Sprott Is Once Again Attractively Priced (NYSE:SII)

Petmal

Investment Thesis

Sprott (NYSE:SII) is an investment company focused on natural resources, precious metals especially, but the company has also increased its uranium exposure lately. It is a stock I have owned for the better part of the last 5 years, even though I have liquidated my holdings a couple of times when the stock has gotten ahead of itself. I have written many articles about the company on Seeking Alpha in the past.

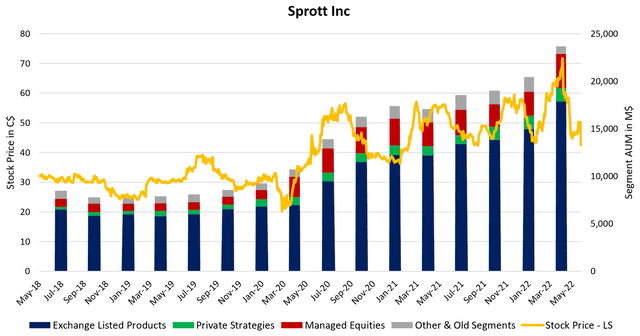

Figure 1

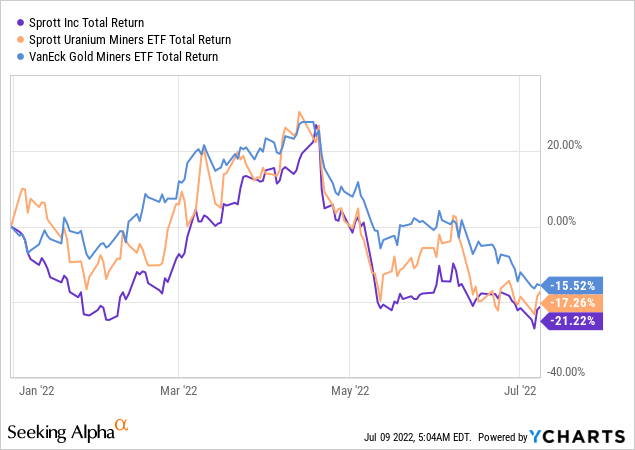

In 2022, the stock price has been slightly more correlated with uranium equities than precious metals miners, even if the two industries have traded relatively closely to each other. After the selloff in Q2 2022, the stock is once again trading at a very attractive level.

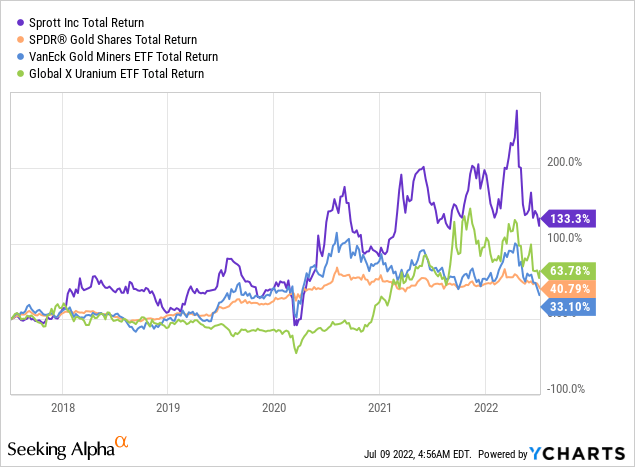

Figure 2

Valuation Vs. Royalty & Streaming Companies

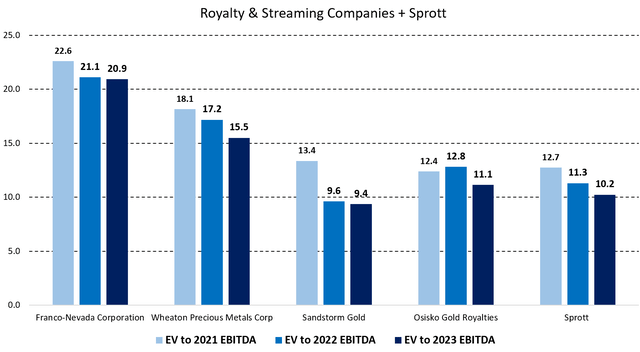

As an investment company, Sprott is less capital intensive than miners. The company also carries much less operational and political risk. A better comparison is in my view with the royalty & streaming companies, even though their profit margins are typically slightly higher than Sprott’s.

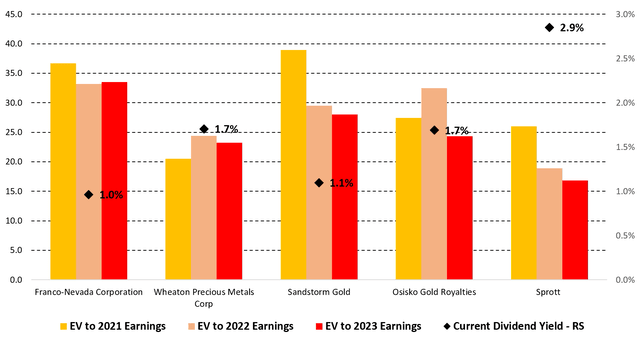

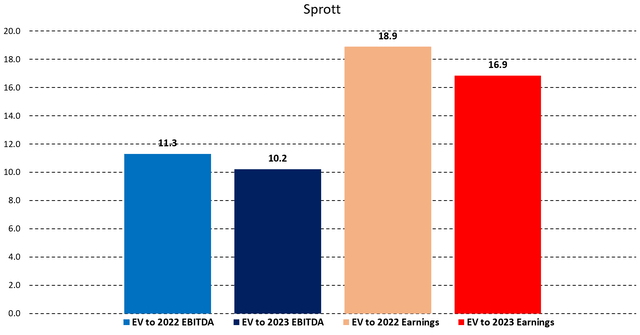

In the charts below, the valuation for Sprott is being compared against some of the larger royalty & streaming companies, where we can see that Sprott has a more attractive EV to Earnings, significantly more so than some of the other companies.

Figure 3 – Source: Data from Koyfin Figure 4 – Source: Data from Koyfin

I do, however, think Sprott’s 2022 earnings estimate is a little bit aggressive unless precious metals prices and/or uranium prices increase aggressively during the second half of the year. However, that is probably partly true for the royalty and streaming companies as well. I also like the fact that Sprott has a more respectable dividend yield at 2.9%.

Exchange Listed Products Segment

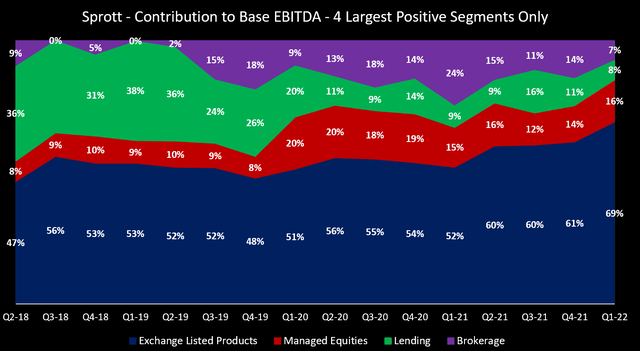

Sprott derives most of its revenues and earnings from the Exchange Listed Products, Managed Equities, Lending, and Brokerage segments. The Exchange Listed Products segment has lately started to contribute an ever-greater amount to total earnings. So, it is by far the most important segment. It is also a segment where the Trusts and the ETFs can be tracked daily on Sprott’s homepage.

Figure 5 – Source: Quarterly Reports

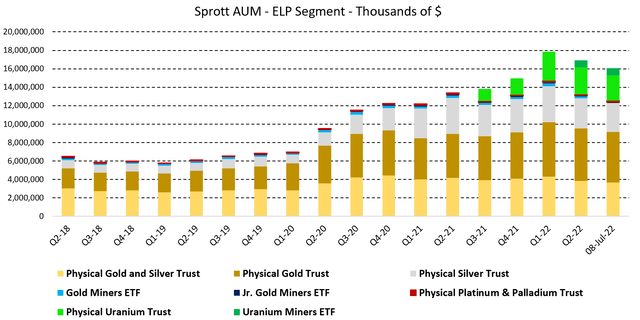

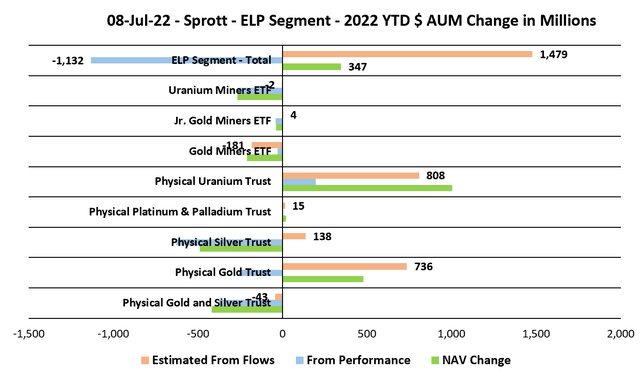

Despite a challenging 2021 and 2022 in the precious metals market, which is still Sprott’s largest source of revenue. The company has managed to grow the ELP segment by 30% in 2021 and 8% so far in 2022. This is due to some smart acquisitions in the uranium industry, as most of that growth has come from the addition and inflows to the Sprott Physical Uranium Trust (OTCPK:SRUUF) and the Sprott Uranium Miners ETF (URNM).

The fact that the segment has seen $1.5B in inflows and a healthy AUM growth during a depressed 2022 bodes well for the future once the sentiment improves.

Figure 6 – Source: Data from Sprott.com Figure 7 – Source: Data from Sprott.com

Conclusion

Sprott might not be as dirt cheap as some of the most beaten down miners presently. However, the current valuation is in my view still attractive, given the impressive growth Sprott has shown over the last few years together with a very healthy dividend yield of 2.9%, which is significantly more than most lower risk investments in the precious metals industry.

Figure 8 – Source: Data from Koyfin

It seems like the stock price has overcorrected to the downside lately, while it is still in a long-term upward trajectory. That has historically been a good time to buy the stock or add to the position, which is what I have done recently.