Hasbro/Mattel Pair Trade Still OK (NASDAQ:HAS)

ViktoriiaNovokhatska/iStock via Getty Images

Overview:

Prior to 2021 there was a 10-year stretch in which Mattel vastly underperformed Hasbro. At Mattel, revenues over this span were actually flat to down and there was a succession of four CEOs in five years. The basic Barbie line lacked sales momentum, too much cash was spent on share buybacks rather than on building international efficiencies, the important Frozen Disney Princess line from Disney was lost to Hasbro, and new product introductions were not inspiring consumers. I first covered these ideas last year in separate SA notes on Hasbro and Mattel (Hasbro Stock: Strategic Direction Is Unclear (NASDAQ:HAS))and (Mattel Q2 Earnings: The Stock Might Finally Be Swell (NASDAQ:MAT)).

Meanwhile, Hasbro was riding high. Though the company probably also spent more on share buybacks than it should have, it captured the Frozen line in 2016 when it was highly popular and growing fast.

Both companies have become much more involved in filmed entertainment in the form of movies, television shows, and video games. MAT just signed JJ Abrams to produce a Hot Wheels movie. And a Barbie movie is currently in principal photography and to be released a year from now. But in 2019, Hasbro, which had done well with Transformer films, went a big step further in acquiring Canada’s Entertainment One for $3.8 billion and thereby ballooned its debt to $3.8 billion (even after later selling One’s music arm for $365 million). This deal closed just two months before Covid locked down factories and knocked down sales and cash flows. There was no way to know in 2019 that a pandemic was about to engulf the world, yet this was still not an acquisition for which Hasbro management had any particular expertise.

The only saving grace in 2020 was that stay-at-home activities helped sales of board games (Monopoly, Game of Life, Battleship, Scrabble, etc.), an area in which Hasbro has long been the leader. Other notable brands include Play-Doh, Nerf, GI Joe, Potato Head, Peppa Pig, and My Little Pony. Long run, these are all likely to be strong enough for HAS to regain its growth trajectory by 2024-25, but MAT seems to be on a faster track, in my opinion.

In addition, and more sadly, long-time CEO Brian Goldner in 2021 passed at age 58 and many years before he might have retired. As a result, it’s been difficult for outside analysts to assess the strategies and growth prospects for the now-debt burdened company. Rumors are rife that the company might spin-off its Wizards of the Coast (Dungeons & Dragons) division. Should this occur, it would probably provide at least a quick boost for the stock price but not change the larger picture.

Around the same time, over at Mattel, the management turmoil has seemingly ended, with Ynon Kreiz, an experienced executive taking the helm and revitalizing not only the Barbie (Q1 ’22 sales up 12%), Hot Wheels, Polly Pocket and Fisher-Price baby product lines and reclaiming Disney’s Elsa Princess licenses but also working with an experienced and relatively stable management team. It’s also been unconfirmed but speculated that private equity firms have been seriously looking to take Mattel private.

Common Problems

Both companies, however, are faced with a common set of real-world problems that they for the most part cannot control. First, toys and games have become greatly dependent on availability of chips, which have been relatively scarce over the past year. Toys in particular are dependent on plastics made of petroleum derivatives and with the price of oil trading at double last year’s price production costs are up significantly, Then there is the dependence on manufacturing in China, which is becoming politically (and lockdown-wise) more difficult to efficiently sustain and justify.

Both companies appear to be shifting production to other Asian countries, but such shifts can only be effectuated over many years.

There are also more obvious short-run problems in unloading the shipments that are stalled in California ports.

Last and not least is the pinch on consumer spending as disposable incomes are not keeping up the pace of overall inflation and with a likely economic recession directly ahead.

Rising interest rates can often become another challenge. MAT’s upcoming maturity schedule shows no significant long-term debt due to roll over until later in the decade (i.e., past 2025). For the same period, HAS’s total debt coming due at the end of 2024 is around $500 million. As explained in my Travel Industry Economics: Guide for Financial Analysis, Springer, 2021, leverage (debt/EBIDA) and debt(debt/revenues) ratios are important metrics that take on extra significance when economies go into recession and interest rates rise.

Mattel’s Q1 ’22 leverage ratio fell to 2.4 from 3.3 a year earlier. And debt to expected full year revenues are in a comfortable zone of around 40%. For HAS, similar estimated ratios are leverage, 2.5, and debt, 60%. None of these ratios are extreme but those for MAT are a somewhat financially healthier.

For both companies, economic developments in the next few weeks will be the key determinants of Q4 holiday earnings results. For these companies, Christmas arrives in late July and early August when ships are loaded in Asia for arrival in September. If ports are still clogged by Labor Day, shelves at major retailers might be rather bare. And on top of that, if a recession is ongoing in Q4, demand will also likely be relatively weak for toys and games that cost a lot more than they did even a year ago.

For MAT, I would forecast 2022 adjusted EPS at $1.35-1.40 and 2023 EPS at maybe $1.75-1.80. Those estimates are a bit below recent company “guidance.” For HAS, my best guess on EPS is $4.95 and $5.10 for 2022 and 2023 respectively and also below consensus.

Conclusion:

Both companies face common problems that they alone cannot easily solve. Flying popular productions in from Asia is a very expensive alternative to unloading boats. However, in facing these problems, it seems that MAT is in a much better position to weather the economic storms than is HAS. Both companies may see weak earnings in Q4 and it’s probable that consensus earnings estimates for ’22 and ’23 need to be trimmed.

MAT shares, however, have a further advantage in that some private equity funds have expressed an interest in acquiring the company. HAS presently does not have such a price-levitation feature lurking in its background.

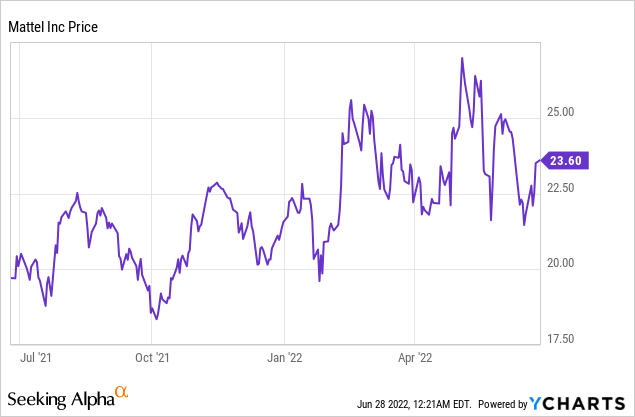

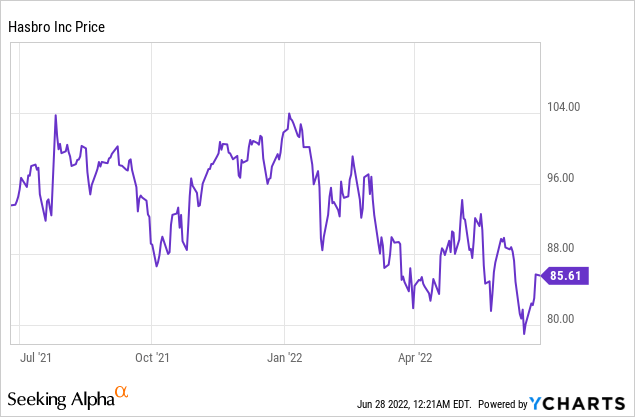

The pattern that has persisted since last year remains intact. Both stocks might fall in a bear market/recession environment, but if so, HAS has a weaker financial cushion and less resilience. Thus, a pair trade of buying MAT and selling HAS in a price-adjusted ratio still makes sense. The ratio would be buy around 4 units of MAT for every unit of HAS sold.