HYGW ETF: Double-Digit Forward Yields, Long-Term Capital Depletion

Spencer Platt

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 26th.

Several readers have asked for my thoughts on the three recently launched BlackRock BuyWrite Fixed Income ETFs. These are:

- the iShares High Yield Corporate Bond BuyWrite Strategy ETF (BATS:HYGW), which invests in high-yield corporate bonds, and sells covered calls on the same

- the iShares Investment Grade Corporate Bond BuyWrite Strategy ETF (LQDW), which invests in investment-grade corporate bonds, and sells covered calls on the same

- the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW), which invests in long-term treasuries, and sells covered calls on the same

All three funds offer investors strong, double-digit dividend yields, but extremely low potential capital gains. On a total return basis, the net effect should be positive when interest rates decline, and vice versa. Downside potential remains unchanged while upside potential is limited, so expect long-term declines in share prices and capital losses.

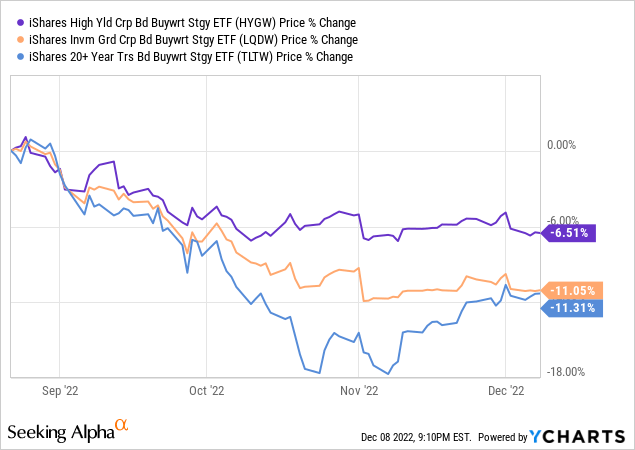

In my opinion, HYGW is the best of the bunch, as it has the lowest exposure to interest rates, and so should see comparatively low underperformance if interest rates soften.

In my opinion, TLTW is a subpar investment opportunity, due to the fund’s above-average interest rate exposure. Losses would be quite significant if rates soften, a distinct possibility if inflation continues to normalize. Too risky, for me at least.

LQDW is somewhere between HYGW and TLTW.

In my opinion, interest rates are likely to decline in 2023, as inflation continues to normalize. These funds would underperform under said conditions, so I would not be investing in any of them at the present time. Bear in mind, this is almost entirely a macro call: the funds themselves are reasonable enough.

BlackRock BuyWrite ETFs – Strategy Overview

HYGW, LQDW, and TLTW are incredibly similar funds, each of which invests in a specific bond index fund and sells covered calls on the same. For simplicity’s sake, I’ll be focusing on HYGW moving forward, but the analysis would be more or less the same for LQDW and TLTW. Exceptions are specified.

HYGW invests in high-yield corporate bonds, through an investment in the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the industry benchmark. As such, HYGW has many of the same characteristics as HYG, including high credit risk, exposure to interest rates, etc.

HYGW then sells covered calls on the entirety of its investment. HYGW’s covered call strategy is effectively equivalent to selling almost all potential capital gains for cash, almost all of which is then distributed to shareholders in the form of dividends. Potential capital losses remain unchanged.

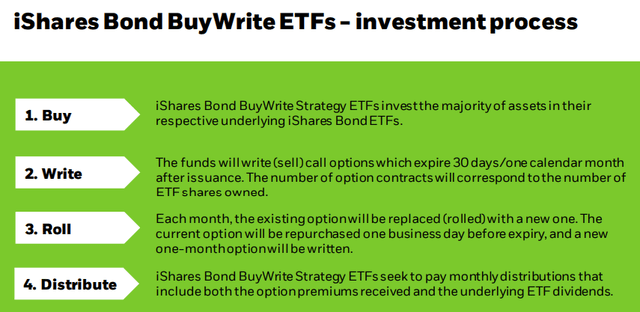

As per BlackRock, the fund’s investment process is as follows.

HYGW

Selling covered calls has important implications for these funds and their shareholders. Let’s have a look at these.

BlackRock BuyWrite ETFs – Strategy Effects

Selling covered calls significantly increase dividend yields, with HYGW’s latest monthly dividend payment equaling an annualized 22.4% dividend yield. For reference, HYG currently yields 5.0%. As the fund is quite young these are extremely rough figures, but yields are incredibly strong, that much is certain.

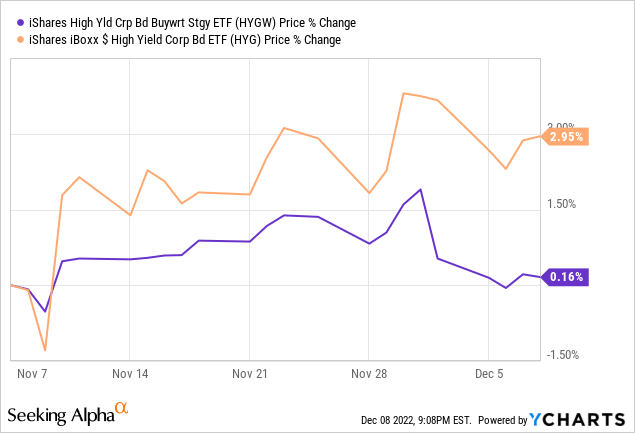

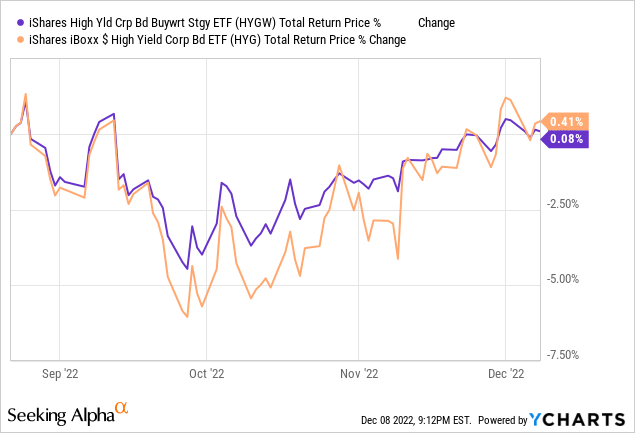

Selling covered calls significantly decreases potential capital gains, with HYGW experiencing very close to zero capital gains in the past. As an example, HYG’s share price has increased 3.0% this past month, while HYGW is up a measly 0.2%.

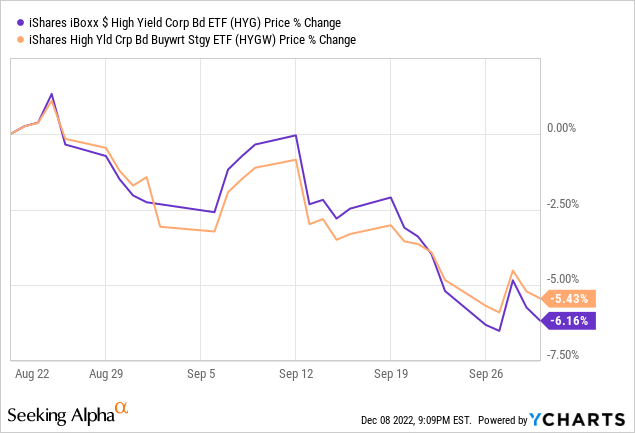

Selling covered calls has no impact on capital losses or share price reductions, with HYGW experiencing similar losses to HYG in prior time periods. As an example, both funds saw comparable losses from mid-August to early October. HYGW’s losses were technically a bit higher, but that seems to have been the result of volatility.

HYGW’s upside potential is significantly reduced while its downside potential remains unchanged. This should almost certainly result in long-term capital losses / declining share prices. HYGW’s share price has declined by 6.5% since inception, as expected, although the fund is quite young, so this information is not all that material. Still, I’m quite confident that the fund should see long-term capital losses, as the fund’s strategy and holdings all but ensure that this will be the case. LQDW and TLTW have seen capital losses since inception as well.

The fund has a significantly increased dividend yield, but significantly reduced potential capital gains.

HYGW should outperform relative to its peers when high-yield corporate bonds move sideways or down, due to the fund’s significantly increased dividend yield.

HYGW should underperform relative to its peers when high-yield corporate bonds increase in price, due to the fund’s significantly reduced capital gains.

In both cases the details matter, but the overall situation seems clear enough. As HYGW is a relatively young fund I was unable to find clear, meaningful, reasonably long examples of the above. Still, the pattern does seem to hold since the fund’s inception, with HYGW outperforming when prices decreased, and underperforming when these increased.

As an aside, I would like to clarify that HYGW should outperform when bonds move sideways, which does not necessarily mean up then down. The above is a particularly clear example of the distinction. HYG has been flat these past few months, but there was a clear downwards movement followed by a clear upwards movement. HYGW outperformed on the way down, then underperformed on the way up. Performance would almost certainly have bee stronger and more consistent if HYG had been flatter.

Let’s summarize the above.

HYGW invests in a high-yield corporate bond index ETF and sells covered calls on the entirety of its holdings. Doing so significantly increases the fund’s dividend yield, at the expense of significantly reduced capital gains, with no impact on downside potential. The net effect tends to be positive when prices move sideways or down, negative when these decrease. Seems simple enough.

HYGW – Expected Performance Under Various Economic Scenarios

HYGW’s strategy has important implications for the fund’s relative performance during various economic and market scenarios. Emphasis on relative: the fund remains a bond fund, with all the implications that entails.

HYGW should outperform relative to its peers when high-yield corporate bonds move sideways or down.

Bond prices almost always go down when interest rates increase, as investors sell their older, lower-yielding bonds to buy newer, higher-yielding alternatives. HYGW should therefore outperform during hiking cycles. The fund has not outperformed during this cycle, as the fund is quite young, and was created once most hikes were priced-in. Still, I’m quite confident that the fund should outperform during future hike cycles.

High-yield corporate bond prices also go down when credit spreads widen, which tends to occur during downturns, recessions, and bear markets. In simple terms, investors tend to sell risky high-yield bonds when times are tough, causing their prices to drop. HYGW has yet to experience a downturn or recession, so I can’t really show a time period in which this has occurred. Still, I’m quite confident that the fund should outperform during future downturns and recessions. This only applies for HYGW. LQDW focuses on investment-grade bonds, which tend to see small price movements during downturns. TLTW focuses on long-term treasuries, which tend to see significant gains during downturns, opposite of HYGW. As such, TLTW should underperform during downturns, recessions, and bear markets.

Benchmark interest rates and credit spreads might move in opposite directions, so take care when parsing the above. HYGW could underperform during a hiking cycle if credit spreads also widen, for instance.

HYGW should underperform relative to its peers when high-yield corporate bonds move up.

Bond prices almost always move up when interest rates go down, due to greater investor demand for older, higher-yielding bonds, versus newer, lower-yielding alternatives. As such, HYGW should underperform when rates go down.

In my opinion, with inflation normalizing, and with the Fed discussing a slower pace of hikes, interest rates for medium and long-term treasuries and bonds should decrease in 2023. I would not be investing in HYGW or its peers under these conditions, although some investors might disagree with thsi.

Sometimes, bond prices increase at maturity, when bought below par, as is the case right now. In simple terms, rising interest rates have caused bond market prices to decline, but the actual value of the bond, that which must be paid at maturity, remains the same. Bond investors should receive hefty capital gains when this occurs. Said gains should lead to underperformance for HYGW.

High-yield corporate bond prices increase when credit spreads narrow, which tends to occur when economic conditions improve. In simple terms, a better economy means higher demand for risky assets, boosting their price. LQDW and TLTW do not invest in high-yield corporate bonds, so this does not apply to them.

In my opinion, with economic conditions improving, and with the Fed discussing a slower pace of hikes, credit spreads should narrow in the coming months. I would not be investing in HYGW under these conditions, although other investors might disagree.

Quick Peer Comparison

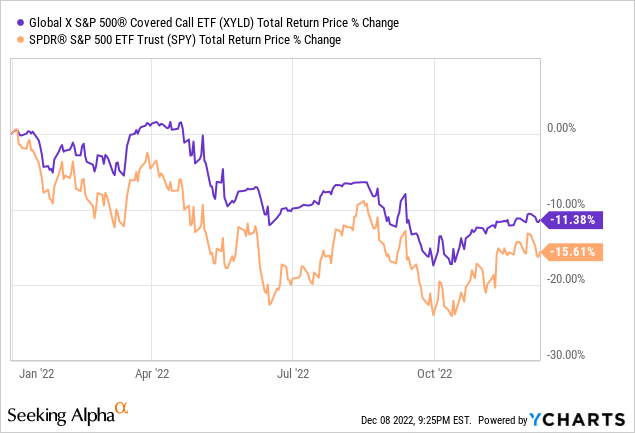

Finally, wanted to do a quick comparison of these funds with some equity covered call ETFs. Specifically, the Global X S&P 500 Covered Call ETF (XYLD), the Global X NASDAQ 100 Covered Call ETF (QYLD), the Global X Russell 2000 Covered Call ETF (RYLD).

The equity ETFs take steps to reduce distribution volatility, and to sustain share prices / asset values. Steps include selling covered calls with strike prices slightly above market prices, which means some capital gains are still possible, and capping monthly distributions at 1.0% of asset values, particularly important when option premiums are high, as they currently are. These policies do not materially impact the expected returns or these funds, or their characteristics relative to their indexes, but they do decrease their volatility somewhat, and make them less aggressive choices. BlackRock does not engage in these or similar actions, so expect heightened dividend and share price volatility for HYGW, LQDW, and TLTW.

Bonds are safer, less volatile securities compared to equities, which results in lower option premiums for the BlackRock funds, and distributions for their shareholders.

Bonds are much more exposed to interest rates than equities, so expect higher losses and volatility when interest rates are changing rapidly, as they currently are.

Bonds are much less exposed to broader economic conditions than equities, so expect lower losses and volatility when economic conditions are changing rapidly, as they currently are.

Bonds are income vehicles with low prospective capital gains than equities, so selling covered calls on bonds seems like a better strategic fit. In my opinion, at least.

Selling covered calls on equities seems like a much clearer, understandable strategy relative to bonds, due to the lack of interest rate exposure. The BlackRock ETFs seem to have too many moving parts, in my opinion at least.

In general terms, I prefer the equity covered call ETFs, as their longer performance track-records gives me confidence in my assessment of their characteristics and performance. The BlackRock ETFs seem fine, but I would prefer to have a few more months of performance information to be more certain of this. As an example, XYLD should outperform relative to the S&P 500 when said index is down, as has been the case YTD.

HYGW should outperform relative to HYG when high-yield corporate bond indexes are down. Said indexes are down YTD, but we can’t analyze HYGW’s performance YTD, as the fund is incredibly new, and was created after bond indexes went crashing down. I’m pretty confident in my analysis of these funds, but an actual performance track-record is important too.

Conclusion

The three BlackRock BuyWrite Fixed Income ETFs invest in bonds and sell covered calls on the entirety of their holdings. Doing so increases their yield, but reduces their potential capital gains. The net effect should be positive when interest rates increase, negative when rates decrease. In my opinion, rates are likely to decrease in 2023, as inflation normalizes. As such, I would not be investing in any of these funds at the present time.