Enterprise Products Maintains A Well Deserved Lead (NYSE:EPD)

kate_sept2004/E+ via Getty Images

Enterprise Products Partners (NYSE:EPD) is one of the largest midstream companies in the world. The company has a strong history of driving substantial shareholder returns from its unique portfolio of assets and we expect it to be able to continue those shareholder returns. As we’ll see throughout this article, this combination of assets makes the company a valuable investment.

Enterprise Products Partners Overview

Enterprise Products Partners has a unique and diversified portfolio of assets that the company will be able to use to generate substantial shareholder returns.

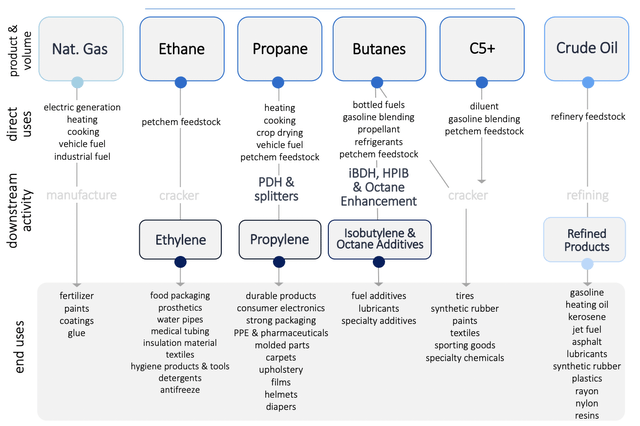

Enterprise Products Partners Investor Presentation

The company operates at nearly every stage of the value chain from natural gas to crude oil to ethane, propane, and all the other fossil fuel products in between. The company interacts with these products both when they’re initially lifted from the ground and throughout the value chain as they’re refined into more valuable products.

The benefit of the midstream toll operator business is the company doesn’t care about the prices of the products at the start or at the end. It extracts its toll operator at each and every level. The same way a toll bridge doesn’t care about the value of your car.

Enterprise Products Partners Changing Market

The company continues to operate in a market with substantial potential even if volumes take a hit.

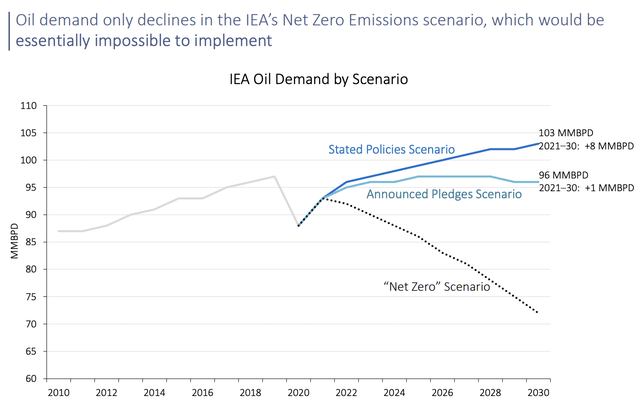

Enterprise Products Partners Investor Presentation

The company continues to perform well in a variety of demand scenarios. In both stated policies and announced pledges scenarios volume is expected to rebound and remain steady. The only way where volume decreases substantially is in a “net zero” scenario. While we see that scenario as much more likely than the company, it’s still manageable.

Specifically, the world has required that energy security is just as important as an energy transition. As the world weans itself away from Russian oil, volumes there might increase, but US revenue can be expected to remain strong.

Enterprise Products Partners Continued Investments

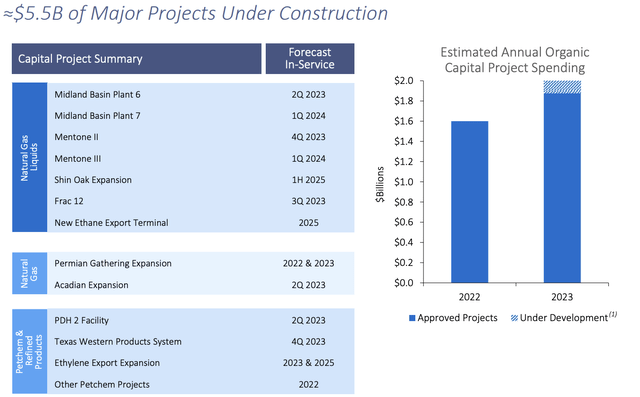

Enterprise Products Partners has continued to take advantage of opportunities in the market to invest heavily.

Enterprise Products Partners Investor Presentation

The company’s annual capital spending in 2022 was roughly $1.6 billion, but in 2023 that’s expected to expand towards $2 billion, with roughly $100 million from under development but not yet approved projects. The majority of these are natural gas liquids projects although the company does have other refined product and natural gas projects.

An important takeaway here is that while the company is continuing to focus on growth, it’s not diversifying at all for a net zero scenario. That could put pressure on the company if the market changes faster than anticipated.

Enterprise Products Partners Financial Positioning

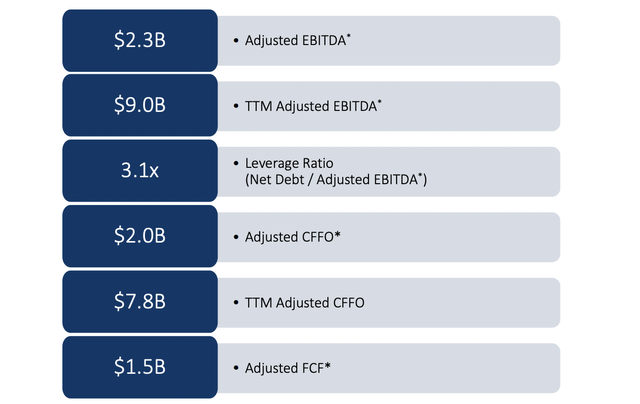

The company has continued to perform incredibly well off of its earnings maintaining a strong financial position.

Enterprise Products Partners Investor Presentation

The company earned $2.3 billion in adjusted EBITDA in the most recent quarter with $1.5 billion in adjusted FCF. That FCF is a substantial double-digit FCF yield showing the company’s ability to drive shareholder returns. The company has an incredibly manageable 3.1x leverage ratio that mean the company can focus on shareholder rewards over debt.

The company has $33 billion in long-term debt, almost 84% which expire in >10 years and 93.2% in fixed rate debt. That means the company’s debt due for the next 10-years averages roughly $500 million. The company has pushed its average term to maturity to 4.4%, or roughly $1.4 billion in annual interest, a comfortably affordable level.

The manageable debt load the company has shown the strength of its financial positioning.

Our View

The company is continuing to focus on a variety of avenues that can drive substantial shareholder returns.

The company is continuing to invest in midstream energy infrastructure to the tune of almost $2 billion annually. The company continues to offer a reasonable dividend and we expect it to continue increasing it at an incredibly sustainable rate. At the same time, the company is planning to opportunistically buyback shares and support its balance sheet.

The company doesn’t have the same FCF strength of other companies, however, it does have the advantage of reliability and a lower debt load than many companies. Given that strength, we expect the company to form a reliable bedrock of any portfolio.

Thesis Risk

The largest risk to Enterprise Products Partners in our view is the company’s refusal to adjust to a changing energy market. The company has the strength to outperform until 2040, but as energy markets evolve, delays in the company adapting its portfolio can substantially hurt it in the long run. That can hurt the company’s ability to replicate its double-digit returns.

Conclusion

Enterprise Products Partners is one of the best positioned midstream companies around with a dividend yield of almost 8%. The company has a strong history of improving its dividend yield and we expect that to be able to continue steadily going forward. On top of that, the company has one of the strongest financial positions and capital programs.

The company’s $6 billion in annualized FCF represents a double-digit FCF yield and leaves the company with enough money to cover interest, pay its dividend, and invest without increasing its debt load. That investment will enable FCF to grow more substantially for the long run. That strength makes Enterprise Products Partners a valuable investment.