Brenntag: Trading At A 10% FCF Yield And Pursuing M&A (OTCMKTS:BNTGF)

Kannan D/iStock Editorial via Getty Images

Introduction

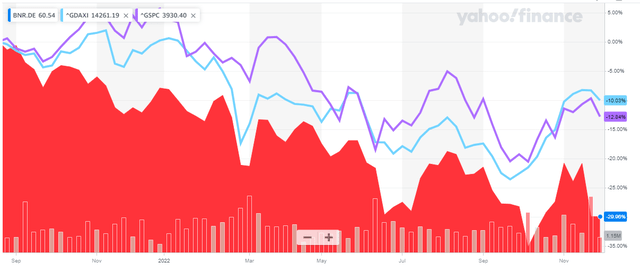

In August 2021, I mentioned I was on the sidelines and would be happy to revisit Brenntag (OTCPK:BNTGF) (OTCPK:BNTGY) at a lower share price. We’re now 15 months later and Brenntag’s share price has dropped from in excess of 86 EUR to just over 60 EUR per share. That’s a 30% drop and means the company has clearly underperformed the general markets as you can see below (the blue line is the DAX index, the purple line is the S&P performance since my previous article). And that’s why I think this could be a good time to revisit this Germany-based chemical products distributor.

Yahoo Finance

Brenntag’s primary listing is in Germany where it’s trading with BNR as ticker symbol on the Deutsche Boerse. The average daily volume in Germany is approximately 420,000 shares and this is clearly superior to any other listing. As there are 154.5M shares outstanding, the current market cap of Brenntag is just over 9.3B EUR.

The first nine months of the year are promising

In this article I’ll have a closer look at the financial performance of Brenntag, as well as how the recent M&A rumors may impact the company. For a better understanding of Brenntag’s business model I’d like to refer you to this very extensive 73 page corporate presentation which provides a very detailed overview of the company and all its aspects.

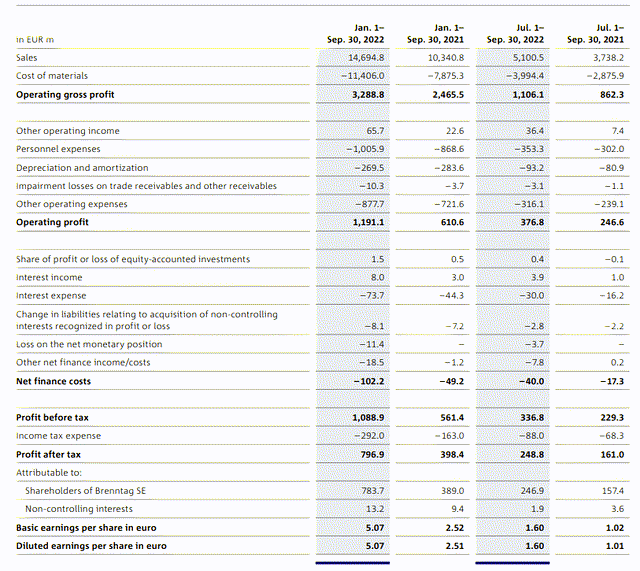

In the third quarter of this year, Brenntag reported a total revenue of 5.1B EUR, and generated an operating profit of 1.1B EUR on that revenue. This means the company has been able to protect its margins as it was able to keep its gross margins relatively stable around the 22% mark.

Brenntag Investor Relations

Some of the other operating expenses did increase at a faster pace though as for instance the personnel expenses are 15% higher than in the third quarter of last year but with an operating profit of 377M EUR, the operating margin of 7.4% is higher than the 6.6% in Q3 2021, but a bit lower than the 8.4-8.5% achieved in the first six months of the year.

But with a total net income of 1.60 EUR per share in the third quarter, which brought the 9M 2022 EPS to 5.07 EUR per share, I think shareholders of Brenntag could (and should) be pretty satisfied.

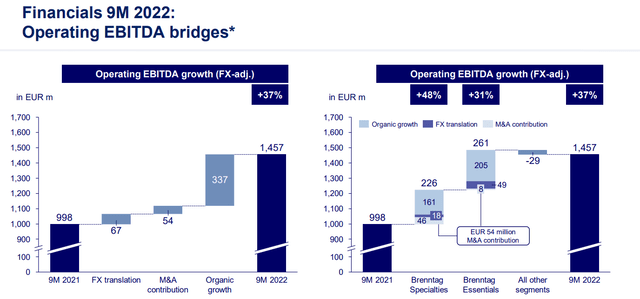

Brenntag did not provide a very detailed Q4 outlook but it did confirm it expects a full-year operating EBITDA of 1.75-1.85B EUR. The operating EBITDA in the first nine months of the year was 1.46B EUR which means the Q4 EBITDA will likely come in at around 300-400M EUR. This confirms the company’s comment the inflationary headwinds will persist in the near future.

Brenntag Investor Relations

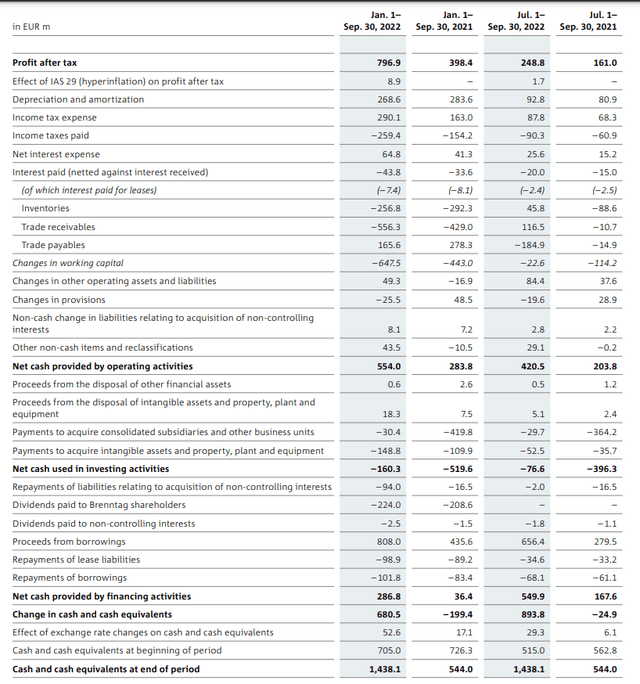

The implied Q4 EBITDA guidance now also allows us to calculate the anticipated full-year free cash flow. We know the company reported an operating cash flow of 554M EUR in the first nine months of this year, but this includes a 648M EUR investment in the working capital position and excludes 99M EUR in lease payments and almost 3M EUR in payments to non-controlling shareholders. On an adjusted basis, the operating cash flow was exactly 1B EUR in the first nine months of the year.

Brenntag Investor Relations

The total capex was 149M EUR, resulting in an adjusted free cash flow of approximately 850M EUR in the first nine months of the year. That’s a strong result, but keep in mind the final quarter of the year will be capex-heavy as Brenntag has been guiding for a full-year capex of 270M EUR, indicating the Q4 capex will be around 120M EUR.

Let’s now assume the Q4 EBITDA will be 350M EUR. We know the depreciation expenses will be around 95M EUR and the interest expenses will be around 25M EUR. This should result in a pre-tax income of 230M EUR and a net income of 169M EUR based on an average tax rate of 26.5%.

We also know the 120M EUR capex + 25M EUR in lease expenses are about 50M EUR higher than the combined depreciation and amortization expenses. This means the Q4 free cash flow result will be approximately 50MM EUR lower than the reported net income, and 110-120M EUR would be a solid and reliable Q4 free cash flow result. This would bring the full-year free cash flow result to 950M EUR, for just over 6 EUR per share. And that makes the current share price of just over 60 EUR rather attractive.

Brenntag is pursuing M&A

The chemical distribution sector is still pretty fragmented and it’s ripe for more M&A. At the end of November, Brenntag confirmed it was talking to Univar Solutions (NYSE:UNVR), a US-based competitor to discuss an acquisition of the latter. No further details have been provided yet, but a Credit Suisse (CS) analyst mentioned a $40/share acquisition would be reasonable. I tend to agree.

Univar generated a free cash flow result of in excess of $550M in the first nine months of the year, and the valuation of approximately 9 times EBITDA based on the aforementioned $40/share would represent an enterprise value of just under $9B. That’s not cheap, but there surely will be synergy benefits that could be unlocked if two major players would merge.

Brenntag also would be able to pursue this M&A deal with an all-cash bid. At $40/share, it would have to fork over $6.5B in cash and assume about $2.2B in net debt. This would increase its own net debt position from about $2B to $10.7B or approximately 10.2-10.3B EUR. Assuming the combined entities will hoard cash in 2023 and will be able to reduce their net debt by 1.2B EUR on a combined basis, the YE 2023 net debt would be ‘just’ 9.5B EUR. That’s very high in absolute numbers, but we also know the combined EBITDA (excluding synergy benefits) would exceed 2.5B EUR. The debt ratio would thus come in below 4 times EBITDA by the end of next year and further drop to less than 3 by the end of 2024 if/when the synergy benefits kick in. This is just a theoretical calculation, but the numbers indicate it should be doable.

While it’s still early days and there is no guarantee an offer will materialize, I think the combination of both companies would make sense from business perspective and a financial perspective.

Investment thesis

Brenntag’s current market cap of 9.3B EUR and enterprise value of 11.2B EUR (excluding lease debt) makes the company pretty attractively valued at just 6.5 times this year’s EBITDA (excluding lease amortizations). I would not oppose a transaction with Univar, even if that would happen at $40/share as I think the combined entity would be pretty strong.

I currently have no position in Brenntag, but I’m getting increasingly interested now the share price has dropped by about 30% since my previous article.