CarMax Stock: Tailwinds Weakening, Headwinds On the Horizon (NYSE:KMX)

Mario Tama/Getty Images News

Introduction

Stock market weakness offers opportunities. But it also means we have to work our way through a load of bad news. In the past few weeks, I discussed banking stocks, transportation stocks being pressured by the bullwhip effect, the energy crisis in North America and Europe, and other things. In this article, we’re going to discuss used cars, an industry tied to consumer sentiment like no other. CarMax Inc. (NYSE:KMX), the nation’s largest used-cars retailer reported fantastic earnings as both sales and earnings per share came in higher than expected. However, these results were mainly caused by higher prices, which are slowly crushing the consumer. Moreover, analysts are starting to worry that the impact of higher rates is adding additional pressure on the company’s future results. Adding to that, the valuation isn’t that great considering that KMX isn’t a fast-growing business in general.

In this article, we look at financial results, macro developments, and company comments.

So, bear with me!

A Bit Of Macro

The pandemic changed the world. It impacted every aspect of our lives, and it still drives today’s macro news. After all, without the pandemic, inflation wouldn’t be so high right now. The response to the pandemic did a number on supply chains, consumer behavior, and the way governments continue to deal with new upswings in cases (i.e., China).

One industry that was impacted more than others is the auto industry. Broken supply chains (i.e., semiconductor shortages) caused auto production to drop. Meanwhile, people wanted to become more independent. This included moving to the suburbs and relying on personal transportation.

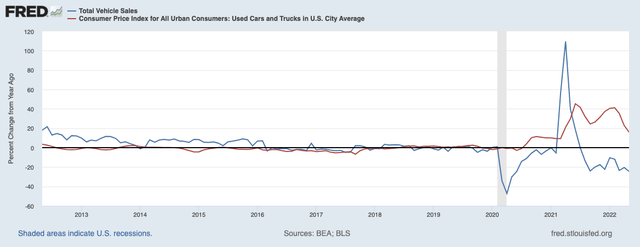

Hence, demand soared in a time of lower supply. The graph below is truly remarkable. It shows total vehicle sales in the United States and the price index of used cars and trucks – both on a year-on-year basis.

Between 2012 and 2018, vehicle sales rose by roughly 5% per year. Used car prices were in a steady downtrend. It helped car manufacturers. Then, new vehicle sales came down after 2016. The focus shifted from cars to trucks. Companies like Ford (F) focused on higher-margin vehicles instead of volumes.

In 2020, the pandemic hit. Total vehicle sales imploded as manufacturers shut down production in early 2020 followed by a trend where they were simply unable to produce the output they initially planned.

It resulted in a steep increase in used car prices. After all, when the new supply is down, used car sales are a good alternative. Used car prices exploded. In May of this year, used car prices were still 16% higher. That’s on top of a 30% gain in May of 2021. These numbers are absolutely stunning.

St. Louis Federal Reserve

The problem is that the economy isn’t able to withstand these issues. High inflation is the worst thing in a scenario where prices were already an issue for a big part of the population. This isn’t just the case in the US, but in Europe as well.

Especially after the start of the Ukraine war, a lot of inflationary trends got worse. Energy became more expensive, automotive shortages worsened, and food inflation became a big driver of all-item inflation.

Moreover, central banks are forced to hike rates to combat inflation, resulting in tighter financing conditions. This hurts industries that need cheap funding like housing and autos.

Hence, it is no surprise that consumer confidence is low. It’s just a very tough time for a lot of people.

How bad is it?

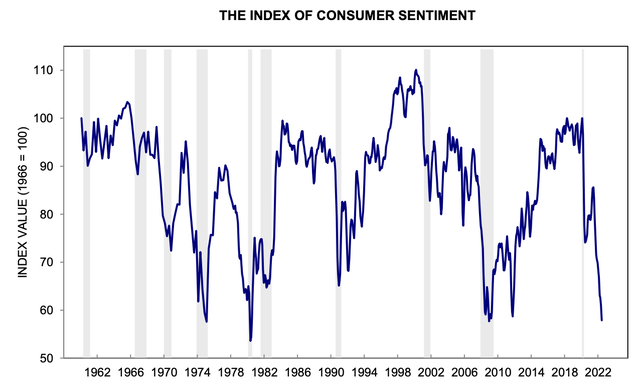

According to the University of Michigan’s famous consumer sentiment index, it’s as bad as it was during the Great Financial Crisis. This is the reason why a lot of consumer-focused companies are really struggling.

University of Michigan

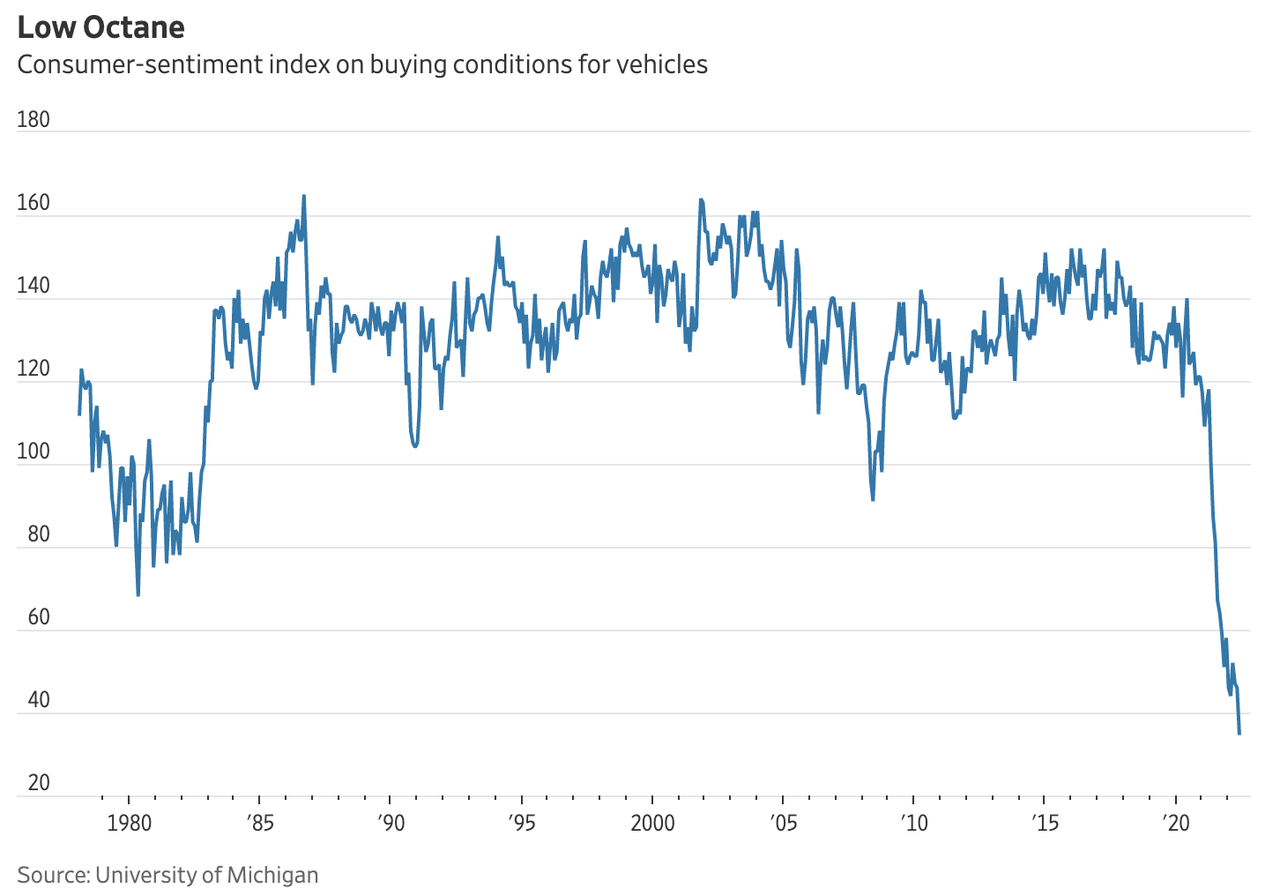

And to make things worse, I’ve another chart that’s even more bearish.

The chart below shows Michigan consumer sentiment on buying conditions for vehicles. It’s truly stunning to see how far BELOW the Great Financial Crisis bottom we currently are.

Wall Street Journal/University of Michigan

It makes sense as the Great Financial Crisis was a demand crisis. Now we’re in a supply crisis that is turning into a demand crisis as well. New cars are either too expensive or not available. Used cars are expensive as well. And given the price of gas, driving is becoming a headache for a lot of people as well.

So, here’s how this impacted CarMax

CarMax is an absolutely fascinating company that I haven’t covered since 2019 – shame on me. I always say, even if people don’t care for certain companies, it’s always worth looking at industry comments and numbers.

CarMax is huge. With a market cap of $15.8 billion, it’s the largest retailer of used vehicles, selling more than 920 thousand units in its 2022 fiscal year (ending February 28, 2022). According to the company:

We are also one of the nation’s largest operators of wholesale vehicle auctions, with 706,212 vehicles sold during fiscal 2022, and one of the nation’s largest providers of used vehicle financing, servicing approximately 1.1 million customer accounts in our $15.65 billion portfolio of managed receivables as of February 28, 2022.

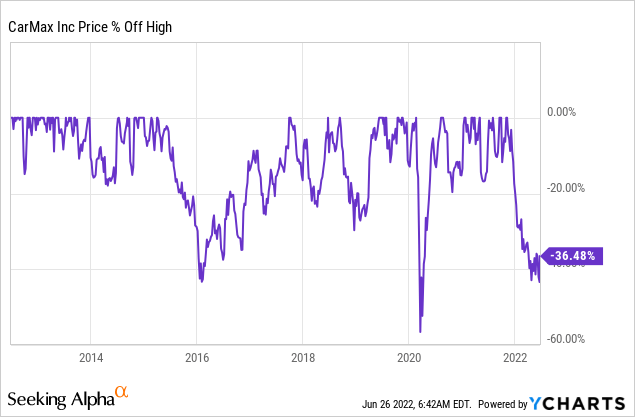

With that said, its just-released earnings are very interesting. The company rallied more than 7% after reporting its results, bringing the total drawdown to 36% from its all-time high. One of the worst sell-offs in recent history. Only the initial reaction to the pandemic was worse.

The company reported 1Q23 (the fiscal year 2023) revenue of $9.3 billion. This is $150 million higher than expected and 20.8% higher compared to the prior-year quarter.

It helped to boost GAAP EPS to $1.56, $0.07 higher than expected, but down from $2.63 in the prior-year quarter.

While I do not disagree with the market reaction as it simply re-priced the investment thesis, the news isn’t good at all. While it, technically speaking, doesn’t matter how or why a company makes money, the best way is if it’s because of a healthy consumer. That’s absolutely not the case.

CarMax sold 427 thousand units in its retail and wholesale segments in its first quarter. That’s a decline of 5.5%. Online sales accounted for 11% of retail sales, up from 8% in the prior-year quarter. That’s a good number as KMX is looking to enhance the customer experience.

Excluding wholesale, total retail vehicle sales were down 11.0% to 241 thousand. Comparable store units were down 12.7% (this excludes acquisitions).

According to the company:

We believe a number of macroeconomic factors weighed on our first quarter unit sales performance, including the lapping of stimulus benefits paid in the prior year period; widespread inflationary pressures, including challenges to vehicle affordability; and waning consumer confidence.

Total retail revenues, however, improved by 13.9% thanks to an increase in the average retail selling price of roughly $6,300. That’s a 28.0% increase in the used sales price! The average (retail) vehicle selling price is now $28,844.

Nonetheless, the gross profit was down 5.3% as a result of a 5.6% lower retail gross profit reflecting the combined effects of the decline in retail unit sales and an improvement in the related gross profit per unit, which rose by $143 to $2,339.

Moreover, the other day, the Wall Street Journal covered certain industry trends.

Wall Street Journal

The Wall Street Journal wrote that one of the company’s biggest tailwinds is slowly eroding. Used car supply is easing as a result of lower demand and returning supply. This is set to hurt prices going forward.

As of mid-June, new-vehicle inventory was down 70% compared with the same period in 2019, according to Cox Automotive. Used-vehicle inventory has recovered and is down just 11% over the same period.

Moreover, related to rates, analysts are increasingly cautious when it comes to CarMax’s lending.

Another place to watch is CarMax’s lending business, which could start facing pressure as higher interest rates mean funding costs become more expensive. Last quarter’s healthy interest margins largely reflected those from previous years because CarMax has an “earn over time” rather than immediate “gain on sale” accounting model, CarMax noted during Friday’s call. Seth Basham, equity analyst at Wedbush, noted in a research report that the spread between CarMax’s loan rates for consumers and its own funding cost has narrowed to the lowest level since 2008.

In other words, financing, a major source of income for large industry players is losing its earnings power.

It also doesn’t help that credit quality is quickly deteriorating as the Ford CFO said earlier this month.

As reported by Fox Business (Ford CFO comments):

“We’re looking for every indication and every data point we can to get a read on where the consumer is, where they’re headed given everything that we see out there, the inflationary pressures, the economic issues, et cetera,” he continued. “So we are seeing some headwinds there a little bit when it comes to delinquencies as maybe a leading indicator.”

So, what does this mean for KMX’s valuation?

KMX Stock Valuation

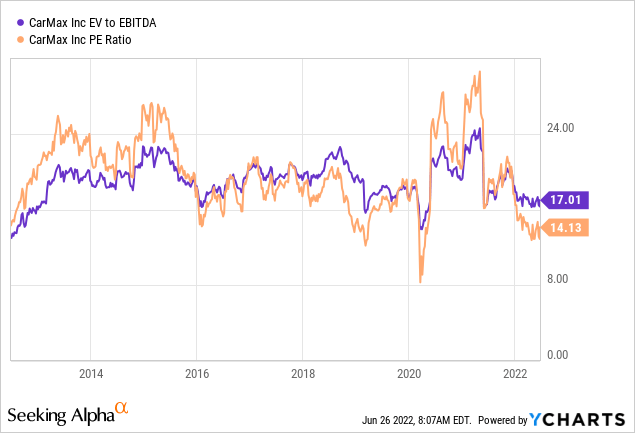

The best thing about this market is that a lot has been priced in. The S&P 500 is barely above bear market territory, tech stocks have priced in a steep Federal Reserve hiking cycle and CarMax is down 36%.

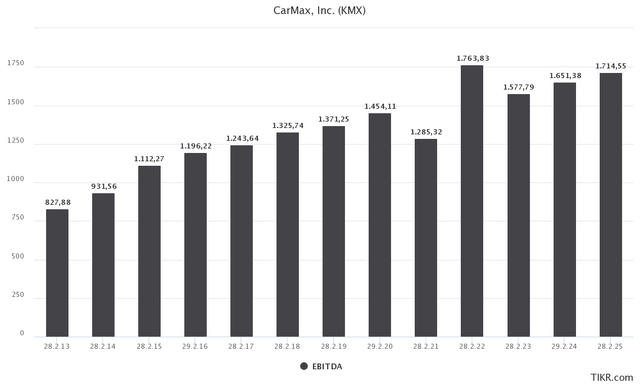

Right now, we’re dealing with a $15.8 billion market cap. $5.8 billion in expected FY2024 net debt, and $1.65 billion in expected FY2024 EBITDA. The company has roughly $70 million in current pension-related liabilities.

TIKR.com

This gives the company an enterprise value of $21.67 billion. That’s 13.1x expected EBITDA. The company is trading at 16.5x next (fiscal) year’s normalized earnings.

All things considered, I think the valuation is fair – not cheap.

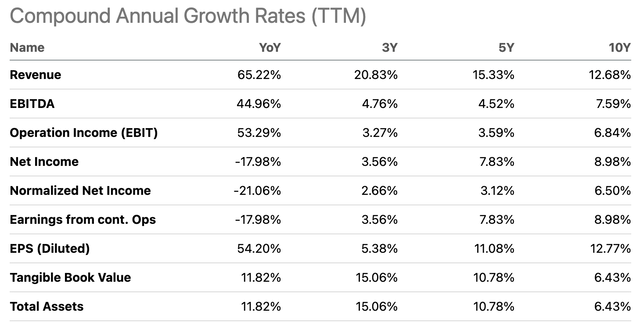

Using Seeking Alpha’s handy overview, we see that growth rates have dropped significantly if we ignore the year-on-year growth rate in sales accelerated by higher used car prices. And even despite these sales growth numbers, net income is now in contraction. The three-year average is 3.6%, down from 7.8% on a five-year basis.

Moreover, it will be hard for the company to achieve rebounding short/mid-term growth. Prices are under pressure and unit sales are unlikely to rebound until the economy starts a meaningful recovery. Consumer sentiment is simply too bad.

Seeking Alpha

In other words, I still don’t think the risk/reward warrants big investments. Being down 36%, there is room to buy some shares and add on further weakness, but I’m not keen on getting people to bet on (used) car dealerships.

Takeaway

In this article, I wanted to achieve two things. First of all, diving into the details of the (used) car industry, consumer sentiment, and related economic developments. Second, to assess if this makes CarMax a buy after the company soared more than 7% after reporting good earnings.

The problem is that while a lot has been priced in, I’m not that eager to buy KMX. I expect used car prices to come down as weaker demand and better supply turn into headwinds. Moreover, loan quality is coming down as a result of a weaker consumer on top of lower (expected) margins for KMX’s lending business.

The valuation is “fine”, but not in deep value territory, which one might expect after a sell-off this steep.

I hope to return in a few months when both pricing and unit sales will look much different. Depending on the stock’s performance, we may be dealing with a better investing/trading opportunity then.

For now, I rather stay away.

(Dis)agree? Let me know in the comments!