Lam Research: Robust Demand Offset By Supply Chain Issues (NASDAQ:LRCX)

Aguus/E+ via Getty Images

Investment Thesis

Lam Research Corporation (NASDAQ:LRCX) is a Wafer Fabrication Equipment supplier and service provider to the semiconductor industry. The company is based in Fremont, California. In this thesis, I will mainly focus on the outperformance of the Service business of LRCX and its growth potential in the coming quarters. Also, I will be addressing the supply chain issue faced by the company that is restricting its ability to meet the demand. LRCX is one of the best companies in the semiconductor equipment manufacturing space in terms of valuation and growth prospects, but until it tackles its supply issue, it is hard to recommend a buy. I assign a hold rating for LRCX.

Company Overview

LRCX creates and produces tools for making semiconductors, including systems for thin film deposition, plasma etching, photoresist peeling, and wafer cleaning. In the semiconductor industry, these technologies are utilized to produce transistors, interconnects, improved memory, and packaging frameworks. The company’s main market is in South Asia, where the majority of its products are exported. According to the March quarter, the company’s supply to China, which accounts for 34% of total sales, is followed by South Korea, 24%, and Taiwan, 16%. Sales in the US and Europe account for just 8% and 3% of its total revenues. LRCX, in contrast to other businesses, observed a significant demand even during the Covid-19 shutdown. The global supply chain problem is the company’s critical limitation, which has hampered expansion despite robust demand.

Service Business Outperformance and Robust Demand

To complement its production and sale of semiconductor components, LRCX established a Customer Service Business Group (CSBG). This business turned out to be a game-changer and gave the company outstanding success. Due to record utilization, the LRXC services business increased by more than 40% in CY21 and now represents 35% of LRCX’s revenue. The CSBG segment company made money from upgrades, spare parts, and reliant specialized/mature equipment. The share of this service business is expected to grow in the coming quarters, and it is expected to help increase the profit margins of LRCX. I believe this will be a key factor for the company’s growth in FY22 and FY23.

Despite the difficulties encountered on the supply end, the company has seen its demand continue to rise in recent quarters. The business reported deferred revenue of $600 million from prior quarters in the quarter ending March 2022. The business pushed $2 billion in deferred revenue from the March quarter of 2022 to the following quarter. I estimate a strong level of demand for semiconductor components for the next 3-5 years.

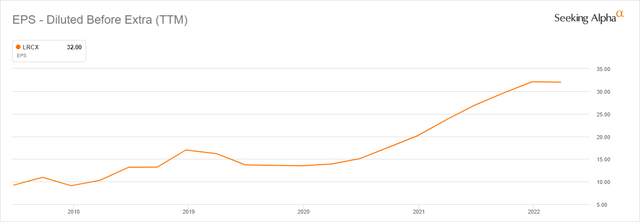

Over the previous five years, the company generated EPS growth at a CAGR of 24.70%. The company has previously recorded robust and stable growth, but the decline in the EPS from the most recent quarter caused a decline in the total growth rate. The business outperformed its competitors even during COVID-19. If the company can effectively tackle the supply chain issue, I anticipate increased revenue and greater profit margins in the future. My EPS estimates for FY 22 and 23 are $31.72 and $38.2, respectively.

LRCX March Quarter 2022 Financials

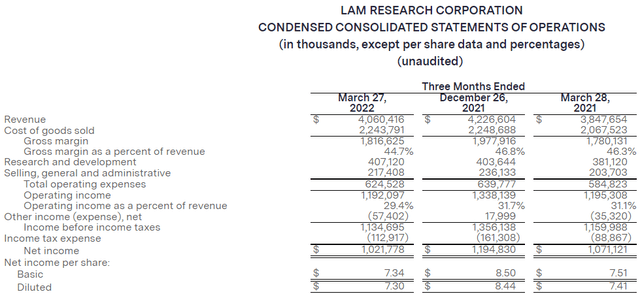

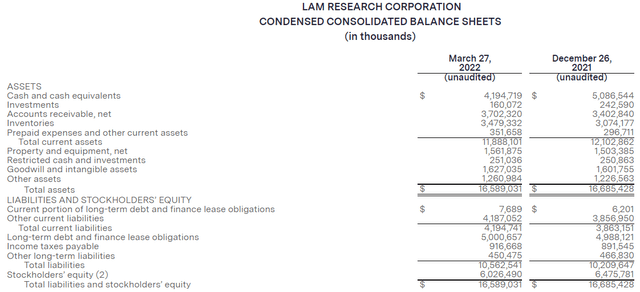

The company reported revenue of $4.06 billion as opposed to the $4.25 billion market predictions, falling short of expectations. Additionally, compared to the prior quarter, revenue fell by 4%. The industry-wide supply chain disruption is the primary cause of the revenue decline. As per non-GAAP, the net income was $1.036 billion, a 14.17% decline from the December 2021 quarter. Operating income represented 29.4% of the revenue, while gross margins as a percentage of revenue were 44.7%. The company announced diluted EPS of $7.40, down 13.2% from $8.53 in the December 2021 quarter. This fall in EPS was a direct result of increased operational costs caused by inflation in transportation and raw materials costs.

LRCX reported $4.19 billion in cash and cash equivalent, down from $5.08 billion in the December 2021 quarter. The $1.3 billion share repurchase, which included the settlement of employee stock-based pay, was the primary cause of this decline. In addition, the business spent $145 million on capital expenses and distributed $211 million in dividends to stockholders, which stands at $1.5 per share.

According to my analysis, the company’s fundamentals appear to be strong overall. This drop in revenue can be attributed to the disruption of the supply chain brought on by Covid-19 and the Russia-Ukraine war. The firm maintained its position that the deferred orders with them would be executed in the upcoming quarters, and they claimed that the revenue was not lost but rather deferred to the next quarter. According to my analysis, the company’s fundamentals appear to be strong overall.

Tim Archer, LRCX’s President and Chief Executive Officer, commented

In an extraordinarily difficult supply environment, Lam reported March quarter results within guided ranges. We are focused on resolving our supply issues as quickly as possible to support strong customer demand. We remain confident in the secular drivers of wafer fabrication equipment investment as well as Lam’s leadership position and expect to return to solid growth as industry constraints ease.

Supply Chain Disruption Limiting Revenue Growth

Global industrial supply networks were negatively impacted by high demand and multiple global lockdowns. Due to operational difficulties brought on by the pandemic, supply chain issues are predicted to continue beyond 2022. The supply scarcity has been amplified by the issues around cargo shipments, manpower shortages and restrictions, limited storage capacity, and supply and demand imbalances. Moreover, supply chain concerns and inflation-related market changes have greatly affected organizations worldwide. The Covid-19 lockdowns have exacerbated this supply chain disruption in China due to rising Covid-19 cases. Going forward, we believe that the company must strategize to address the supply chain issue.

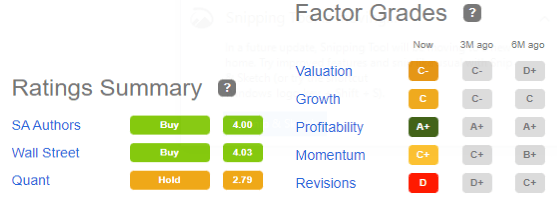

Quant Ratings

Seeking Alpha

My rating of hold on LRCX aligns with Seeking Alpha’s Quant ratings. I want to highlight the A+ grade for profitability, which has been consistent for the last six months and will continue in upcoming quarters as per my analysis. I believe that the growth grade will greatly improve in the future with the hope of easing Covid-19 restrictions in China.

Valuation

LRCX is currently trading at $450.19 and has seen a year-to-date decrease of 37.94%. The company has a market cap of $62.4 billion. The stock is currently trading at the PE ratio of 14.07x. Let’s compare this to the PE ratio of Applied Materials at 13x and Tokyo Electronics at 16x, one of the biggest competitors of LRCX. The company comes out to be in the same range as its competitors. As per my analysis, the company is fairly valued at the current price levels, and there is a scope for growth in future.

Conclusion

I assign a hold rating for LRCX. After analyzing all the growth factors and risks that LRCX faces, I would recommend holding the stock till the markets stabilize. Markets are volatile right now, and it would be advisable to not make any new positions in LRCX. Though the company has good growth prospects, the management needs to solve its supply chain issues.