Green Dot Stock: Undervalued Secular Growth Opportunity (NYSE:GDOT)

ljubaphoto/E+ via Getty Images

Investment Thesis

The Green Dot Corporation (NYSE:GDOT) is a financial technology company. The company will be one of the biggest beneficiaries of the secular growth in the industry due to the impact of the covid-19 on digital payment. Digital and contactless payment have become the new normal for the people, which will act as a primary growth factor for the company. Given the company’s current share price, I believe the company valuation is very attractive, and I assign a buy rating on the stock.

Introduction

GDOT is an Austin, Texas-based fintech that offers a Banking as a Service ((BaaS)) platform that enables to move money through electronic payments. The company provides many financial services, including debit, checking, credit, prepaid, and payroll cards. The company offers its service under three segments: Consumer Services, Business to Business Services, and Money Movement Services.

The Consumer Services segment comprises deposit account programs such as consumer checking accounts, prepaid cards, secured credit cards, and gift cards. The company provides this service through 90,000 retail locations and several marketing channels. The Business-to-Business segment generates its income by partnering with consumer and technology companies by integrating the BaaS platform and managing workforce payments with Employer Channel. Currently, the company offers its services to big companies such as Apple, Uber Technologies, Intuit, Amazon, and Stash Financial. Lastly, the Money Movement Services gets its revenue per transaction basis through cash deposits and disbursements.

According to the annual report for 2021, the company generates 55% of its revenue through card revenues, while 17% comes from cash processing. Interchange revenue is 27% of the total income, and 1% is an interest income.

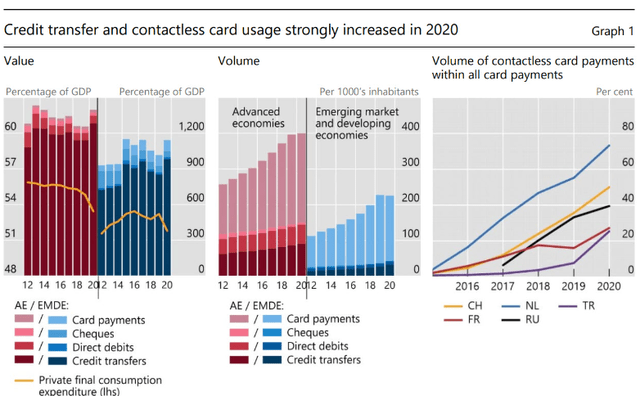

Impact of Covid-19 on Digital Payment

During the Covid-19, developed and emerging economies have seen a sharp increase in digital money transfers. The digital transfers were made through online banking, mobile banking app, credit card transfer or automated transfer. This increasing trend was observed in all the world economies, which resulted in a sharp increase in the share of non-cash payments in the total GDP. According to a recent survey by Visa, they have seen a 30% YoY growth in contactless payments, and 47% of people said they abstain from shopping in shops that don’t have contactless payments. Nowadays, everyone prefers to make payments by debit or credit card. Also, the money transfer of large amounts is done by using credit cards, which is the most significant contributor to digital payment growth. When the coronavirus crisis is over, 87% of those surveyed who made fewer cash payments during the pandemic said they would still do so. This was shown in an ECB study of all the nations in the euro area. We will have to wait to figure out if the epidemic will have a similarly negative long-term impact on currency hoarding. An earlier study found that cash holdings’ growth declined after a crisis or uncertainty ended. GDOT is launching its unified technology platform, which is currently in test mode to make digital payments more efficient for consumers. The product development is on track, and the effects of this new platform will be reflected in next year’s results. After considering all growth factors, I believe the payment platform industry will witness secular growth in the coming days. In a secular growth industry, everyone will want to be invested in a strong asset company like GDOT. I also believe digital and contactless payment will be the new normal for people worldwide, which will act as a primary growth factor for digital payment companies.

Additional Catalyst

Accelerated Share Repurchase Program: The company’s board has authorized $25 million as an accelerated share repurchase (ASR) program in addition to the $100 million previously announced share repurchase fund. The company has repurchased 914,037 shares under ASR at an average of $27.35 per share. Approximately $72 million is available under the Program.

George Gresham, CFO and COO of GDOT, stated,

We started 2022 off with solid earnings performance as a combination of underlying growth coupled with a focus on cost control and driving efficiency allowed us to deliver revenue and earnings growth despite facing tough comparisons versus last year. With the solid performance in the first quarter, we are raising our 2022 guidance while maintaining our ability to invest in our strategic initiatives.

Presence of Activist Shareholder: Recently, the activist shareholder Starboard Value has taken a significant position in GDOT. Starboard believes that the company is significantly unvalued due to the incapability of the management and inefficient capital allocation. Starboard has forced the company to change senior management and the capital structure to focus on disciplined growth. Their main focus is on margin and EPS growth with a significant increase in free cash flow. Generally, activist shareholders change the company’s structure to make it more efficient and bring out its real value. I believe Starboard is also doing the same with GDOT to resale their holding to some strategic investor. GDOT has substantial assets and efficient leadership, which makes the company a very attractive strategic acquisition opportunity.

Financials

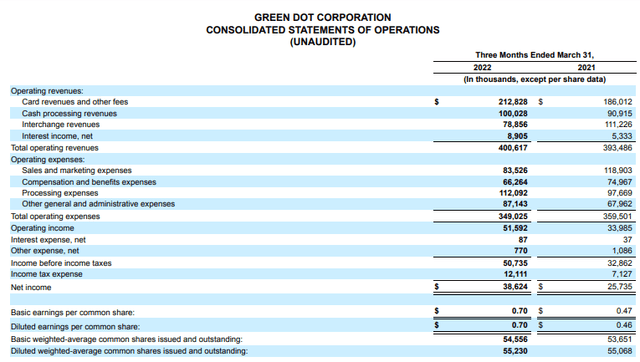

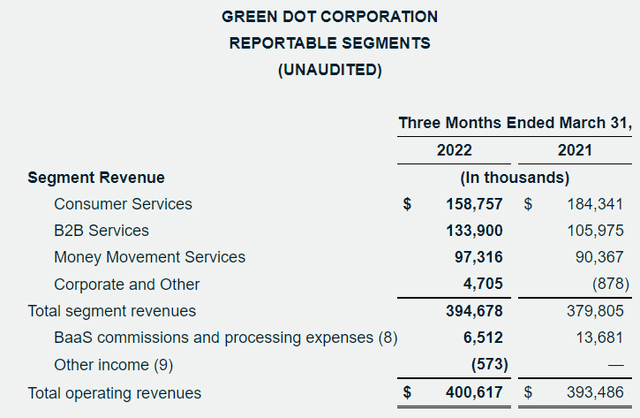

GDOT has recently reported strong Q1 FY2022 results. The company has reported $394.7 million in operating revenue which is a 4% YoY growth compared to the $379.8 million of the Q1 FY2021. The reported EBITDA was 22.9% of the operating revenue which is $90.3 million. The EBITDA has grown 23% YoY compared to $73.4 million in the same period as last year. This expansionary margin is a good sign which shows that the company structure is becoming efficient. The first quarter’s net income is $58.6 million or $1.06 per share, which is 27% YoY growth compared to the $46.1 million or $0.83 per share of the Q1 FY2021. GAAP diluted EPS of the quarter was $0.70, which is 52% YoY growth. The company repurchased in total 914,037 shares under the ASR at an average price of $27.35 per share in the first quarter of 2022.

The Consumer Services revenue decreased by 13% YoY, while revenue of B2B increased by 26%. The income from Money Movement Services has increased by 7%.

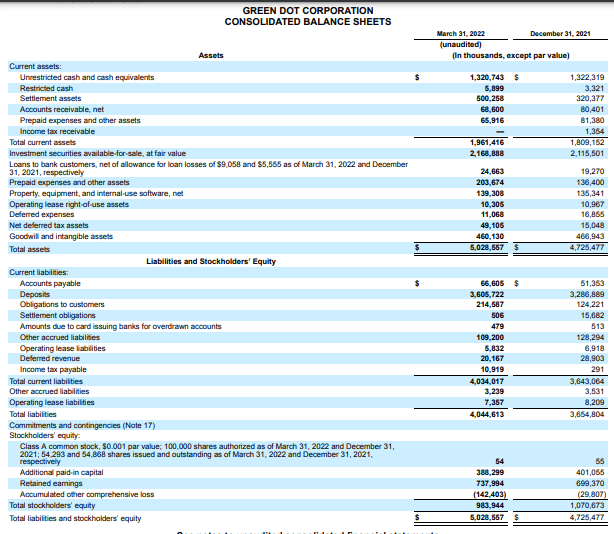

SEC: 10Q GDOT

The company currently has $1.3 billion in cash, which cannot be considered as high liquidity. But the company also has $2.2 billion in investment securities available for sale. After combining both of them, the liquidity has reached healthy levels of $3.5 billion. The downside to this argument is that the company has $3.6 billion as deposits on its balance sheet, which completely offset both of them. Still, I believe having a huge cash amount on the balance sheet gives a solid advantage to the company.

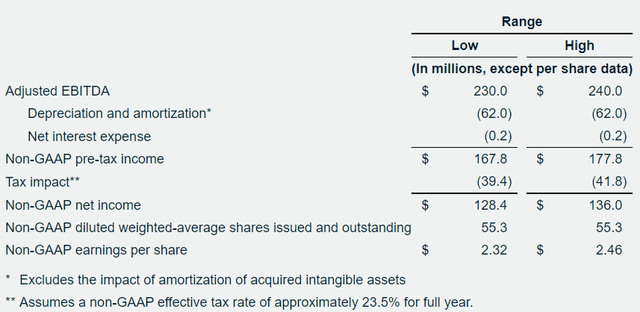

The company has updated the outlook for FY2022 after the first-quarter results. The company expects its revenue to grow at an average growth rate of 2%, which will be between $1.394 billion and $1.430 billion. The company is estimating EBITDA to be in the range of $230 million and $240 million, which is 8% YoY growth. The EPS is expected to be in the range of $2.32 and $2.46. I believe the company’s estimates are inaccurate and actual results will be significantly higher as compared to the current outlook, which will align with my investment thesis of secular growth in the industry.

Risk factors to consider before deciding on GDOT

High Dependency on Walmart: Walmart is the largest retail distributor for GDOT, with 24% of its total operating revenue derived from products and services sold through Walmart stores. GDOT provides a variety of products and services through Walmart, and it’s a huge risk for the firm if, in any case, the Walmart-GDOT agreement terminates. I believe almost 25% of revenue dependency on any one organization is a serious risk and a serious cause of concern that should be addressed, and contingency plans to tackle it should be in place. GDOT estimates 27-30% of its revenue to be generated through Walmart stores by FY23. Thus, GDOT’s dependency on Walmart appears to continue even in the coming years.

Software Development Operations in China: GDOT has the majority of its software development operations outside the United States, with most of these operations being run through Shanghai, China. GDOT prefers China due to low human resource cost. But in the last few months, China has seen lockdowns all over the country, disrupting activities and causing increasing costs in managing operational functionality. Also, the company faces a higher risk of data breach and Intellectual property rights in China, given the recent crackdown on IT companies by Chinese authorities. GDOT also shared this concern in its annual report 2021. I believe software development will be a significant part of GDOT’s portfolio given the increasing online payment in recent years, which is expected to grow significantly in the future. To ensure smooth functioning, it is crucial that GDOT address this issue.

Valuation

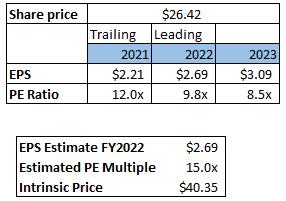

Relative P/E Model by Author

The company will be a beneficiary of secular growth due to the impact of the covid-19 will act as a catalyst for the firm. That’s the reason why I believe the EPS estimates of the company are very conservative and will turnout significantly higher. My estimated EPS for FY2022 is $2.69, which is 16% higher than the company estimates. According to my EPS estimate, the leading PE multiple of 9.5x, which we got after dividing the current share price of $26.42 by the EPS estimate of FY2022. The leading PE ratio of 9.5x is very inexpensive, and the company can be considered a growth company due to secular growth. I believe with the relative PE model, the company will trade at a PE multiple of 15x, which will give the intrinsic value of $40.35 per share, which is a 52% upside from the company’s current share price. These factors make GDOT an excellent stock to add to your portfolio.

Conclusion

According to my relative PE valuation, GDOT is currently trading at an inexpensive valuation with solid catalysts. I think the company is a good growth investment opportunity. After analyzing the secular growth catalysts in the industry and the presence of activist shareholders, I believe they will experience margin expansions and strong free cash flow in the coming years. After considering all these factors, I assign a buy rating for GDOT.