Bed Bath & Beyond Stock: On The Road To Disaster (BBBY)

Justin Sullivan/Getty Images News

Investment Thesis

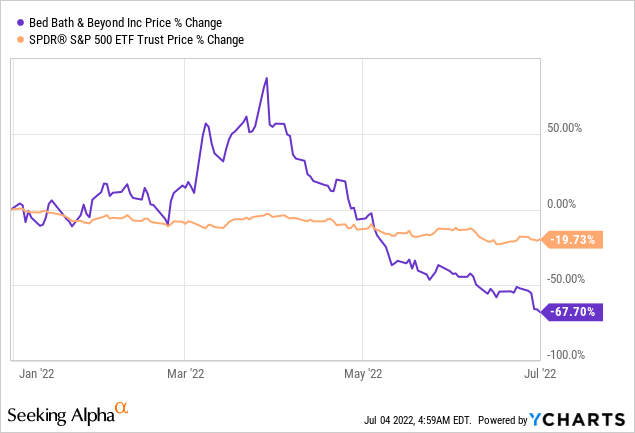

Bed Bath & Beyond Inc.’s (NASDAQ:BBBY) shares have gone down by nearly 68% YTD due to numerous issues that have surrounded the retailer. However, the fall from grace is far from over, and we do not expect a turnaround anytime soon. In today’s analysis, we explore why we think there is little to no hope left for the once admired retailer giant and investors should avoid investing in BBBY.

Falling Revenues & Shrinking Margins

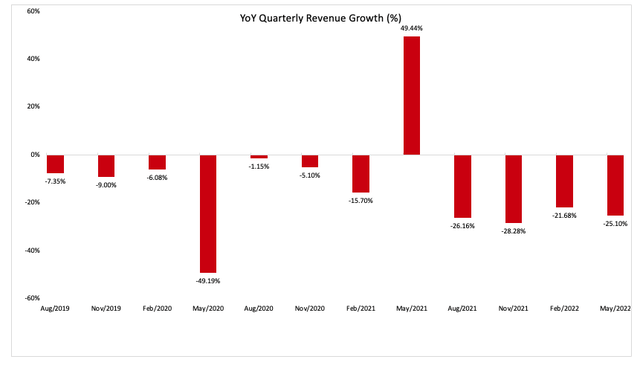

BBB reported another quarter of dismal results ending May 2022. Compared to the same quarter the previous year, net sales declined by 25%, while net loss widened from $51 million to $358 million on a GAAP basis. This isn’t the first quarter that the company has shown negative year-over-year revenue growth; there has been a consistent drop in revenues over the last three years except for the quarter ending May 2021, when lockdowns were being lifted, and consumers rushed towards in-store shopping. However, this surge was followed by four consecutive quarters of negative revenue growth.

To make matters worse, the home retailer has had to bear significant transient costs such as inventory markdown charges and port-related fees due to global supply chain issues and factory bottlenecks. For example, during part of the critical holiday season, the chain ran short of its 200 bestselling items due to delayed inventory supplies, resulting in lost sales.

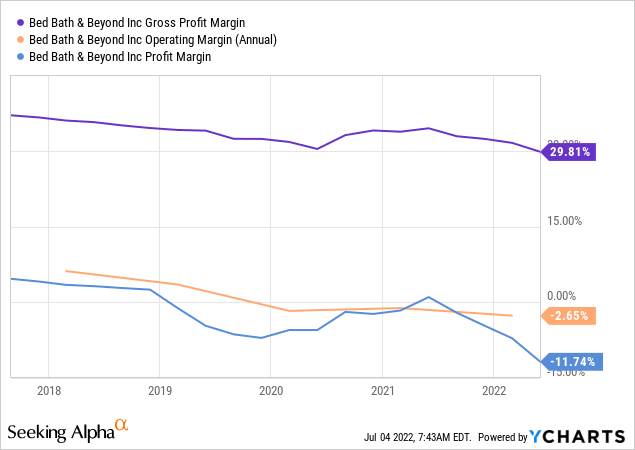

Unfavorably, there was no product demand when the inventory showed up, forcing the company to mark down inventory. This has caused gross margins to shrink from 32.4% in the same quarter last year to 23.9% in the most recent one. Additionally, the Adjusted EBITDA margins fell from 4.4% to -15.3% YoY, and operating margins have remained negative for almost all quarters in the past three years. It is quite clear that the company’s performance from the business operations standpoint has been abysmal.

Data Suggests Poor Inventory Management

The inventory challenges are expected to persist in the foreseeable future as the declining sales will lead to piling inventory levels with slower turnover and, eventually, further inventory markdowns. In addition, the cash conversion cycle is also squeezed to 57 from 70 days during pre-pandemic levels as a result of tighter payment terms from suppliers. It is reasonable to assume an increasing trend in payable days as rising concerns over the company’s credit outlook and operational challenges will push suppliers to stricter payment terms or minimize their exposure to BBBY.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | TTM | |

| Days Payable | 54.5 | 54.9 | 52.8 | 48.8 | 57.6 | 63.0 | 63.1 |

| Days Inventory | 137.5 | 130.1 | 123.2 | 112.9 | 112.4 | 115.2 | 120.6 |

| Cash Conversion Cycle | 83.0 | 75.3 | 70.4 | 64.1 | 54.8 | 52.2 | 57.4 |

| Inventory Turnover | 2.66 | 2.81 | 2.96 | 3.23 | 3.25 | 3.17 | 3.03 |

| Inventory-to-Revenue | 23.6% | 22.8% | 22.2% | 21.1% | 20.4% | 21.6% | 23.2% |

Source: Author’s table using data Guru Focus.

Management’s Failure – Turnaround Strategy

Back in 2019, BBB brought in Mark Tritton as the CEO to reverse the company’s declining performance. Tritton immediately took action by divesting non-core banners, closing underperforming stores, improving the e-commerce ecosystem, and getting rid of slow-moving inventories through large discounts while focusing on the company’s core strengths.

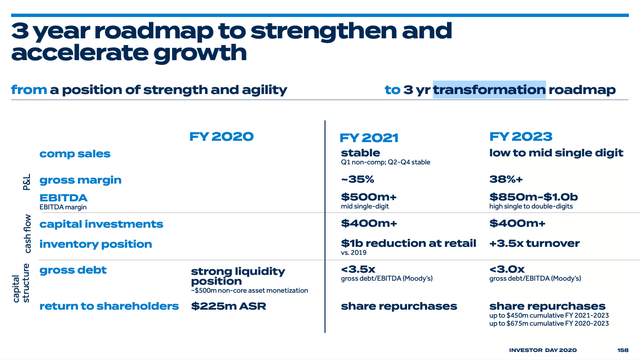

In addition, Tritton quickly brought forward a strategy that involved a shift from popular national brands to new, private-label offerings. Unfortunately, the timing was not right for this strategy to work since the additional work required for private-label brands to be brought to the stores left the retailer with more exposure to supply chain issues. Moreover, even the customers did not show much eagerness toward private labels, forcing the board to admit that the strategy had backfired. Finally, the 2020 plans of hitting 35% in gross profit margins by 2021, according to Tritton’s plans, fell short and has deeply concerned investors.

Tritton’s Plan Investor Day 2020 (bedbathandbeyond.gcs-web.com)

Tritton had also moved to overhaul the stores by cleaning up cluttered aisles. While this was a good initiative, the company announced it would pause this up-gradation process to save on cash. In admission to the failure of the turnaround strategy, Tritton has now been shown the door, and the interim CEO intends to find a ‘good balance between national brands and private labels’. This brings BBB back to square one, from where they started in 2019.

What we believe BBB needs, and the management has consistently ignored, is a digital forward strategy to cater to the consumer’s changing shopping behavior. Those who prefer going to the store to buy home goods are getting old, while the young ones who are the new homeowners prefer buying stuff online. The retailer’s move towards e-commerce has been slow. During the pandemic, e-commerce sales were at an all-time high while BBB performed poorly. Without a solid online presence, competitive prices, and sophisticated systems to predict spending patterns and inventory requirements, the future seems bleak for the company.

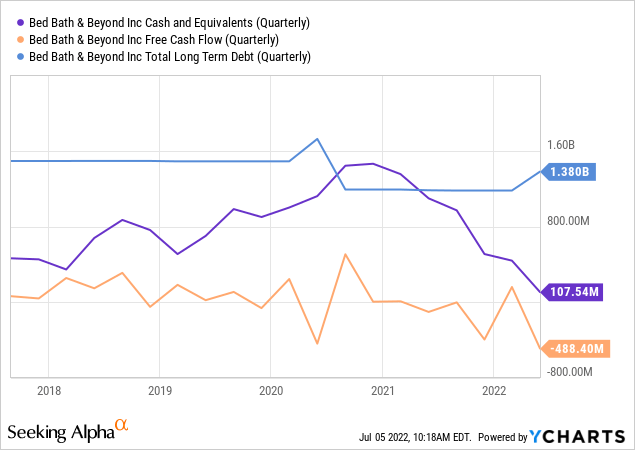

The Level Of Cash Burn Is Unsustainable

The once-strong balance sheet of BBB has weakened to the extent that the company now sits on roughly $107 million in cash. In the most recent quarter, it burned through more than $300 million of its reserves and borrowed $200 million from its credit line. The retailer’s struggle with liquidity isn’t new, as it has sold off its real estate for liquidity provision in the past.

Poor cash management at BBB has left the investors startled. While business operations were crumbling, the company moved on with a $1 billion accelerated share-buyback program. However, the situation has reached the point the company’s bonds have plunged to new lows amongst fears that it won’t be able to repay its debt. With whispers of Chapter 11 filings in the market, close are the days when suppliers will start to pull back on credit days. A liquidity crunch could lead the retailer into a further deteriorating financial health spiral.

Changes In Management & The Activist Investor

BBB is under immense pressure from activist investor Ryan Cohen to improve performance and explore strategic alternatives for its Buybuy Baby chain. Tritton’s exit from the company is also attributed to Cohen’s criticism of executives and their high compensation packages. In addition, a day after the company announced replacing the CEO, it named a new chief accounting officer, and the board had three new directors suggested by Cohen. While the presence of an activist investor may put the company on track, sudden executive changes add to the confusion.

Undoubtedly, it would take some time for the company’s board to find a new CEO. Moreover, in a situation where an activist investor is pushing for executive compensation to be connected with the company’s performance, it would be an uphill task for the board to find someone competent enough to get the business out of this mess. Last but not least, the current leadership team has an average tenure of just 1.8 years; will the new management be able to do the seemingly undoable, this is another question.

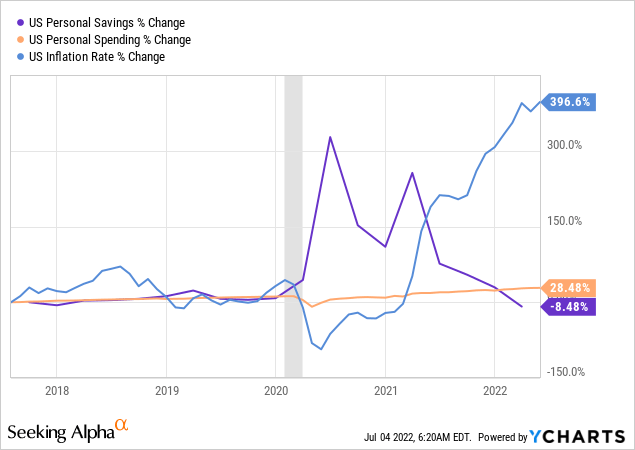

Macroeconomic challenges to the industry

At a time when macroeconomic challenges pose a threat to the overall industry performance, being optimistic regarding BBB isn’t possible for us. Inflation in the US is currently the highest since 1981, and consumer spending is slowing down. BBB is already facing challenges due to changing customer sentiment and purchasing patterns. The impact of steep inflation is yet to come, and we believe the retailer is not ready for it. Following the rising prices, FED is raising interest rates aggressively, and experts fear that recession could be on the horizon. If US economic growth slows down, any attempt at turning the business around will prove to be futile, in our opinion.

Moreover, high-interest rates will make it expensive for the company to raise debt. The housing market is expected to deteriorate coming months, which would mean slower demand for BBB’s products. The cost pressures on the company are expected to persist as container rates, and shipping costs have risen significantly following the supply-chain constraints arising from COVID-related lockdowns. The recent rise in oil prices further aggravated the situation. With all these, the near-term outlook doesn’t seem promising for the home-goods market.

Concluding Thoughts

Undoubtedly, any positive development with a new CEO, the company’s earnings, and macroeconomic outlook in the next quarter may temporarily boost the stock price. However, the operational challenges will remain in the foreseeable future, and turning around a struggling retailer under the current economic conditions is questionable.

Despite the high uncertainty and additional downside risk, we wouldn’t recommend shorting the stock at current levels since a considerable part of the risk might have already been priced in. Instead, investors should avoid any investment in the struggling retailer as we enter into a recession and wait until the whole landscape clears up.