Montrose Environmental Group Stock: Fairly Valued At Best (NYSE:MEG)

photovs/iStock via Getty Images

In recent decades, concern over the environment has grown. This has been due to the fact that pollution, namely greenhouse gas emissions, has caused significant harm to this planet and poses a further threat moving forward. Along the way, a slew of other environmental concerns have also pushed people and companies alike to ensure that the world we live in can be safe and healthy for future generations. Although this has posed significant costs on some companies, the fact remains that other firms have risen up and taken advantage of this paradigm shift. One such player is Montrose Environmental Group (NYSE:MEG). In recent years, the management team at Montrose Environmental Group has done a good job growing the company’s top line. Cash flows have also followed a similar trajectory. At the same time, however, the company still struggles to turn a profit and shares are rather pricey relative to similar firms. Add on top of this the fact that this year may not be the best for the business, and I cannot in good conscience rate the firm any higher than a ‘hold’ at this time.

A play on a healthier planet

As I mentioned already, Montrose Environmental Group focuses on making this planet a healthier place. More specifically, the company provides a range of services to help its clients and communities in meeting their environmental goals and needs. To be more specific, we should dig into the three core segments the company has. At the top of the list, we have Assessment, Permitting and Response. According to management, this unit is responsible for offering planning and ecosystem consulting activities, regulatory consulting, and emergency response services. Other activities focus on environmental audits and permits for current operations, facility upgrades, new projects, decommissioning projects, and development projects. During the company’s 2021 fiscal year, this segment was responsible for 47.9% of the company’s revenue and for an impressive 53% of its profits.

Next in line, we have the Measurement and Analysis segment. Through this, the company provides lab services, testing, and leak detection and repair services. At the end of the day, this segment is responsible for testing air, water, and soil to determine concentrations of contaminants and to determine the toxicological impact of contaminants on flora, fauna, and human health. Last year, this segment was responsible for 28% of the company’s revenue and for 29% of its profits. The final segment, meanwhile, is called Remediation and Reuse. This segment is responsible for providing clients with engineering, design, and implementation and operations and maintenance services. Activity mostly involves the treatment of water that is contaminated, as well as the removal of contaminants from soil. The company is also engaged in activities related to the creation of biogas from waste, but much of this relies on its clients’ assets and capabilities. Last year, this segment was responsible for 24.1% of the company’s revenue and for 18% of its profits.

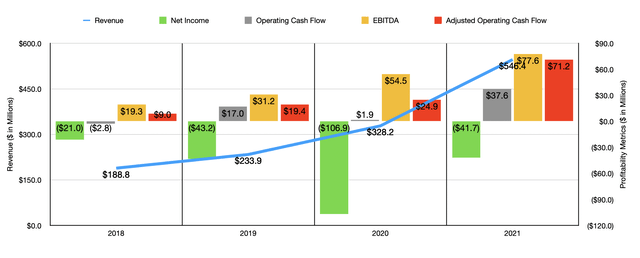

Author – SEC EDGAR Data

Financial performance achieved by Montrose Environmental Group has been really impressive when you focus on the top line. According to management, revenue in the past four years has risen significantly, jumping from $188.8 million in 2018 to $546.4 million last year. Some of the growth the company has seen in recent years has been driven by acquisitions. For instance, in 2019, the company acquired seven different firms that brought on revenue in that year totaling $23.2 million. It made three acquisitions in 2020 that added $82.4 million to sales. And in 2021, it added six firms to its portfolio that contributed $33.7 million in sales. Obviously, the company has also benefited from organic growth. The strongest upside for the company came from the Assessment, Permitting and Response segment, which saw revenue skyrocket from $98.5 million in 2020 to $261.9 million last year, largely as a result of some of its aforementioned acquisitions.

While the trend for revenue has been positive, the same cannot be said of profitability. The company has consistently generated net losses in each of the past four years. The best year was in 2018 when the loss was just $21 million. Last year, this loss was nearly double that at $41.7 million. Operating cash flow has been a bit better. But not by much. From 2018 through 2021, this metric improved from negative $2.8 million to $37.6 million. The only time that we see a consistent uptrend is when looking at this metric after adjusting for changes in working capital. Back in 2018, this metric would have totaled $9 million. Last year, it was $71.2 million. A similar uptrend can be seen when looking at EBITDA, with the metric climbing from $19.3 million in 2018 to $77.6 million last year.

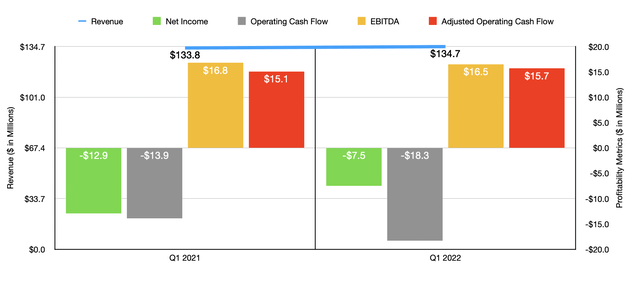

Author – SEC EDGAR Data

When it comes to the current fiscal year, performance has been mixed. Revenue did increase in the first quarter, inching up from $133.8 million to $134.7 million. On the other hand, profitability is still a disappointment. In the first quarter of 2021, the company generated a net loss of $12.9 million. The same quarter this year, that metric had improved to a loss of $7.5 million. On the other hand, operating cash flow for the company has worsened, going from a negative $13.9 million to a negative $18.3 million. If we adjust for changes in working capital, at least, the metric did improve year over year, inching up from $15.1 million to $15.7 million. At the same time, EBITDA managed to decrease slightly, declining from $16.8 million to $16.5 million.

In general, I don’t like seeing significant net losses, especially over an extended timeframe. But to make matters worse, financial performance this year does not look to be much better than it was last year. At present, management anticipates revenue of between $520 million and $570 million. At the midpoint, this would imply sales of $545 million. That would actually be down slightly from last year’s revenue. The only profitability metric that management provided was EBITDA. This should come in at between $73 million and $78 million. The midpoint reading there of $75.5 million would actually be 2.7% lower than what the company generated in 2021. No guidance was given when it came to other profitability metrics. But if we assume that adjusted operating cash flow would decrease at the same rate that EBITDA should, then investors can anticipate it coming in at around $69.3 million for the year.

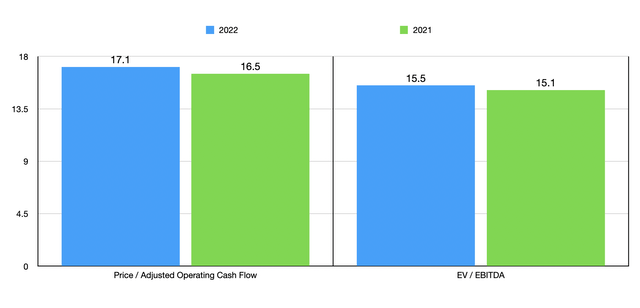

Author – SEC EDGAR Data

If these estimates turn out to be accurate, the company is trading at a forward price to adjusted operating cash flow multiple of 17.1. Meanwhile, the forward EV to EBITDA multiple should be 15.5. If, instead, we were to use the results from 2021, these multiples would be 16.5 and 15.1, respectively. As part of this process, I also decided to value the company relative to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 6 to a high of 64.4. Four of the five firms were cheaper than Montrose Environmental Group. Meanwhile, using the EV to EBITDA approach, the range was from 4.7 to 13.5. In this case, our prospect was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Montrose Environmental Group | 17.1 | 15.5 |

| BrightView Holdings (BV) | 11.3 | 10.4 |

| SP Plus (SP) | 7.8 | 9.3 |

| Heritage-Crystal Clean (HCCI) | 6.0 | 4.7 |

| Harsco (HSC) | 9.5 | 7.9 |

| CECO Environmental Corp (CECE) | 64.4 | 13.5 |

Takeaway

Although top line growth achieved by Montrose Environmental Group has been impressive in recent years, this year is looking to be somewhat disappointing. I am incredibly discouraged by the significant net losses the company has achieved over the years. Yes, cash flows have generally improved and are looking positive. But even in that case, the stock looks more or less fairly valued on an absolute basis while being overpriced relative to similar firms. If we give the company the benefit of the doubt and assume that growth will continue, the stock might eventually become underpriced. But because I view it as more or less fairly valued on an absolute basis, I have decided to rate it a ‘hold’ at this time.