Trinity Capital: 17% Yield, Plus 5% Extra, 22% Discount (NASDAQ:TRIN)

8vFanI

Do you own any BDCs? Business development companies offer retail investors high-yield exposure to private companies, and some of them, like Trinity Capital Inc. (NASDAQ:TRIN), focus on companies which already are backed by venture capital firms. These other firms don’t want to lose their investments, and will continue to support these companies. This has been crucial during and after the pandemic.

Profile:

Trinity Capital Inc. is an internally-managed BDC which specializes in venture debt to growth stage companies looking for loans and/or equipment financing. Trinity Capital Inc. was founded in 2019 is based in Phoenix, Arizona, with additional offices in Lutherville-Timonium, Maryland, San Diego, California and Austin, Texas.

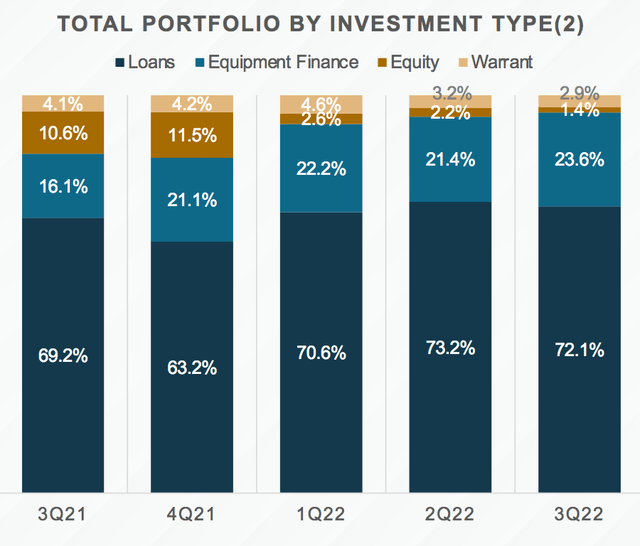

It IPOd in January 2021, but had a longer prior history dating back to ~2008 in its predecessor funds.As of 9/30/22, Secured Loans made up ~72% of TRIN’s portfolio, followed by Equipment Financings, at ~23.6%, Equity, at 1.4%, and Warrants, at ~3%.

TRIN site

TRIN has debt positions in 85 companies, warrant positions in 77 portfolio companies, and equity positions in 25 companies. It has funded $2.2B out of $38B in opportunities over its 14 year history, with 275 investments and 153 exits.

TRIN site

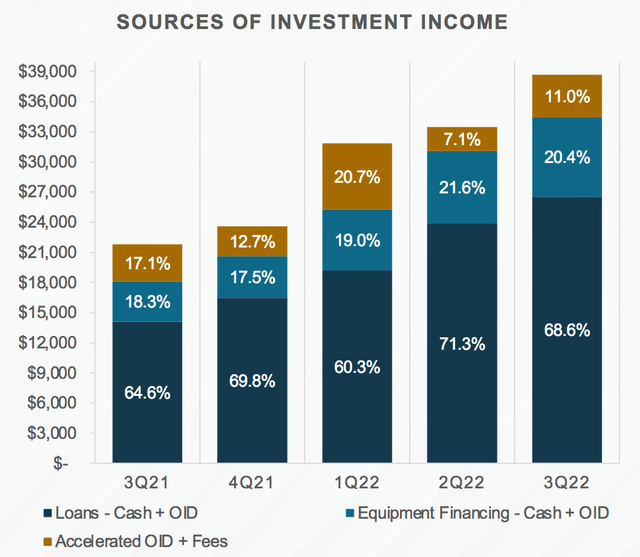

TRIN’s main source of income, ~69%, stems from loans, followed by equipment financing, at ~20%, and accelerated OID + fees, at 11%:

TRIN site

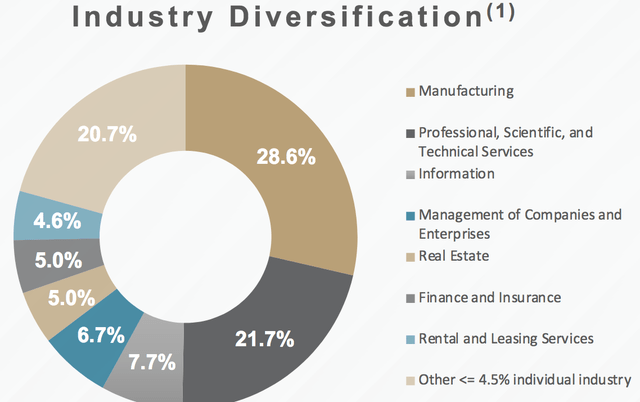

The main difference in TRIN’s holdings vs. other BDCs’ is that it has more exposure to manufacturing, 28.6%, due to its equipment financing investments.

Other than that, its industry exposure seems to roughly follow the norm, with ~22% of its investments in Professional, Scientific and Technical Services companies, and ~21% in various industries, all under 4.5%.

TRIN site

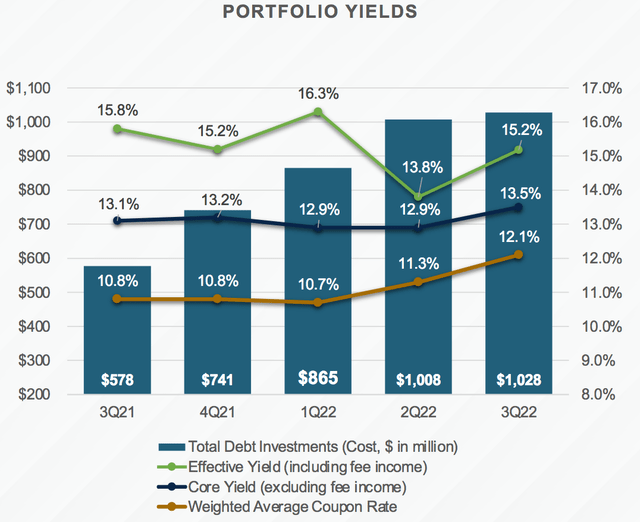

Management has grown the debt portfolio by 78% over the past year, to $1.028B. The debt portfolio yield hit a high of 16.3% in Q1 ’22, dropping to 13.8% in Q2 ’22, and hit 15.2% in Q3 ’22, with an effective coupon rate of 12.1%, as of 9/30/22:

TRIN site

Rising Rate Impact:

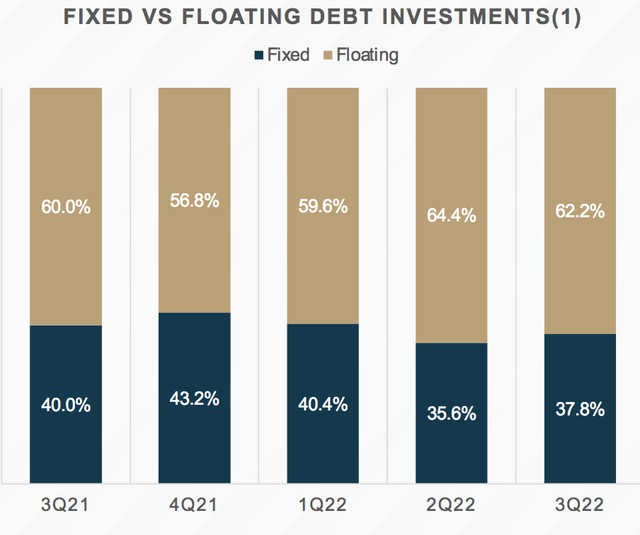

Management has increased the overall percent of floating debt investments to over 60% in Q2 and Q3 ’22, which aids TRIN’s earnings in the current rising rate environment. The floating rate percent was as low as 49% in Q2 ’21. TRIN has over 75% of its borrowings at a fixed rate.

They estimate that, for every 100 basis point increase in the prime rate adds an additional $4.8M of interest income, or $0.14/share to TRIN’s annual earnings.

TRIN site

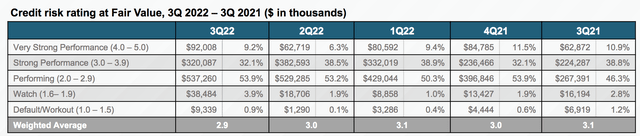

The flip side to rising rates is how well the underlying companies can handle them. As of 9/30/22, 95% of TRIN’s holdings were in the top 3 tiers. The 2 lowest tiers increased to 4.8%, $48M, vs. 4%, $23M, in Q3 ’21.

On October 27, one of TRIN’s holdings, Core Scientific, one of the largest publicly-traded crypto mining companies in the U.S., filed an 8-K announcing that its operating performance and liquidity had been severely impacted.

Core Scientific was current on its payments to Trinity through October. TRIN’s management placed the financing to Core Scientific on non-accrual effective November 1. TRIN’s investment in Core Scientific, collateralized by critical computing equipment, has a cost basis of $24M and a fair value of $19.4M.

TRIN holds equipment finance facilities with three public companies in the digital asset space: Core Scientific, Hut 8 Mining, and CleanSpark. As of 9/30/22, these financings represented $65M, less than 6% of TRIN’s total investments on a cost basis and $60M on a fair value basis.

TRIN site

Earnings:

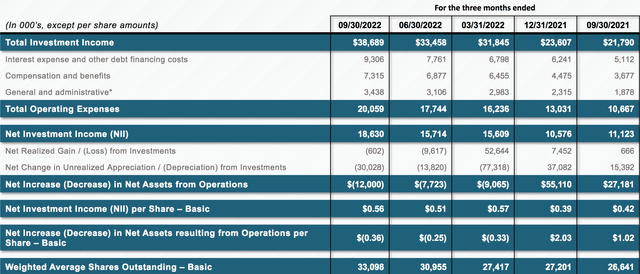

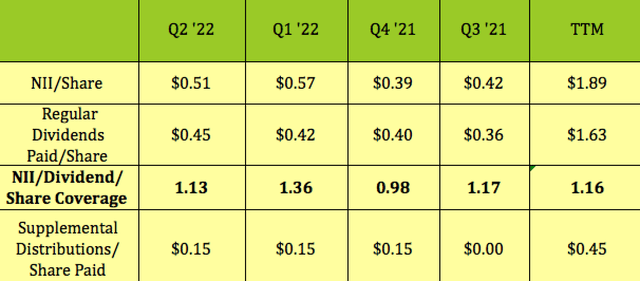

Q3 net investment income increased by 19% from Q2 ’22 to a record $18.6M. NII per share of $0.56 for Q3 represents a $0.05 increase from the prior quarter and a 124% coverage on TRIN’s core dividend.

TRIN site

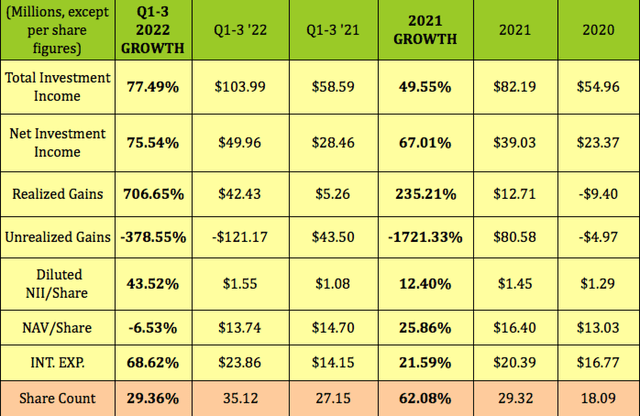

TRIN has had major growth over the past seven quarters. You’d expect big growth from a newly minted public entity, but, given the increasingly challenging and volatile market, TRIN’s results look impressive. Total Investment Income rose 77%, and NII grew 75% in Q1-3 ’22.

On the negative side, there has been a lot of share dilution – management has raised capital via share offerings, diluting the share count by 62% in 2021, and by 22% so far in 2022.

Even with that dilution, NII/share still rose 44% in Q1-3 ’22, and 12% in 2021. With the larger investment portfolio has come much higher Interest expense, which rose ~69% so far in 2022, ~22% in 2021.

Hidden Dividend Stocks Plus

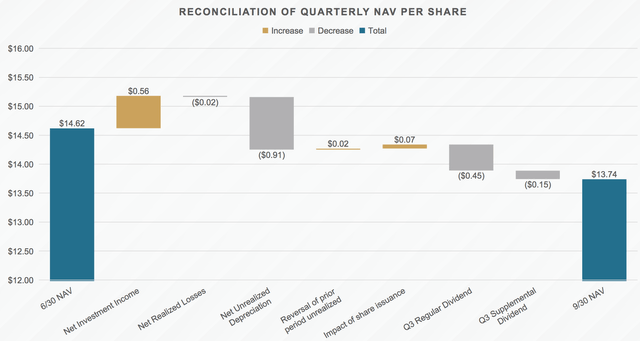

TRIN’s NAV/share was $14.62 as of 6/30/22. There was -$.91 in unrealized depreciation, and a total of $.60 in quarterly dividends, vs. $.56/share in NII, and $.09/share in miscellaneous items, leading to $13.74/share NAV as of 9/30/22. A lower Q3 ’22 NAV/share is a trend we’re seeing in general in the BDC industry, due to unrealized depreciation in Q3 ’22.

TRIN site

New Business:

Management originated $128M in new commitments, and funded $94M across 22 portfolio companies during the third quarter.

TRIN entered into an agreement in early December, to co-manage a newly formed joint venture, the i40 JV, with certain funds and accounts managed by a specialist credit manager with over $5B of assets under management. The JV will invest in loans and equipment financings to growth-stage companies that have been originated by Trinity.

The initial capital commitment to the JV is $171.4 million, consisting of a $21.4 million commitment from Trinity and a $150.0 million commitment from certain funds and accounts managed by the specialist credit manager. The JV intends to enter into a credit facility to leverage its assets in order to enhance returns and create additional deployment capacity.

Dividends:

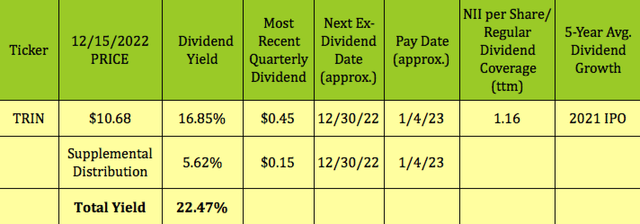

TRIN most recently paid a $.45 regular and a $.15 supplemental dividend in October. Management says it intends to pay another $.15 supplemental dividend based upon Q4 ’22 earnings.

At its 12/15/22 $10.68 price, TRIN’s regular $.45 dividend yields 16.85%, and its $.15 supplemental dividend adds an additional 5.62%, for a total of 22.47%.

Hidden Dividend Stocks Plus

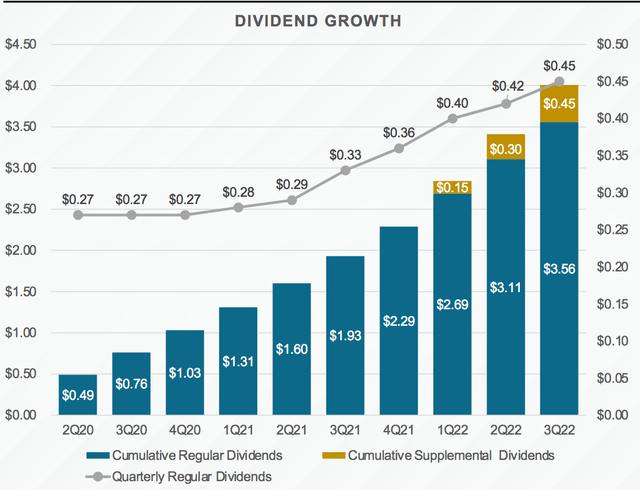

Management has increased the base dividend for six straight quarters, starting at $.28 in Q1 ’21, and rising to $.45/share in Q3 ’22.NII/Share covered the regular quarterly distributions by 1.13X in Q2 ’22, with a trailing average of 1.16X. Trinity’s estimated spillover income as of 9/30/22 was $67M, ~$1.90/share, which allows it to continue supplementing its core dividend.

Hidden Dividend Stocks Plus

TRIN has paid out a total of $3.56/share in regular dividends, and $.45 in supplemental dividends, for a total of $4.01 since Q2 2020:

TRIN site

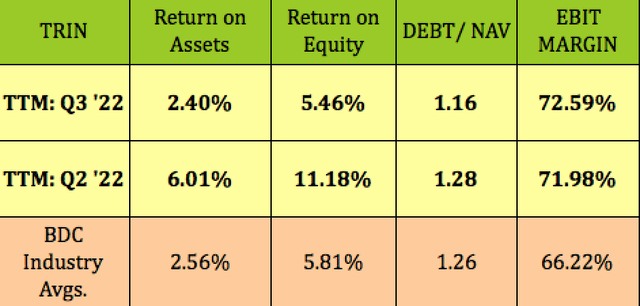

Profitability and Leverage:

TRIN’s trailing Net Income, which includes non-cash depreciation, was hit by a -$28.78M total in Q3 ’22, which decreased ROA and ROE to much lower levels in Q3 ’22. Debt/NAV leverage was a bit lower in Q3 ’22, at 1.16X, while EBIT Margin was up slightly, and above the BDC industry average:

Hidden Dividend Stocks Plus

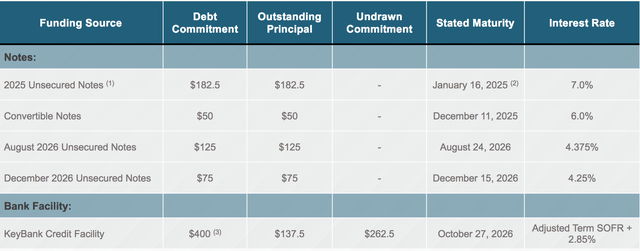

Debt and Liquidity:

TRIN had $247M in liquidity, as of 9/30/22, comprised of ~$213M of undrawn capacity under its credit facility and $34M in unrestricted cash and cash equivalents.

Its debt ladder looks good, with no maturities until January 2025, when $182.5M in unsecured notes come due. Its $400M credit facility matures in October 2026, giving management plenty of time to refinance.

TRIN site

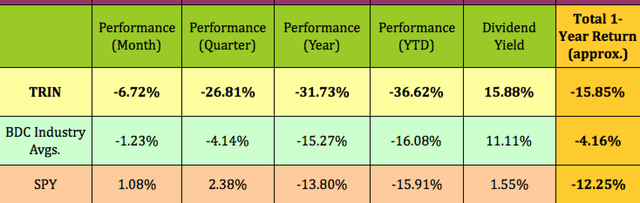

Performance:

Mr. Market has definitely given TRIN the cold shoulder over the past year – TRIN has lagged the BDC industry and the S&P 500 by wide margins over the past month, quarter, year, and year to date. TRIN’s ~1-year total return also lagged its industry average and the S&P.

TRIN’s crypto exposure has spooked the market, even though it’s a relatively small amount of its total exposure. The share dilution also didn’t help.

Hidden Dividend Stocks Plus

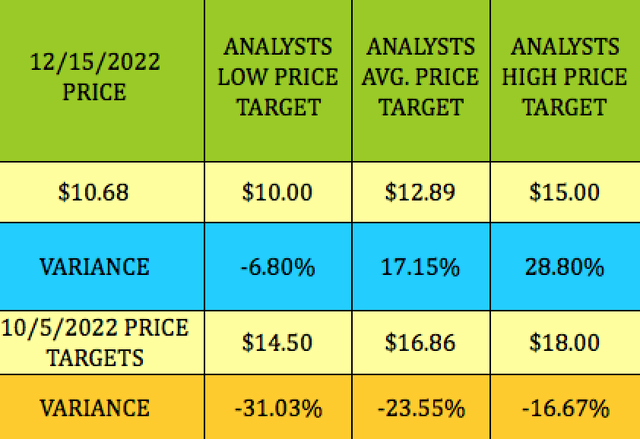

Analysts’ Targets and Downgrades:

Analysts have gotten into the act – TRIN received three downgrades in October and November from Susquehanna, Keefe Bruyette, and Compass Point.

Analysts’ price targets crashed since our last article on TRTN in early October, with the lowest target falling -31%, the average target down -23.5%, and the highest target falling by -16.7%.

At $10.68, TRTN is ~7% above the current $10.00 lowest target, 17% below the $12.89 average price target, and ~29% below the $15.00 highest target.

Hidden Dividend Stocks Plus

Valuations:

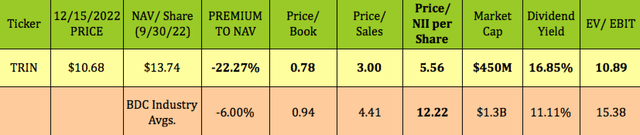

Those downgrades and market skepticism have led to a 22% discount to NAV/share for TRIN, vs. the BDC average discount of 6%.

TRIN’s trailing earnings multiple, price/NII, is less than 50% of the BDC average valuation, at 5.56X vs. 12.22X. Its EV/EBIT of 10.89X is also much lower than the 15.38X BDC industry average. Meanwhile, TRIN has a base yield of nearly 17%, vs. the 11% BDC average.

Hidden Dividend Stocks Plus

Parting Thoughts:

Another pressure on some BDCs, including TRIN, is that it has been a tough overall VC market this year – the estimated VC deal count in Q3 2022 was the lowest since Q4 of 2020.

Will TRIN continue to be punished by the market for its crypto exposure and its share dilution? No one knows, but at this point, TRIN has ample liquidity, no near term debt maturities, and looks very undervalued.

We rate TRIN as a contrarian, speculative BUY. Don’t bet the ranch on TRIN, but patient income investors may be rewarded over the long term.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.