Skyworks Stock: Uncertain Short-Term Forecast For Revenue

Dave Walsh/iStock via Getty Images

With Skyworks Solutions, Inc. (NASDAQ:SWKS) being clocked along with the balance of the stocks in the PHLX Semiconductor Sector Index (SOX), investors might be tempted to walk away. In our view, it is during these periods that tremendous insight into future investments occurs. The price to earnings (P/E) for Skyworks, at $90 a share, is less than 9. Historical growth rates have been significantly higher than single digit. But, clouds still fill Skyworks’ sky, obscuring our vision, creating an unbelievably cheap price. So, come with us, let’s head to the closest, grab a broom and swish away some clouds hoping to find blue sky.

Quarter Results & the Business Report

From the last quarter, the company reported:

- Revenue of $1.35 billion.

- Cash from operations at $400 million.

- $100 million in paid dividends.

- Repurchased 3 million shares.

- Two 10% customers: Apple (AAPL) and Samsung (OTC:SSNLF).

- Soft China market.

- Incredible strides with Samsung.

- Strong broad market business across the board with IoT, automotive, infrastructure.

- I&A business “setting a new all-time revenue record.”

- General statement regarding customer relationship that management believes will drive forward business revenue growth.

- China represents approximately 10% of the company’s business.

Last Full-Year Results

In November of last year, the company reported its last full-year results summarized below:

- Delivers Record FY21 Revenue of $5.109 Billion, up 52% Y-o-Y

- Posts FY21 GAAP Diluted EPS of $8.97, up 87% Y-o-Y; FY21 Non-GAAP Diluted EPS of $10.50, up 71% Y-o-Y

- Generates Record Operating Cash Flow in FY21 of $1.772 Billion, up 47% Y-o-Y

Year-over-year growth was more than impressive at 50% plus.

Competition

Even with stellar growth, analysts and investors seemed preoccupied with possible competitive issues mainly with QUALCOMM (QCOM). Both Qorvo (QRVO) and Skyworks, at recent conferences, added different, yet valuable insight. At the J. P. Morgan conference, Robert Bruggeworth, Qorvo’s CEO, answered,

” . . but my point is, yes, they’ve made some progress in RF. But again, most of their RF content is our largest customer for millimeter wave. . . . So we feel that we’ve got a strong portfolio, and we’ve done quite well. We have not lost share at a Qualcomm in China, if that’s the question.”

Skyworks offered this commentary at its last quarterly conference,

“I mean on the modem side (Qualcomm), the baseband processor, we don’t make that product, but we have technologies that will wrap around just about anybody’s baseband, . . . So we’re agnostic to that. And our customers are really going to make the decisions that they need to make to get the best performance. So, you could very well see a high-content device populated with a lot of very unique Skyworks Solutions that are all in-house, custom crafted, not fabless, done in-house . . . in our factories with people that live and breathe wireless.”

Between the two companies, the market is asking for a large variety of specialty needs, something that QUALCOMM can’t provide. Again, QUALCOMM’s big increase in RF is primarily with Apple in millimeter wave. Neither Qorvo or Skyworks are particularly seeing content push out.

Growth

At the Bank of America Technology conference, Griffin was asked about coming growth. In particular, analyst, Vivek Arya, asked,

“Liam, I’m curious to get your thoughts on how do you do the demand planning because with the large flagship customers you have, usually, it’s — the year starts with a lot of excitement that they’re going to do a ton of units. And then there is an article in the paper somewhere that, oh, number of units has been revised down by 10%, 20%, and then there’s another article in August or September. This is not your first lode, right? So how do you kind of plan for that every year just conceptually?”

Arya was fishing for Apple’s health. Unfortunately, Griffin dances around and never answers.

Defining growth opportunities is more difficult with Skyworks in our view, but one area is with Samsung during the 2nd half of this year in both flagship and mid-tier phones. After reviewing the transcripts, we wonder if Skyworks isn’t also expecting growth with the Huawei spinoff, Honor.

Apparently, China OEMs such as Oppo, Vivo have fallen behind in technology and want to catch up. Skyworks believes it can provide much needed technology to help out. Overall, Skyworks believes that China is a growth market and is planning resources for China.

A reiterated buy by Mizuho analyst Vijay Rakesh on Skyworks Solutions, Inc. seems to be the strongest argument. His argument includes: Skyworks

“positioned well for the upcoming 5G ramps around the globe driven by strong iPhone, Korean OEM share gains and China OEM traction, and a significant 50-100% dollar RF content increase per handset vs. 4G,” plus “opportunities in its broad markets business with growth in IoT/auto/industrials, . . .”

In this view, the revenue growth comes with more 5G phone ASP.

Risks & Mitigating Risks

Risks do abound. The world is either in a recession or heading there. The GDPNow (Atlanta Fed) prediction shows a -2%, meaning the United States is in a recession (two quarters of negative growth in a row). How much will the slowdown affect unit sales? Great question of which we have no answer. Adding to this is the missing information about future Apple unit sales.

Another risk, risk from badly timed inaccurate news still occurs. On Friday, Digitimes posted that Apple was about to cut by 10% year over year, iPhone 14 units. The market dumped off key Apple suppliers including Skyworks, Qorvo, and Cirrus Logic (CRUS).

“Analyst Ming-Chi Kuo doubts a Digitimes report that says TSMC’s iPhone 14 orders have been cut by 10%. . . the analyst says the shipment forecast for iPhone 14 components and EMS remains the same as he reported early this week.”

He noted a huge increase in China demand for the 14 over the 13. It should be noted that Micron (MU) did warn last week cutting approximately 10% from its revenue guidance for the balance of year. And Foxconn didn’t, but rather increased the 2nd half of the year revenue projections.

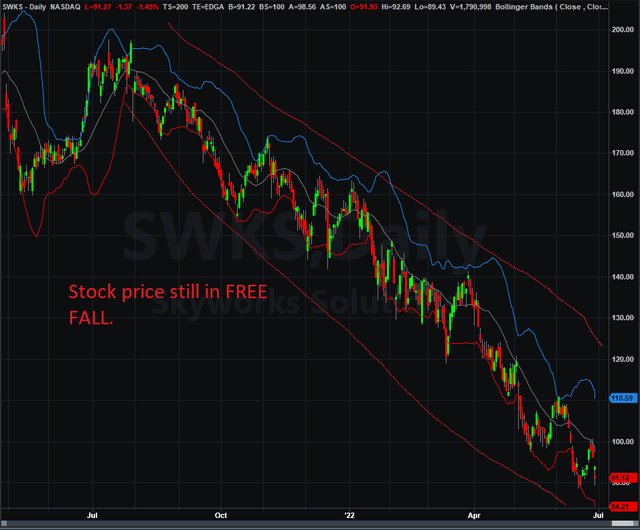

With this stock price approaching dirt cheap along with others, a buying opportunity is coming. Yet the stock prices are still in free fall shown in the TradeStation chart below.

Buying in this environment has risks, significant risks. One possible method might be to wait for the earnings report in early August and watch the market reaction. A bullish response on strength might be a good place to start a new position. What is clear is that the stock is technically beaten up and when that changes, the upward move will be strong. The swish of the broom moved some clouds opening the inspection for blue sky. Management expects Skyworks to grow, but recessions with accompanying customer weakness may delay its real growth for a year or two. Where is the bottom and when to buy becomes the question? Again, a strong stock response after earnings might be a good time.