Helmerich & Payne Stock: Potential Higher Shareholder Returns (NYSE:HP)

Stadtratte/iStock via Getty Images

Introduction

I’ve been looking forward to this article after covering a number of oil drillers in the past few weeks. In this article, I want to achieve two things. First of all, to discuss the service and equipment side of the North American oil production industry. We’ll incorporate the recent Dallas Fed Energy Survey as well as related trends that show what companies are struggling with and what they expect. Second, I’m going to give you a company that goes well with this trend in case investors want to invest in the industry. The Oklahoma-based Helmerich & Payne (NYSE:HP) company is the owner of one of the most advanced drilling rig portfolios in North America. It provides key supplies to major upstream companies. Its balance sheet is top-tier and utilization rates are high. Moreover, the company has underperformed drilling companies, which could change if supply constraints ease.

With that said, let’s get to it!

The Oil Industry – Opportunities & Challenges

In the past two weeks, I wrote two articles highlighting two oil drillers with low breakeven points and an emphasis on free cash flow used to return cash rather aggressively to shareholders – one using high dividends, the other focusing on buybacks.

As the titles suggest, I went a bit political. This is based on the ongoing trend from fossil fuels to renewables. It’s a bit of a forced trend, and politicians aren’t afraid to admit it anymore as I cover in these articles.

Given that (in the case of the US), 79% of the total energy supply is coming from fossil fuels, we’re dealing with a dangerous inflationary trend (caused by supply issues) that is working its way through the economy. It’s happening in the US, Europe, Asia, and frankly everywhere.

EIA

One quote that I used in my Devon Energy article is the one below from Goehring & Rozencwajg who have been on this supply issue for a while:

Years of underinvestment in upstream oil and gas projects has produced the present deficit. Trying to reverse this shortfall will take years of upstream capital spending at rates double and triple of what we are spending today. Until we reverse this shortfall in upstream capital spending, we will not fix the underlying problem.

Goehring & Rozencwajg

Moreover:

Oil and gas capital spending fell by over 60% between 2010 and 2020. Investment in the US shales fell by over 70%. Over that entire period, the cumulative reduction in capital spending compared to the trend was more than $1 tr.

Over the same period, ESG concerns came to grip the global investor community. We believe much of the capital needed to build renewable projects was diverted away from upstream oil and gas investment. Unfortunately, wind and solar are intermittent sources of power that suffer from very poor energy efficiency.

With that said, we now have valuable insights from the Federal Reserve Bank of Dallas as well. The bank publishes a quarterly energy survey, which I have been reading for years. It’s a fascinating deep dive into its energy industry, providing us with interesting details.

The title of its most recent report, released on June 23, 2022, is:

“Oil and Gas Activity Jumps; Costs Escalate, Supply-Chain Delays Worsen”

That’s the perfect summary of the ongoing energy crisis.

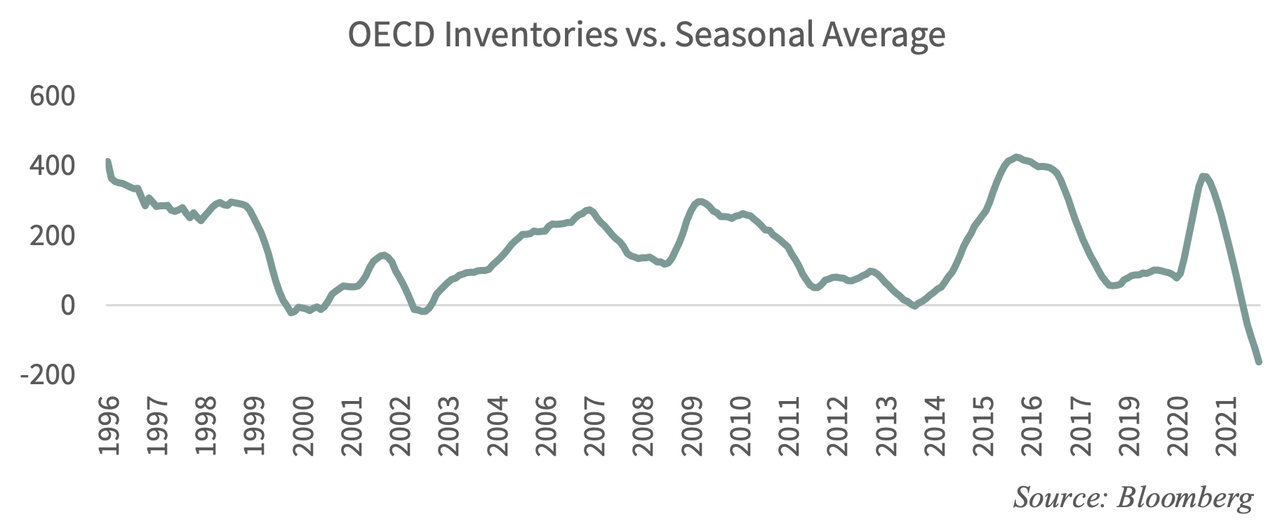

Now, let me throw some charts your way, which add to our energy bull case.

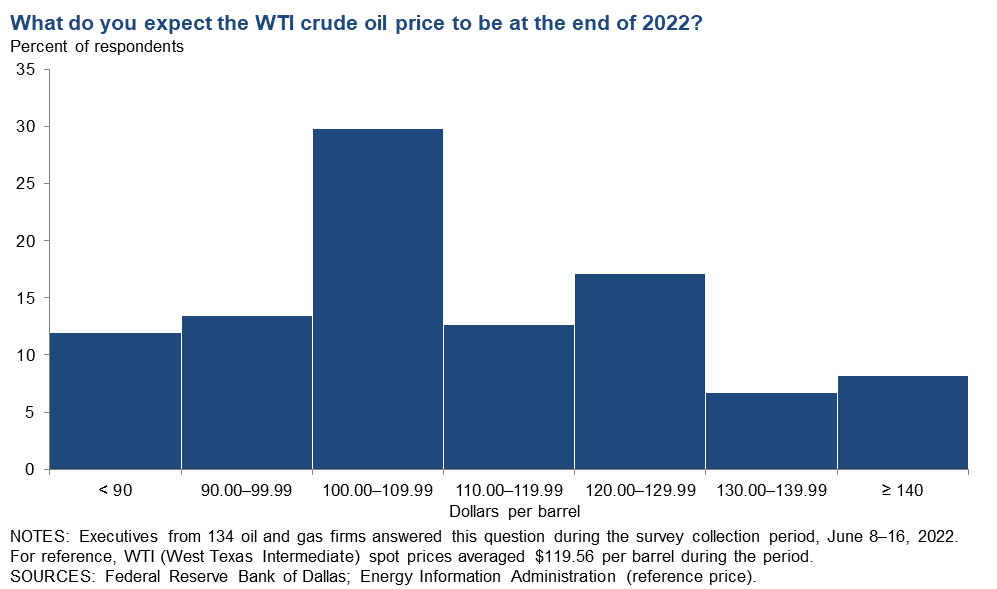

First of all, I was surprised to see the end-of-year WTI crude oil targets of 134 energy executives. A minority of executives expect oil to finish the year below $100. Most see prices between $100 and $110. However, roughly a quarter of respondents expect the year to finish above $120.

Dallas Fed Energy Survey

Usually, these responses are far more conservative as executives, in general, don’t believe that high prices can or will last. In prior cycles, they were right as aggressive exploration and production growth always caused supply to jump. As soon as demand weakened, oil plummeted.

Now, the consensus seems to be that oil prices get support from the severely broken supply. And these executives know the supply side better than any of us.

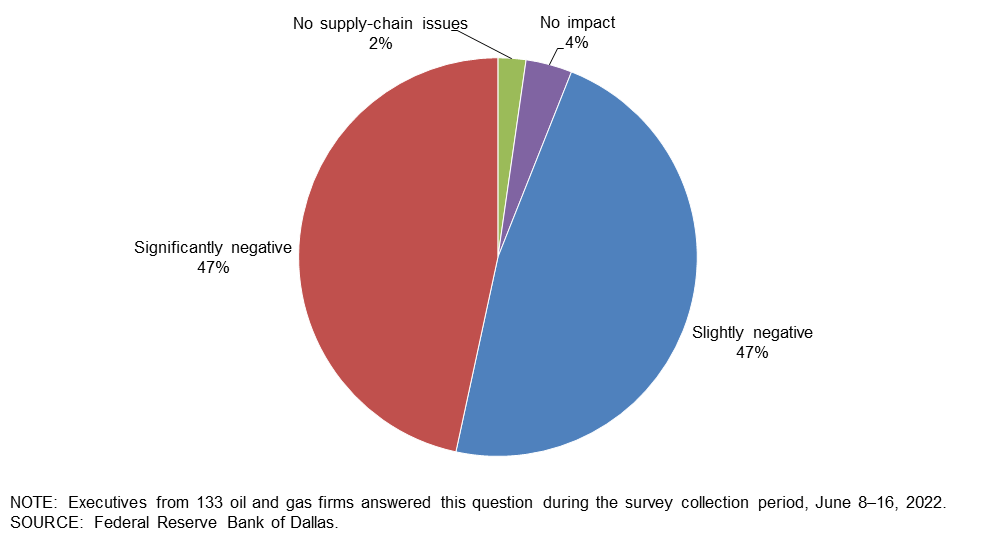

After all, 94% of companies experience supply-side issues as the pie chart below shows. 47% of all respondents rate the impact of supply chain issues on their firm as “significantly negative”.

Dallas Fed Energy Survey

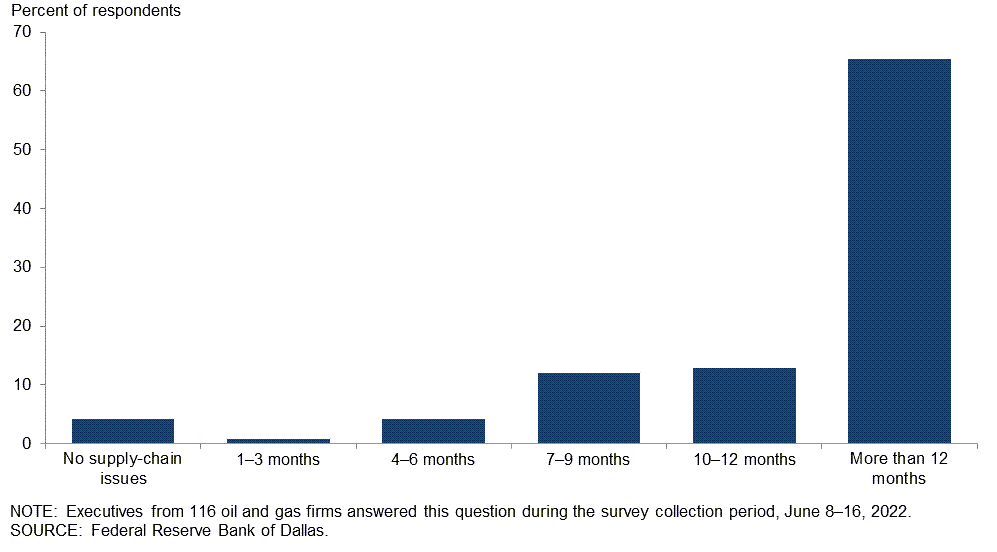

That’s pretty bad. What’s even worse is that more than 60% expect supply issues to last longer than 12 months.

Dallas Fed Energy Survey

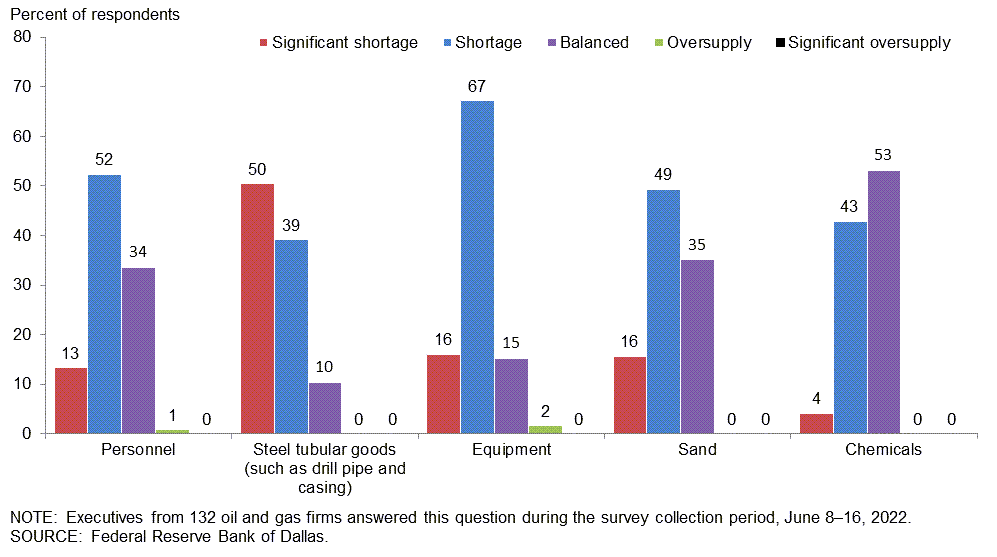

This makes sense as we’re dealing with supply issues that are deep-rooted. According to the Dallas Fed, there are shortages in personnel, steel tubular goods, equipment, chemicals, and even fracking sand. Significant shortages are the worst in steel tubular goods, the very products needed to establish new rigs and wells.

Dallas Fed Energy Survey

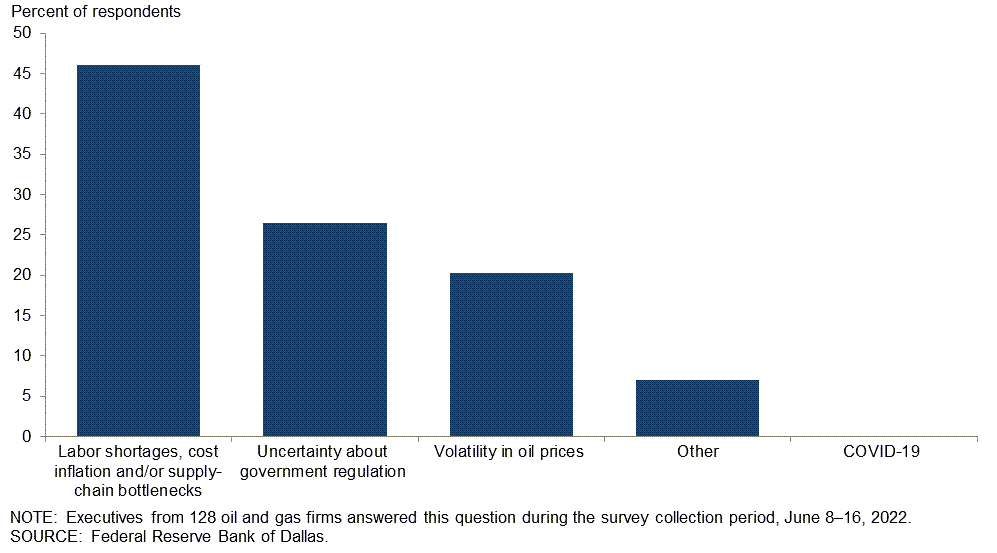

These issues are so significant that it’s the single biggest factor contributing to industry uncertainty – it even beats uncertainty caused by government regulation.

Dallas Fed Energy Survey

I believe that makes total sense as most drillers know what the government is up to. However, executing plans within this framework is still made impossible in some cases by supply issues. These supply issues also threaten existing production to some extent.

As a result, roughly 70% of respondents make the case that US crude oil production will not reach the 1 million barrel per day production hike this year, as predicted by analysts. 35% of participants don’t expect production to rise by more than 800 thousand barrels per day.

With that in mind, let’s look at the start of this article, Helmerich & Payne

What All Of This Means For Helmerich & Payne

Helmerich & Payne is a $4.5 billion market cap company operating in the energy sector. It operates in the oil & gas drilling industry. It doesn’t produce a single drop of oil but it delivers high-quality rigs to customers.

I’ve followed the company since I started trading 11 years ago for one major reason: it used to be a great trading vehicle in addition to a company like Exxon Mobil (XOM). Traders – and large funds – used to watch the ratio between HP’s share price and XOM’s share price.

The reason is outperformance. When oil prices rise, energy companies invest in growth. Hence, they buy new equipment. When oil prices fall, equipment investments are neglected.

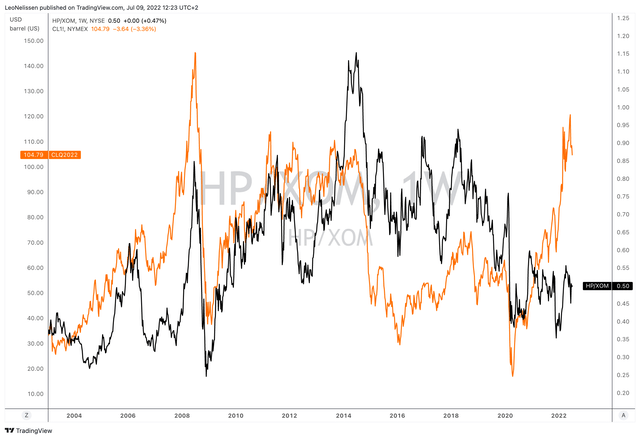

The chart below shows the ratio between HP/XOM and the price of WTI oil. The correlation isn’t perfect, but if you look closely, you can see that prior trends in oil were always followed by the equipment/upstream ratio.

TradingView (Orange = NYMEX WTI Crude, Orange = HP/XOM ratio)

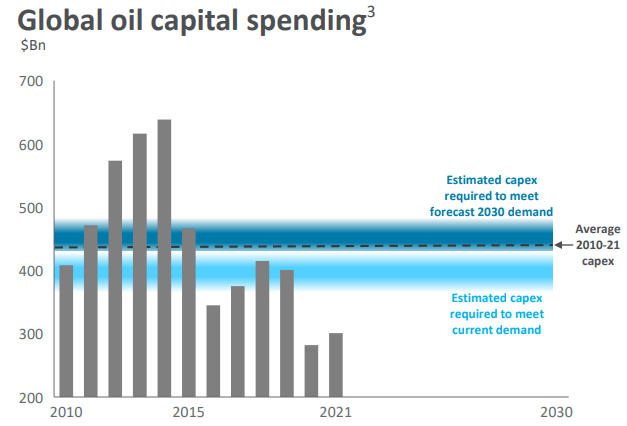

Until 2020, of course. Now the traditional playbook has been thrown out of the window. Oil prices are rising but energy companies are not boosting production as they used to do. After all, global oil capital spending is well below where it needs to be to satisfy the expected 2030 oil demand.

Seeking Alpha

As a result, HP isn’t outperforming anymore.

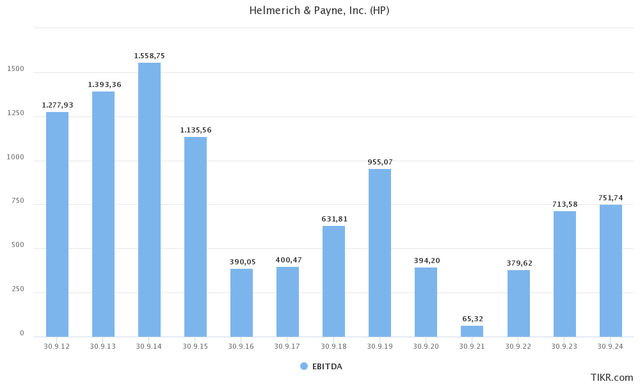

Note that the company’s EBITDA history (and outlook) are extremely similar to the global CapEx trend I showed you above. This obviously makes sense and it shows that the company could do $714 million in EBITDA in the business year ending in September of 2023. That’s a big improvement compared to the current business year, but not even close to what the company did in the fracking revolution years prior to the 2015 sell-off in oil.

Helmerich & Payne isn’t sleeping at the wheel. They do know that the industry has changed.

This is what the Tulsa-based company commented in April:

Given the industry’s negative experience in recent years, it should be no surprise to anyone that US producers have remained cautious, rational and discipline with regard to their capital expenditures, even in the face of spiking commodity prices. HP’s strategy is to also maintain CapEx budget discipline and holding that line is something we believe is crucial to creating a healthy and sustainable company over the longer term.

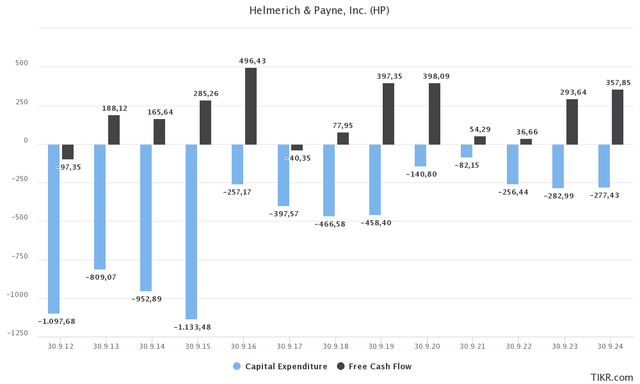

If we look at the company’s CapEx and free cash flow history, we see that the company is indeed lowering CapEx. In the years ahead, CapEx isn’t expected to make it past $290 million. That’s way below prior cycles. As a result, the company is in a good spot to boost free cash flow well past $300 million despite lower demand. Please note that free cash flow is operating cash flow minus CapEx. It’s cash a company can spend on debt reduction, dividends, and buybacks.

It helps a lot that Helmerich & Payne has one of the most advanced portfolios of drilling rigs. It has 271 available rights. All but 7 are onshore drilling rigs. 236 are located in the US. 230 of these (85% of the total) are Super-Spec FlexRig assets.

Super-spec rights have an economic life of 30 years. Components like engines have shorter lives and are maintained regularly. These rigs have low total maintenance costs, better reliability, and higher safety standards than “traditional” rigs, making them good alternatives for income-seeking drillers in an environment where the “easiest” drilling opportunities are behind us.

The company has the largest fleet of super-spec rigs with a utilization rate of 73% on US land. The total utilization rate of its portfolio is 68% as both international land and offshore utilization rates are low.

While I don’t see a rapid increase in the company’s utilization rate, it’s OK as existing business drives high free cash flow. If the company can do $350 million in FCF in its next business year, it would imply a free cash flow yield of 7.7%. The company currently pays a $1.00 annual dividend per share. This implies a dividend yield of 2.3%.

While it’s hard to estimate what future buybacks will look like – the company is using these to distribute additional cash – analysts are just “straight-lining” estimates when it comes to net debt. In the next business year, net debt is expected to fall from $200 million to negative $28 million. In 2024, net debt could be negative $464 million.

Moreover, the company has NO major debt maturities until 2031. In other words, even if rates continue to explode higher, it is in a fantastic position to avoid financial trouble. Moreover, with a current total debt to capital ratio of less than 20%, the company is the healthiest public onshore drilling equipment provider in the United States.

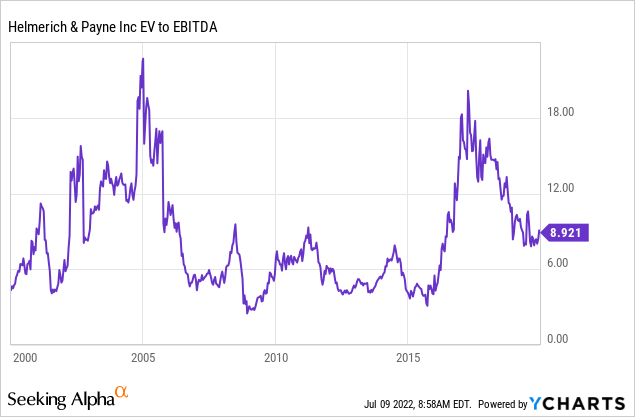

When it comes to the company’s valuation, we’re dealing with a $4.53 billion market cap, $27 million in FY2023 net cash expectations, and $50 million in pension-related liabilities. This puts the enterprise value at $4.6 billion. That’s roughly 6.3x FY2023 EBITDA.

In this case, I’m not at all pricing in the company’s potential to use free cash flow to lower net debt into deep negative territory. In other words, this valuation comes with a very high margin of safety over the next 2-3 years.

In other words, I believe HP is too cheap. If I had to put a value on the company, I would go with a $5.2 billion market cap to price in net debt reduction and steady EBITDA results close to $730 million. This implies between 15% and 20% upside.

Takeaway

In this article, we looked at the situation from an energy executive’s point of view. On top of political issues, we’re seeing that supply chains are broken. Materials, personnel, chemicals, and related commodities are all lacking. It is highly likely that oil production growth targets are being missed as none of these issues are likely to be solved within 12 months.

Helmerich & Payne, one of North America’s largest providers of onshore rigs and equipment is seeing the same. Like oil drillers, the company has given up on long-term CapEx growth. It is making sure to maintain its existing fleet and increase its utilization rate in onshore projects as well as finding growth through offshore opportunities.

The company is focusing on free cash flow growth, eliminating net debt, hiking its dividend, and using buybacks to distribute additional cash to shareholders.

However, while the company is undervalued, I’m not buying the company. Unlike prior cycles, the equipment versus upstream ratio is broken. Investors rather buy oil drillers that keep CapEx low to distribute sky-high dividends. That’s what I’m doing as well.

I believe that HP is a political play. So here’s how I would deal with this stock. Keep it on your list for certain political outcomes. If the Republicans win big in this year’s midterms and/or the 2024 general election, I believe we will see much looser environmental restrictions, allowing companies to boost output. I believe this will be very fertile ground for an outright investment in HP or a spread trade versus certain drillers.

Needless to say, I’ll keep you up to date on that.

For now, the biggest takeaway is that supply will remain subdued in the oil industry, providing a big tailwind for oil and related commodities/stocks.

(Dis)agree? Let me know in the comments!