Meta Has More To Offer (NASDAQ:META)

Justin Sullivan

Thesis On Meta

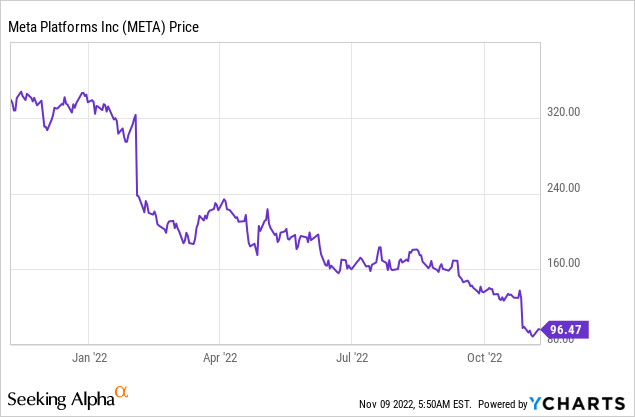

Since Meta (NASDAQ:META) announced that it is going to invest heavily in the Metaverse late last year, the company’s stock price has dropped more than 71% and is still dipping.

Meta has been one of the most controversial companies in the last year and with many investors believing that it is not only losing market share to TikTok but is also having problems with Apple’s (AAPL) iOS 14 changes, the stock price is now trading at around $100 and at ridiculous multiples.

Q3 Results

After the social network company revealed a second consecutive quarter of declining revenue, a poor growth outlook, and mounting costs at its loss-making metaverse section, Meta stock plunged more than 20% a few weeks ago, reaching its lowest level since 2016. Despite continuing to develop, Facebook’s parent company Meta has lost $677 billion in market value this year.

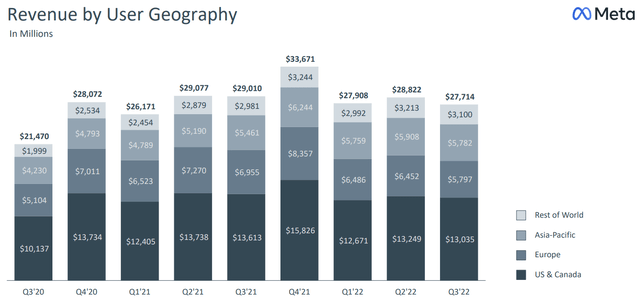

Particularly, in the most recent quarter, Meta’s sales and earnings fell by 4% and 52%, respectively, as it faced increased competition from TikTok, a slowdown in ad spending, and the effects of Apple’s ad-tracking adjustments.

Moreover, the company’s Reality Labs section, which focuses on the metaverse, has lost $9.4 billion so far this year, and it predicted that losses there will increase substantially in the future.

All these have led to many shareholders selling the company’s stock even at a loss just to avoid even worse.

Growth Is Negative By Choice

Meta expanded its revenue by 37% in 2021 and Covid was primarily responsible for Meta’s ability to expand at such a rapid rate. Every company had to promote itself online during quarantine, which increased demand for Meta’s service. Because there was such a strong demand, not only did the cost per advertisement rise, but the business also started running more advertisements. These both combined caused the revenue to soar. However, this is no longer the case as people are once again going out, and thus it is normal for the company to see a short-term reduction in revenue as a result of the rapid decline in demand for its service, but this does not mean that the company is dead.

Despite what many investors think about Meta, I believe that if the company wanted, it could manage to grow its revenue at a decent pace, even in the last quarter. I think the reason that this didn’t happen is that Meta is currently not focusing on revenue growth as they want to gain market share in reels.

Reels

forbes.com

Meta is really pushing reels in order to compete with TikTok and it is working.

Some stats that make me believe that reels are going to be Meta’s secret weapon are:

- In 2022 Instagram Reels have an average engagement rate of 1.95%, which is at least double compared to the other post types.

- Also, while regular videos have a view rate of 1.74% on average, Instagram Reels record an average view rate of 2.54%.

- According to data, the average reach rate for Instagram Reels in 2022 is 20.59%.

- Meta starts to share its revenue from reels with some creators. According to executives at media companies that are taking part in this scheme, Instagram pays media companies for uploading Reels that exceed specific view criteria. These payments to media firms are different for each account, but they are capped each month and are mainly depending on how many views an account’s Reels receive. This is in my opinion the strongest weapon Meta possesses against competitors as now content creators are not only making money from customers that bought their products through a reel they posted, but they are also making money just for posting and creating new content for the platform and they, therefore, have one more motive to prefer Instagram.

Given the impressive rate at which Reels are predicted to grow, they surely have a chance to assist Meta in the future in improving its metrics and expanding its presence in the continuously expanding short-form video segment.

Taking into account everything mentioned above, it is safe to say that Reels could assist Meta in improving its performance in the upcoming years and alleviate the issues brought on by Apple’s decision to change its privacy policy, as there is evidence to suggest that a short-form video segment would continue to gain additional momentum and attract more advertisers.

And the corporation is not yet running advertisements in them. Once they start running more advertisements, I think this could easily evolve into a $10-$15 billion industry that is expanding quickly. Imagine the impact on the stock price if the company generated an additional $15 billion in revenue over the following three years from a high-margin industry.

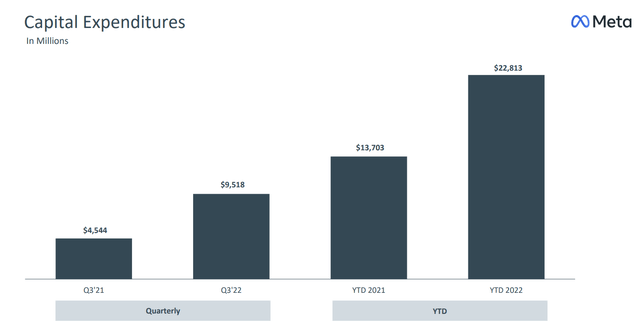

But investors are also concerned about the decline in the company’s earnings and wonder if these investments that drive the Capital Expenditures of the company up are going to lead somewhere.

Capital Expenditures

Two or three years ago Meta had over 40% operating margins but now, as Capital Expenditures have grown that much, this number is down to 20%. But, although this is disappointing, it was not unexpected as the company’s management had at least warned the investors that the business would invest heavily in its future and that would affect its current margins. What most investors don’t know is that these expenditures are not all about Reality Labs. Meta is also investing to develop better algorithms and fight the problem that new Apple’s IOS changes brought to the table. The concept is that if before the update users were spending two or three hours daily and now the company finds a way to keep them engaged for one more hour, it will be able to collect more data from them and thus show them better and more efficient ads. The issue is that in order to construct that superior algorithm that will bring these results, the corporation requires stronger infrastructure, which will cost a lot upfront but will yield higher revenue and earnings in the long run.

Overall, the company is investing in its future rather than its current products, so higher capital expenditures shouldn’t be a major problem.

The only issue here would arise if the corporation continued to invest billions of dollars in its own operations while failing to achieve faster growth. Fortunately, this is not what analysts predict will happen to the company; instead, they predict that over the next five years, growth will range from 6% to 12%.

Conclusion

After the last earnings report, I can say that I have no idea if the company’s stock price could fall more or have bottomed.

What I believe however is that the current price that it is currently trading at is a ridiculous valuation for a company this big with this kind of moat. Although some investors consider the company to be doomed, I think that it has more to offer and that when the investments that it is currently making eventually pay off, the stock price is going to climb up to all-time highs again.

This is why I believe that Meta is a bargain now, and I rate it as a BUY.