EVX: Valuation And Quality Issues Under The Hood (NYSEARCA:EVX)

SteveDF/iStock via Getty Images

The VanEck Vectors Environmental Services ETF (NYSEARCA:EVX) is a passively managed fund overseeing a portfolio of companies involved in “waste collection, transfer and disposal services, recycling services, soil remediation, wastewater management and environmental consulting services.”

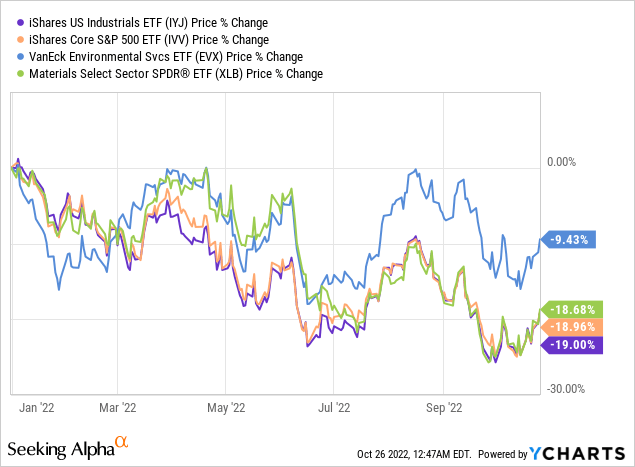

This is a fairly promising, genuinely defensive investment theme that has fared much better this year compared to the market as well as other ETFs targeting industrials and materials sector equities as most of its holdings chugged along amid almost omnipresent inflation pressures together with recession fears thanks to the resilience of their business models (e.g., undergirded by recurring revenues).

However, despite the fact that EVX has not only outperformed IVV in excruciating inflation, higher interest rates environment this year but also since its inception (with caveats), there are downsides investors who are considering buying into the environmental services theme should review as carefully as possible, with valuation being the primary concern discussed in greater depth below in the article. There are also a few issues on the profitability side not to ignore.

Overall, owing to the fund being overweight Waste Management (WM) and Republic Services (RSG), two heavyweight names I believe do deserve a place in an FCF-centered long-term portfolio, I would assign it a Hold rating despite the vulnerabilities uncovered.

The investment strategy and the portfolio

EVX’s investment mandate is to track the NYSE Arca Environmental Services Index. Its constituents are drawn from the universe of those companies with:

business activities that may benefit from the global increase in demand for consumer waste disposal, removal and storage of industrial by-products, and the management of associated resources.

The benchmark features a modified equal weighting, with the top four constituents combined accounting for 40%, the bottom five with the smallest market capitalizations accounting for 10%, and 50% reserved for the rest.

In the current iteration, owing to the 40% principle, EVX’s portfolio encompassing 24 stocks is tilted towards the bellwethers, with the weighted-average market capitalization at $20.8 billion, as of my calculations. A sophomoric conclusion can be drawn here that the profitability characteristics of this large-cap mix should be rather robust, while some issues might be encountered on the valuation side.

However, the issue is that the median market is materially below the weighted average one, currently at $3.88 billion as mid- and small-caps account for 54% of the portfolio. So it does not come as a surprise that certain profitability issues surface upon more attentive inspection, while there is also something to criticize when it comes to trading multiples. In this sense, investors who are considering buying into EVX should understand that smaller, less resilient players with unstable margins and weaker returns on capital might detract from the fund’s returns. I will address these issues shortly in the performance section.

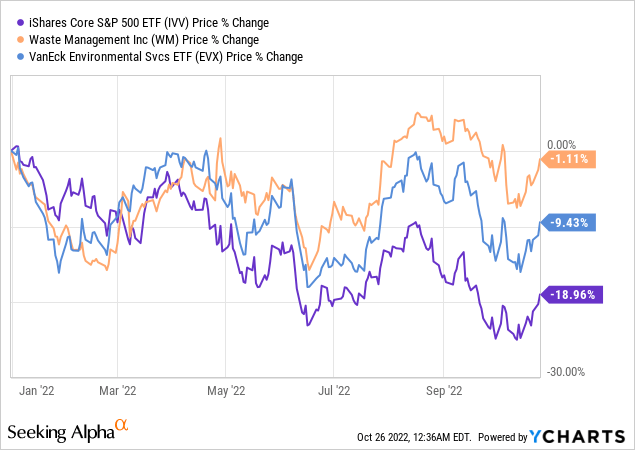

Waste Management is EVX’s heaviest investment, with over 10% of the net assets allocated. Though WM does not sport leading growth characteristics, with a forward EBITDA growth rate of just 11%, its profitability is nothing short of exemplary, especially considering its 11.7% FCFE margin. Thanks to its recession-proof business model as it provides an essential service and because of its steady cash flow generation investors certainly appreciate, this environmental services heavyweight is down by just ~1.1% this year, defying a bear party on the Street.

However, not all EVX holdings are as profitable and efficient as WM.

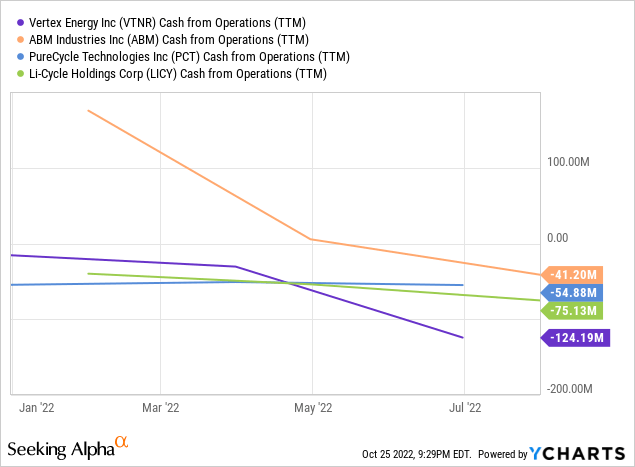

Turning to the quality issues, it is worth noting that just slightly above 58% of the holdings have at least B- Quant Profitability grade, a level I consider suboptimal. More specifically, seven companies on the list were incapable of delivering even a measly net profit in the last twelve months, while four also failed to generate positive cash flows, namely Vertex Energy (VTNR), Li-Cycle Holdings (LICY), PureCycle Technologies (PCT), and ABM Industries (ABM). These companies account for over 12% of the net assets, and I would not say their influence on total returns is insignificant, especially in a capital scarcity era that favors self-sufficient names with steady income and cash flows.

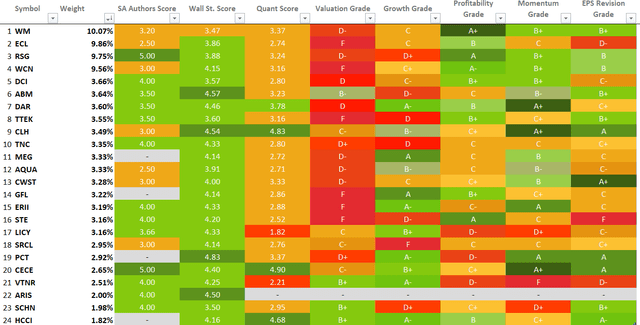

With a level of profitability being far from ideal, a moderate valuation profile should be expected, but this is not the case with EVX. In fact, as illustrated by the table below compiling the Quant data, almost 76% of the holdings are apparently overvalued, WM included.

Created by the author using data from Seeking Alpha and the fund

Additionally, I believe it would be pertinent to remark that while the median debt-adjusted earnings yield for the industrials sector is ~9% (the inverted EV/EBITDA), the EVX investors get the weighted average at just ~5.6%. Besides, the weighted-average Price/Book of 4.75x, which is 2x the industrials sector median and 3x the materials sector median, is also barely indicative of a comfortable valuation (thankfully, none of the holdings has a negative net worth, so I made no adjustments).

Performance analysis: a concentrated portfolio of four key EVX names would do better

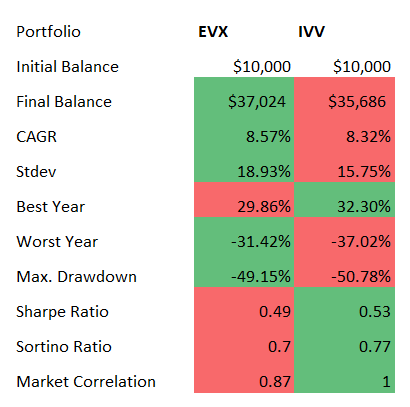

Since its inception (excluding October 2006 and October 2022), EVX has marginally outperformed the iShares Core S&P 500 ETF (IVV), by around 25 bps even despite its rather burdensome expense ratio of 55 bps.

Created by the author using data from Portfolio Visualizer

The issue here is that this total return was achieved with a much higher standard deviation vs. the bellwether fund, so expectedly its risk-adjusted returns (the Sharpe and Sortino ratios) look bleaker.

But what if we check whether the portfolio composed of the stocks EVX overweighted did better? And the fact is, it did.

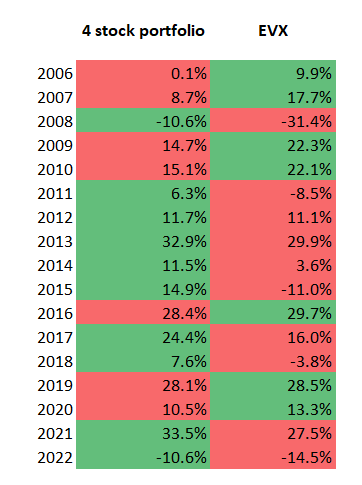

I used the November 2006 – September 2022 period, with WM, Ecolab (ECL), Republic Services, and Waste Connections (WCN) weighted equally and rebalanced annually; dividends were reinvested. It appeared that this portfolio delivered a 13.54% CAGR, with an ~15% standard deviation, while EVX achieved just 8.57%, with a standard deviation of almost 19%. Interestingly, the 4 bellwethers portfolio was down by just 10.6% in the 9M 2022, while the ETF declined by 14.53%. For better context, the annual total returns of the tested portfolio and EVX were as follows:

Created by the author using data from Portfolio Visualizer

By the way, I covered Republic Services in June 2020, with a Buy rating, highlighting its exemplary FCF generation. Since then, RSG has returned ~73%, while the S&P 500 advanced by just ~24%.

Is it worth buying into EVX?

The gist is that what I always recommend to my dear readers is to look beyond the long-term growth prospects of a certain theme, which might be improperly reflected in asset prices or simply overestimated, to say the least, and instead focus on the equity mix a particular ETF targeting the theme has, paying due attention to the factors it is most exposed to in the current version.

And in fairness, when assessed from a few angles and with due attention paid to valuation and profitability, I see little reason to buy into EVX, even though there is no denying that environmental services do offer some protection against a possible recession in a hard landing scenario and they are capable of surviving elevated inflation thanks to business model resilience.

EVX’s past performance is rather robust, no doubt, even with alpha delivered since its inception, though fairly microscopic. Still, I am of the opinion adding the four key EVX names to the long-term portfolio is a better strategy, even considering their comparatively rich valuations (resulting from the quality premia), while the ETF itself deserves a Hold rating at best.