ASML Stock: Impact Of US Government’s DUV Lithography Embargo (NASDAQ:ASML)

adventtr

Shares in ASML Holding (NASDAQ:ASML), a key supplier of equipment to semiconductor makers, fell on Tuesday following a Bloomberg News report that the U.S. Government wants to restrict the company from selling equipment to China.

If this were to happen, ASML would add DUV lithography (deep ultraviolet) equipment to its EUV (extreme ultraviolet) systems currently being embargoed from sales to China. Certainly, the move would be a blow to China and its foundry companies that already use DUV systems such as SMIC (OTCQX:SMICY) and Hua Hong (OTCPK:HHUSF). But it goes further, which is the point of this article.

Background

I have published a significant number of Seeking Alpha articles on ASML in the past several years and have had a Hold on the company based on strong headwinds facing the company. My last article on ASML in Seeking Alpha was published just after its Q1 2022 earnings call on April 26, 2022 entitled “ASML: Dissecting An Incredibly Poor Q1 2022 And Earnings Call.”

But I refer readers to my article a month earlier on March 22, 2022 Seeking Alpha article entitled “ASML: 5 Headwinds Continue To Plague The Company.” In it, I address specifically the DUV issue in China and the background. In the article I noted;

“The National Security Commission on Artificial Intelligence, a committee established by Congress in the John S. McCain National Defense Authorization Act for Fiscal Year 2019. There are 15 commissioners appointed to the National Security Commission on Artificial Intelligence.

Of the 15 commissioners, twelve were appointed by members of Congress, two were appointed by the Secretary of Defense, and one was appointed by the Secretary of Commerce. In early March 2021, the commission recommended that the U.S. Government block ArF DUV Immersion lithography equipment from being delivered to China, as noted on page 231of the Commission’s report.”

The sanctions against ASML come at a time when it is hamstrung by EUV shipment delays to other countries due to a fire at its EUV plant in Berlin in January, which to date has not resumed production.

It comes also at a time when Japanese DUV competitor Nikon Corporation (OTCPK:NINOY) in late 2021 announced it is currently developing the next-generation NSR-S636E ArF immersion scanner, which will deliver superior overlay accuracy and ultra-high throughput to support manufacturing of the most critical semiconductor devices. Nikon’s latest DUVL that is capable of producing 5nm is scheduled for introduction in 2023.

In addition, China’s home-grown Shanghai Micro Electronics Equipment (SMEE) is developing its second-generation DUV immersion lithography system, which could produce down to 7nm chips with multiple patterning.

International Implications

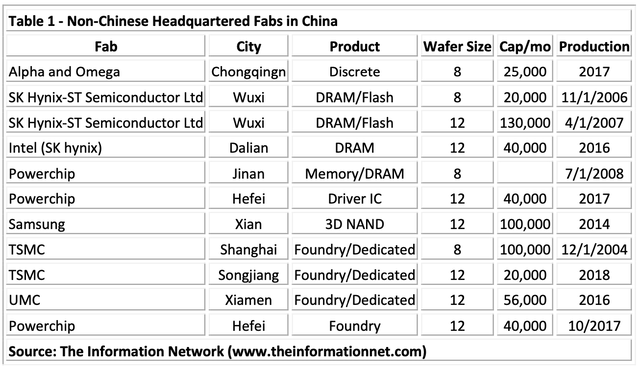

Non-Chinese Headquartered Plants in China

Mainland China has the largest number of semiconductor fab construction projects in progress in the world, with 57 fabs currently in operation and 26 fabs under construction or planning, including 19 for 12-inch fabs and 8-inch fabs. The proportion of global production capacity has also increased from 3% in 2016 to 12% in 2021. China-based IC production in 2021 was $31.2 billion, representing just 6% of the global IC market. But IC production by Chinese companies headquartered in China was $12 billion, just 2.5% of global production.

In other words, $20 billion in ICs produced in China were produced by non-Chinese headquartered plants in China. Sanctioning DUV lithography system sales to China would impact several non-Chinese semiconductor companies.

Table 1 shows these plants, according to our report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends.” They include some of the largest IC manufacturers.

It is important for readers to recognize that even without EUV capability, which is used in <7nm node chip production by TSMC (TSM) and Samsung Electronics (OTC:SSNLF), 7nm chips can be manufactured with DUV without EUV. In fact, I discussed how Chinese foundry SMIC has been able to manufacture 7nm ICs without EUV in an April 4, 2022 Seeking Alpha article entitled “SMIC: U.S. Sanctions Aimed At This Chinese Foundry Aren’t Working.”

SMIC isn’t the only Chinese foundry that has grown strongly. Another Chinese foundry, Hua Hong, also has its most advanced technology with a mature 28-nm process and it is working on advanced 14-nm technology – an area where SMIC has already achieved scaled production.

Thus, in an effort to block SMIC and Hua Hong from acquiring ASML’s DUV systems, U.S. sanctions will hurt political and technology partners TSMC (Taiwan), UMC (UMC) (Taiwan), Samsung (Korea), SK hynix (HXSCL) (Taiwan), and Powerchip (Taiwan).

Despite the intentions of sanctions, we need to consider the comment by U.S. president Biden on the Russian sanctions imposed after their invasion of Ukraine:

“Sanctions never deter,” Biden said during a Thursday press conference at a NATO summit in Brussels, Belgium. With Ukraine in ruins, Biden is evidently right, raising the question why is the U.S. doing this to ASML?

A Further Slap in the Face for Partner Companies

Back in September 2021, the U.S. government told semiconductor manufacturers, including Samsung Electronics, SK hynix, TSMC, and Intel (INTC), to submit their confidential information.

According to an article in KED Global:

“The White House gave the global chipmakers 45 days to answer the voluntary request. Such a request has put the firms in a tight corner as the information on sales, inventory and clients has been widely regarded as corporate secrets.”

Also in the article:

“Sources report that the American government is reviewing the potential use of the Defense Production Act (DPA) to enforce the data submission. The DPA is a US federal law enacted in 1950 during the Korean War as part of a broad civil defense and war mobilization effort.”

The U.S. forced these global semiconductor manufacturers to submit internal information on their chip inventory as well as the number of orders and sales data in a move to tackle the ongoing global chip shortage. However, even today, the press is filled with news that the automakers are stymied by semiconductor shortages. So that tactic didn’t work either.

Investor Takeaway

The U.S. government’s efforts to block DUV sales to China will not only impact ASML’s revenues, but it will also impact technology and political partners of the U.S. with chip fabs in China.

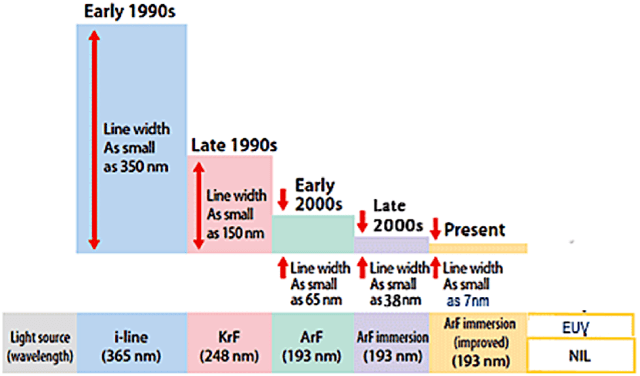

As with previous sanctions, the move is aimed at preventing Chinese companies from making state-of-the-art chips that could be used by the Chinese for military applications. DUV systems, primarily ArF immersion, are used in IC manufacturing between 7nm and 38nm, as shown in Chart 1. Thus, DUV is critical to most leading-edge companies manufacturing in China, particularly since most new fabs built there are at the 14-28nm node capability.

ASML

Chart 1

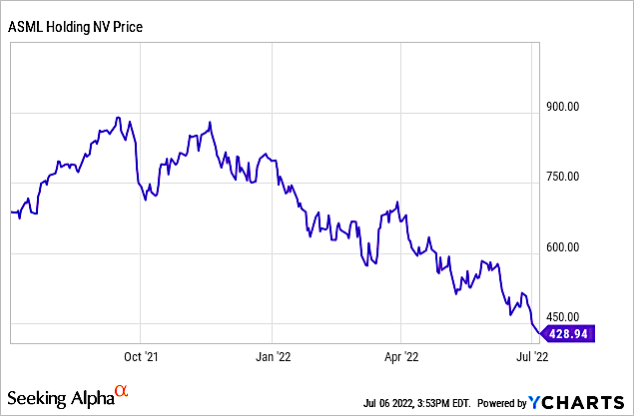

ASML’s share price reached a peak on Sept 13, 2021 when it closed at $888.0 and has dropped 52% since then. The share price fell more than 7% on July 5, 2022 after Bloomberg reported that the U.S. government is trying to get the semiconductor equipment company to stop selling its tools to China. But the market has stabilized on July 6, 2022.

Chart 2 shows that ASML’s share price has continued to plummet since its high. In my opinion, my analysis of the headwinds that ASML faced prior to this recent government edict remains intact. The most significant is the drop in revenues from EUV sales mostly from the fire in Berlin.

YCharts

Chart 2

In my above referenced April 26, 2022 Seeking Alpha article on ASML, I noted that in the company’s Q1 earnings call that ASML purposely didn’t provide an update of a fire impacting its EUV production, and to date, an update has not been given. This fire created a supply-chain disruption that impacted revenues. ASML was paid for only 3 systems but shipped 9 in Q1 2022 compared with 12 shipped and 11 paid for the previous quarter.

Because of the complexity of the EUV systems, ASML has a unique way of categorizing EUV sales versus shipped. ASML uses the term “fast shipments,” which is in support of customers’ desire to bring systems into production as quickly as possible. By skipping some of these testings in its factory, ASML can shorten the cycle time. Final testing and formal acceptance then take place at the customer side, at which time ASML will recognize revenue. Only at that time does ASML get paid.

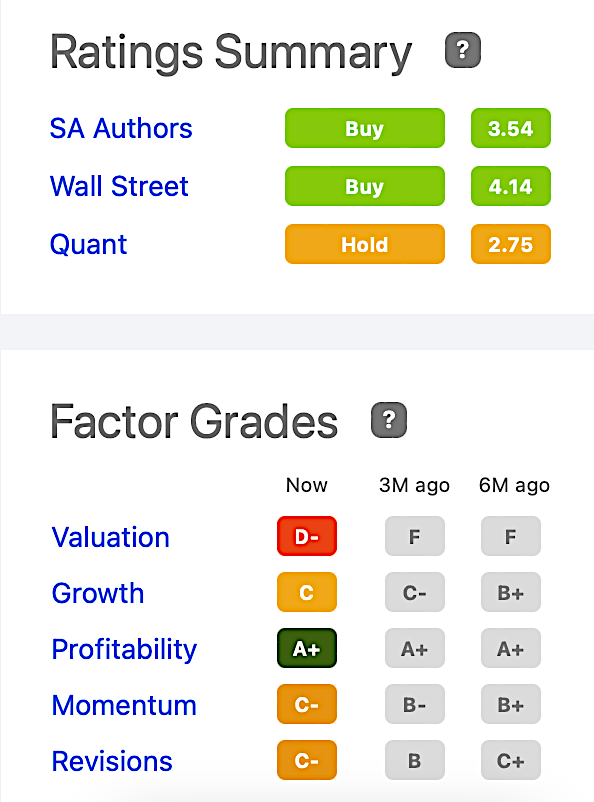

ASML is rated a Hold by Seeking Alpha’s Quant Ratings show in Chart 3. Also shown are Factor Grades showing degradation in the past 3 months and 6 months except for Valuation, which improved as share price dropped.

Seeking Alpha

Chart 3

With headwinds persisting and the possibility of the additional U.S. sanction, I rate ASML a Sell. Over the past year, I had placed a Hold on the company, but no improvements are imminent. Had the fire issue been resolved, which has impacted revenues, there would have been a press release from the company. But nothing indicates to me the supply-chain problems persist.

The stock has already dropped 52% since its high, and is down 37% for the year. Long-term investors can avoid further risk by selling now and buying back based on the outcome of any potential government interference.