Gildan Activewear: Sustainability Champion Trading At A ~9x P/E (NYSE:GIL)

Justin Sullivan/Getty Images News

Gildan Activewear (NYSE:GIL) is not that well known of a company even though millions of consumers use its products. The reason is that most of its products are sold using the brands of other companies, such as Nike (NKE), Fanatics, etc. Gildan does own some of its own brands, such as Gildan and American Apparel which it bought after its bankruptcy, but the vast majority of its sales are to private labels and third-party brands. This allows the company to operate at a large-scale, and without taking any fashion risk.

Gildan has been successful in the tough Apparel industry thanks to a few factors including low-cost of production thanks to high operational efficiency, superior product innovation, and accentuating its leading sustainability standing as a competitive differentiator.

Financials

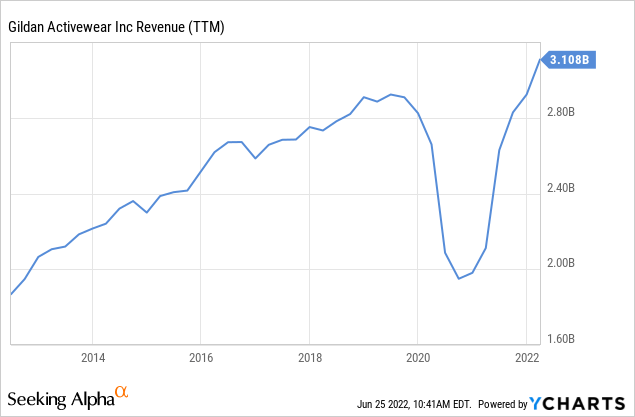

In general, revenue has been rapidly growing for Gildan, with the exception of the pandemic period where sales declined significantly.

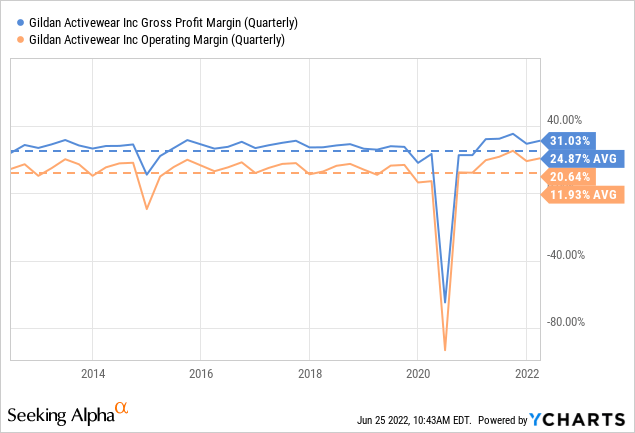

The business earns relatively decent profit margins, despite the apparel industry being a tough industry to operate in. Particularly impressive has been its recent operating margin above 20%.

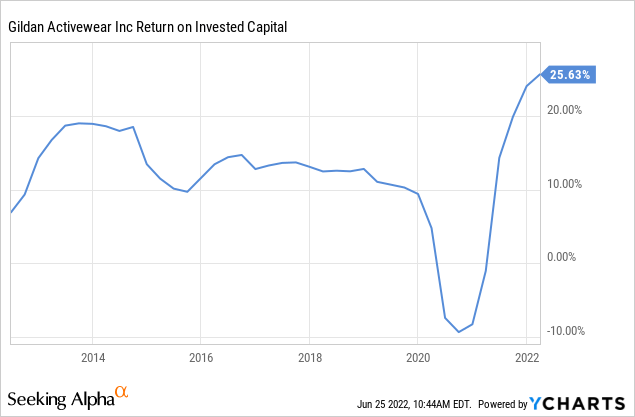

The improved margins have resulted in very attractive returns on invested capital, now also above 20%, and which even some technology companies would envy.

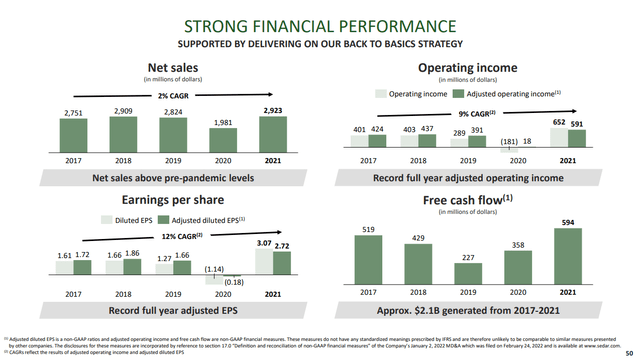

The slide below summarizes some of the most important financial figures for the company, note in particular how the company has greatly benefited from operating leverage. Despite net sales growing at only ~2% CAGR, operating income has grown at a very respectable ~9% CAGR, and earnings per share having the benefit of share buybacks have grown even faster at ~12% CAGR. The company generates a good amount of free cash flow, much of which it uses for share repurchases and dividends.

Growth

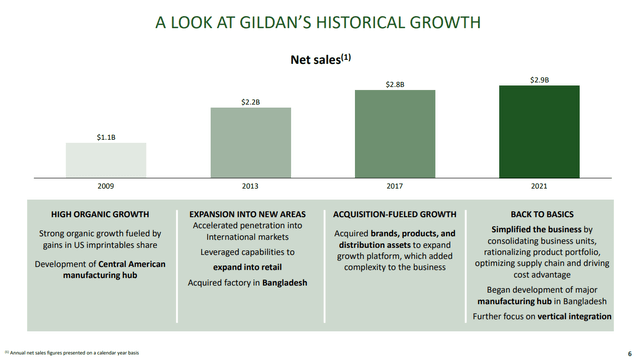

The company segments its historical growth in different phases, with the most recent period being one of lower net sales growth, and more focusing on simplifying the business after a period of acquisition fueled-growth.

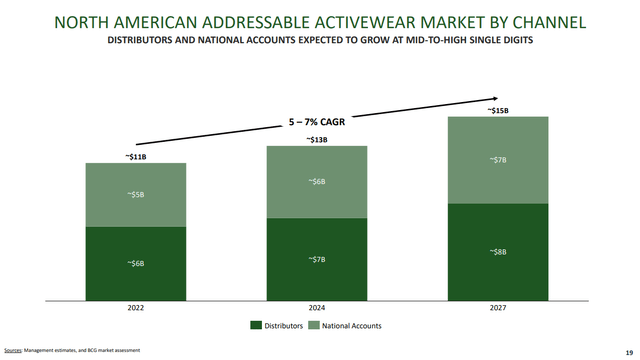

Going forward, the company expects its main markets of distributors and its national accounts to grow at mid-to-high single digits. The company would need to gain only moderate market share then to grow sales at a low double digits percentage.

Balance Sheet

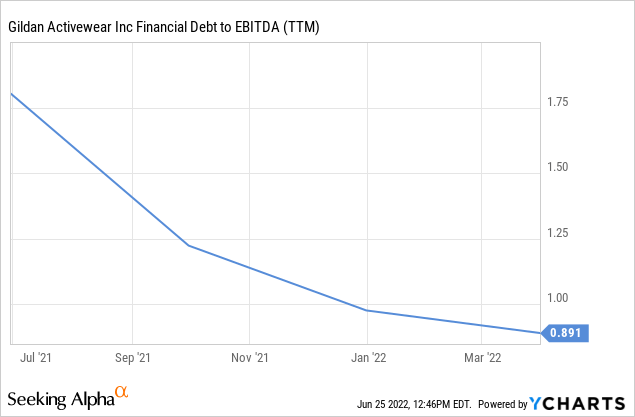

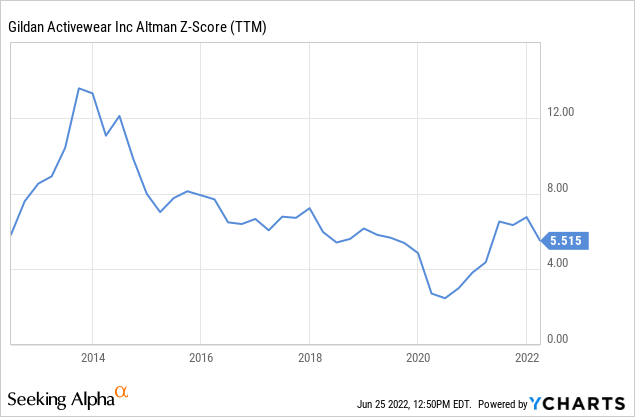

The company’s balance sheet is currently under-leveraged with a debt to EBITDA ratio of less than 1x. This should allow the company to continue with aggressive share repurchases going forward. We do prefer that the company not be too aggressive, and hopefully it won’t take leverage beyond 2x.

In any case the company is on solid footing, with an Altman Z-score comfortably above 3.0, and therefore no short/medium term risk of bankruptcy.

Valuation

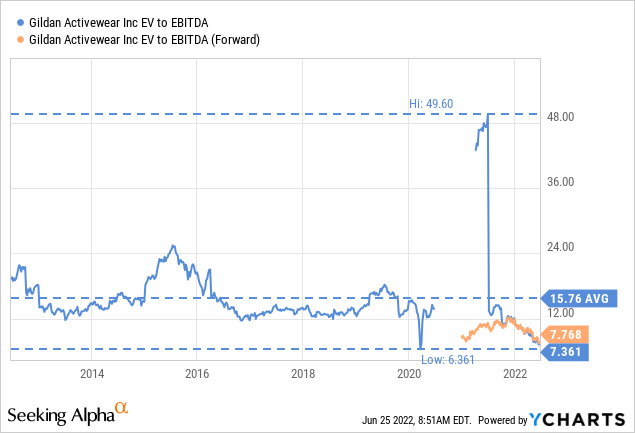

We believe shares are a strong buy based on the cheap valuation multiples at which they are trading. For example, EV/EBITDA is less than 8x, and this is a company with a long history of profitability. In the last ten years, it was only briefly interrupted by the pandemic, but in normal times this is a very profitable company.

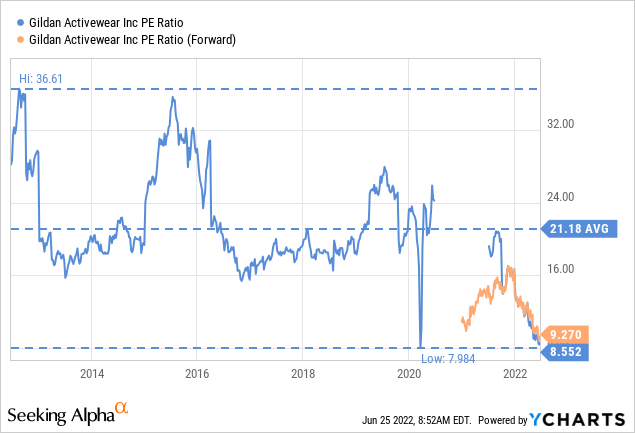

We get the same picture when looking at the price/earnings ratio, which is ~9x for both the trailing twelve months and the forward ratio. We do not need to do a discounted cash flow analysis to be able to tell that a quality company like this one trading at less than a 10x multiple is undervalued.

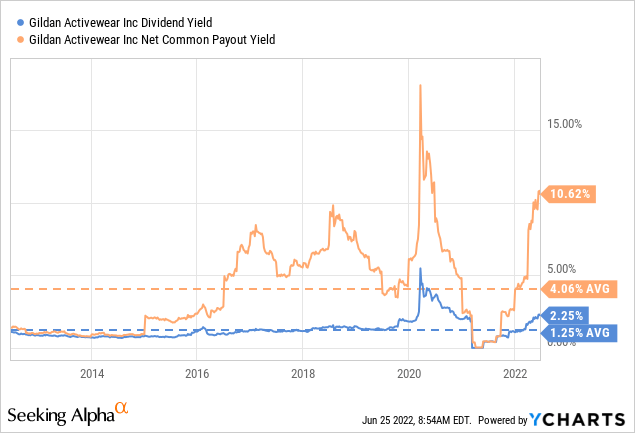

Some investors might be slightly disappointed that the dividend is not higher, but if one looks at the net common payout yield which includes both dividends and net share repurchases, shares are actually yielding a very attractive ~10.6%.

ESG

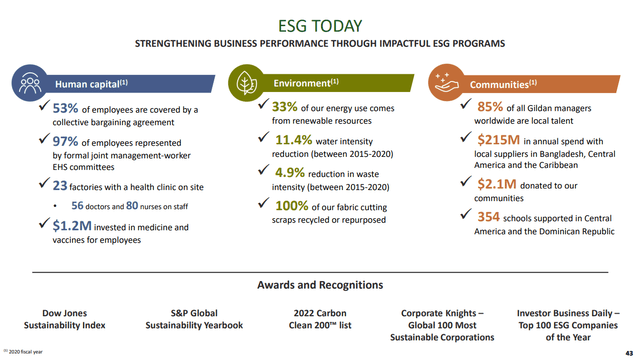

One of the things we like best about Gildan is that it is managed in a very sustainable way, and as a result it has won many ESG awards, such as being considered one of the 100 most sustainable corporations in the world by the prestigious Corporate Knights. It was added to the list in 2022, at position #79. It is also part of other important sustainability indexes such as the Dow Jones Sustainability Index.

Risks

The apparel industry is an extremely competitive industry, and the main risk we see is that if the company loses its operational excellence it could go from making money to losing money very quickly. The company’s competitive advantage is being a low-cost producer, through economies of scale and operational excellence, if it lost either of the two its profitability could be seriously compromised. The company also wins significant amounts of business thanks to its commitment to sustainability. If the company loses its sustainability credentials, it could put a lot of business at risk.

Conclusion

Gildan Activewear is a sustainability champion operating in the tough apparel industry, but with a number of competitive advantages. The company has been able to generate attractive profits, growth, and shareholder returns while being one of the most sustainable in its industry. Shares are currently trading at a very attractive valuation of ~9x forward earnings, and we think investors should give them serious consideration. There are some risks to consider, but overall we see a solid balance sheet and company.