3 Effective Ways to Achieve Financial Freedom

What does it mean to achieve financial freedom? When you become financially independent, you no longer have to rely on a job for income. Your investments can cover most or all of your living expenses — allowing you to spend more time with family and friends, and focus on your true passions.

You won’t have to clock into a 9-to-5 job that you don’t like just to pay the bills. Instead, you’ll get to decide what you want to do with your day. Whether that’s working on a side hustle, grabbing lunch with a friend, or just watching TV and relaxing.

Believe it or not, it’s possible to achieve financial freedom by working hard and investing your money wisely. Here are three effective financial strategies that will put you on the road to financial independence.

Pay Off Debt

Debt is the enemy of financial freedom. When you’re bogged down by a bunch of loans, you have to spend more time working just to service your debt. You can’t save as much money because you’re trying to afford your minimum payments on top of your regular living expenses. And you’re potentially wasting thousands of dollars on interest charges depending on the interest rates you’re paying.

If you want to achieve financial freedom, step number one is to get rid of your debt. You’ll probably have to make some sacrifices to pay off your car note or student loans ahead of schedule, such as canceling subscriptions and eating at home most of the time. But trust us, foregoing luxuries for a while is worth it to become debt-free. After you make that last loan payment, you’ll have less stress and more time for important things in life.

Invest Your Money

Once you’re debt-free and don’t have to make loan payments anymore, you’ll have hundreds or thousands of dollars left over every month. So what should you do with it?

As a child, you were probably taught the value of saving. But if you stash your extra cash in a bank account like your parents told you to, you’ll actually lose money. The average annual percentage yield on a bank account is just 0.21%, which isn’t nearly enough to keep up with inflation. That’s why investing your money in the stock market to earn a higher return is crucial if you want to achieve financial freedom.

Passive Trading Vs. Active Trading

There are two different investing strategies you can use to grow your wealth—passive and active trading. Passive trading is a long-term investing strategy that involves buying and holding a diversified portfolio of stocks, bonds, and index funds. This approach doesn’t require a lot of effort or investing know-how, but only enables you to earn average returns, and is difficult in the current market conditions.

Historically, the stock market has yielded an average return of 10% per year, which is about what you can expect to make from passive trading.

If you want to try to beat the average performance of the stock market, you can learn how to become an active trader. Active traders use the stock market’s price fluctuations to their advantage, with the ability to make money when the market goes up and when it goes down. Instead of holding securities long-term, they may make trades more often (ranging from intra-day to several months between trades) in an attempt to maximize their returns.

Making more frequent trades as an active trader gives you a chance to earn much higher than average returns, but it does not come without risk – like all investing. You can become a better, more effective active trader by learning investing strategies from veteran traders and paper trading (investing via a simulator without risking real money).

Become a Profitable Trader

Want to achieve financial freedom by learning how to become a profitable trader? Joining an educational trading community like The Financial Cloud will give you the tools you need to master the art of trading.

As a Financial Cloud member, you’ll have access to trade ideas, institutional-grade trading tools, and automated software that is designed to make trading easier, faster, & more reliable. They also provide over 500 hours of training videos taught by industry experts and proven traders. These video courses will teach you about the stock market, how to trade, options basics, mentality and risk management, market internals and sectors, and so much more. Whether you want to break into day trading, swing trading, or long-term investing, The Financial Cloud will help you get started by giving you the tools, knowledge, and strategies you need to succeed.

The Financial Cloud is basically an all-in-one trading system designed to make you a profitable trader!

Join The Financial Cloud

Ready to join The Financial Cloud and start pursuing financial freedom through trading? For Black Friday (ENDS February 14th!), they’re offering a $1 Premium + Indicator Combo Package ($108 Value) for one full month (code and link below). This affordable trial will give you enough time to get your feet wet and grasp the basics of investing and trading. Once you learn the skill of trading, you will never look at the market and financial freedom the same again. You’ll also have a chance to win prizes in their $10,000 Giveaway, just join the $1 plan to receive more information on how to enter (no purchase necessary to enter after joining the $1 Combo plan). .

For the $1 Special, Use Promo Code (Savings107) or click the link below:

https://thefinancialcloud.memberful.com/checkout?plan=88010&coupon=Savings107

If you’re committed to achieving financial freedom and want to master active trading, this deal is for you!

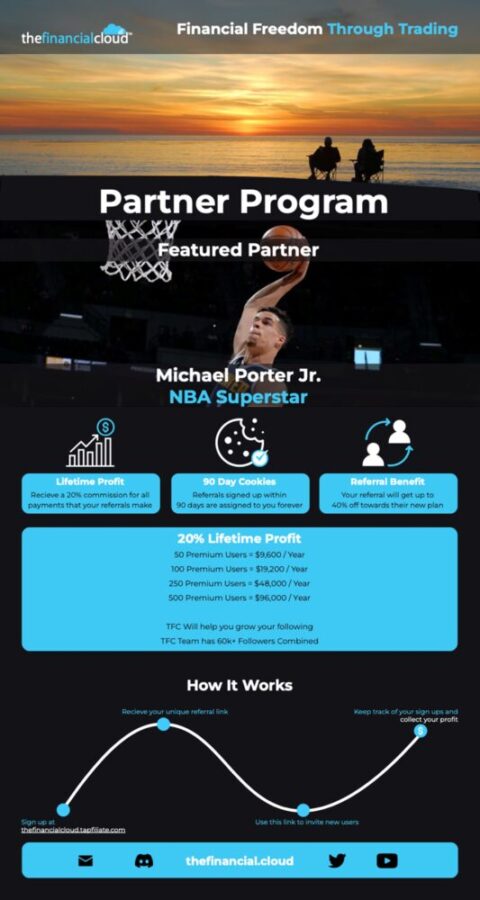

The Financial Cloud even has a partner program, which NBA superstar Michael Porter Jr. is a member of. You can become a partner too by recommending The Financial Cloud to your family and friends using your unique referral link. If someone signs up with your link, you’ll earn 20% commission on any payments they make to The Financial Cloud for life. The partner program is a nice way to earn some side income while helping your loved ones start investing.

What are some of your best tips and strategies for gaining financial independence? Share your thoughts in the comments section below!