Parkland Corp: 4% Dividend Yield Trading At Less Than 7X DCF (OTCMKTS:PKIUF)

edb3_16/iStock via Getty Images

Introduction

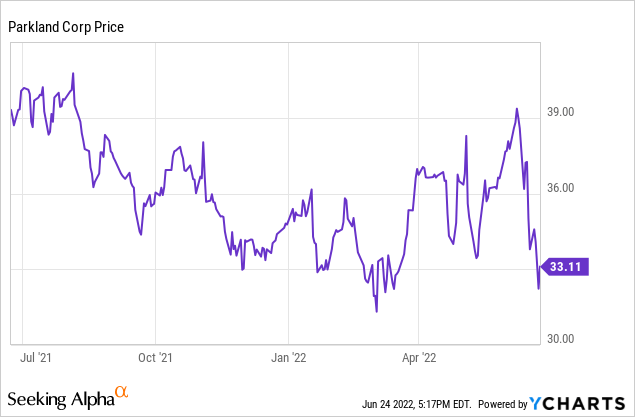

In February, I looked at Parkland Corporation (OTCPK:PKIUF), a Canada based processor and retailer of oil products. The company has been looking to diversify into other sectors in an attempt to grow its EBITDA outside of the fuel-related businesses and earlier this year it closed the acquisition of a frozen food retailer. A surprising diversification, but I’m giving the Parkland management the benefit of the doubt. Parkland remained on my shortlist and after seeing the strong Q1 results and the improving refining margins, the company may perform better than expected this year.

As Parkland is a Canadian company I would strongly recommend to use the company’s Canadian listing which is far more liquid than any of its secondary listings. The average daily volume on the TSX exceeds 400,000 shares. This article is meant as an update to my previous article and to get a better idea of the background of Parkland I’d recommend you to read my previous article.

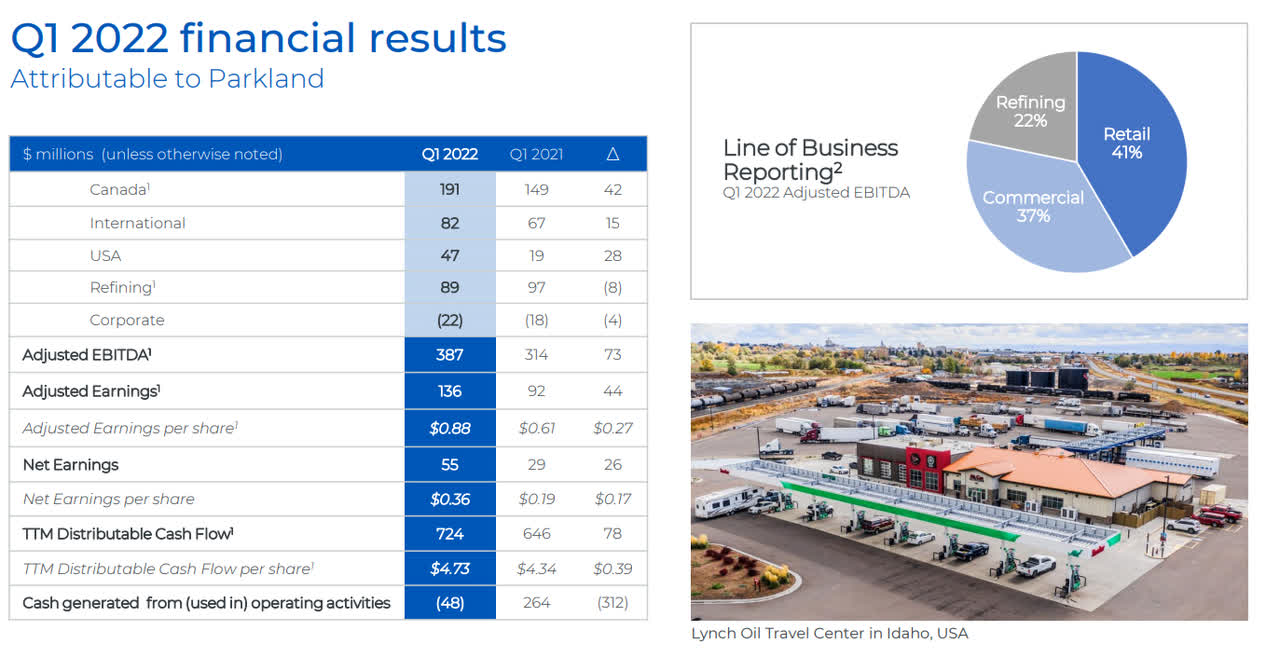

The Q1 performance was phenomenal with a very high distributable cash flow

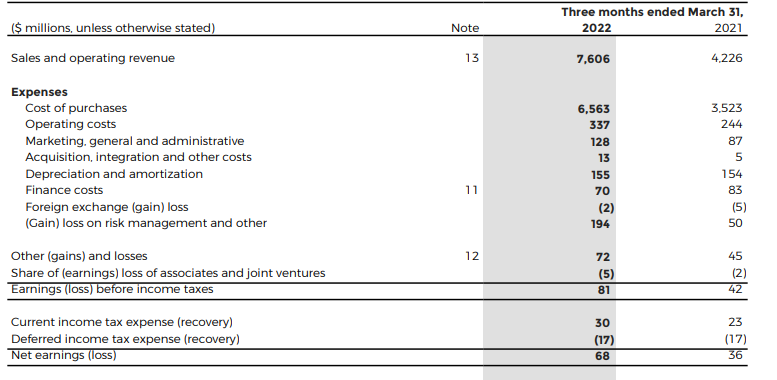

Thanks to the higher fuel prices and the addition of new divisions, Parkland’s revenue increased from C$4.2B to C$7.6B. Of course, the operating expenses increased as well as the COGS almost doubled but other expenses like the finance costs decreased.

Parkland’s pre-tax income of C$81M was twice as high compared to Q1 2021 but there are a few non-recurring elements that had a massive impact on the financial results. The income statement shows a loss of C$194M on hedges and a C$72M “other gain” which is related to the change in fair value of redemption put options Parkland committed to. This is a non-cash charge and as I’ll explain based on the company’s cash flows, this has only a limited impact on Parkland’s ability to generate a positive free cash flow.

Parkland Investor Relations

Despite these non-recurring losses, the net income was C$68M of which C$55M was attributable to the shareholders of Parkland, resulting in an EPS of C$0.36 based on the current share count of approximately 155M shares.

That’s definitely not great as it would indicate the company is trading at 25 times the annualized earnings from Q1. But keep in mind that the pre-tax income would have been about three times higher than what has now been reported if it weren’t for the losses in the hedge book.

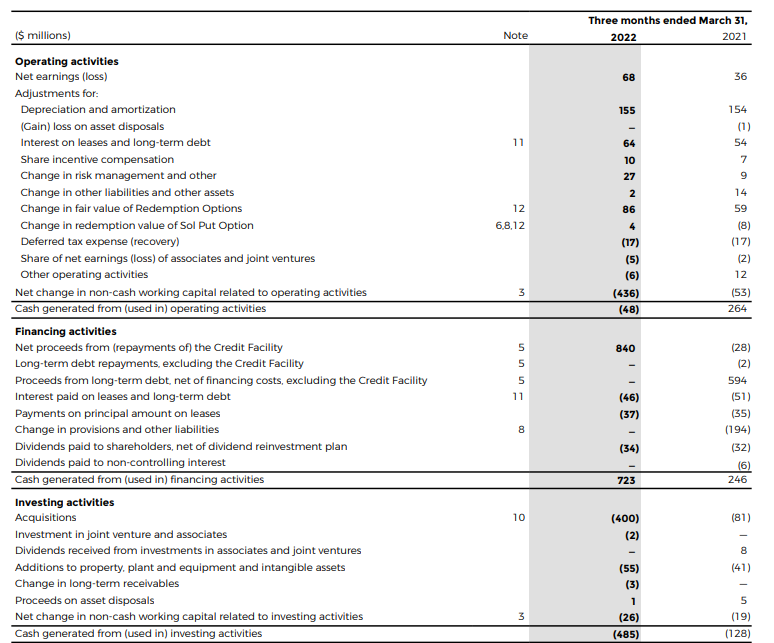

The majority of the hedging losses were realized and the cash flow statement shows only C$27M in hedging losses were added back to the cash flow. But more importantly, the C$86M in non-cash expenses related to the loss on the value of the redemption put options were added back to the operating cash flow.

The operating cash flow was a negative C$48M on a reported basis, but you can clearly see there was a massive investment in the working capital position (mainly an inventory build-up). Adjusted for these changes in the working capital, the operating cash flow was a positive C$388M. This however includes a C$17M tax recovery and excludes the C$46M in interest expenses and C$37M in lease payments. Additionally, I think it’s only fair to also deduct the C$13M in net income attributable to the minority interests.

Parkland Investor Relations

This means that on an adjusted basis, the operating cash flow was C$292M. The total capex was C$55M resulting in a free cash flow result of C$237M. Keep in mind the growth investments are included in this capex number and according to the breakdown provided by Parkland, only C$29M of the capex was sustaining capex. This means the sustaining free cash flow was roughly C$263M or C$1.70/share. The sustaining capex was obviously pretty light in the first quarter as the TTM maintenance capex exceeded C$200M. That’s why you shouldn’t just extrapolate the Q1 free cash flow to the entire financial year.

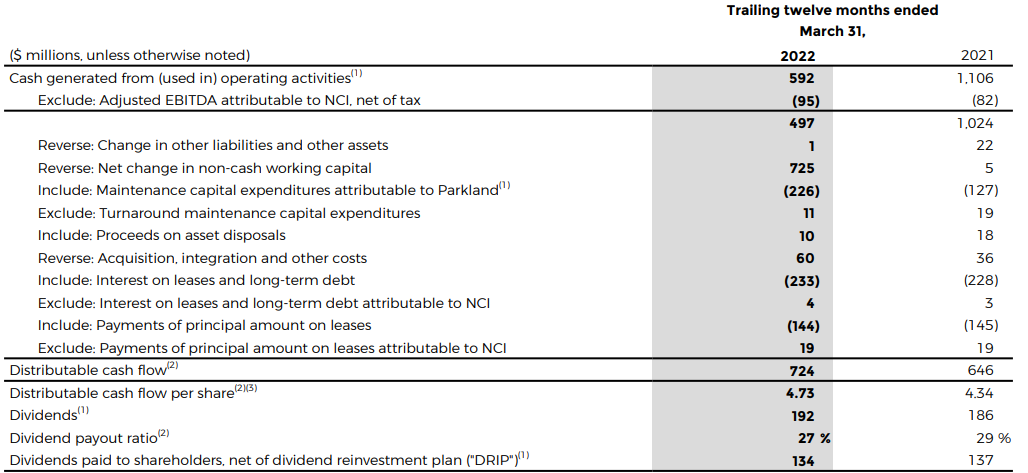

Parkland provides an excellent breakdown of its trailing twelve-month distributable cash flow calculation. Over the past 12 months, the company generated in excess of C$700M in distributable cash flow, or C$4.73 per share.

Parkland Investor Relations

Parkland recently moved from monthly distributions to quarterly distributions to the tune of C$0.325 per quarter. That’s C$1.30 per share per year for a dividend yield of 3.95% based on a C$33 share price. The payout ratio is just 27% based on the TTM distributable cash flow which means Parkland is retaining about half a billion dollar in cash per year to fund its expansion and diversification strategy.

The outlook for 2022 seems achievable

One of the main reasons why I wanted to have another look at Parkland is the refining division. The company operates the 55-60,000 barrel per day Burnaby refinery in British Columbia and this refinery already posted a nice contribution to the adjusted EBITDA in Q1 2022.

Parkland Investor Relations

The refining margins have only increased since the first quarter and both in Europe as well as in the US and although Parkland will likely see an improved cracking spread as well, keep in mind Parkland also has a substantial asphalt and aviation fuel business so it remains to be seen how the average refining margin will evolve during the second quarter. I’m optimistic to see a good performance in the current quarter but can’t really figure out by how much the EBITDA from the refining segment will increase.

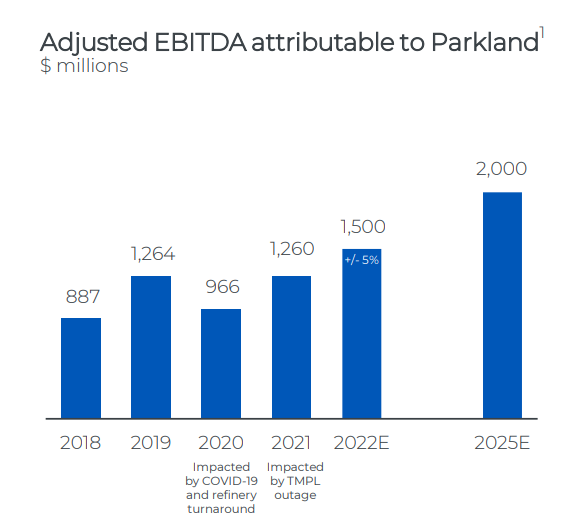

The official guidance calls for a full-year adjusted EBITDA of C$1.5M (C$1.425-1.575B including the 5% potential variation) which makes it easier to calculate the anticipated free cash flow.

We know the interest expenses are approximately C$260M per year, with the cost of the leases estimated at C$150M per year. The sustaining capex will be C$250M and assuming an average tax rate of 30% and C$475M in depreciation (excluding leases) per year, the full-year sustaining free cash flow should come in at around C$750-800M for a free cash flow per share of around C$5/share. And this means the company will continue to self-fund its future expansion plans to reach a C$2B EBITDA by 2025.

Parkland Investor Relations

Investment thesis

Despite paying a dividend representing a yield of almost 4%, Parkland retains about C$500M per year in distributable cash flow on its balance sheet to fund investments in growth and acquisitions. Parkland already spent C$400M on acquisitions in the first quarter and will likely close a C$168M acquisition of Vopak oil terminals in Canada this quarter.

It feels counter-intuitive to invest in a fuel retailer when there seems to be a push for EVs. However, I like Parkland’s focus on diversifying away from being a pure fuel retail company and I expect the future acquisitions to also be in a different field. The perception of Parkland being a fuel retailing company is likely why the stock is trading at just over 6 times its distributable cash flow but the market seems to not trust the company’s expansion plans despite having C$500M per year at its disposal for growth capex and M&A investments. Parkland is in an exceptional position as it can “buy” its future. It has the capital on hand to reduce its exposure to the fuel markets, so an investment in Parkland is a bet on the management doing the right thing with its diversification strategy.

I currently have no position in Parkland but I’m trying to write some out of the money put options.