DCF. Once the yield is at 5% (~$16/17 per share) the buybacks category can be split among debt payback and growth capital accelerating those two sections even faster.

However, regardless of how the company spends the money we expect strong double-digit overall shareholder returns.

Options Investing Strategy

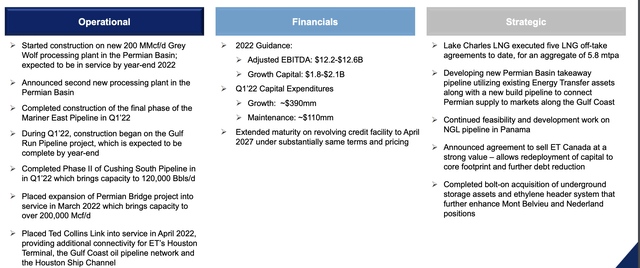

For those looking to invest, we recommend using an options investing strategy with Energy Transfer.

Options Investing Strategy – TD Ameritrade

The above chart shows the current option pricing for the company. For those looking to invest, we recommend selling cash secured PUTs at $8 / share at a midpoint of roughly $1.57 / share. These options will last 2 years to expiration for investors. For those who sell these cash secured PUTs there’s two options worth paying attention to.

The first is the company’s share price drops to less than $8 / share. In that situation you get to invest at a cost-basis of roughly $6.4 / share, moving your 8% yield towards 15+%. You’ll be left with a great company at a great price. The alternative is the share price stays above $8 giving you a 10% annualized yield on your cash for 2 years, a great cash yield.

Either way you get strong returns.

Thesis Risk

The largest risk to our thesis in our view is a long-term decline in the oil markets. Energy Transfer relies off of volume in the markets and over the coming decades that volume is continuing to decline as the company invests billions to grow. That means the company’s strong FCF now could steadily decline hurting the company’s ability to drive returns from its assets.

Conclusion

Energy Transfer’s share price has remained weak taking the company’s dividend towards 8% with a roughly $30 billion market capitalization. The company’s debt is near its targets and the company is currently generating an almost 30% DCF yield. The company is using a variety of levers to generate overall shareholder returns.

We’d like to see the company aggressively focus on share buybacks with debt pay-down before investing in growth. While remaining focused on growth is important we expect that that strategy would set up the company much better for the long term. An options investing strategy could enable even stronger returns highlighting how the company is a valuable investment.