QYLG And If It’s A Better Investment Than QYLD

baona

I am often asked why I prefer the Global X Nasdaq 100 Covered Call ETF (QYLD) to the Nasdaq 100 Covered Call & Growth ETF (NASDAQ:QYLG). Rather than just providing a simplistic answer regarding income generation, I decided to write an article and compare these two ETFs from Global X. I will have them go head-to-head and look at an initial investment of 100 shares since 2021 and YTD in 2022. I will also compare them as if an investor took the income monthly or reinvested it. QYLG is an interesting hybrid fund, whereas QYLD is strictly geared toward income investors. Regardless of the data and research I provide, investors should do their due diligence and clearly understand their investment objectives. QYLG may align with one investor’s objectors more than QYLD, and vice versa.

Global X

QYLG is a hybrid fund that exposes investors to growth aspects while generating income from covered calls

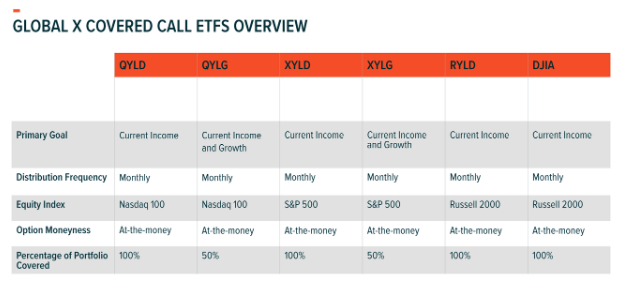

In 2020, Global X came out with two hybrid funds with the objective of blending above-average yield with modest potential for capital appreciation. The Nasdaq 100 Covered Call & Growth ETF (QYLG) and the Global X S&P 500 Covered Call & Growth ETF (XYLG) are Global X’s solutions to providing income without sacrificing all of the gains the markets experience. QYLG is similar to QYLD as it invests in the companies found in the Nasdaq 100, but the main difference is that QYLG only writes covered calls on 50% of the portfolio. By utilizing a buy-write strategy on 50% of its underlying assets, QYLG doesn’t cap its upside potential the way QYLD does. QYLD sacrifices most of its upside potential as they write covered calls against its entire asset base. QYLG, on the other hand, only utilizes 50% of its assets to back its buy-write strategy to generate income, while the other half of its portfolio is uncapped and can generate as much upside as the market will allow.

I own much more QYLD than QYLG, but that won’t create a bias as I will go strictly by the numbers in the following section. I prefer QYLD to QYLG because I am looking for income when it comes to these investments. There is tremendous competition when considering investments for capital appreciation or a hybrid blend of capital appreciation and income. I don’t think the question should be limited to QYLD vs. QYLG. With rising rates creating yields around 4.5% for a 1-year CD, QYLD is an interesting alternative for income investors as its yield is significantly higher than what you can get from a no-risk investment. When considering a hybrid such as QYLG, the question shouldn’t be QYLD vs. QYLG, but rather, QYLG vs. other ETFs or single equity investments. There are several ETFs that come to mind that I could consider over QYLG for a hybrid ETF, such as the Schwab U.S. Dividend Equity ETF (SCHD) or the Amplify CWP Enhanced Dividend Income ETF (DIVO). I am not picking QYLD over QYLG because I feel it’s a better fund; I am allocating much more capital toward QYLG because it aligns with one of my investment objectives more.

QYLG vs. QYLD, unbiased 2021 to present and YTD comparison

I will provide 4 comparisons between QYLG and QYLD and provide my thoughts then everyone can come to their own conclusions. Here is what I will be comparing:

- QYLG vs QYLD

- 2021 – present: taking the distributions

- 2021 – present: reinvesting the distributions

- 2022 – present: taking the distributions

- 2022 – present: reinvesting the distributions

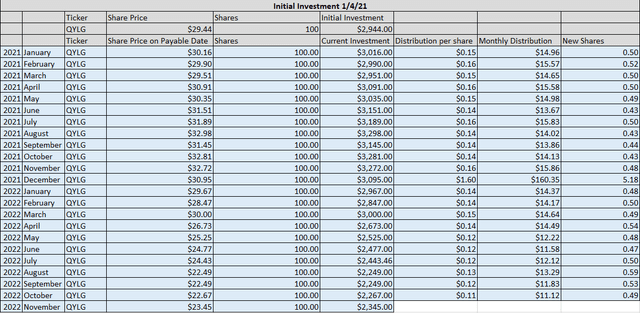

Steven Fiorillo, Global X, Seeking Alpha

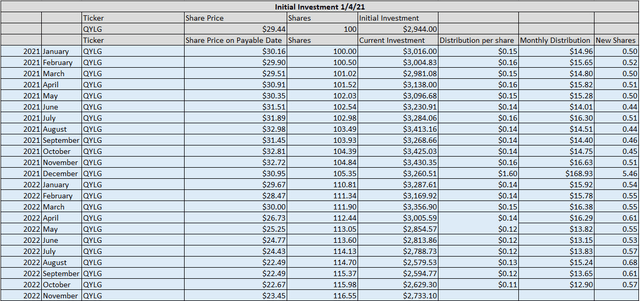

An initial investment of 100 shares in QYLG at the beginning of 2021 would have cost $2,944. Today, shares are trading for $23.45, and the initial investment would have declined by -$599 for an initial investment ROI of -20.35%. QYLG has paid $453.29 in distributions, a 15.40% yield on invested capital. When everything is netted out, the Total ROI for QYLG is -4.95%.

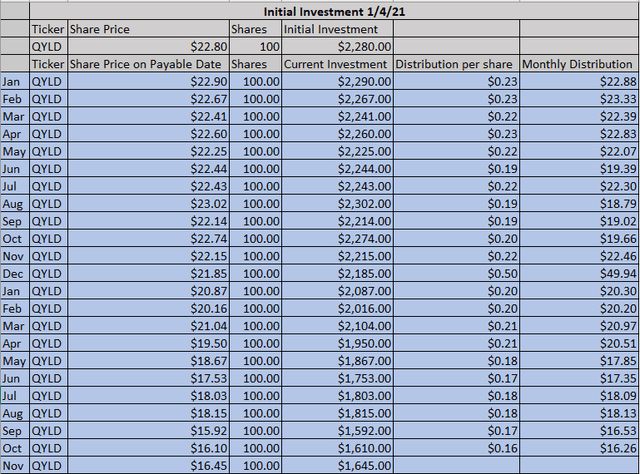

Steven Fiorillo, Global X, Seeking Alpha

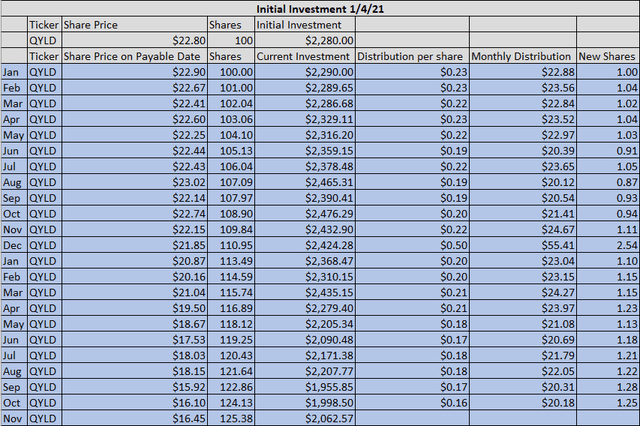

At the beginning of 2021, QYLD traded for $22.80, and an initial investment for 100 shares would have cost $2,280. Today, this investment would be worth $1,645, which is a loss of -$635 for an initial investment ROI of -27.85%. QYLD has paid $471.25 in distributions which is a 20.67% yield on investment, creating a total profit of -$163.75. The total ROI for QYLD since Jan 2021 is -7.18%.

From taking the distributions as income, QYLG has been a better investment from a total ROI perspective, but QYLD has generated just over 5% in additional yield.

Steven Fiorillo, Global X, Seeking Alpha

Now I will look at the data since 2021 as if the distributions were being reinvested. The share base in QYLG would have increased to 116.55 shares, placing the current investment at $2,733.10. The initial investment ROI would be -7.16%. QYLG would have generated $483.01 in income, which is a 16.41% yield on investment. The added 16.55 shares would generate an additional $50.65 in annual income based on the TTM distributions.

Steven Fiorillo, Global X, Seeking Alpha

By reinvesting the distributions in QYLD, the initial investment would have lost -$217.43, as the current value would be $2,062.57. QYLD would have paid $522.50 in distributions for a 22.92% yield on the initial investment. The initial share base would have grown by 25.38 shares, creating an additional $65.64 in forward projected annual income based on the $2.59 TTM distribution per share. The total ROI would be -9.54%.

When looking at QYLD and QYLG from reinvesting the distributions, QYLG has been a better investment from an ROI perspective but has generated about 6.5% less of a yield.

Now I will look at these investments on a YTD basis in 2022.

Steven Fiorillo, Global X, Seeking Alpha

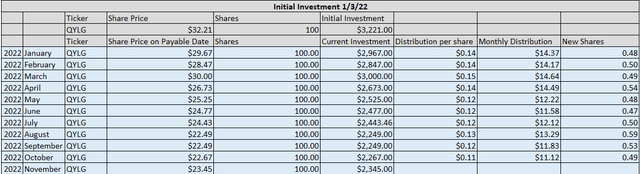

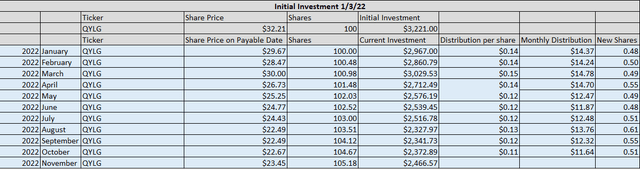

At the beginning of 2022, QYLG traded at $32.21 per share. An initial investment of 100 shares would have cost $3,221. YTD shares have declined to $23.45, which is a negative return of -$876. The initial investment ROI on QYLG is -27.20% based on its shares. QYLG has paid $129.83 in distributions which is a 4.03% yield on investment. The total profit on QYLG is -$746.17, and its total ROI from an investment standpoint when the income is netted from the capital loss is -23.17%.

Steven Fiorillo, Global X, Seeking Alpha

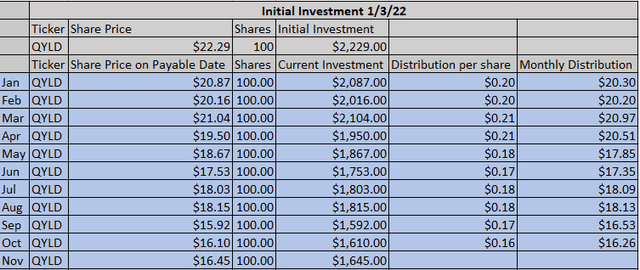

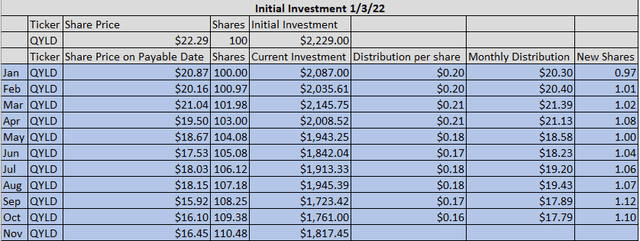

QYLD traded for $22.29 at the beginning of 2022, and an initial investment would have cost $2,229. The current investment today would be worth $1,645, which is a decline of -$584 or an initial investment ROI of -26.20%. QYLD has paid $186.19 in distributions which is an 8.35% yield on investment, bringing the total profit to -$397.81. The total ROI for QYLD has been -17.85% based on buying 100 shares at the beginning of 2022.

Based on taking the income in 2022, QYLD has outperformed QYLG on its initial investment ROI, the yield on investment, and total ROI. Now I will look at these investments as if the income was reinvested.

Steven Fiorillo, Global X, Seeking Alpha

An initial investment in QYLG would have declined by -$754.43 as the income was reinvested. The total ROI would be -23.42% YTD. QYLG would have generated $132.64 in distributions which is a 4.12% yield on investment. The initial share base would have appreciated by 5.18 shares, and the additional projected annual income would increase by $15.87 based on the TTM distributions.

Steven Fiorillo, Global X, Seeking Alpha

An investment in QYLD would have declined by -$411.55 to $1,817.45 for an initial investment ROI of -18.46%. QYLD would have generated $194.33 in distributions and produced an additional 10.48 shares in 2022. The additional projected annual income would be $27.11, and the yield on investment would amount to 8.72%.

Looking at QYLG and QYLD in just 2022 is a much different result than from the beginning of 2021. Regardless if you took the income or reinvested it, QYLD has been a significantly better investment. In both scenarios, it generated more than double the yield and generated around 5% in additional ROI.

Conclusion

QYLG generated a large distribution in December of 2021, so the current TTM distributions may significantly change come January. In 2022 alone, QYLG hasn’t performed as well as QYLD, as just the initial investment has declined by -27.2% compared to -26.2%. QYLG has also generated much less income, and its total ROI, regardless if you took the distributions as cash or reinvested them, is quite lower than QYLD. Looking at these investments since 2021 is a bit of a different story, and I would like to revisit the analysis after the new year so we can see how large of a distribution in December is paid.

After running the numbers, my initial thoughts haven’t changed. I think QYLG is interesting, but I wouldn’t buy it over SCHD or DIVO. From a hybrid fund standpoint, I have to consider both the income and capital appreciation, and DIVO and SCHD have done much better in 2022, even though the income is slightly less. I wouldn’t buy QYLG over QYLD because QYLD meets my investment criteria for generating a high yield, and I am not buying QYLD for capital appreciation. I think anyone who is considering QYLG should identify why what their investment goals are for this investment and do a considerable amount of research prior to adding it to their portfolio.