2 Stocks For High Yield And Dividend Growth

Zerbor

Dividend growth stocks have outperformed growth and tech stocks in 2022. For perspective, the Nasdaq Composite Index is still down (-28.3%), placing it in a bear market. The S&P 500 Index has performed better, with a decline of 15.8%, while the Russell 2000 is slightly worse at (-16.7%). Of all the major indices, the Dow Jones Industrial Averages (DJA) is the best performing at (-7.1%) on the strength of the oil, energy, and healthcare stocks in the Index. Although the market has rallied since its bottom, deals still exist. Some dividend growth stocks are sporting high yields because of recession fears and company-specific issues. We focus on two stocks, Verizon Communications Inc. (VZ) and Whirlpool Corporation (WHR), for high-yield stocks with solid dividend growth that are buys.

Dividend Growth Strategy Performance

First, we summarize year-to-date performance for dividend growth investing strategies. In all cases, the five categories of dividend growth stocks are outperforming the NASDAQ (COMP.IND) and the S&P 500 Index (SP500). Moreover, some are doing better than the Dow 30. In fact, only the Dogs of the Dow in 2022 are performing better, with a YTD gain of 3.8%.

|

Category |

YTD Return |

|

Dividend Kings |

(-3.8%) |

|

Dividend Aristocrats |

(-3.9%) |

|

Dividend Champions |

(-0.2%) |

|

Dividend Contenders |

(-13.8%) |

|

Dividend Challengers |

(-8.0%) |

Source: Stock Rover (as of November 21, 2022)

Clearly, the strategy provides downside protection because dividend growth requires long-term revenue and earnings growth. The companies tend to be high-quality and return cash to shareholders through dividends and share buybacks. Additionally, dividends are important because research has demonstrated that they contribute a meaningful percentage of total return and stocks that pay done exhibit lower volatility.

Verizon Communications

Verizon Communications is a stock that should provide solid total return through a combination of capital gains and dividend yield. The company is one of the three largest cellular carriers in the United States. Also, it has a large broadband and legacy wireline businesses.

Verizon has around 120 million wireless customers, including 91 million postpaid accounts, four million prepaid accounts, and 25 million data devices. Additionally, the firm has 6.7 million FiOS and other broadband customers. In addition, the company serves approximately 25 million fixed-line telecom customers. The company sold its AOL and Yahoo content businesses in 2021.

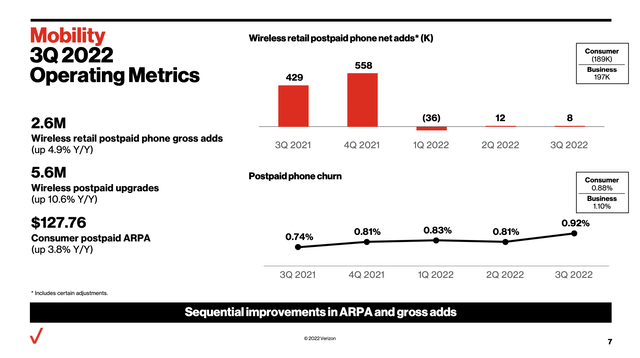

The stock price is down in 2022 because the firm has struggled with weak retail cellular subscriptions and upward trending churn rates relative to its competitors. T-Mobile (TMUS) is performing better because of its earlier emphasis on 5G, while AT&T (T) has refocused after divesting its content and DirecTV businesses. That said, Verizon is rolling out its 5G offerings and should be more competitive in 2023, if not quite at parity.

Dividend growth investors will like that Verizon is a Dividend Contender with 18 years of increases. The most recent dividend increase was in September 2022 to $0.6525 per share. Verizon consistently advances the dividend by about 2% annually in the past decade.

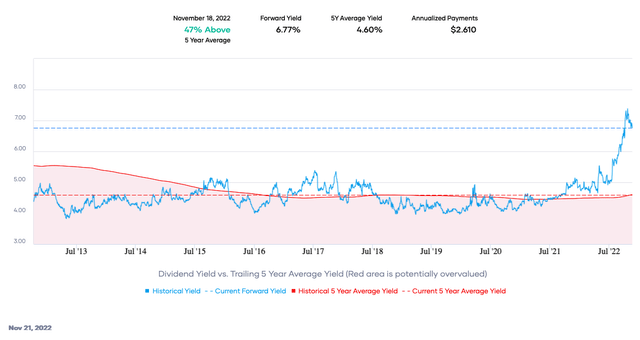

The dropping stock price has concurrently increased the yield, which is now ~6.77%. Granted, the dividend yield is off its recent peak of over 7%, but it is still more than two full percentage points above the 5-year average. Also, the forward dividend yield is several times the average of the S&P 500 Index. Although the dividend yield is elevated, the payout ratio is only ~47%. Moreover, the dividend required $10,714 million, while free cash flow (“FCF”) was $14,340 million, giving a dividend-to-FCF ratio of roughly 75%. This value is on the higher end of what we desire because of elevated capital expenditures, but the combination indicates the dividend is safe for now.

A high yield alone is insufficient to buy a stock, but Verizon is also undervalued based on historical metrics. The forward price-to-earnings ratio is almost 7.5X, below its 5-year and 10-year ranges. Assuming a reasonable multiple of 11X gives a fair value estimate of ~$56.64 per share.

A second valuation metric, the Gordon Growth Model, gives a fair value estimate of $43.50 per share using a conservative discount rate of 8% and a dividend growth rate of 2%. The average of the two methods is $50.07 compared to the current stock price of $38.67.

Investors should like Verizon because of its high yield and dividend growth united with its undervaluation. Therefore, I view Verizon stock as a buy now.

Whirlpool Corporation

The second company we discuss is Whirlpool Corporation, which carries an excellent yield, and decent dividend growth combined with safety and undervaluation. Whirlpool is a market leader in household appliances. The firm owns national and regional brands like Whirlpool, Maytag, KitchenAid, JennAir, Amana, Gladiator Bauknecht, Hotpoint, etc. It generates roughly $21 billion in sales.

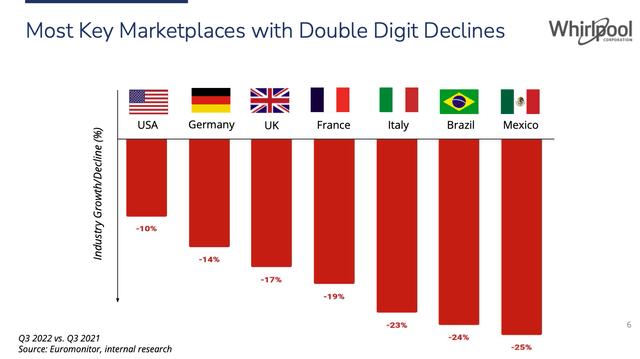

The company is struggling with issues not entirely of its own making, namely rising interest rates, recession fears, and high inflation. Hence, demand is low in almost all key markets, and costs are trending higher. That said, Whirlpool has experienced periods of soft demand, like the subprime mortgage crisis, and knows how to adjust. In addition, Whirlpool is acquiring InSinkErator, a garbage disposal and hot water dispenser business, for $3 billion. Whirlpool should be able to grow sales in this business by expanding products to its other brands and enhancing distribution.

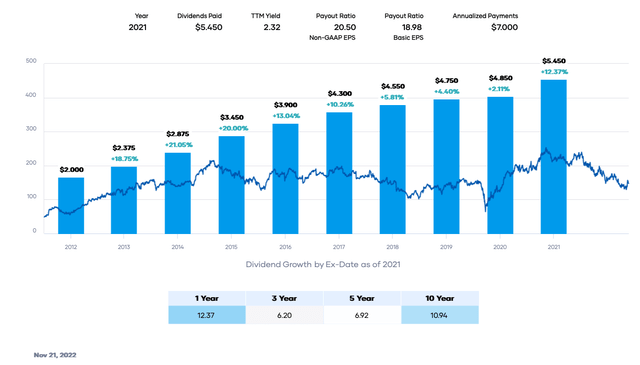

Whirlpool is a Dividend Contender with 12 years in a row of rising dividends. The growth rate is a solid ~7% per annum. Furthermore, the minimal payout ratio of around 21% provides confidence about future growth and dividend safety. Similarly, the dividend is covered by FCF of $639 million in the past 12 months. The dividend required only about $380 million. The most recent increase was to $1.75 per share in February 2022. Investors should expect another increase early in 2023.

The forward dividend yield is approximately 4.75%, much higher than the 5-year average of 3.28%. The yield was only greater during the COVID-19 pandemic.

Besides higher yield, dividend growth, and safety, Whirlpool is undervalued. The earnings multiple is only ~7.7X, below the 5-year and 10-year ranges. In addition, the company is in a cyclical industry, causing price and valuation fluctuations. The 10-year span is between 8X and 14.5X, suggesting investors expect little from the company because of rising interest rates and slowing home sales.

Assuming a cautious earnings multiple of 9X and reversion to the long-term average gives a fair value estimate of $169.76 per share. The Gordon Growth Model results in a value of $175 per share with an 8% discount rate and a 4% annual dividend growth rate. The average of the two methods is $172.38 compared to the current stock price of $145.24.

Whirlpool is in a cyclical industry. But when the valuation declines and the dividend yield rises, it is an excellent time to take a position. Therefore, I view Whirlpool Corporation as a buy now.