Nike Stock: Forcing The Bears To Flee (NYSE:NKE)

Joe Raedle

Thesis

NIKE, Inc.’s (NYSE:NKE) FQ1’23 earnings release led to a steep panic selloff that buyers rejected resolutely. As such, the market appeared to have forced buyers/bearish investors to capitulate at its October post-earnings lows.

NKE has outperformed the market since our pre-earnings update (Buy rating). It recovered nearly 30% from its October lows, eviscerating the bears/weak holders who panic-sold at the worst possible moments.

We are not surprised by how the market stunned these bears, as we highlighted previously that NKE’s valuation was no longer expensive relative to its historical averages. Coupled with the extent and speed of the capitulation move, it set up a remarkable mean-reversion recovery as NKE’s sentiments headed into extreme pessimism.

Furthermore, analysts’ estimates on Nike were also slashed post-FQ1 as buyers bailed out of NKE. Therefore, it was helpful that analysts had turned increasingly worried over Nike’s forward guidance, given elevated inventory and increased promotional cadence.

As always, we urge investors never to panic in capitulation moves. The market uses massive down moves to force rug pulls on weak holders/over-leveraged buyers and ensnare short-sellers before lifting it back higher. Even if you want to cut exposure, sell into a rally against a well-established resistance zone and not in a steep selloff.

Notwithstanding, we see some digestion from NKE’s remarkable recovery before a consolidation could form for investors to accumulate subsequently.

Revising our rating from Buy to Hold for now, as we anticipate the pullback.

The Market Ignored Wall Street’s Slashed Estimates

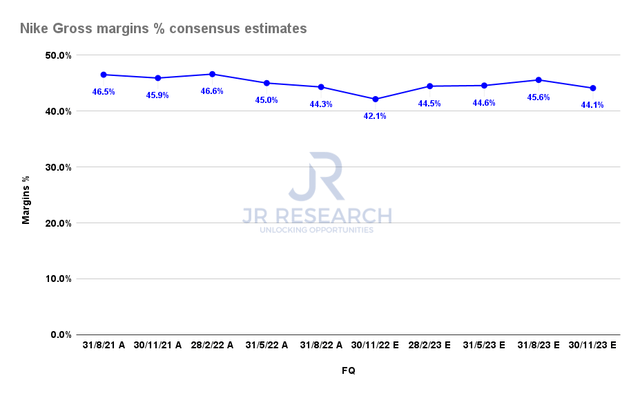

Nike Gross margins % consensus estimates (S&P Cap IQ)

Nike reported gross margins of 44.3% in FQ1, down markedly from last year’s 46.5%. It also came in below the previous consensus estimates of 45.3% as further inventory woes hit Nike.

As such, Nike analysts revised its Q3 gross margins down to 42.1%, in line with management’s guidance of 42.2% (midpoint). However, management also highlighted that it expected to return to a less promotional cadence moving ahead, as it moved to clear its inventory levels expeditiously.

Hence, we believe it’s credible for Nike’s FQ2’23 to be the bottom for its gross margins trajectory before recovering through FY24. It’s also in line with management’s full-year gross margins guidance of 43.8%.

Notably, management has already baked in continued forex headwinds and a relatively weak China situation in its outlook.

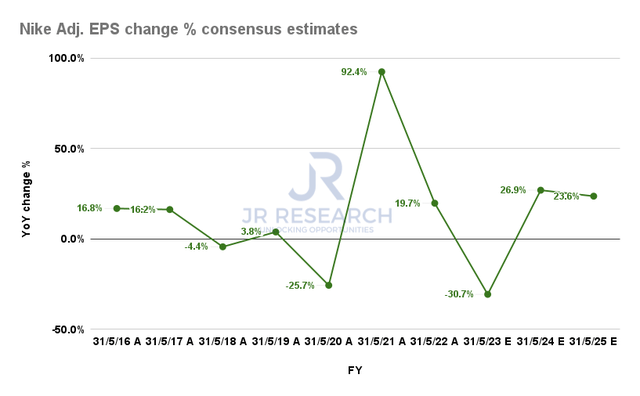

Nike Adjusted EPS change % consensus estimates (S&P Cap IQ)

As such, analysts turned highly pessimistic over Nike’s earnings prospects in FY23. As such, Nike’s adjusted EPS decline has been revised further to 30.7% YoY from its pre-earnings projections of a 12.4% fall.

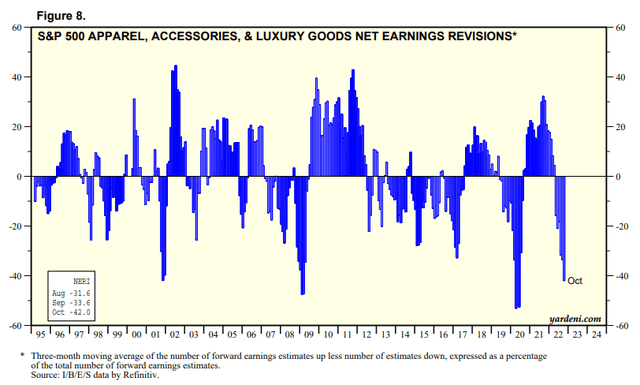

S&P 500 Apparel, Accessories, & Luxury Good net earnings revisions % (Yardeni Research, Refinitiv)

Furthermore, we gleaned that analysts have turned increasingly downbeat over Nike and its industry peers with further net earnings revisions through October.

The extent of the downward adjustments has likely reflected a pretty steep recessionary scenario, as seen above. Hence, we believe Nike’s projections have been sufficiently de-risked after its Q1 earnings.

NKE’s Valuation Remains Well-Balanced

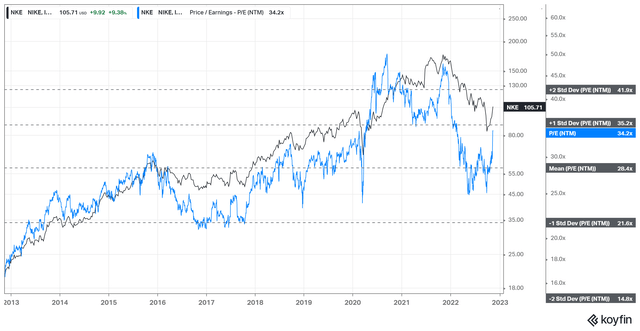

NKE NTM normalized P/E valuation trend (koyfin)

With the significant revisions to Nike’s forward earnings projections, NKE’s NTM normalized P/E also surged as it recovered from its recent October lows. Compared to its peers’ NTM median P/E of 15.9x (according to S&P Cap IQ data), the bifurcation is palpable.

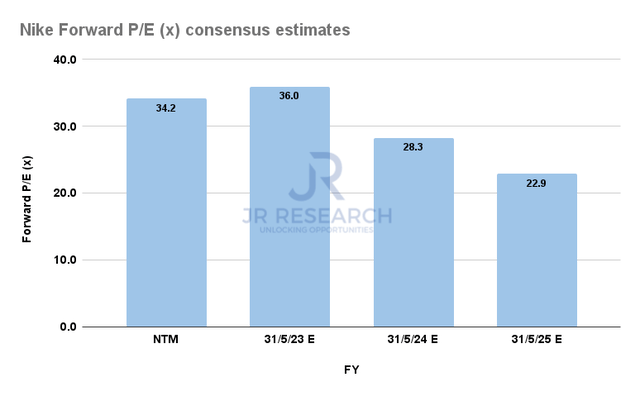

NKE Forward P/E consensus estimates (S&P Cap IQ)

Furthermore, NKE’s FY24 normalized P/E of 28.3x is in line with its 10Y average of 28.4x. Therefore, Nike is expected to recover its earnings power significantly through FY24, helping to sustain its current valuation.

We assess that NKE’s valuation seems pretty well-balanced for now, with the potential for upside earnings surprises moving ahead, leading to a re-rating. Hence, we parse that its long-term reward/risk remained skewed toward the upside from these levels.

Is NKE Stock A Buy, Sell, Or Hold?

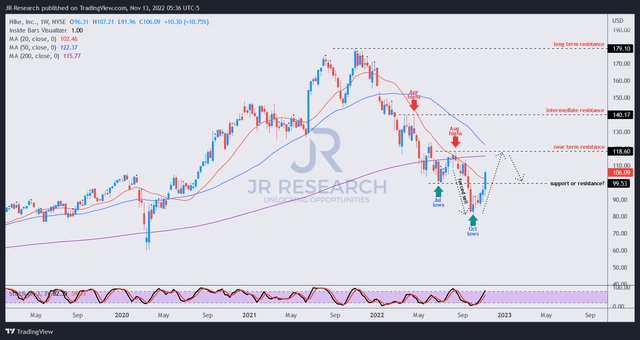

NKE price chart (weekly) (TradingView)

With the considerable surge from its October lows, we deduce that a pullback seems likely to shake out some near-term overbought momentum.

Our analysis suggests that NKE’s near-term resistance should continue to see stiff selling pressure. Therefore, we urge investors to wait for a pullback for NKE to re-test its previous support levels before considering adding more positions.

Revising from Buy to Hold for now.