Energy Transfer: Potential 40% Upside With Limited Risk (NYSE:ET)

CHUNYIP WONG

Throughout 2022, Energy Transfer (NYSE:ET) has been greatly benefitting from a favorable environment that rewarded most of the energy stocks. The company managed to report record profits in the last few months, its share price recently reached new highs and despite a slight depreciation that it has experienced lately there are still several catalysts that could help the business continue to create additional shareholder value in years to come.

One such catalyst is the potential expansion into the international export business. While Energy Transfer has been one of the most well-known natural gas midstream operators in the U.S., the potential of becoming a supplier of LNG to external markets is opening a unique opportunity for the company to greatly benefit from the tight natural gas market. Let’s not forget that the Russian invasion of Ukraine earlier this year began to reshape global energy markets, and as Russian natural gas supplies leave the market due to logistical constraints and geopolitical issues, now is a great time for Energy Transfer to extend its horizons and once again use the favorable environment to reward its shareholders even more.

Tight Natural Gas Market Favors Energy Stocks

Back in June and July, I heavily covered the natural gas market and even wrote a bullish article on Energy Transfer in which I highlighted the developments that could help its shares to appreciate in the short to near term. Since that time, the company’s stock is up ~19% and there is every reason to believe that there’s even more room for growth due to the rising demand for natural gas both in the U.S. and on the international markets.

If we go through the company’s latest earnings results, we’ll see that despite the earnings miss, Energy Transfer’s revenue of $22.94 billion in Q3 was nevertheless up 37.6% Y/Y, while its adjusted EBITDA was $3.09 billion, up from $2.58 billion a year ago. Thanks to such a strong performance, the company handed $1.58 billion in distributable cash flow to investors, up from $1.31 billion a year ago, which indicates that the demand for natural gas remained high during the quarter despite the relatively high record prices.

Going forward, one of the biggest domestic growth catalysts for Energy Transfer is the relatively high re-contracting rates for its midstream business, which would more than likely help the company to continue to generate record returns. Even though the prices for natural gas in the U.S. slightly decreased from their recent highs, they nevertheless continue to be above recent historical averages as a portion of American supplies are going for exports to meet the rising global demand, which prevents a total collapse of domestic prices. The fact that Energy Transfer’s interstate and intrastate transportation volumes were up by double-digits and set new records in Q3 indicates that the domestic demand is unlikely to go away anytime soon while the tight global market is more than likely to continue to balance the price.

Thanks to this, Energy Transfer has already recently increased its dividends, while at the same time it has all the chances to meet its target leverage ratio of 4.0x-4.5x debt-to-EBITDA over time due to the favorable conditions that are likely to remain for a while.

Therefore, I think it’s safe to say that the street’s consensus price target of $16.31 per Energy Transfer share, which indicates an upside of over 40%, is justified given the latest developments. After all, the company’s management has already increased the full-year guidance, which is a sign that the business is more than likely to close the year on a high note and its stock has additional room for growth from the current levels.

Energy Transfer’s Consensus Price Target (Seeking Alpha)

An Upcoming International Opportunity

Note: mmt refers to million metric tons, bcm refers to billion cubic meters.

As Energy Transfer’s midstream business continues to generate record returns, the company is actively exploring external opportunities that could help it use the global shortage of natural gas supplies to its advantage.

In the foreseeable future, Energy Transfer is planning to build an LNG export facility on top of its existing Lake Charles LNG import and regasification plant on the U.S. Gulf Coast in Louisiana. The company already has all the permits necessary to build the facility on the brownfield land that it also owns and back in August, it was already announced that Energy Transfer has signed a 20-year agreement with Shell (SHEL) to supply 2.1 mmt of LNG per year. During the latest conference call, the management stated that to date it has signed six such agreements to supply a total of 8 mmt of LNG per year to global markets.

As of today, Energy Transfer expects to make a final investment decision on the project by the end of Q1’23. As of now, it’s looking for additional partners to finance the project and previously it already stated that it’s open to selling down up to 75% interest in the project to third parties in order to not overstretch its own finances. If the decision is made, the first deliveries of LNG from the new facility will begin in 2026.

While some might think that due to such a long timeframe it makes no sense to finance the project, I tend to disagree. First of all, due to Russia’s invasion of Ukraine, Europe and the countries of the European Union in particular started the process of decoupling from Russia. In addition to the embargo on Russian oil, the EU has managed to significantly decrease the imports of Russian natural gas from 40% before the war to only 9% in September without facing shortages and fully filling its storage. This was possible mostly thanks to the increase in imports of LNG from other parties and state actors. By the end of next year, Europe is expected to increase its LNG import capacity by an additional 50 bcm.

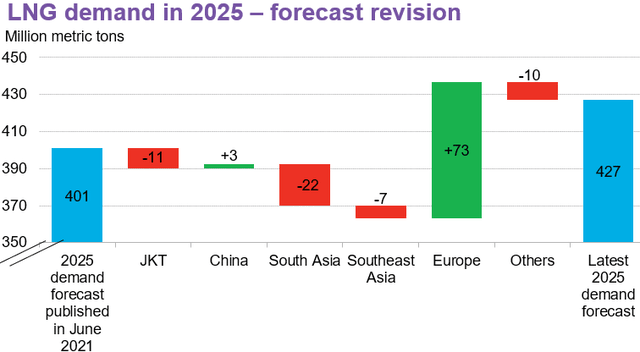

At the same time, Bloomberg in its revised forecast believes that the global annual demand for LNG would be 427 mmt in 2025, above its pre-war prediction of 401 mmt due to the disruptions caused by the Russo-Ukrainian war.

Forecast for the LNG Demand for 2025 (Bloomberg)

What’s also important to note is that as Europe begins to rely on LNG imports greater than before, Russia has no options on how to pivot to Asia due to various logistical constraints. The country’s state-owned natural gas provider Gazprom (OTCPK:OGZPY) expects to export a total of only ~100 bcm of natural gas this year to external markets, down 46% Y/Y, while the situation is likely to worsen even more in 2023 due to the inability to transfer natural gas through the system of Nord Stream pipelines.

Considering that China’s demand for natural gas is forecasted to reach 353 bcm this year, while in 2021 Russia exported a total of only 16.4 bcm of natural gas to Beijing, it becomes obvious that the supply of LNG from other parties would continue to cover a significant portion of China’s demand for the foreseeable future. Add to this the fact that the IEA expects half of the Russian natural gas that the country exported in the past to disappear from the global market by the end of the decade and it becomes obvious that supplies of natural gas would be tight while the demand is unlikely to go anywhere away. As a result, it makes perfect sense for Energy Transfer to invest in the Lake Charles LNG export facility and benefit from the favorable natural gas environment in the long run.

Russian Natural Gas Exports in the World Energy Outlook 2022 vs. 2021 (International Energy Agency)

Risk

At this stage, there is one major risk to Energy Transfer’s bullish thesis, which is the potential return of Russian natural gas to European consumers in previous amounts. For it to happen not only does the system of Nord Stream pipelines needs to be repaired but also peace needs to return to the European continent as well. Unfortunately, that’s unlikely to happen anytime soon.

Since 2014, Russia has been constantly violating Ukraine’s sovereignty by breaking the 1994 Budapest memorandum, the 1997 Russian-Ukrainian Friendship Treaty, and the 2003 Treaty on the Ukrainian-Russia Border, which Putin himself personally signed, all of which acknowledged Ukraine’s sovereignty over its internationally recognized borders. On top of that, Moscow has also constantly violated the Minsk agreement, which was signed a few years ago to prevent Russian regular troops from capturing even more of Ukraine’s sovereign land. Considering Russia’s latest escalation by bombing critical infrastructure and leaving Ukrainian citizens without electricity, it becomes obvious that Moscow is not interested in any peace at this stage, as there are also no guarantees that it won’t break its promise once again in the future given its record of violating treaties.

However, even if somehow Russia is able to return to the European market, it’s highly unlikely that the EU would once again begin to over-rely on the imports of natural gas from Moscow given the endless list of natural gas disputes that the latter has initiated over the recent decades. Therefore, there’s a high probability that Energy Transfer would continue to generate record returns amidst the loss of the bulk of Russian supplies.

The Bottom Line

As the international natural gas market is expected to remain tight amid declining supply and an ever-rising demand, Energy Transfer has a unique opportunity to continue to generate great returns for years to come. By operating in North America, which is a net exporter of energy and natural gas, in particular, the company has all the chances to supply net importers of natural gas such as Southeast Asia and potentially Europe for decades to come thanks to its favorable geographic location and a dedicated infrastructure that could meet the rising demand.

While there’s a small possibility that in the end, the final investment decision on the expansion of the Lake Charles LNG project could be negative, I don’t think that that’s going to be the case given the fact that the demand in other parts of the world is highly unlikely to drop potentially until the end of the decade.

At the same time, while the company’s management is looking for international growth opportunities, Energy Transfer’s midstream operations are more than likely to continue to generate excess returns and create additional shareholder value in the long run in part thanks to the favorable environment for natural gas businesses in North America as well.