Harmony Gold Stock: Needs Higher Gold Prices For Profitability (NYSE:HMY)

bodnarchuk

Intro

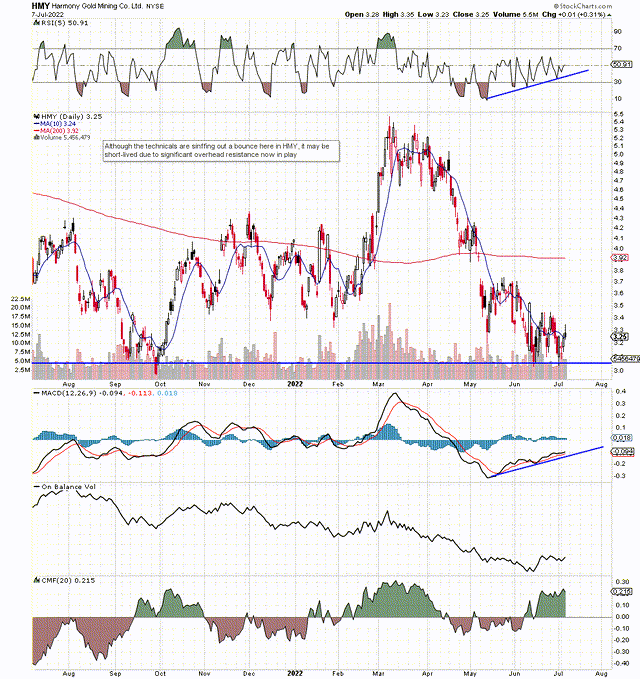

If we pull up a chart of Harmony Gold Mining Company Limited (NYSE:HMY), we can see that shares over the past 15 weeks or so have lost close to 40% of their value. Concerning the near term, shares have managed to stay above their June lows, but the underlying trend continues to be bearish so investors have to be careful when timing an entry here. We state this because once shares lost their 200-day moving average back in early May, selling intensified to the downside. The selling eventually stopped at the 2021 lows, but shares have now a sizable amount of resistance to overcome before returning to bull mode once more.

The trajectory of mining companies’ share prices is closely linked with the prevailing price of the commodity that they mine. Shares of Harmony, for example, rallied aggressively above their 200-day moving average in February of this year when the price of gold rallied well above $2000 an ounce. Does this mean that the opposite (a weakening HMY share price) will continue to take place in a weakening gold price environment? This may very well be, but apart from the fact that higher costs on the front-end must be controlled to maximize margins, risk/reward plays always come down to the relationship between the stock’s valuation and its inherent profitability.

Here is how Harmony currently stacks up in these departments.

Technical Chart Of Harmony Mining (Stockcharts.com)

Many investors who invest in the gold mining space believe that inflation is good for mining companies, and it generally is. The problem, however, is that gold mining companies such as Harmony have high fixed costs (Harmony has already announced its solar intentions to combat electricity costs on the front-end) which inevitably get higher in inflationary periods. Investing in physical gold or an exchange-traded fund (“ETF”) that tracks the gold spot price is an excellent inflation hedge, whereas a mining stock such as Harmony may not be shielded against rising prices as many may believe.

Margin Pressure

Why do we state this? Well when we look at Harmony’s income statement over the past four quarters, things begin to get more transparent. Over the past four quarters, Harmony has generated almost $2.64 billion in sales, of which $609.6 million turned into gross profit. This gives the company a trailing twelve-month gross margin of 23.1%. This number is slightly below Harmony’s 5-year average of 24.1% and significantly behind the sector’s average gross margin of 32.4%. Harmony´s net profit of $119.2 million currently equates to a net profit margin of 4.52%, which again trails the sector (8.81%) by a significant margin.

So all things remaining equal, Harmony’s cost of revenue is roughly $0.77 for every $1 of product sold. Now, here is the kicker. Even if Harmony only realizes 5% inflation on costs on the front end over the next 12 months, and there is no change in the price of the metal Harmony sells, the company´s cost of goods sold will rise approximately 4% or $0.04 to $0.81 for every $1 of product sold.

If the above scenario were to materialize, this trend would put sustained pressure on Harmony’s earnings which may even mean we witness negative earnings for a period of time. The reason being is that the company’s gross margins are simply not high enough, to begin with. The sector, however, which has higher average gross margins will not see the same adverse impact on its earnings over time because of its lower cost of goods sold, all things remaining equal.

We can see this “pressure” in the company’s valuation, as Harmony’s forward GAAP earnings multiple presently comes in at a mere 16.90, which is well above the sector’s 10.95. This earnings multiple corresponds to an earnings yield of approximately 6%, whereas the sector’s earnings are currently yielding 7.5%. Furthermore, Harmony’s below-average 1.52% dividend yield further diminishes expected returns compared to the sector in general (2.14%).

Conclusion

Suffice it to say, when you take the above into account, Harmony in fact needs higher gold prices compared to the sector at large due to its lower margins and lower earnings yield. We designate HMY a hold at best at its current price due to the risk/reward profile not being skewed enough in our favor. We look forward to continued coverage.