Black Bear Value Fund Q4 2022 Letter

simoncarter

To My Partners and Friends:

- Black Bear Value Fund, LP (the “Fund”) returned +1.8% in December and +12.5% in 2022.

- The S&P 500 returned –5.8% in December and -18.1% in 2022.

- The HFRI Index returned –0.9% in December and -8.1% YTD.

- We do not seek to mimic the returns of the S&P 500 and there will be variances in our performance.

| Note: Additional historical performance can be found on our tear-sheet. |

From the start of our Partnership, it was clear that investment knowledge alone would not be enough for a sustainable business with a competitive advantage. If we could create a long business runway we could invest for the long-term (not the next quarter or year). As a result, I underwrote the business to failure…I presumed to raise 0 dollars meaning Lauren and I would have to fund the business entirely ourselves for 5-10 years. We would invest in high quality service providers but otherwise keep the operating costs lean. This mentality, while unusual, gave me the freedom to look for ideas and quality long-term investors. Having a durable business structure leads to quality partners which leads to the ability to have a quality long-term and concentrated portfolio…they’re all interconnected. Thankfully we have attracted amazing LP’s that range from high-net-worth individuals to family offices. Although our headcount has grown from a team of 1 to a team of 2 (CFO David Proskin), we will forever maintain a lean and bootstrapped culture. It helps explain our returns, our patience, and our extremely high-quality LP base.

Year in Review

“Don’t play everything; let some things go by….

What you don’t play can be more important than what you do.” – Thelonious Monk

As the quote above references, sometimes what we omit is as important as what we include.

Previous letters have discussed our feelings about the pernicious effects of excessively low interest rates. Too much free money chased too few ideas leading to inflated values in all sorts of financial assets (though I use the term asset loosely when it comes to certain “new” creations). The valuations of many companies approached the stratosphere and our Partnership sat out and did not participate. The ever-increasing rise in prices of money-losing-companies and speculative ideas created a combination of social proof and MAJOR fear of missing out….so the prices marched higher. Most people wanted to participate and came up with narratives that justified paying nosebleed prices. Remaining on the sidelines required a level of both independent thought and acceptance of underperformance…not easy. We went a step further and shorted many of these companies which makes me a bit of a masochist. Although I thought we were correctly positioned it was still painful in the interim. In the fullness of time, I felt the benefits would outweigh the short-term financial and emotional costs.

Lagging performance is never a fun spot, but my job is to protect capital as much as it is to grow it. Letting these speculative opportunities pass us by was a large differentiator for us in 2022 and as a short a meaningful source of profits.

By most measures 2022 and 2021’s returns would be considered acceptable. They are also unusual and should not be expected in a year when the overall markets are down. It is important to remember that today’s returns are from yesterday’s (or yesteryears’) decisions. Oftentimes when situations are most uncertain the associated potential returns can be the most profitable.

There is nothing wrong about enjoying a year of quality returns so long as we remain modest and continue to have reasonable expectations going forward. It is unusual to experience this kind of outperformance on a regular basis so we should all keep our expectations in check.

That said, we own businesses at substantial discounts to fair value and remain short numerous businesses/credit instruments that are either grossly overvalued and/or candidates to go bankrupt. In any given year it’s impossible to know what happens with security prices, but so long as we focus on the medium/longterm horizon, we should be in good shape.

Quality Partners & Family

We could not manage to have these kinds of years without patient LP’s who have taken the time to understand our manner of concentrated long-term investing. Returns from year to year can be lumpy and unpredictable. What is consistent and very predictable is the support and quality of our LP base. Thank you for giving me the latitude to do my job on our mutual behalf in both tough years and in more profitable years.

A big thank you to my wife Lauren, and our children, Sydney, Zoey and Max. My wife likes to say that the positive of working for yourself is you can work anywhere and have flexibility…but the negative is you can work anywhere and have flexibility to work whenever you want. Their love and patience are a critical ingredient in what we are doing.

Could Something Else Be Unprecedented?

As we all know inflation took off in 2022 and resulted in interest rates going up and dramatic drops in prices of many securities.

It’s curious how many investors/speculators who have large mark-to-market losses cite the “unprecedented” rise in rates as an explanation for their missteps. Is it possible that the environment that led to their success was also unprecedented (aka free money)? I’ve noticed that on the way up many managers were very smart and could see the future and, on the way down, it’s unprecedented bad luck. Humility is good for everyone. Yours truly has eaten plenty slices of humble pie. Generally speaking we are never as smart or as dumb as we may think (present company included).

No Points for Degree of Difficulty

I am often asked my opinions on a range of stocks and world issues that I simply do not have a firm view on. Many think it’s a schtick (Yiddish for gimmick) that I say, “I don’t know”. But the reality is investing is not having an opinion on everything. In fact, it’s not having an opinion on most things. Better to know a little about a lot and then have very focused work and opinions on a select area. This is not exciting for most people who want to hear “market thoughts” or what Google’s Q1 earnings are, the results of the Russian invasion of Ukraine, or whether we will be in a recession in 2023.

Looking back over the last year I’ve seen many investors explain recent investing mistakes and lessons learned in speculative areas like unprofitable tech, SPAC’s, crypto etc. And then in the next breath they describe how they are attacking the exact same areas with their newfound wisdom. It’s strange to me. Maybe it was just too difficult to figure out and they were attempting to jump 10-foot hurdles vs. 1-foot ones? Investing in new areas of innovation and predicting the future is HARD! I am sure there are people out there who are exceptional at it…not me. I think many investors would be best served looking in the mirror and realizing we are not hired to be the masters of all things with increased levels of difficulty. Oftentimes new areas of innovation benefit the customer the most and are highly competitive from the business owner’s perspective.

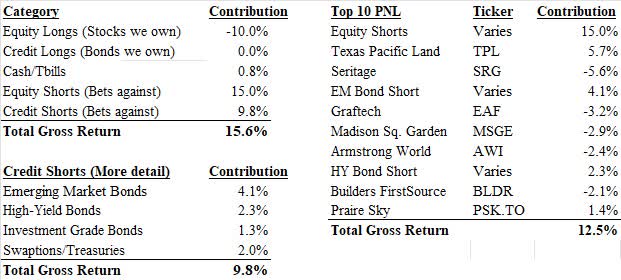

Breakdown of PNL Components

While we lost ~9% of our capital between our Longs/Cash this is a better outcome relative to the market. If we did not have any short exposure, we would have been down ~9% still outperforming the broader markets. We did have the benefit of short exposure both in equities and credit leading to ~ +13% net return for the year. As discussed in prior letters these shorts were expected to provide asymmetric returns in the event there was some combination of a risk-off/interest rate rise/sanity returning to the market. Thankfully they worked.

Inflation/Credit Shorts/Equity Shorts

We remain short credit though in smaller size compared to last year. While inflation is moderating, we are a long way from 2%. We still have not had a normal credit cycle where companies who should be out business default on their debt. Persistently low interest rates have allowed sick companies to keep getting medicine in the form of refinanced debt. We could start to see increased defaults both in lower rated Investment Grade (BBB bonds) and Junk credit. Those who own this paper may be surprised when their bonds have very few asset protections in place and recoveries are low. Based on today’s pricing very little in the way of defaults and/or low recoveries is contemplated. The credit short is less asymmetric than years past but still attractive as a short prospect.

People like to comment on the rate of change versus the duration of a new paradigm. Its possible inflation calms down and we’re back to 1-2% for a long time. The odds seem unlikely given the underdevelopment of energy/commodities and reshoring of more expensive labor in the United States. If inflation stays higher for longer, rates will remain higher as well. There are many business models which presume low rates forever making it challenging to exist if/when higher rates persist (even around today’s rates). We are short those companies.

As a reminder, we own businesses that have pricing power and limited/no dependance on the need for external funding. This is important because as input and wage costs pressure profitability of many companies, our businesses should be able to weather the storm and capitalize through both organic market share gains and/or acquisitions of companies that may not have had a healthy balance sheet or operating structure.

Top 5 Businesses We Own

Builders FirstSource (BLDR) – 16% of AUM

BLDR is a manufacturer and supplier of building materials with a focus on residential construction. Historically this business was cyclical with minimal pricing power as the primary products sold were lumber and other non-value-add housing materials. Since the GFC, BLDR has focused on growing their value-add business that is now 40%+ of the topline. BLDR can pre-assemble components such as a roof truss and deliver it to the homesite. This allows homebuilders (their end-users) to shorten their construction time and have higher returns on capital. The company has modest leverage and has been using their abundant free-cash-flow to buy in over 30% of the stock in the last 18 months.

While mortgage rates are higher, they are not unusual versus history. The low rates of the last 5-10 years are the outlier. We have a structural shortage of housing in the USA. With existing homeowners locked into low rate mortgages, the aspiring homeowner may increasingly need to find a home from a homebuilder. The next 6-12 months could be rocky as people adjust to the increase in pricing and rates. Eventually the housing market should adjust to the new normal (or rates could go down). We do have a large credit short which benefits if rates continue to go up.

Normalized free-cash-flow per share looks to be in the range of $8-$12 per year. At year end pricing of ~$65 that implies a free-cash-flow yield of 12-18%. If we owned this business privately and someone offered us a teens annual cash-flow yield, we would be jumping at it! The pessimism surrounding housing, interest rates and recession fears provides some of the reasons why this opportunity exists.

Berkshire Hathaway (BRK.A, BRK.B) – 12% of AUM

Below is the rough Berkshire on-a-napkin valuation. Again, this is a rough exercise.

- Cash of ~$79,000 per class A Share

- Down/Base/Up marks cash at book value to an 11% premium or $87,000

- Investments based on December prices ~$252,000 per class A share

- Presume a range of stock prices that result in:

- Down = $225,000 per class A share (-11%- assumes portfolio is overpriced)

- Base = $294,000 per class A share (+17%)

- Up = $382,000 per class A share (+51%)

- Presume a range of stock prices that result in:

- Operating businesses that should generate ~$18,000 of pre-tax income per Class A share

- Down = 9x = $168,000 per share – equates to ~8% FCF yield

- Base = 11x = $205,000 – equates to ~7% FCF yield

- Up = 12.5x = $233,000 – equates to ~6% FCF yield

- Overall (vs. $469,000 at quarter end) o Down = $480,000 (+2%) o Base = $586,000 (+25%)

- Up = $702,000 (50% underpriced)

We added a short of Apple (aapl) vs. the Berkshire position. Apple has become a large part of the BRK business and wanted to limit our exposure to that investment as it seems expensive.

Going forward I expect Berkshire to compound at above average returns from this price.

BRK is a collection of high-quality businesses, excellent management, and a good amount of optionality in their cash position. If the cash were to be deployed accretively, the true value would be greater than an 11% premium (as mentioned above). The combination of a pie that is growing, an increasing share of said pie due to stock buybacks, upside optionality from cash and a tight range of likely business outcomes that span a variety of economic futures gives me comfort in continuing to own Berkshire.

Madison Square Garden Entertainment (MSGE) – 9% of AUM

MSGE’s primary assets include the Madison Square Garden arena, MSGN (the regional sports network), Tao Group, the Radio City Rockettes show, and an in-construction entertainment venue in Las Vegas called the Sphere.

These assets have historically traded at a “Dolan Discount”. Some of that discount is warranted as management has sometimes taken actions to benefit some shareholders while harming others (Selling MSGN at a steep discount to MSGE). Alternatively, management has also been thoughtful about spins and share buybacks to benefit shareholders.

The Sphere is a $2BB endeavor that’s ~65% complete and planned to open in the 2nd half of 2023. Until then the Company will be spending the bulk of their cash to complete the development. Part of the opportunity revolves around the uncertainty of the value of the Sphere as well as inflationary pressures for the remaining costs. In our downside we incorporate 25% inflation on the remaining costs as well as a 50% write-down of the asset. I don’t believe this to be the case but provides more of a proof point as to how cheap the entity is trading.

Over the coming 6-12 months MSGE is expected to spin off its traditional live entertainment businesses. MSG Networks (the regional sports network), MSG Sphere (the venue under construction in Las Vegas) and Tao Group will be in one entity with all the others assets (Madison Square Garden, Rockettes etc.) in another entity. We will await more details and communicate them in a future letter.

If we take the above-mentioned haircut to the Sphere and haircut their other assets, we arrive at a net asset value of $1.5bb or $43 a share as compared to a price of $44 at year-end. Based on more reasonable estimates I arrive at a fair price that’s 2-3x where the equity is trading now. Note our downside is lower than in previous communications. With higher interest rates it felt more appropriate to underwrite to a more harsh environment.

Asbury Group (ABG) – 8% of AUM

Asbury Group operates auto dealerships across the United States. We have written at length about our affinity for the auto-dealer business. While much attention is paid to the number of cars sold, the strength of the model comes from the back of the house in parts and services where more than 50% of the profits come from. We are exiting a period of high margins on new and used car sales. Shortages of inventory have allowed dealers to make record profits when selling a car. As inventories normalize and interest rates rise, I fully expect the dealers to make less profit (called the GPU) when selling a car. Car prices cannot go up ad-infinitum and at some point, there will be buyer pushback.

Less discussed is while profits per car are at all-time highs, the volumes sold have mirrored prior recessions. My expectation is that dealers will likely make less per car but will mitigate some of that pressure by selling more cars, especially used vehicles, as prices drop.

When an auto dealer sells a car to a consumer, they capture both the trade-in (inventory to sell) and the relationship for parts and services. It is a razor-razorblade model in a highly fragmented industry (many dealerships are owned privately by families). The large dealer groups have transitioned to an omni-channel model where much of the selling/pre-buy activity can be done online reducing the need for headcount and making the transaction smoother for their customers. The lower operating costs of the business are not appreciated by the market. They are appreciated by us and the management teams as most dealers, including ABG, have been buying in lots of stock with their free-cash flow.

ABG should be able to earn $25-$35 in free-cash flow per share in a “normal” year. At year-end pricing that implies a 14-20% annual yield. As I’m writing this I’m wondering why we don’t own more….

Civeo (CVEO) 8% of AUM

Civeo is the company whose name we have kept under wraps throughout the year. It is a smaller cap company and I did not want to potentially influence the price higher by writing about it and giving it attention. Both Black Bear and Civeo bought back stock and I’d prefer lower prices. Despite this disclosure, I hope those who read this pay similar attention to me as my kids when I tell them to turn the TV off (not much).

We have a large investment across the energy & commodity spaces. I’ve looked for both direct energy investments (Occidental – drilling/chemicals), derivative of energy/commodity investments (Prairie Sky – royalties) and adjacent beneficiaries (CVEO). The thesis is simple…we haven’t developed enough energy or commodity resources to satisfy the near and medium term needs of the world as well as provide for a renewable/less-carbon intensive future.

Civeo is a workforce housing company for those who are living/working away from home in more remote locations. They provide lodging, food services, housekeeping and property maintenance in Canada, Australia and the United States. The main sectors they serve are mining and oil/gas development. They also provide services to municipalities, sporting events, education, film production and the military.

CVEO went through a brutal stretch during COVID yet still generated the equivalent of 12% of its market-cap in cash in a lousy year. In the coming years this business could be worth 2-3x where it’s priced now as more development is needed in their end markets. It’s hard to predict any given year of this business but they should be able to earn $3-$5 in cash in most years which equates to 10-17% free cash flow yield.

Fund Updates/Tax Discussion/Medium-term Growth Plans

We should recognize taxable income that is lower than our profits much of which will be long-term gains. I anticipate K-1’s will be distributed with plenty of time for the tax-filing deadline.

All investors should have received communication from Opus about an online Investor portal. All statements, K-1’s etc. can be found there and should make all of our lives a bit easier when documents are needed.

This past year we added David Proskin as our CFO. It has worked out great as Dave has helped take a lot of day to day financial tasks off my plate and allowed me more time to focus on the portfolio. I want to extend my thanks to David as he’s been a big help.

Thank you for our service providers: BTIG (Prime Broker), EisnerAmper (Tax/Audit) and Kleinberg, Kaplan (Legal) for their help throughout the year. They have been helpful partners and been great sounding boards we encounter new “to-do’s” as we grow.

Some have asked what our medium-term business plan is as we have been growing. Our mission and day to day actions remain the same. The priority is the portfolio and investing. As we welcome new investors there is more day-to-day operational work that will likely pop up. As the Fund grows, I plan on hiring someone in an operational role to help. We are not at that stage but could be approaching it soon. When I find that my attention is being pulled away from the portfolio too often, it is time to reassess the headcount and look at getting help.

However, a BIG advantage for us is a long runway with a lean operating structure….so any hiring decisions are considered and thought through. I’m not looking to create internal pressure to raise assets by raising our operating expenses.

Black Bear was specifically setup for markets like this. While it is uncomfortable for many to be deploying capital in a rocky environment, it is not for me. These are precisely the conditions I find the most rewarding as a longer-term investor. When times are happy few pay attention to risks and prudence is punished. When people get frightened everything looks worrisome and risk-taking becomes rare. As a result, we can buy ever cheaper high-quality businesses and look out beyond the average investors’ investment horizon. We have a structural advantage with longer-term capital, excellent and patient investors and a fully aligned investment manager. We will continue to play offense when many seem to be in retreat.

Thank you for your trust and support.

Adam Schwartz, Black Bear Value Partners, LP

|

THIS DOCUMENT IS NOT AN OFFER OF, OR THE SOLICITATION OF AN OFFER TO BUY, INTERESTS IN BLACK BEAR VALUE PARTNERS, LP (THE “FUND”). AN OFFERING OF INTERESTS WILL BE MADE ONLY BY MEANS OF THE FUND’S CONFIDENTIAL PRIVATE OFFERING MEMORANDUM (THE “MEMORANDUM”) AND ONLY TO SOPHISTICATED INVESTORS IN JURISDICTIONS WHERE PERMITTED BY LAW. This document is confidential and for sole use of the recipient. It is intended for informational purposes only and should be used only by sophisticated investors who are knowledgeable of the risks involved. No portion of this material may be reproduced, copied, distributed, modified or made available to others without the express written consent of Black Bear Value Partners, LP (“Black Bear”). This material is not meant as a general guide to investing, or as a source of any specific investment recommendation, and makes no implied or express recommendations concerning the matter in which any accounts should or would be handled. The returns listed in this letter reflect the unaudited and estimated returns for the Fund for the periods stated herein and are net of fees and expenses, unless stated otherwise. Black Bear currently pays certain fund expenses, but may, at any time, in its sole discretion, charge such expenses to the Fund. Please note that net returns presented reflect the returns of the Fund assuming an investor “since inception,” with no subsequent capital contributions or withdrawals. You should understand that these returns are not necessarily reflective of your net returns in the Fund, and you should follow-up with Black Bear if you have any questions about the returns presented herein. An investment in the Fund is speculative and involves a high degree of risk. Black Bear is a newly formed entity with limited operating history and employs certain trading techniques, such as short selling and the use of leverage, which may increase the risk of investment loss. As a result, the Fund’s performance may be volatile, and an investor could lose all or a substantial amount of his or her investment. There can be no assurances that the Fund will have a return on invested capital similar to the returns of other accounts managed by Adam Schwartz due to differences in investment policies, economic conditions, regulatory climate, portfolio size, leverage and expenses. Past performance is not a guarantee of, and is not necessarily indicative of, future results. The Fund’s investment program involves substantial risk, including the loss of principal, and no assurance can be given that the Fund’s investment objectives will be achieved. The Fund will also have substantial limitations on investors’ ability to withdraw or transfer their interests therein, and no secondary market for the Fund’s interests exists or is expected to develop. Finally, the Fund’s fees and expenses may offset trading profits. All of these risks, and other important risks, are described in detail in the Fund’s Memorandum. Prospective investors are strongly urged to review the Memorandum carefully and consult with their own financial, legal and tax advisers before investing. The development of an investment strategy, portfolio construction guidelines and risk management techniques for the Fund is an ongoing process. The strategies, techniques and methods described herein will therefore be modified by Black Bear from time to time and over time. Nothing in this presentation shall in any way be deemed to limit the strategies, techniques, methods or processes which Black Bear may adopt for the Fund, the factors that Black Bear may take into account in analyzing investments for the Fund or the securities in which the Fund may invest. Depending on conditions and trends in securities markets and the economy generally, Black Bear may pursue other objectives, or employ other strategies, techniques, methods or processes and/or invest in different types of securities, in each case, that it considers appropriate and in the best interest of the Fund without notice to, or the consent of, investors. Performance returns compared against benchmark indices are provided to allow for certain comparisons of Black Bear’s performance to that of well-known and widely-recognized indices. Such information is included to show the general trend in the markets during the periods indicated and is not intended to imply that the holdings of any of the applicable accounts were similar to an index, either in composition or risk profile. The indices represented herein are the S&P 500 and the HFRI EH: Fundamental Value Index (“HFRI EH FVI”). The S&P 500 is a free-float weighted/capitalization-weighted stock market equity index maintained by S&P Dow Jones Indices, which tracks the performance of 500 large companies listed on U.S. stock exchanges. The HFRI EH FVI reflects fundamental value strategies which employ investment processes designed to identify attractive opportunities in securities of companies which trade a valuation metrics by which the manager determines them to be inexpensive and undervalued when compared with relevant benchmarks. This presentation contains certain forward looking statements. Such statements are subject to a number of assumptions, risks and uncertainties which may cause actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by these forward-looking statements and projections. Prospective investors are cautioned not to invest based on these forward-looking statements. Furthermore, many statements in this presentation are the subjective views of Black Bear, and other reasonable persons may have differing views. Unless it is unequivocally a statement of fact, any statement herein (even if not specifically qualified as an opinion (i.e., with language such as “in the opinion of” or “we believe that”)) should nevertheless be understood and interpreted as an opinion with which reasonable persons may disagree, and not as a material statement of fact that can be clearly substantiated. The information in this presentation is current as of the date listed on the cover page and is subject to change or amendment. The delivery of this presentation at any time does not imply that the information contained herein is correct at any time subsequent to such date. Certain information contained herein has been supplied to Black Bear by outside sources. While Black Bear believes such sources are reliable, it cannot guarantee the accuracy or completeness of any such information. This Presentation has not been approved by the U.S. Securities and Exchange Commission (the “SEC”) or any other regulatory authority or securities commission. This Presentation does not constitute an offer of interests in the Fund to investors domiciled or with a registered office in the European Economic Area (“EEA”). None of the Fund, Black Bear or any of their respective affiliates currently intends to engage in any marketing (as defined in the Alternative Investment Fund Managers Directive) in the EEA with respect to interests in the Fund. Receipt of this investor presentation by an EEA investor is solely in response to a request for information about the Fund which was initiated by such investor. Any other receipt of this investor presentation is in error and the recipient thereof shall immediately return to the Fund, or destroy, this investor presentation without any use, dissemination, distribution or copying of the information set forth herein. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.