Agree Realty Stock: Here’s What Investors Should Do Now (NYSE:ADC)

SeventyFour/iStock via Getty Images

Investment maxims can be confusing to adhere to if taken in a vacuum. For example, most investors have heard the Buffett statement that it’s far better to buy a wonderful company at a fair price than to buy a fair company at a wonderful price. However, what is the exact criteria for a wonderful company, and what if there are many wonderful companies in the same sector?

This brings me to Agree Realty Corp. (NYSE:ADC), which I believe fits the definition of a wonderful company. It’s seen rather strong share price appreciation since I last visited it in March, giving investors a 14% total return. In this article, I highlight ADC and whether it’s a buy, hold, or sell, and what other options there are, so let’s get started.

Why ADC?

Agree Realty is a net lease REIT that’s been around for over half a century. Today, ADC is one of the premier net lease REITs, with a portfolio of 1,510 properties, located in 47 states covering 31 million in gross leasable area.

Unlike a number of shopping center REITs, net lease REITs such as ADC didn’t its dividend back in 2020. This is due in large part to the resilient and low-cost operating structure of ADC’s triple net leases, in which its tenants pay for the property taxes, maintenance, and insurance. This results in a relatively higher operating margin (with depreciation add back) of 80.5% over the trailing 12 months, comparing favorably to that of other REIT asset classes.

What sets ADC apart is that it has a track record of not only acquiring net lease properties, but also developing them both internally and through its partner capital solutions platform. This is beneficial for ADC as it gives the company the flexibility to pursue development when cap rates on acquisitions get to be too low.

This is reflected by development projects currently underway, including a record 15 development and PCS projects that commenced, and 18 projects that were completed in the first quarter alone.

Moreover, ADC continues to see a robust pace of acquisition volume, with 106 properties acquired in the same quarter, at a reasonably attractive weighted average cap rate of 6.0%. Notably, excluding a 55 property portfolio acquisition, the weighted average cap rate is even higher at 6.2%, and 74% of the rents are generated from investment grade retail tenants.

Looking forward, ADC is well-positioned with a respectable BBB rated balance sheet, with a net debt to EBITDA ratio of just 4.3x and nearly $1 billion in liquidity to fund its development and acquisition pipeline.

ADC’s balance sheet strength should serve it well in a rising rate environment, as this should result in less competition for deals from more leveraged players with a higher cost of debt. Furthermore, its 3.8% dividend yield is well covered by a 72% payout ratio, based on Q1 AFFO per share of $0.97.

Near-term headwinds include higher material costs, which could result in higher construction costs on developments. This was noted by the CEO, who sees limited risks to ADC, as noted during the Q&A session of the recent conference call:

Q: With regards to the development pipeline, what are you seeing in terms of construction costs and how does that ultimately allocate relative to the yield?

A: Construction costs continue to rise across the country. And so, we are very cognizant of where those costs. These are generally fixed return projects. I think most tenants are aware that construction costs, and also lead times things like HVAC units, roofing material, both things are factoring into construction costs, but also efficiencies to deliver.

I think and that’s why we see a number of retailers looking to us with the liquidity, obviously being publicly traded and having the access to the revolving credit facility, to be able to provide certainty, truly of delivery at the end of the day. But construction costs continue to be a challenge for everybody here, we are very cognizant of those. And like I said, most of the transactions that we enter into are open book, fixed return, and so that risk isn’t going to be on us.

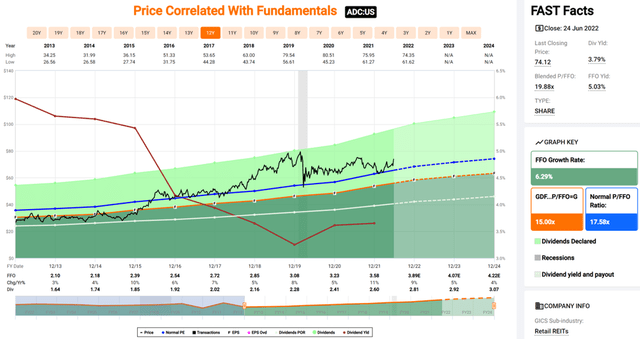

Turning to valuation, I don’t find the share price to be particularly attractive (nor expensive either) at the current price of $74, with a forward P/FFO of 19, sitting above its normal P/FFO of 17.6 over the past decade.

ADC Valuation (FAST Graphs)

This is also considering the fact that ADC is materially more expensive than its peer group. This includes Realty Income Corp. (O) with a forward P/FFO of 17.4, and peers National Retail Properties (NNN), Store Capital (STOR), and Essential Properties Realty Trust (EPRT), all of which trade with a forward P/FFO below 15.

Investor Takeaway

Overall, I believe that Agree Realty is a high-quality net lease REIT with a sound strategy, balance sheet, and execution. However, at the current price, I don’t find the shares to be attractive, as it appears that many of the strengths have already been baked into the share price. While I believe ADC should be a long-term hold, there are better places in the net lease space to allocate capital towards at the moment.