3 Dividend Stocks For The Oil Price Supercycle

Bet_Noire

Introduction

It’s time to do two important things. First, we’ll discuss oil market fundamentals. Most of my readers know that I have covered oil supply worries a lot since 2020. These worries are a major reason why oil did so well this year. These supply worries were mainly based on political reasons like forced net-zero initiatives. In this article, we’ll talk about these things as well. However, we’ll also talk about non-political reasons to keep supply low, which include strategic and valuation-related reasons that keep oil executives from supporting production growth.

Second, I will give you three dividend stocks that I’m buying as oil is hit by demand fears. With oil prices retreating due to significant economic weakness, I’m very closely monitoring the best-of-breed oil income stocks as I continue to believe in a long-term bull market for energy equities.

In this article, I will give you some of the best when it comes to earning income while waiting for capital gains.

So, there’s a lot to discuss. Let’s get to it!

What’s Up With Oil?

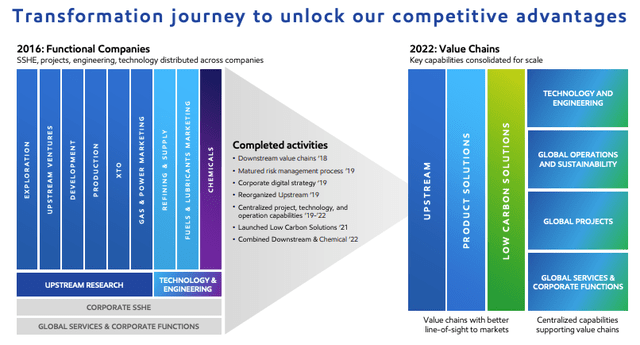

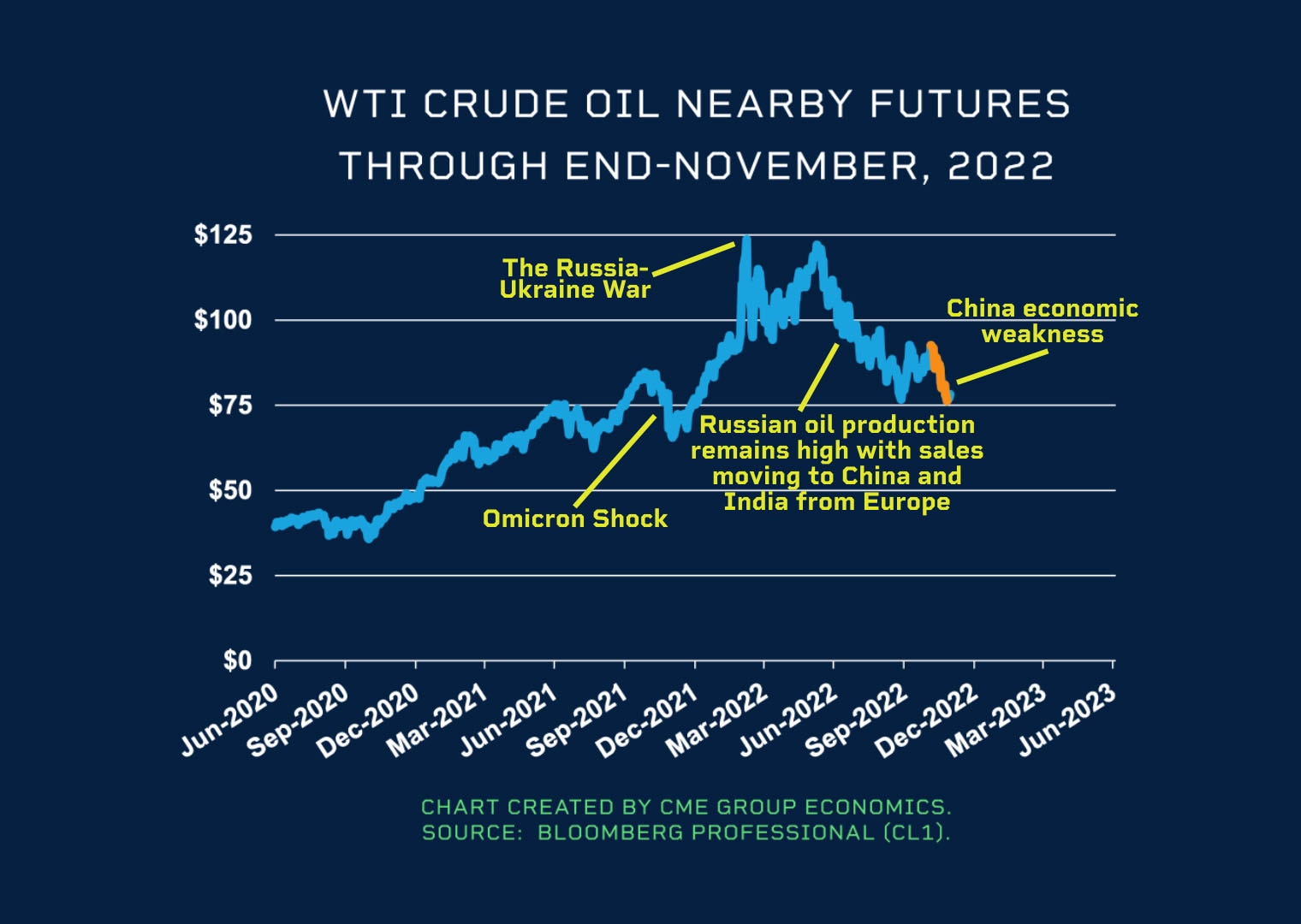

What’s going on with oil prices? WTI crude oil is now trading at $72 after hitting $125 shortly after Russian troops moved into Ukraine earlier this year.

CME Group

Oil bears are currently making the case that we’re going back to “normal”. The spike in oil prices was caused by the Ukraine war, lower energy demand is offsetting supply weakness, and the long-term inflation call (let alone the commodity supercycle) is dead.

I disagree with that for a number of reasons that we’ll all discuss in this article. However, I do not disagree with the demand weakness thesis. While the CME Group (CME) chart above mentions China’s economic weakness, I would make the case that global (instead of regional) economic weakness is what’s hurting demand.

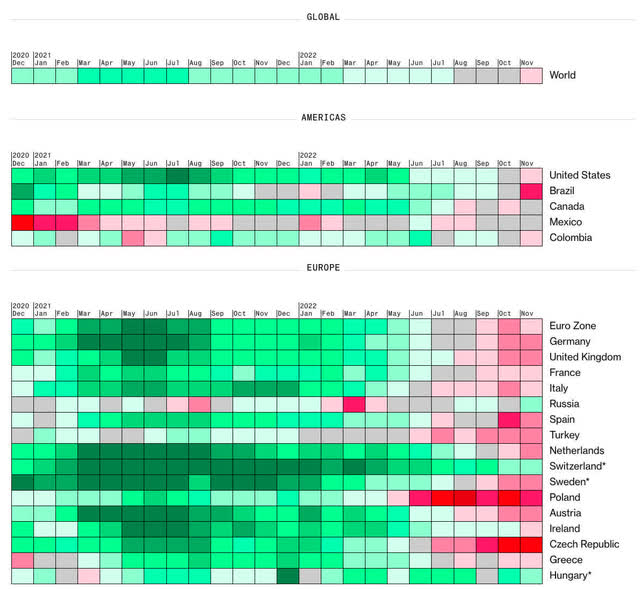

Looking at the Global Purchasing Manager Index heatmap below, global economic growth is now in contraction. In this case, weakness is everywhere as I included a detailed overview of both the Americas and Europe. While some nations are still growing, all major economies are contracting.

Bloomberg – Global PMI Heatmap

I even think there’s a case to be made that China was forced to ease its COVID restrictions as the pressure on its economy was simply too high, which would temporarily weaken the oil bull case.

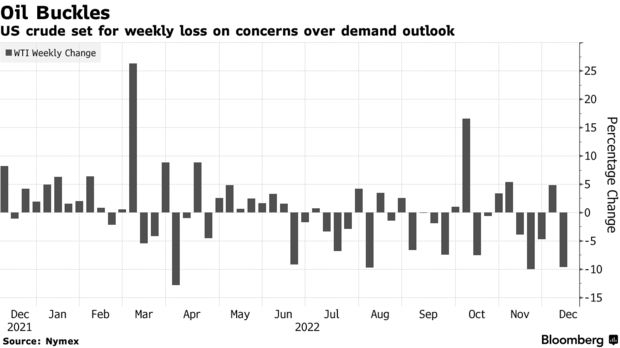

Saudi Arabia, a major exporter of crude oil lowered its prices for Asia (its core market) earlier this month. It came just a few days before oil prices tumbled roughly 10% in a single week.

Bloomberg

While oil is still at elevated levels (the same goes for the aforementioned Saudi Arabian contract prices), the chatter of demand fears is growing.

Crude is now on track for its first back-to-back quarterly decline since mid-2019 on a souring economic outlook as central banks tighten monetary policy, though Treasury Secretary Janet Yellen still sees the US avoiding a recession. Traders are also assessing the fallout from a price cap on Russian oil, which has led to a jam of tankers in Turkish waters due to a standoff over insurance.

As most readers may know, I have significant oil exposure. In my dividend portfolio, I have close to 20% energy exposure (Exxon Mobil (XOM), Chevron (CVX), and Valero Energy (VLO)). I am also overweight oil in other portfolios.

To be completely honest, I’m not enjoying it when my stocks fall. However, I am far from worried. After all, I believe in a long-term uptrend in oil prices. It was obvious that this would come with the occasional bump in the road. If anything, it allows me to buy more energy at better prices (and better yields for income!).

However, before I give you the stocks that I’m closely watching, let’s dive into reasons why I do not believe that the oil supply will come back roaring.

Three Major Reasons Why I Remain An Oil Bull

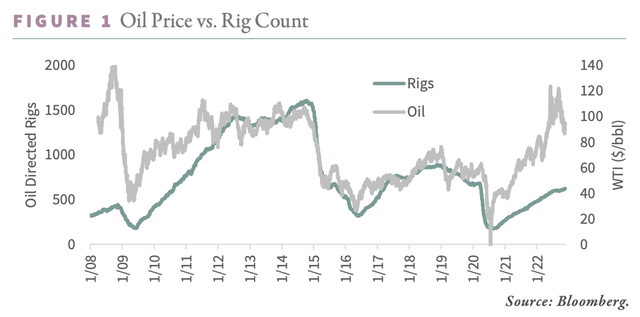

There are many ways to show oil price growth. One of them is the number of oil rigs active in the United States. That number peaked in 2014 when oil prices were hovering close to $100. The rig count made a lower high in 2018 before global economic growth started to slow. Now, the rig count is two years into its post-pandemic recovery. However, we’re still far away from 2018 levels. Yet, oil is trading at prices last seen when the rig count was above 1,500!

Bloomberg, Via Goehring & Rozencwajg

There are three major reasons that explain this development.

Reason 1: Politicians

Reason number one is a reason we discussed a lot this year. While I try to avoid getting political as much as possible, these articles often caused heated political debates in the comment section.

Political reasons are the most obvious. We’re now in a situation where oil companies prefer to protect their own business over boosting production. Bear in mind, rapid production growth boosted by shale output caused significant oil price declines in both 2014/2015 and 2020 when demand started to weaken.

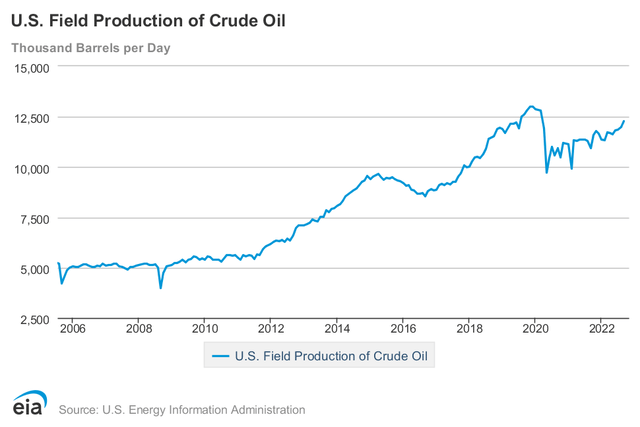

More than two years after the pandemic bottom, oil production is still below its peak in the United States. That’s the slowest recovery since the start of the shale revolution.

Energy Information Administration

Most governments in developed nations are pushing hard for strict environmental standards. They are slow to approve new drilling permits (and leases), very supportive of renewable energy when it comes to subsidies, and aggressive when it comes to punishing oil and gas companies with windfall taxes.

This is spilling over to large corporations like insurance giants who are not willing to insure large fossil fuel projects. That’s absolutely devastating for trust in the industry, which makes stronger supply growth even more unlikely.

Some politicians, even powerful people like President Biden are saying the quiet part out loud. They want oil drilling to end.

In such a scenario, it would be absolutely stupid for oil companies to maintain strong production growth as it would just flood the market with more oil. Lower demand would amplify the downtrend in oil prices.

Hence, as long as there is a global movement that does not recognize that affordable and reliable fossil fuels are part of the energy transition, we will not see any willingness from oil companies to significantly improve supply.

I cannot blame them.

Reason 2: Investors

This is the point where I need to give credit to Goehring & Rozencwajg who brought up this issue in their latest quarterly report.

It’s a highly interesting and important issue that I have not seen anywhere else.

Essentially, investors are also keeping oil companies from accelerating production. This happens despite massive outperformance and low valuations.

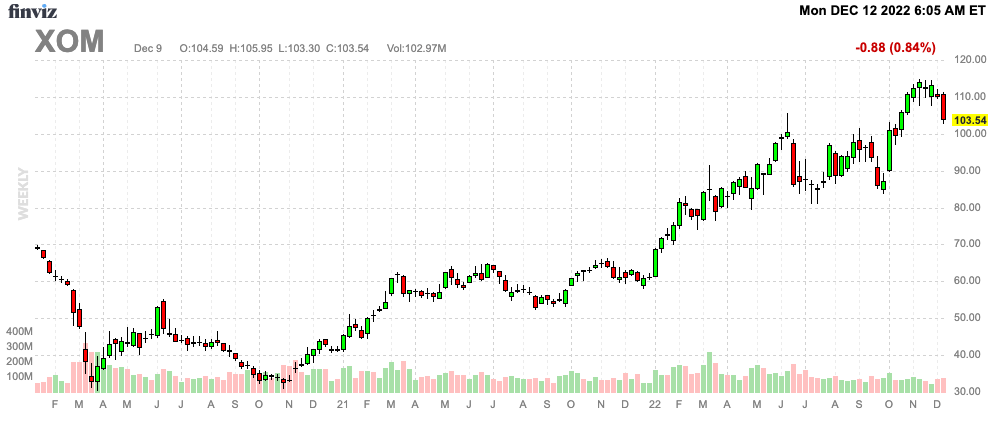

For example, Exxon Mobil is up 70% year-to-date. That’s almost 90 points better than the S&P 500. Meanwhile, it’s trading at less than 5x EBITDA. One of the lowest valuations since 2014.

A low valuation is obviously a good thing.

However, there’s another benefit. A low valuation is supportive of higher shareholder distributions instead of boosting production.

What Goehring & Rozencwajg explains is that companies in the exploration and production (oil production) sector are trading at 0.8x net-debt adjusted PV-10 per share. The PV-10 value is something the SEC requires oil companies to publish. Companies must list their proven reserves and estimate the discounted cash flows using a given oil and gas price. Removing net debt and dividing by the share count results in the net-debt adjusted PV-10 per share – sometimes referred to as NAV.

In the past, investors valued energy companies using multiples of the NAV to reflect future development potential not yet reflected in the current reserve number.

For the first time in a very long time, companies are now trading at a discount to this NAV value.

Now, G&R gives an interesting example. Let’s assume a company is trading at 0.8x its net-debt adjusted PV-10 per share. The company has $1 billion of PV-10, 10 million shares, and $200 million of net debt. The CEO can choose between spending $100 million on new drilling or buying back shares.

If they can find and develop energy reserves for $15 per barrel, the company will book 6.7 million barrels of new proven reserves for its $100 million investments. At $80 crude, that investment could generate $130 million in new PV-10. However, because the market values the company at only 0.8x NAV, the ending stock price would remain unchanged.

If the company were to repurchase shares, the share count would fall by nearly 20%. Adjusting for net debt and dividing by the new lower share count implies a stock appreciation of 5%.

In other words, even though drilling new wells would result in a high rate of return for the company, the CEO would be better off just returning cash. On top of that, he wouldn’t have to touch his best-undrilled wells. That’s a win-win for shareholders and the company. It’s a loss for everyone relying on affordable energy.

On a side note, we can assume that this is why Continental Resources (it used to trade under the CLR ticker) has gone private again.

This trend won’t change unless investors start to redirect capital back into the energy industry.

Related to this is reason 3.

Reason 3: Strategy

One of the reasons why oil production growth is falling is the fact that producers in basins like Eagle Ford and Bakken have drilled most of their best wells. In the past few years, a number of companies run into trouble after running out of high-quality inventory (Oasis Petroleum, Whiting Petroleum, and Cabot).

Companies need to be careful when it comes to Tier 1 (the best assets) inventory management. Estimates are that in 2018, 28% of Tier 1 wells were drilled in the Permian.

In 2022, that number has likely breached 60%.

Stretching the best assets is key when it comes to protecting the business and shareholder wealth. To quote G&R:

[…] you can easily see why oil company executives would keep the pace of development subdued. On the one hand, you could increase activity, risk attracting the ire of policymakers, have your stock price go down, and deplete your irreplaceable asset. On the other hand, you could return capital to shareholders, stay under the radar of policymakers, have the market reward your capital discipline, and keep your Tier 1 assets for a later time when the market will better value them.

What I Expect To Happen To Oil

These predictions are tricky. However, I’m not trying to predict weekly oil closing prices. What I care about is the bigger picture. After all, I’m trying to gain long-term capital gains and income (dividends). I’m not actively trading oil and oil drillers.

Right now, oil is in a tough spot. Demand worries are a big issue. Oil could fall to $60. Heck, it could fall to $50 if things get really ugly.

However, at none of these points would any oil company I recommended in 2021 or 2022 run into any issues, which is why I haven’t been worried for a single second. If anything, it would allow us to buy more as I expect the oil uptrend to remain valid for many years to come.

We’re in a new era of energy. Oil supply growth isn’t coming back anytime soon in my view. Especially not if oil companies have to go through another oil bear market due to demand!

I believe that oil will rebound close to the second half of 2023. At that point, higher demand will dominate again. Supply will still be subdued. Hence, I expect a higher oil price average in the years ahead of at least $80-$90 with spikes to more than $110.

Now, let me show you three stocks that I believe are terrific investments for the long run.

Bear in mind that I care for income and capital gains. Also, I had to limit this article to three stocks to prevent it from getting too long. There are also other good stocks out there. We can discuss these in the comment section and in future articles.

Note that I usually highlight the yield of each stock in the sub-title. I’m not doing that this time as most oil companies pay a variable dividend based on the oil price. So, when I put in “variable yield”, I’m suggesting that the dividend is driven by a variable dividend policy. Technically speaking, all dividends are variable, but you get my point.

So, let’s get to number one.

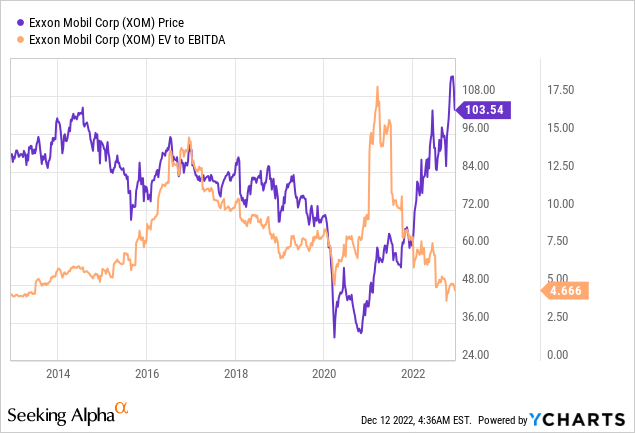

1. Pioneer Natural Resources (PXD) – Variable Yield

FINVIZ

While I have been a fan of PXD for a while, it has become one of my all-time favorite oil stocks. I own the stock and I have given it to everyone I advise. It’s one of the first stocks we’ll aggressively buy once the demand side of the economy strengthens.

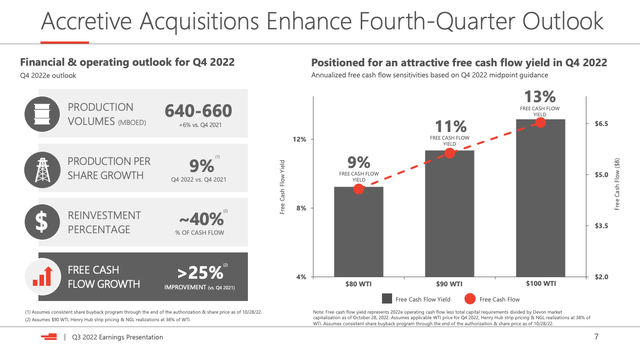

With a market cap of $50.9 billion, the Texas-based driller is one of America’s largest producers. In 4Q22, the company is expected to produce at least 655 thousand barrels of oil equivalent per day. Roughly half of that will be crude oil.

With major productions in the Midland Basin, the company truly has everything a shareholder can hope for.

- The company has more than 20 years’ worth of inventory. This is by far the biggest number among its peers. This reduces the need for M&A to maintain production capacity. It’s something I find really important.

- The company has not hedged any production. While this increases the downside, it has a healthy balance sheet and very low breakeven costs. Moreover, any upside results in high free cash flow.

- The company has less than $4.0 billion in net debt and no debt maturities larger than $1 billion until 2025. The net debt-to-book capitalization is 15%. It also has $2 billion worth of undrawn credit.

- Pioneer is free cash flow breakeven at less than $40 per barrel WTI with production costs in the $12-00 to $13.50 per barrel of oil equivalent range.

- The company has a strong focus on shareholders. The company pays a relatively low base dividend. However, it has a variable dividend policy. The company has a “deal” with its shareholders to return up to 75% of post-base dividend FCF to shareholders using the variable dividend. On top of that, it can use buybacks to (indirectly) distribute additional cash.

In other words, the company pays up to 80% of its free cash flow to shareholders. It doesn’t need the money for other purposes. What this means is that a high oil price equals a high dividend. A lower oil price means a lower dividend.

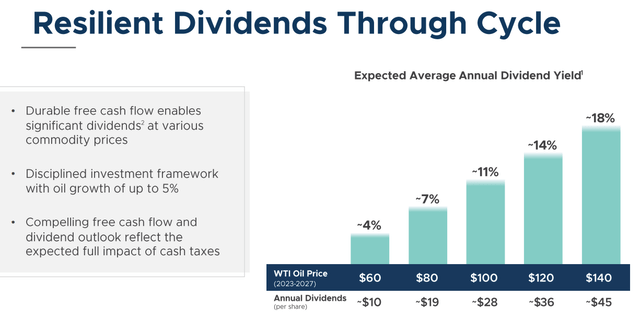

Thanks to PXD, we have numbers to indicate what these dividends might look like. At $60 WTI, investors might (there are never any guarantees) receive $10 in annual dividends. That’s 5% of the current share price. That’s a decent yield, but nothing wild. However, as I expect oil prices to have a much higher long-term average, things get interesting again. At $80 WTI, the dividend almost doubles, indicating a yield close to 10%. At anything above that, we’re taking serious dividends with sky-high yields.

Stock number two is similar to PXD.

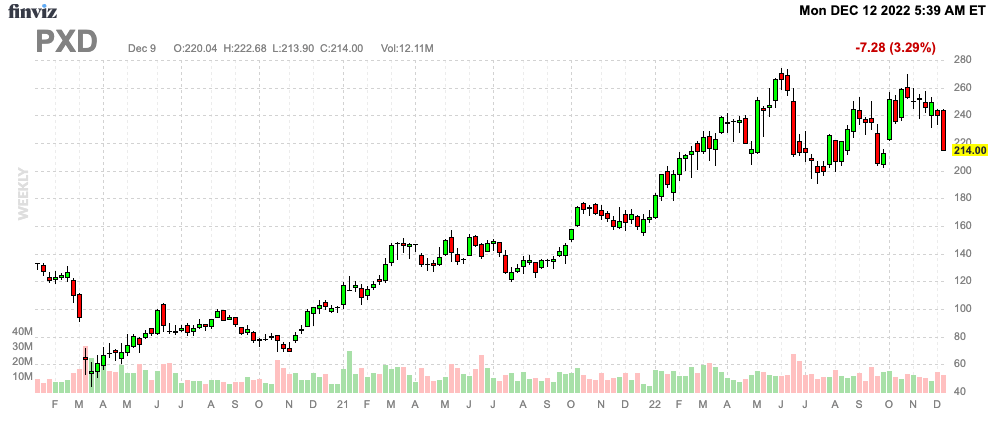

2. Devon Energy (DVN) – Variable Yield

FINVIZ

Yes, obviously, Devon Energy is a part of this article. Not just because I love this company, but also because I did get some requests from people who own DVN shares.

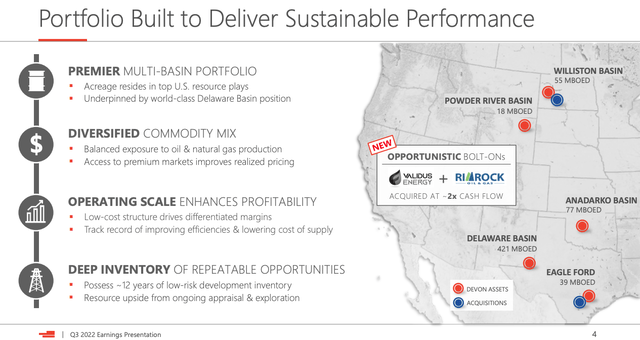

With a market cap of $39.0 billion, Devon is smaller than Pioneer, yet it’s still one of America’s onshore giants. Headquartered in Oklahoma City, the company has onshore assets in multiple basins. The focus is on the highly profitable Delaware Basin where the company produces more than 420 thousand barrels of oil equivalent per day.

Like PXD, Devon is not a company that will eventually (in the future) be a good stock for income. No, Devon reached its balance sheet target already in 2021. Back then, it lowered its net leverage ratio to 0.8x, which is below its 1.0x target. This year, the company is expected to lower that ratio to 0.5x.

The company, which is breakeven in the low $30 WTI range (that’s one of the lowest I’ve ever seen) has hedged roughly 20% of its production, which leaves a lot of free cash flow upside.

The company has roughly 12 years’ worth of risked inventory, which means at the current activity. Its unrisked inventory is more than 20 years with appraisal and tighter spacing.

Thanks to these numbers, the company has high margins. At $80 WTI, it achieves a 9% free cash flow yield. Note that this is based on a $76 stock price. It’s currently slightly less than $60, indicating a FCF yield of roughly 11%. However, bear in mind that oil is also $10 lower, so that tends to even it out.

Just like PXD, DVN pays a fixed and variable dividend. The variable dividend is up to 50% of excess free cash flow (after the fixed dividend). Whatever is left after that is used for buybacks and debt reduction (in that order).

What this means is that given the free cash flow numbers, DVN pays a dividend similar to PXD.

Now onto number 3.

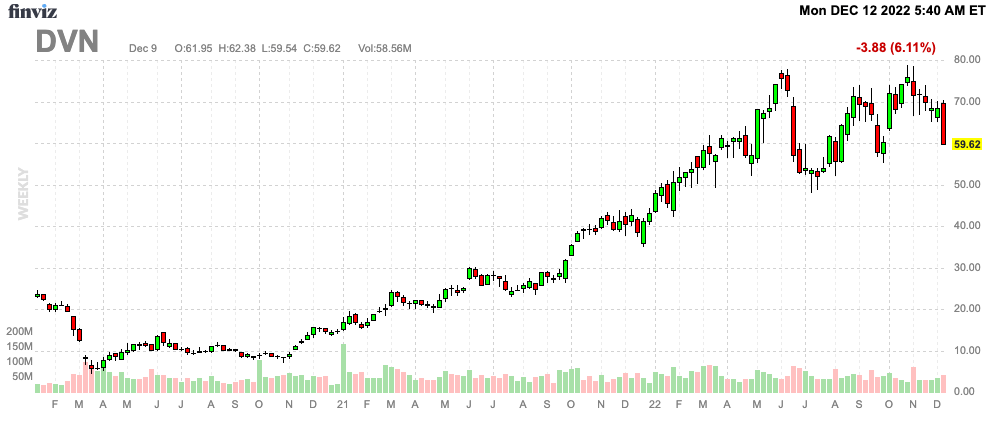

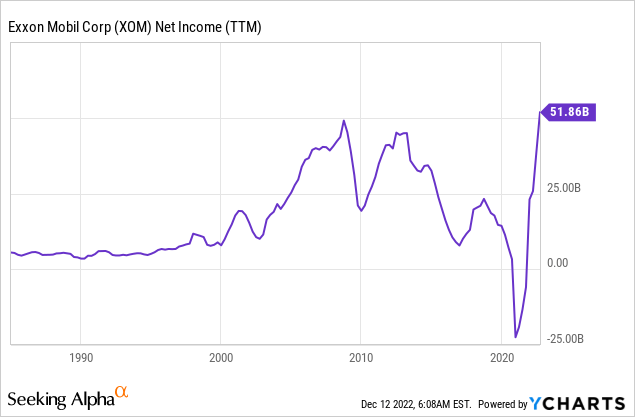

3. Exxon Mobil (XOM) – 3.5% Yield

FINVIZ

Exxon Mobil is my second-largest holding. I bought it in 2020 when the growth stock buying frenzy peaked. Back then, XOM was trading in the low $30 range and everyone hated oil. The number one discussion was whether big oil would cut dividends or not.

Exxon is different compared to PXD and DVN. Very different. While it does drill for oil and gas, it is a major operator of refineries (meaning large downstream operations) and a target of activist investors like Engine No. 1.

It also does not pay a variable dividend. Exxon currently yields just 3.5%, which is not a lot for an energy stock.

Yet, I still put Exxon on this list.

To me, Exxon is a source of income and safety. XOM is way more conservative with its cash. Its most recent dividend hike was announced on October 28, when management hiked by 3.4%. That’s a tiny hike. Especially considering how much money Exxon is making.

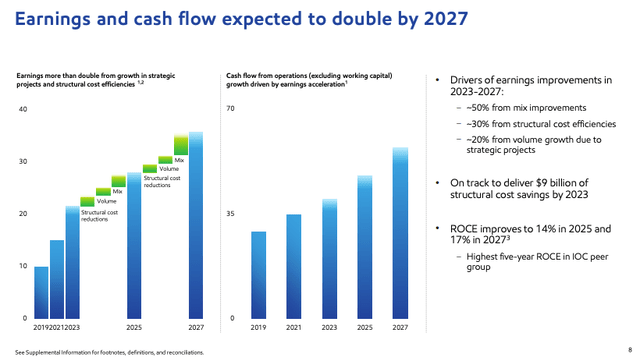

Exxon is more than an oil company. It is producing oil, chemicals, and everything related to that. In its corporate plan update earlier this month, the company once again showed the transformation of its many business segments.

Unlike smaller companies, this $426 billion market cap giant has to invest in carbon capture and other initiatives to bring down emissions (read: to satisfy ESG-focused investors).

However, the company isn’t wasting money. If anything, the company is becoming very efficient. Based on current conditions, the company aims to double earnings and cash flow by 2027! This is expected to come from product mix improvements, structural cost efficiencies, and volume growth in strategic projects.

By next year, up to $9 billion in structural cost savings are likely. That’s a huge deal.

The company expects to invest 70% of upstream CapEx in the Permian Basin, Guyana, Brazil, and LNG projects.

So, what does this mean for shareholders?

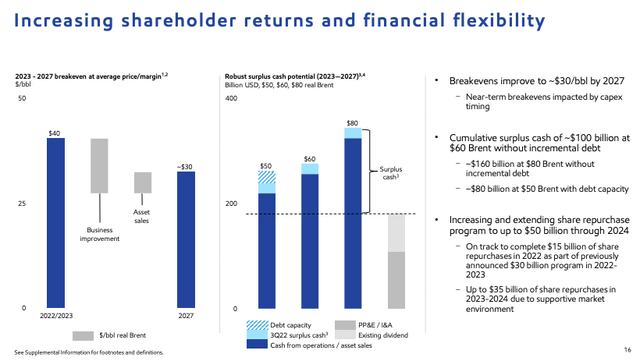

Exxon expects that breakevens improve to $30 per barrel by 2027. While it needs to be seen if that is possible due to inflation, I did not expect guidance to be that good. By then, the company expects cumulative surplus cash of at least $100 billion at $60 Brent (that’s conservative).

At $80 Brent, the company could be looking at $160 billion in cumulative cash savings. At $50 Brent, that number is still $80 billion.

On top of what I expect to be accelerating dividend growth, the company will use buybacks to indirectly distribute cash.

Through 2024, Exxon aims to distribute $50 billion via buybacks! That’s 12% of its current market cap.

While the current dividend yield is somewhat low, I expect stronger dividend growth, high buybacks, and long-term capital gains outperformance versus the S&P 500.

While XOM is a bit more boring than the first two stocks we discussed, I like this giant a lot as it comes with lower volatility and more dividend consistency.

Now, onto my final thoughts.

Takeaway

As we get closer to the end of the year, I wanted to use this article to explain what I expect going forward and what stocks can help you benefit from what I believe will be a (volatile!) long-term uptrend in oil prices.

While oil supply is currently not in the focus anymore due to demand weakness, I expect that to change. oil companies are not expected to boost output due to at least three major reasons discussed in this article.

The pressure from politicians, investors, and strategists is too high to revive the shale revolution of the past 10 years.

Hence, when demand bottoms, I expect oil prices to rebound quite significantly, leading to a high average oil price for the next 5-10 years.

As a result, I’m looking for stocks that deliver both capital gains and income.

In this article, I gave you three of my all-time favorites. Stocks with low breakeven prices, healthy balance sheets, and a focus on shareholder wealth.

With all of that said, I’m looking to add on stock price weakness. As I have a significant oil position, I hope to use demand weakness to add to the stocks mentioned in this article at even better prices.

Needless to say, whatever you think of my outlook, always take care of your own risk management. Note that oil and gas stocks are way more volatile and risky than your average dividend aristocrats. So please take that into account when deciding whether oil is right for you.

(Dis)agree? Let me know in the comments!