Copart Stock: Growth Continues But The Price Isn’t Right (NASDAQ:CPRT)

bigtunaonline/iStock via Getty Images

If there’s one overarching theme about the power of the Internet, it’s that it has empowered individuals to make purchases instantaneously from almost anywhere on the planet. This is true of almost every good imaginable, including vehicles. And one popular way for people to purchase vehicles as a result has become the online auction. One company dedicated to providing this service, as well as vehicle remarketing services, is Copart (NASDAQ:CPRT). Through its online portal, the company offers vehicle sellers a variety of services such as providing online seller access where a user can assign vehicles for sale, check sales calendars, view vehicle images and history, and more. It also has an offering that assists sellers in the vehicle claims evaluation process by providing online salvage value estimates and other activities. Recent financial performance achieved by the company has been rather mixed. But even though profits and cash flows have come in weak as of late, continued revenue growth has been enough to push shares higher. But seeing how pricey shares have become, I cannot in good faith rate the company any higher than a ‘hold’ at this time.

Shares are getting lofty

Back in March of this year, I wrote an article talking about the attractive growth that Copart had achieved over the prior few years. I concluded that if the company continued to grow at a rapid pace, that it could offer significant upside for investors moving forward. At the same time, however, I also warned that betting on this growth could be rather risky. After all, shares of the company were already looking pricey at that time, creating the risk of substantial underperformance in the event that financial conditions worsened. Because of how expensive shares were, I could not help but to rate the company a ‘hold’ to reflect my opinion that the stock should achieve returns that would more or less match the broader market for the foreseeable future. Since then, the market has had other plans. While the S&P 500 has been down by 4.2%, shares of Copart have generated upside of 11.8%.

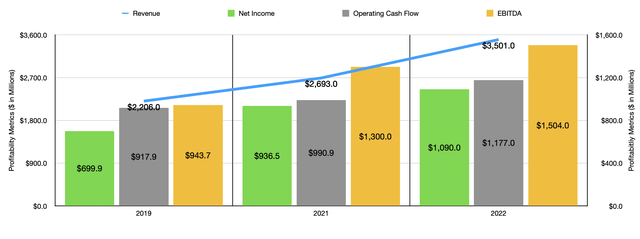

Author – SEC EDGAR Data

To understand why the company has continued to outperform the market, we should first touch on how it finished its 2022 fiscal year. After all, when I last wrote about the company, we only had data covering through the first half of 2022. For 2022 as a whole, sales came in strong at $3.50 billion. This is 30% higher than the $2.69 billion the firm generated during its 2021 fiscal year. The growth the company achieved during this time was rather broad-based. For instance, service revenues for the enterprise grew by 24.5%, with sales located in the US climbing 25.6%, while international sales rose a more modest but still impressive 16.6%. According to management, the growth in sales was largely driven by higher revenue per car caused by the scarcity of vehicles during the global supply chain disruptions we experienced and by an increase in volume resulting from higher miles driven as the global economy reopened. The company also benefited nicely from a jump in total vehicle sales revenue. This number skyrocketed 61.7%, climbing from $400.6 million to $647.9 million. This increase, management said, was driven by more vehicles sold and higher average auction selling prices that, in turn, were driven by market forces and a change in the mix of vehicles sold.

With this rise in revenue, we also saw profits improve. Net income rose from $936.5 million in 2021 to $1.09 billion in 2022. Operating cash flow increased from $990.9 million to $1.18 billion. And EBITDA for the company increased from $1.30 billion to $1.50 billion. The rise in sales definitely helped with the company, as did the higher selling prices of the vehicles sold. Unfortunately though, this strength did not continue into the 2023 fiscal year.

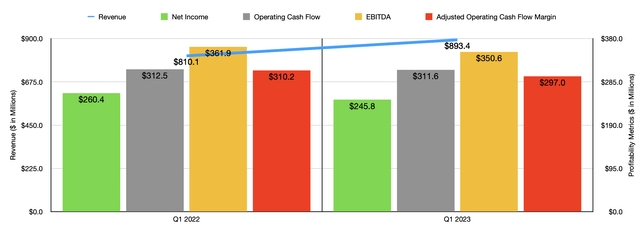

Author – SEC EDGAR Data

In the first quarter of the company’s 2023 fiscal year, sales came in at $893.4 million. That’s 10.3% higher than the $810.1 million the company generated during the first quarter of 2022. Service revenues grew by 8.8% thanks to a change in the mix of vehicles sold and a rise in sales volume in the company’s U.S. market. Internationally, however, the company did see some weakness, but this was driven entirely by foreign currency fluctuations that more than offset strong demand for the company’s services. When it comes to actual vehicle sales, meanwhile, revenue jumped by 17%, driven by increased volume and higher average auction selling prices. Had it not been for foreign currency fluctuations, sales would have risen a more impressive 26%.

While revenue rose nicely, profitability unfortunately did not follow. Net income for the company dropped from $260.4 million in the first quarter of 2022 to $245.8 million at the same time this year. According to management, the key driver behind this decrease was a 24.8% surge in yard operations expenses. Higher volume combined with an increase in the cost of processing each car played a role in this cost increase. This, in turn, was attributed to higher subhaul costs, higher labor costs, and a rise in premiums for catastrophic-related subhaul. On the labor side, the company also suffered from increased overtime, increased travel, lodging, and equipment lease costs, and more. The firm also was hit by costs related to Hurricane Ian that negatively affected bottom line results by $25 million. Sadly, other profitability metrics followed suit. Operating cash flow dropped from $312.5 million to $311.6 million. Similarly, EBITDA took a beating, falling from $361.9 million to $350.6 million year over year.

It would be nice if management could provide any real guidance as to what the future might hold. But in lieu of that, perhaps the best approach would be to annualize results experienced so far for the year. In this case, I am fully prepared to acknowledge that this approach might be inadequate. The hurricane-related costs, for instance, should be one-time in nature. So while they are a true cost, they might result in bottom line performance from my approach being weaker than what the company might ultimately achieve moving forward if no other big one-time costs come up. Based on my assessments though, the company should generate net income of at least $1.03 billion for the year. Adjusted operating cash flow should be $1.25 billion, while EBITDA should come in at around $1.46 billion.

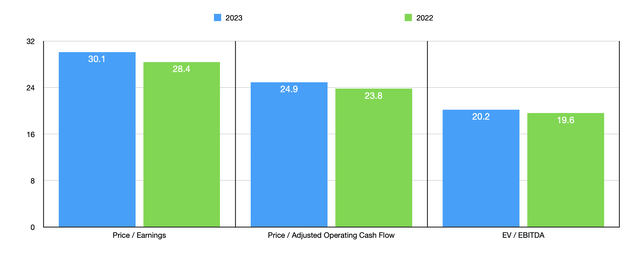

Author – SEC EDGAR Data

Using these numbers, we can see that the company is trading at a forward price-to-earnings multiple of 30.1. The forward price to adjusted operating cash flow multiple should be 24.9, while the EV to EBITDA multiple should hit 20.2. This latter multiple is aided by the fact that the company has virtually no debt and has cash on hand of $1.54 billion. But I digress. As you can see in the chart above, this pricing is a bit loftier than what we would get using data from 2022. Also, as part of my analysis, I decided to compare Copart to five similar companies. As you can see in the table below, the company is more expensive than four of the five companies using each of the three valuation metrics.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Copart | 30.1 | 24.9 | 20.2 |

| Ritchie Bros. Auctioneers (RBA) | 19.9 | 21.9 | 11.1 |

| IAA, Inc. (IAA) | 17.2 | 14.5 | 11.5 |

| Driven Brands Holdings (DRVN) | 75.8 | 20.2 | 33.2 |

| KAR Auction Services (KAR) | 12.2 | 9.0 | 5.0 |

| VSE Corporation (VSEC) | 21.2 | 71.7 | 11.5 |

Takeaway

What we have today, based on the data available, is a company that continues to grow but that has faced some headwinds. Normally in this environment, you would expect bottom line deterioration to be met with a meaningful drop in share price. But when you consider the source of that pain and factor in that sales continue to climb nicely, you end up with a share price increase. Though to be fair, I don’t believe this increase was warranted given how pricey the stock currently is, both on an absolute basis and relative to other companies. Because my opinion on that has not changed, I do still rate the company a ‘hold’ for now.