Corning: Why I’m Adding At These Levels (NYSE:GLW)

peterschreiber.media

I’ve been watching the World Cup recently, and can’t help but draw analogies to the investment world. Like building a sports team, building a basket of stocks requires patience, due diligence, and conviction in one’s research and beliefs.

Many stocks remain cheap given the amount of uncertainty in the economy, making this time the “Olympics” of value investing. That’s because those with a long-term horizon aren’t going to be overly-rotated on near-term headwinds, with the understanding that high quality companies with durable traits will eventually return to their fair value.

This brings me to Corning (NYSE:GLW), which remains value priced, trading closer to its 52-week low than its high of $43.47 from February. In this article, I highlight why dividend growth investors ought to take a hard look at Corning at these levels.

Why GLW?

Corning is a 170+ year old company and a leading global manufacturer of glass, ceramics, and optical fiber. It’s best known for its Gorilla Glass products, which are used to protect smartphone and tablet displays from scratches and cracks. Recently, the company has been expanding into medical technologies, such as its Endura coatings for medical equipment and its Valor Glass products for drug delivery and diagnostics.

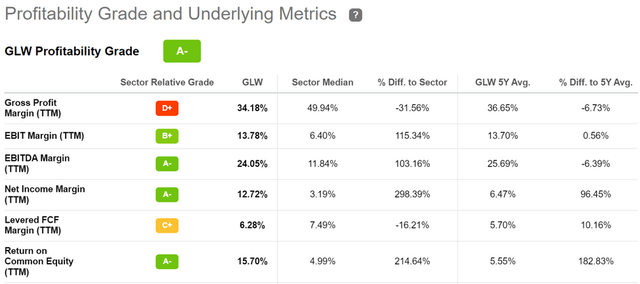

Corning has become increasingly important as an infrastructure player, given its leadership position in optical fiber products, which serve as the plumbing of the internet and wireless connectivity for telecom players. GLW invests a fair amount into research and carries a large number of patents in its fields of expertise. This translates into strong margins for the company. As shown below, GLW scores an A- grade for Profitability, with sector leading EBITDA and Net Income margins of 24% and 13%, respectively.

GLW Profitability (Seeking Alpha)

While Corning’s sales were up just slightly during the third quarter, to $3.7 billion, the long-term growth thesis remains intact, as optical communications, environmental technologies, and life sciences continue to be strong growth drivers, more than offsetting a 22% decline in display technology sales. Having said that, I would expect display technologies to continue to be a drag on sales in the fourth quarter. This is considering recent supply chain disruptions around Apple’s (AAPL) iPhone 14 Pro, with reports this week indicating that consumers can’t find this high-end product in stores.

Notwithstanding near term headwinds around display technologies, the long-term growth tailwinds for GLW are very much in place. For example, GLW recently announced a new manufacturing facility in Arizona to meet growing demand from AT&T (T) as the big telecom player is making big investments in expanding its fiber presence across the U.S. Moreover, GLW plans to reignite demand for display technologies with its cost advantages and innovative products, as highlighted during this past week’s Credit Suisse (CS) Annual Technology Conference:

We are the industry leader with a global manufacturing footprint, cost advantages, distinctive capabilities and leadership in Gen 10.5, which is critical to capturing long-term growth in large screen televisions. And we expect to exit this current display industry correction with strengthened customer relationships, and a refresh manufacturing fleet. Our objective is to outpace growth in smartphones and semiconductor equipment.

Our leadership at innovations, think scratch, drop optics and surfaces, our ability to expand into new categories such as bendable phones and augmented reality technology as well as our leadership in key components for semiconductors are driving outperformance in the face of soft near-term consumer demand for smartphones and IT devices.

Notably, GLW maintains a strong BBB+ rated balance sheet. It also yields a respectable 3.2% at the current price. While the starting yield isn’t particularly high, it is more than double the 1.5% yield of the S&P 500 (SPY) at present. The dividend is also very well protected by a 49% payout ratio and comes with 12 years of consecutive annual growth and a 12% 5-year CAGR.

While GLW doesn’t appear to be particularly cheap at the current price of $34 with a forward PE of 16.4, I believe it’s reasonably attractive due to its very long operating history, track record of innovation, and forward growth profile, with analysts projecting 9 to 15% annual EPS growth over the next two years. As such, I would expect the price to be at least 10% above the current price as a measure of fair value.

Investor Takeaway

Corning is a leader in the optical fiber and display technologies industries, with strong margins and a well-protected dividend yielding 3.2%. With a track record of innovation, long operating history and attractive forward growth profile, GLW appears to be attractively valued at present. Long term investors seeking a respectable starting yield coupled with potentially high dividend growth ought to take a hard look at the stock.